100 Days After the Merge

Introduction

About 100 days ago, Ethereum made its historic transition to a Proof of Stake (PoS) consensus protocol. The transition was the most complex and riskiest upgrade in Ethereum’s seven-year history, and some parts remain to be completed, such as staked ETH withdrawals. The transition, dubbed the “Merge,” occurred on September 15, 2022, and lasted approximately 2 epochs, or 13 minutes. Within this short period the Ethereum blockchain fused with the Beacon Chain, a parallel Ethereum PoS network launched on December 1, 2020. After the Merge, the Beacon Chain officially became the consensus engine of Ethereum, also called the Consensus Layer (CL), while Ethereum became the execution layer (EL), only supporting the execution of user transactions, not transaction settlement or finalization. For a more detailed overview of Ethereum’s transition to PoS, refer to Galaxy’s compendium of research about the Merge here.

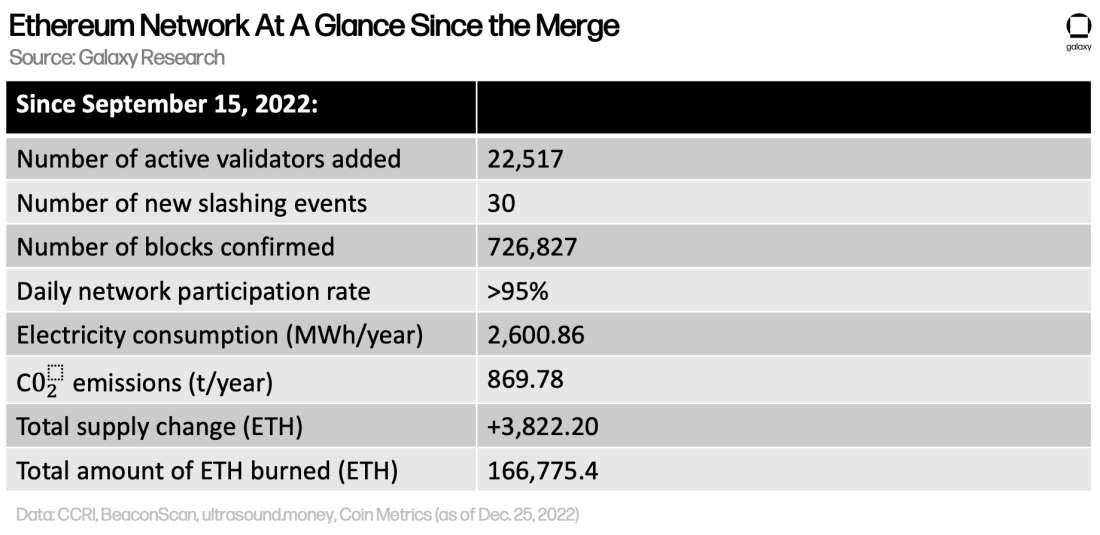

On September 15, Ethereum forked away from producing blocks through the energy-intensive process of Proof of Work (PoW) mining. As a result, the electricity consumption of Ethereum declined by over 99%, from 22.9m MWh/year to now 2,600 MWh/year. While the total amount of energy directed towards Ethereum has dramatically fallen because of the Merge, the energy expended towards other PoW blockchains has soared. Network hashrate on Ethereum Classic (ETC), which is a PoW version of Ethereum that was first launched back in 2016, nearly quadrupled in the days leading up to September 15. ETC Hashrate has since declined from highs of over 280 TH/s to 120 TH/s as of December 24, 2022 but is still elevated compared to its pre-Merge hashrate in August 2022. Hashrate on Ravencoin, which is also a GPU-mineable blockchain (like Ethereum was before the Merge), similarly quadrupled right before the Merge. CoreWeave, a large Ethereum miner, transitioned entirely to cloud computing services rather than retire its fleet of GPUs. Rather than all Ethereum miners shutting down their machines and operations, many Ethereum miners appear to have redirected their hashpower to alternative blockchains post-Merge.

Now relying solely on validators instead of miners, the Ethereum blockchain has been progressing steadily and without noticeable disruption over the past three months. As of December 25, 2022, Ethereum is secured by 491,461 active validators, each of which commits a staked deposit of 32 ETH, and a total of 15.7mn ETH representing 13% of total supply is currently staked on the network. Since the transition to PoS, over 726,000 new blocks have been confirmed through Ethereum’s PoS consensus protocol. Network participation rate, which is the percentage of active validators that are online and fulfilling their duties of block attestations and proposals, has remained above 95% on a daily basis.

