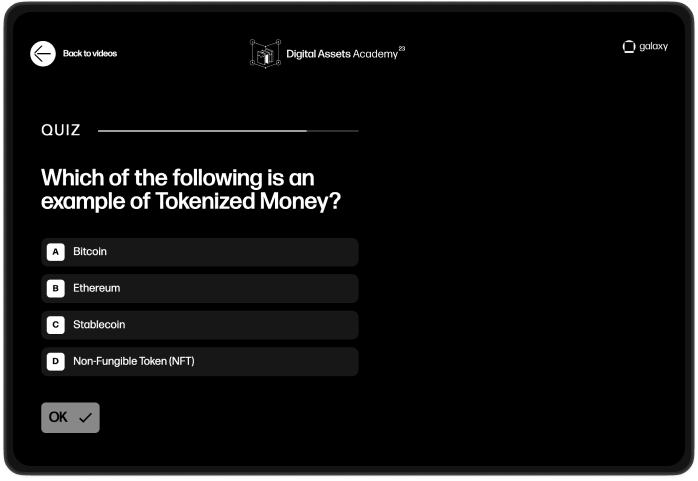

Tokenized Money

A closer look at Stablecoins

In a truly digital economy, stablecoins can offer an effective way to transact globally, combining the benefits of crypto networks with the price stability of widely accepted fiat currencies.

Description

Action Links

Additional Resources

In Summary

A quick summary of the topics discussed in this lecture.

Stablecoins are a type of digital asset where the value is pegged 1:1 to a reference asset.

Collateralized stablecoins can use a variety of types of assets as backing: Fiat, Commodities, Cryptocurrencies, or other types of investments.

US dollar-denominated stablecoins have so far dominated, accounting for more than 99% of total market capitalization.

Counterparty risk: It is important that the reserves to back stablecoins are transparently known with clear regulations for the issuer.

In a truly digital economy, stablecoins can offer an effective way to transact globally, combining the benefits of crypto networks with the price stability of widely accepted fiat currencies.

Test your

Learning progress

Previous Lesson

Digital Assets in an Investor Portfolio

Digital assets have evolved considerably in the fi...

Next Lesson

What is Decentralization

Decentralization occurs when individuals or nodes ...