10 Things That Show Crypto is Booming

From markets to on-chain data, private investment metrics to regulatory developments, the evidence that Bitcoin and the broader cryptocurrency industry is in the midst of a historic growth phase cannot be ignored. Here are the top 10 things and 15 charts to show that crypto is booming.

1) Bitcoin Soars with Inflation Expectations

Since a July 20 bottom around $29k, Bitcoin has been on an epic run, up more than 100% in 90 days. Ethereum too has soared, up more than 110% over the same time-period. Each has dramatically outpaced public equity markets. Most interestingly, Bitcoin has performed as both a risk asset and a gold-like inflation hedge.

Several factors both explain Bitcoin’s latest run but also position it well for the coming months:

Inflation expectations are at trend highs and moving higher. As inflation has become obvious across many sectors of the economy, inflation expectations continue to move higher. Bitcoin has become nearly perfectly correlated with rising inflation expectations, while gold has floundered, signaling some market acceptance of the “Bitcoin is digital gold” thesis. Bitcoin is now 10% of gold’s above-ground market capitalization.

Return of risk appetite. With the Nasdaq Composite and S&P 500 rebounding in October and now only slightly off prior all-time highs reached in August, it’s clear that appetite for risk has returned. At the same time as Bitcoin has performed well on the back of increasing inflation expectations it also enjoys widespread consideration as a risk asset. This dynamic – a risk asset that can act as a gold-like alternative at times – distinguishes it from other assets and makes it particularly attractive at a time like this.

Bitcoin performed well during down days. Nasdaq’s 10 worst performing days in September and October saw it trade down an average of -1.16%, but on those same 10 days Bitcoin outperformed on average at -0.54%. The same was visible in bonds, with Bitcoin trading flat on the 10 worst selloff days for 10yr US Treasury notes (which saw 10yr UST yields rise an average of 5.4bps). This dynamic did not go unnoticed across traditional and crypto-native trading desks.

ETF Approval. The approval and launch today of the first Bitcoin-tracking exchange-traded fund, the ProShares Bitcoin Strategy ETF (NYSE: BITO), heralds a major milestone for the bitcoin and cryptocurrency market. Although BITO utilizes CME futures to gain exposure (rather than a more efficient spot-based vehicle), and the coveted spot-based ETF doesn’t appear close to approval, the emergence of US-based public investment vehicles will allow a broader set of investors to gain Bitcoin exposure.

Rotation from DeFi, alts, and NFT trades back to Bitcoin. Following Bitcoin’s prior peak in April and the broader market peak in May, many funds turned their focus to DeFi, then alternate layer 1 blockchains like SOL, AVAX, and LUNA. As the BTC trade picked up, many funds found themselves structurally underweight BTC. The rotation into Bitcoin is visible in the rising Bitcoin dominance seen below.

This monumental 90 days has seen Bitcoin futures open interest rebound to levels not seen since the peak in April. A large portion of this spike in OI was driven by a rebound in market share for CME futures, indicating the return of a “risk free” basis trade. That trade, if the basis premium to spot remains, will drive additional institutional interest with a buy spot, sell futures strategy, which itself should be bullish for spot prices.

2) US Takes Top Bitcoin Mining Spot as Hashrate Rebounds

Recent data from the University of Cambridge’s Center for Alternative Finance confirms what we know from our business: that, after years of growth, the United States now has the largest share of Bitcoin mining.

The Cambridge study is generally considered to be one of the highest-quality estimates of global mining distribution. Viewers should exercise caution in interpreting the results though, since there are several known issues with the study’s methodology, which involves collecting data from pools. For one, the sample set of pools, while comprising about 40% of hashrate, isn’t quite representative: the inclusion of Foundry, a rare American pool in a landscape mostly filled out by Chinese companies, biases the study somewhat toward the United States, though the final result is in line with our expectations. The IP addresses that pools collect are also spoofable through a VPN: this explains the underrepresentation of China, which accounts for 0% of hashrate in the most recent study, which is certainly not the case in spite of mining restrictions; similarly, other restrictive jurisdictions are probably undercounted. On the flip side, European VPN hotspots like Ireland and Germany, which have strong data privacy laws, are heavily overcounted.