For all the major changes that the Merge brought to Ethereum’s core specifications, the upgrade has proved to have minimal impact on end users and decentralized applications (dapps). The lack of any noticeable network disruptions caused by the Merge affirms the success of the upgrade. Notwithstanding the technical risks associated with the Merge, which are explained in detail in this Galaxy Research report, Ethereum core developers auspiciously pulled off the consensus change without inducing network downtime and while maintaining the same execution environment for users and dapp developers. There are several more game-changing upgrades slated for Ethereum in the upcoming years, but the success of the Merge has reaffirmed confidence in the ability of core developers to steward Ethereum safely and effectively despite the protocol’s ever-increasing code complexity.

This report presents 10 key metrics through which to evaluate the wide-ranging impacts of the Merge on Ethereum 100 days later. First, the report dives into the effects of the Merge on Ethereum’s monetary policy by examining network issuance and burn rate. Then, the report offers a few metrics illustrating the impact of Ethereum’s new consensus mechanism on maximal extractable value (MEV) and validator node operators. Notably, while the Merge has undeniably improved network dynamics in terms of inflation rate and block time uniformity, the upgrade has not significantly increased MEV earnings or validator rewards as much as expected, mainly due to broader market conditions which have caused a decline in overall on-chain activity. Finally, the report offers a comprehensive overview of the staked ETH withdrawals process, which will be activated in Ethereum’s next major upgrade, Shanghai.

Network stats

001

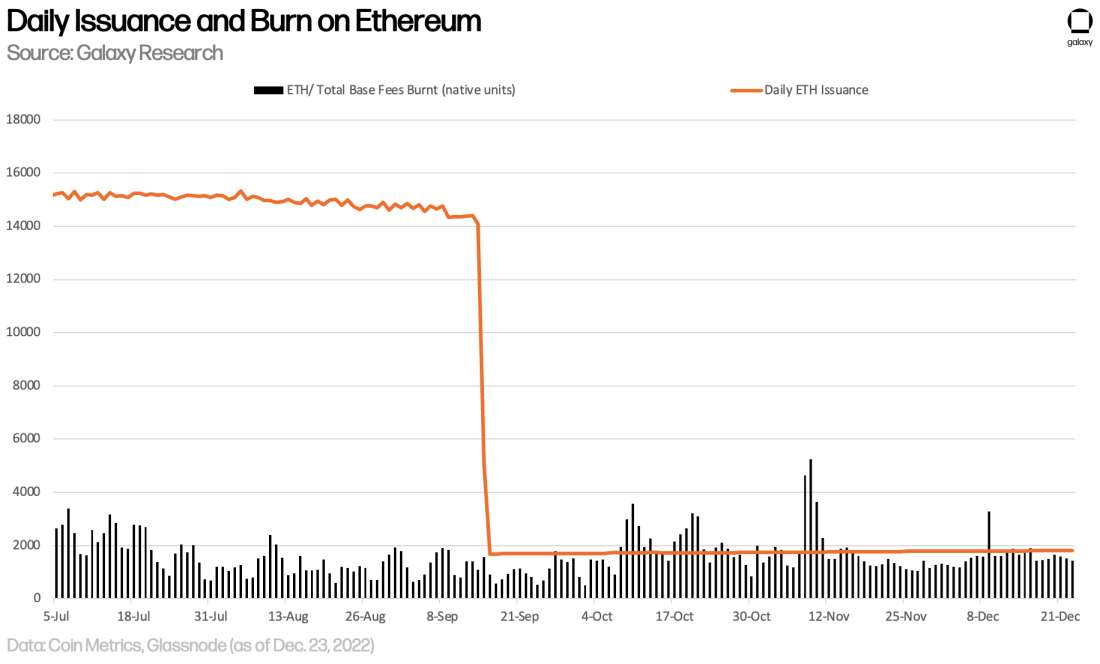

Network issuance and burn – Daily issuance of ETH has dropped from roughly 15,000 ETH to just under 1,800 ETH. Concurrently, the daily burn rate of ETH has not changed significantly since the Merge. Because issuance declined while the burn rate has stayed relatively consistent, the net supply change of Ethereum has been minimal, growing by just over 3,000 ETH over the span of 100 days. At these rates, the annualized inflation rate of Ethereum is 0.12%. Before the Merge, the annualized inflation rate trended between 4% and 5%. As expected, Ethereum’s transition to proof-of-stake has significantly impacted the network’s monetary policy and strengthened ETH’s value proposition as a store of value asset.

002

Block time – Block times on Ethereum have become more predictable and slightly faster because of the Merge. Instead of miners competing to finalize a block through hashing, validators are randomly selected to propose a block every 12 seconds on Ethereum, leading to less variance in block time. In addition, the network also no longer has a difficulty bomb mechanism to artificially increase block times, which has marginally reduced block times from roughly 14 seconds before the Merge to 12 seconds after the Merge. The number of blocks confirmed per day has noticeably increased from a daily average of around 6,000 blocks before the Merge to over 7,000 blocks for the past 100 days. Because of the consistency and speed of block proposals, the total number of blocks and therefore transactions confirmed on Ethereum daily has reached new all-time highs as seen in the chart below. While the improvement does not meaningfully increase the scalability of the network, as expected the Merge has resulted in minor improvements to the user experience on Ethereum through creating reliable block times.

