Bitcoin Futures Basis Spikes with Renewed Market Optimism

This post is part of Galaxy Lending’s Monthly Market Commentary, offering insights into trends shaping the crypto credit and lending landscape. Subscribe to receive this commentary and more directly to your inbox.

In this report:

Market Update: Bitcoin Futures Basis Spikes

Trend: Aave Governance Slashes Optimal Lend Rates

Trend: Demand for Tokenized Treasuries Pick Up

Trend: Ethena Yields Fall in the Wake of Highly Anticipated Airdrop

Market Update

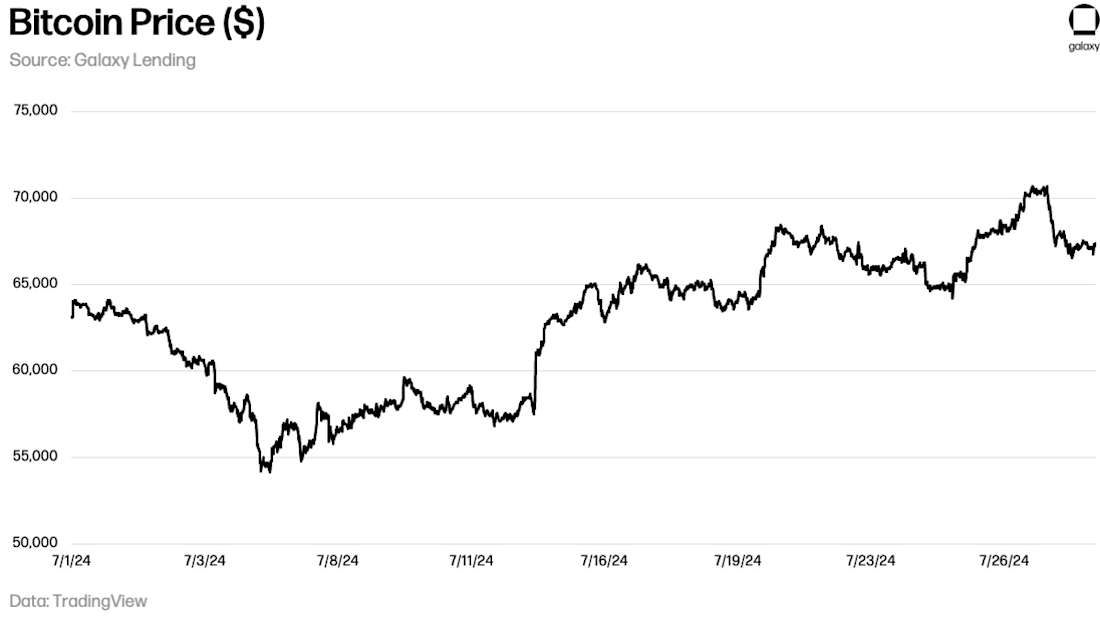

In July, Bitcoin experienced a notable price movement, bottoming out just below $55K before rising to over $70K, only to lose momentum later. This volatility can be attributed to several factors, including reduced selling pressure from the German government and Mt. Gox. However, a significant portion of the surge was driven by anticipation of BTC Nashville, a highly anticipated event.

Ahead of this event, the annualized basis for front month Bitcoin futures spiked dramatically, increasing the cost of short-term cash. The BTC basis reflects a delta-neutral strategy where futures contracts are priced significantly higher than the spot price, creating an opportunity for traders to buy spot BTC and simultaneously short futures to capture the spread. Leading up to the event, the annualized basis yield surged above 40% before settling around 8% afterward.

Additionally, BTC funding rates across major exchanges rose, though less dramatically, highlighting an increased imbalance between long and short positions in the perpetual futures markets. This imbalance also contributed to higher short-term cash rates.

Subscribe to receive this commentary and more directly to your inbox!

Key Trends We're Tracking...

Aave Governance Slashes Optimal Lend Rates from 9% to 6.5%, in response to a decrease in the Dai Savings Rate (DSR)

On July 25th, Aave governance approved the “Stablecoin IR Curve Amendment,” a proposal designed to reduce borrowing costs on the protocol. This adjustment lowers the optimal borrowing rate from 9% to 6.5%, while maintaining the same optimal utilization rate. The change affects markets for USDC, USDT, DAI, and FRAX across both Aave Ethereum V3 and V2.