When we wrote about China’s ban on Bitcoin mining, we predicted that hashrate would migrate to friendlier jurisdictions including the United States. But we didn’t anticipate that the pace of the relocation and hashrate recovery would be as rapid as it’s been.

3) Ethereum's Usage Grows

More than 60m Ethereum accounts have a non-zero balance, the largest of any public blockchain. And MetaMask, the most widely used DeFi and Web 3.0 wallet, has more than 10 million monthly active users, according to ConenSys. Ethereum’s smart contract usage is also at record levels on the back of increasing utilization of DeFi, NFT issuance, and other use-cases.

Even as layer 2 networks and alternative L1s have risen significantly, their reliance on Ethereum-based bridges only reinforces centrality and importance of the Ethereum as the blockchain-of-record for tokens.

4) Layer 2s See Growing Adoption

Bitcoin’s Lightning Network has gone parabolic on the back of increasing exchange adoption, usage in El Salvador, and simpler, more powerful at-home DIY Bitcoin node setups.

The newly launched optimistic rollup-based Ethereum layer 2 network Arbitrum One launched just a little more than a month ago and has amassed significant usage. The use of layer 2 networks on Ethereum is growing, providing significant scaling benefits.

5) DeFi Explosion

The total value locked (“TVL”) in decentralized finance applications and protocols has surpassed $220bn. This is a 24x year-over-year increase, with only $9.2bn locked in DeFi in October 2020. Summer 2020 was called “DeFi summer” for the enormous growth in DeFi adoption, but TVL never passed $9bn during that adoption phase. Since then, projects have honed their incentivization tactics and deployed them on increasingly accessible layer 1 blockchains and layer 2 protocols to maximize growth, resulting in faster, simpler, more accessible, and more lucrative DeFi experiences.

A note on TVL: TVL is a measurement of the USD value of tokens deposited as collateral into lending, market making, and yield aggregation applications. Much of this value is “double counted” (and sometimes more than double), as users use recursive rehypothecation techniques (borrowing off one set of collateral and re-depositing the borrowed funds into the same or other protocols) to gain additional leverage, but the complexities of those strategies are practically impossible to untangle with on-chain data, making this TVL metric the best proxy for the growth of DeFi we have.

6) NFTs See Major Breakout

Non-fungible tokens (NFTs) burst out of the crypto ecosystem and into the public consciousness this summer, with major investors, brands, celebrities, and traditional institutions participating in and championing the market. Despite a sense that the fervor had died down after August’s boom, September saw strong volumes and we expect October to do so as well.

The number of daily addresses interacting with NFTs has also continued to rise, despite hiccups in NFT market price action.

7) Private Investment into Crypto Ecosystem Reaches All-Time High

The amount of money invested by venture capital firms into crypto-focused startups reached new highs in Q3 at over $8bn. The continued and growing interest for VC allocations signals sustained institutional demand for exposure to the crypto ecosystem.

VC demand is so high that competition for allocation has become fierce, with many massive funds seeking to deploy capital in a smaller pool of startups. That plus the increasing maturity of the cryptocurrency ecosystem (and therefore, more later stage deals) has pushed median valuations to all-time highs, more than 70% above the broader VC market.