003

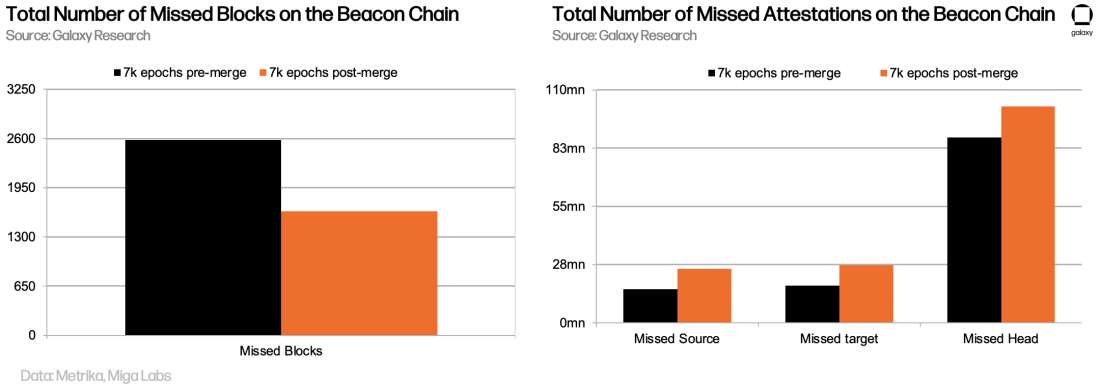

Number of missed blocks and attestations – The number of missed blocks on the Beacon Chain has declined 36.70% post-Merge, which suggests that validators are keener to earn block proposal rewards on Ethereum after the Merge due of additional priority fees and rewards from MEV (which was not present on the Beacon Chain). There has also been a slight rise in the number of missed attestations as the number of total active validators has also increased since the Merge. Validators most frequently earn rewards for making attestations (i.e., voting on correct blocks and transactions). However, validators will also occasionally be selected at random to earn a higher number of rewards for building and proposing a block, though probability of a validator being chosen to be a block proposer is slim: the multiplicative inverse of the total number of active validators (i.e., 491,461 ^ -1 or 1/491,461). Validator rewards from attestations are broken into three main components: the source, target, and head. Any amount of downtime in a validator’s operations are likely to result in a short period of missed attestations rather than a missed block, as block proposals are infrequent in the lifetime of a validator.

MEV stats

004

Adoption of MEV-Boost – The Merge ushered in a new era of MEV extraction on Ethereum that decouples the responsibility of block building from block proposing. Most validators earn MEV by running additional software called MEV-Boost that enables them to connect to multiple third-party relays, off-chain marketplaces where pre-built blocks containing MEV can be purchased in auctions. Relays facilitate honest bidding and block content transfers between block builders and validators, while builders act as the specialized entities that receive lucrative transaction bundles from MEV searchers and package them in with transactions from the local mempool, as well as private order flow, to build the most profitable blocks.

