A Multi-Asset Approach to Digital Asset Investing

Digital asset markets have come a long way since Satoshi Nakamoto’s bitcoin whitepaper was published 15 years ago. As blockchain technology has evolved, new tokens, companies, and investment opportunities have emerged, offering investors various investment opportunities. We believe embracing a multi-asset approach to digital asset investing enables allocators to capture significant idiosyncratic alpha opportunities and reduce risk.

When the Appeals Court reversed the SEC’s rejection of a spot Bitcoin ETF proposal in 2023, it set the foundation for the next wave of digital asset adoption. Today, investors can access BTC and ETH via spot ETFs from traditional brokerage accounts. Over the coming months, several large wealth management platforms with trillions of dollars in AUM are expected to approve spot BTC ETFs for advisors to use on their platforms. We also expect to see spot ETH ETFs approved on these platforms next year. In addition, we will likely see other spot ETF products for other cryptocurrencies announced, widening the investment opportunity.

In the near future, investors may have other avenues to access spot digital assets beyond ETFs. With proper regulation by the SEC, OCC, and CFTC, traditional brokerages and banks may allow customers to buy spot directly in their brokerage accounts. Should anyone buy a passive ETF for one stock? Probably not. Current regulations have prohibited large financial institutions from offering this service. But recent developments, such as the Bank of New York’s move to custody crypto, suggest a positive step in this direction. Investors should be preparing for this shift. Galaxy’s comprehensive report on The Digital Asset Investable Universe offers a starting point for investors to better understand how they can gain access to different investment vehicles.

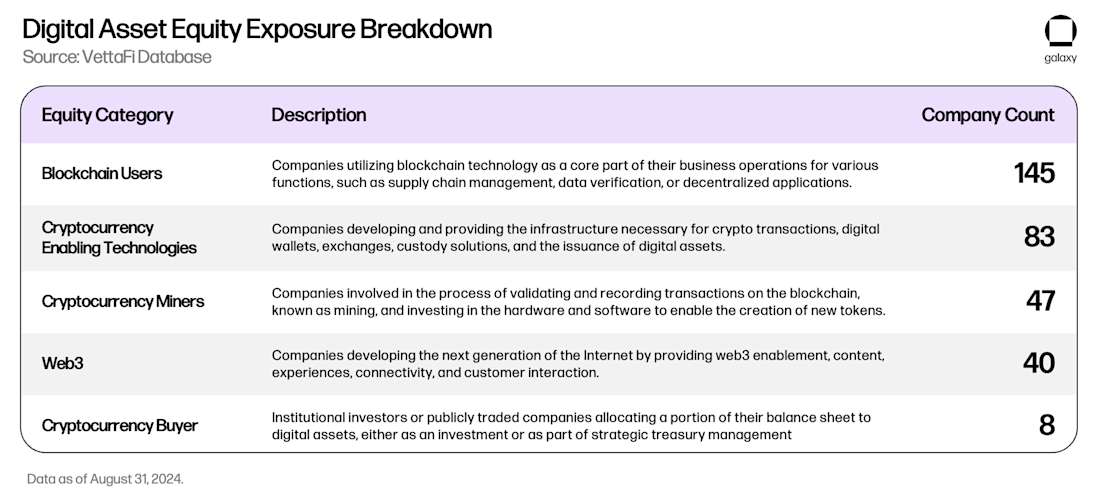

As the regulatory environment improves, we believe there are dozens of blockchain-related companies looking to go public, joining the roster of public companies already operating in the digital asset space. As of this writing, we track over 320 public companies across different categories as shown below.1[1] Most of the direct exposure to crypto with current public equities is found with bitcoin mining companies (e.g. RIOT), companies that hold bitcoin on the balance sheet (e.g. MSTR), or financial services companies that facilitate cryptocurrency trading and/or payments (e.g. COIN). Some investors may want to get exposure to the digital asset space through equities given they trade on regulated exchanges. This is also true for derivatives on these equities and ETFs.

Recently, the SEC approved derivatives for one spot BTC ETF, marking an important milestone for investors. Derivatives allow investors to hedge their exposure, create income streams, and establish synthetic long and short positions. Many investors do not have many options (pun intended) for hedging spot crypto/digital asset exposure due to the lack of regulatory clarity, strict qualified custodian rules, and the inability to access offshore platforms that provide such derivative exposure.

Given the nuances of each asset class, using a multi-asset approach to crypto investing offers more opportunities to capture alpha. Until the asset class matures and regulation is in place, digital assets will remain a higher risk, higher reward asset class with significant growth opportunities. This environment creates mispricing opportunities inherent in assets exposed to high volatility, a trend we see across all asset classes from fixed income to cryptocurrencies. Ultimately, this presents opportunities on both the long and short side to extract alpha and manage risk.

Further, the sell-side barely covers digital asset public companies, the buy-side largely ignores these equities given the lack of benchmark risk, and institutional investors continue to underappreciate the changing regulatory/political environment which will usher in significantly more growth opportunities for the technology. Regardless of who wins the election in November 2024, we believe a new regulatory approach to digital assets will be adopted allowing many more companies to use public blockchains. As a result, investors should consider opportunities today to capitalize on this opportunity.

At Galaxy Asset Management, we’re building products and strategies to offer investors accessible yet sophisticated exposure to digital assets.

Get in touch to learn more.

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected].

©Copyright Galaxy Digital Holdings LP 2024. All rights reserved.