This update, and other such updates, are driven by several factors, but two key considerations are the reduction of interest rate arbitrage opportunities and better alignment with broader market conditions. Interest rate arbitrage involves borrowing at a lower rate and entering a delta neutral position with a higher yield. This practice is prevalent in DeFi and other markets, where assets on one venue may be mispriced from the same assets on another. Such arbitrage opportunities often arise between Aave and Maker, two of the largest on-chain money markets.

In March, Maker increased the Dai Savings Rate (DSR) to counteract DAI selling pressure triggered by yields from Ethena and staked Ethena USD (sUSDe). This adjustment led to significant arbitrage between Aave's borrowing rates and the yields on staked DAI. In response, Aave raised its optimal yield to 14%. As sUSDe yields have moderated and the market has stabilized, Maker has begun lowering the DSR, which currently stands at 7%. To stay competitive, Aave has adjusted its borrowing rates in line with the DSR and Maker’s stability fees.

This change has been well received, reducing the cost of leverage across DeFi. In July, total liquidity of USDC on Ethereum Aave V3 increased from $1.37 billion to $1.53 billion, a rise of $160 million. Simultaneously, the utilization rate grew from 87.7% to 89.9%, indicating strong borrowing demand that outpaces the increased supply, likely due to the lower borrowing rates.

BlackRock's BUIDL continues to gain Market Cap as demand for Tokenized Treasuries picks up.

BlackRock's tokenized treasuries fund, known as BUIDL, has experienced consistent growth in both total value locked (TVL) and number of holders. Since April, the fund's assets have surged from $280 million to nearly $520 million—an increase of $240 million. This rising interest is driven by on-chain participants seeking a more secure alternative to traditional DeFi yields, while still enjoying the benefits of immediate settlement.

Ethena Yields Fall to Low Teens in the Wake of Highly Anticipated Airdrop.

A few months ago, Ethena's yields peaked at around 30%, but they have since dropped to the low teens. This decline followed a much-anticipated airdrop that encouraged users to trade yield for protocol tokens. Additionally, this drop aligns with a broader market trend of decreasing funding rates. Ethena initially launched during a surge in positive funding rates in March, a period marked by strong market gains. Since then, as the market structure has shifted, Ethena's yields have decreased considerably due to their model's heavy reliance on positive funding rates.

Notable News

Superstate Debuts New Fund to Profit From Bitcoin, Ether 'Carry Trade'

Fed to cut rates twice this year, with first move in September, economists say

Mt. Gox creditors start receiving bitcoin and bitcoin cash on Kraken

BlackRock’s BUIDL Crosses $500 Million in Tokenized Treasuries

Germany Speedruns Bitcoin Selloff, Moves $900 Million in Just 8 Hours

Wall Street's Cantor Fitzgerald to Open Bitcoin Financing, Lending Business

Subscribe to receive this commentary and more directly to your inbox!

This newsletter provides links to other websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy”) solely for informational purposes. Galaxy provides comprehensive financial products and services to institutions, corporates, and qualified individuals (typically Eligible Contract Participants and accredited investors) within the digital asset ecosystem. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy and Galaxy does not assume responsibility for the accuracy of such information. Affiliates of Galaxy’s own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by GalaxyDigital Partners LLC. Similarly, the forgoing does not constitute a “research report”, as defined under CFTC Regulation 23.605(a)(9), and may only be considered a solicitation for entering into a derivatives transaction for purposes of CFTC Regulation 23.605. It is not intended to constitute a solicitation for any other purposes under CFTC or NFA rules, and it should not be relied on as a form of recommendation to trade under CFTC regulations. Any statement, express or implied, contained within these materials is subject, in all cases, to the actual terms of an agreement entered into with Galaxy Digital on a principal basis. The Information is being provided solely for informational purposes about Galaxy Digital and may not be used or relied on for any purpose (including, without limitation, as legal, tax or investment advice) without the express written approval of Galaxy Digital. The Information is not an offer to buy or sell, nor is it a solicitation of an offer to buy or sell, any investment banking services, securities, futures, options, commodities or other financial instruments or to participate in any investment banking services or trading strategy. Any decision to make an investment or enter into a transaction should be made after conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment. Additional information about the Company and its products and services can be found at Galaxy Digital’s website at galaxy.com. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2024. All rights reserved.