8) Congressional Allies Plead Case for Industry

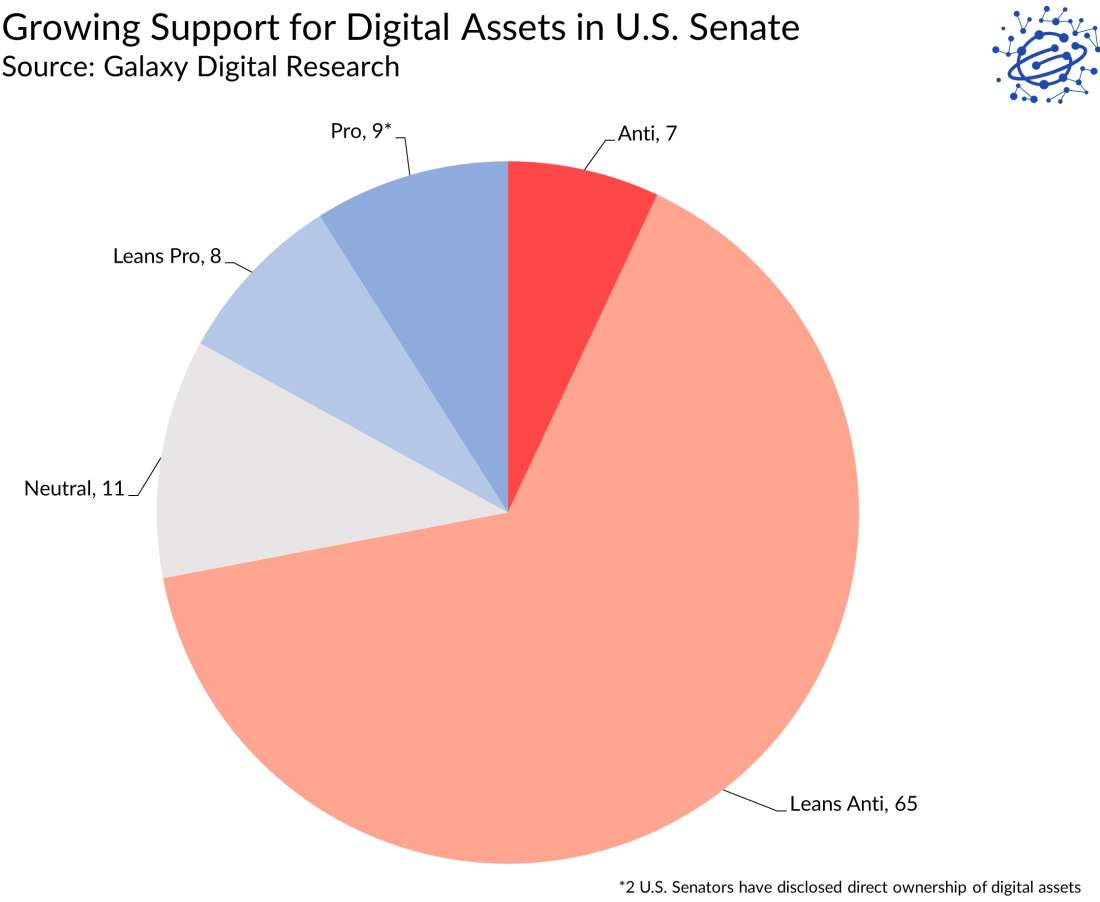

With major regulatory developments and pending legislation poised to affect the cryptocurrency ecosystem, industry advocates have increased their presence in Washington to great effect. By our count, at least 17 U.S. Senators are explicitly supportive of the cryptocurrency industry or lean favorable based on public statements and votes, with another 11 counted as neutral. Together, that’s more than ¼ of the US Senate we count as not-opposed to the cryptocurrency industry, a major advancement in just a few years.

The growth in Congressional support for crypto comes as adoption is growing among retail and institutional investors. A report by Crypto.com published in June found that more than 221 million people own cryptocurrencies (114m owned BTC, 23m owned ETH). A survey of institutional investors by Fidelity published in July found that 52% of institutional investors are invested in digital assets (which included financial advisors, family offices, pensions, crypto hedge and VC funds, traditional hedge funds, endowments and foundations, and HNW individuals), and 70% had a neutral-to-positive perception of digital assets.

9) Stablecoin Ecosystem Continues to Grow

The stablecoin ecosystem, which can be seen as a proxy for inflows given the widespread use of USDT for offshore on-ramping, has grown dramatically over the last year.

10) Cryptocurrency Market Cap Reaches All-Time High

The total cryptocurrency market broke its prior all-time high market capitalization this week, exceeding $2.6 trillion.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.