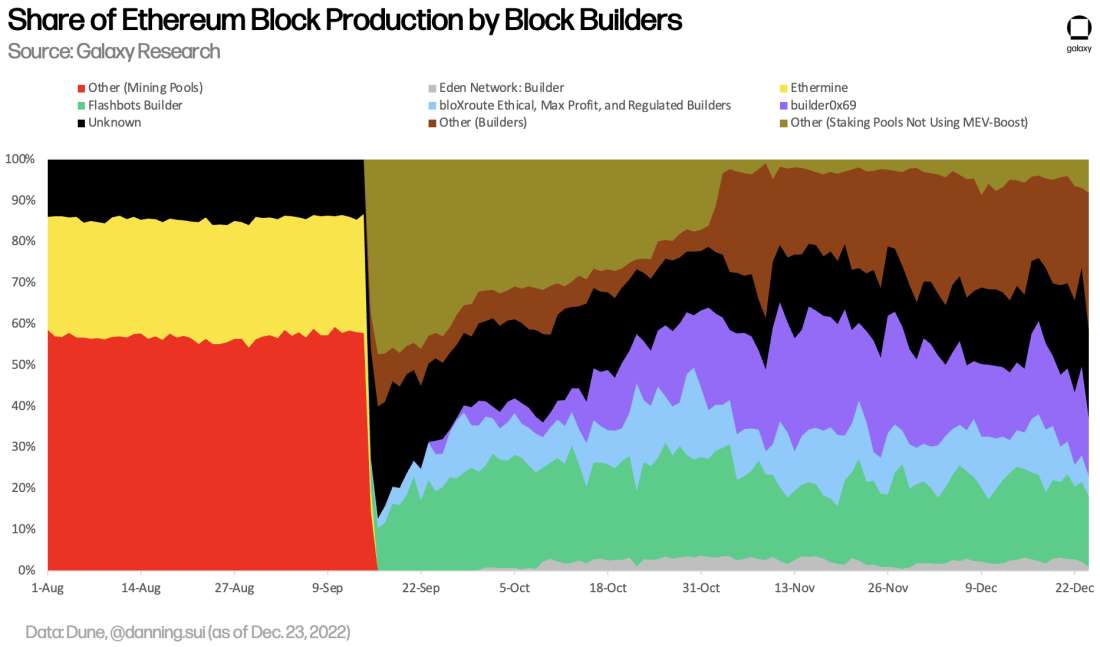

Around the time of the Merge, there were five relay operators and the most profitable builder, the Flashbots builder, dominated over 60% of market share. 100 days later, there are now three additional operators running non-censoring, non-permissioned relaysand the dominance of the Flashbots builder has declined to less than 30%. The number of validators earning MEV through MEV-Boost on Ethereum has also climbed steadily, growing from just over 10% at the Merge to now roughly 80%.

005

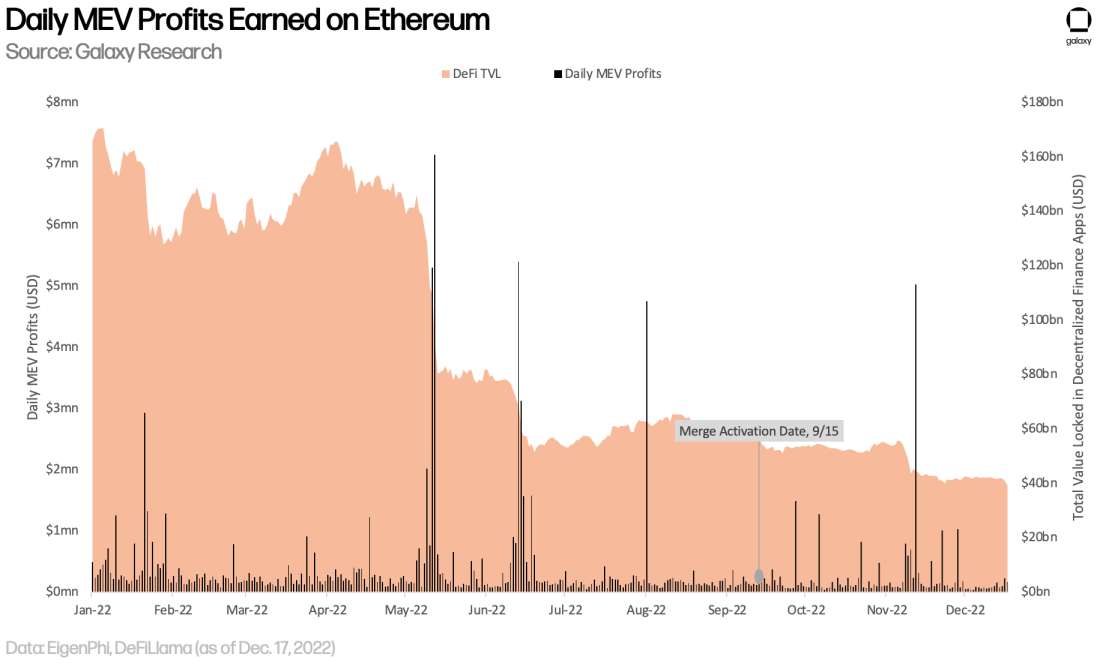

Daily amount of MEV earned – Despite drastic changes to the infrastructure of MEV on Ethereum post-Merge, the amount of MEV earned by stakeholders stayed relatively constant. Spikes in MEV throughout 2022 are usually correlated to increased activity and volatility on decentralized finance (DeFi) applications. Following widespread market panic after the Luna/Terra crash in May, on-chain activity on Ethereum was sparse until activity spiked in response to market volatility in the wake of FTX’s collapse. For more information about on-chain DeFi activity in the month of November, read this Galaxy Research report.

006

Number of censored vs uncensored blocks – One of the negative impacts of MEV-Boost adoption, and thus a second-order effect of the Merge, has been the increase in the number of censored blocks on Ethereum. It is estimated that over 57% of blocks on Ethereum over the past 100 days has been produced by a censoring relay such as the Flashbots relay which actively filters out transactions that have interacted with addresses on the FinCEN’s SDN (sanctioned entities) List. Censorship by relays is voluntary, and the existence of non-censoring relays continues to ensure that all transactions are eventually confirmed, but Ethereum’s credibility as a global, permissionless network would be challenged if most relays censored transactions, for whatever the reason.

Validator stats

007

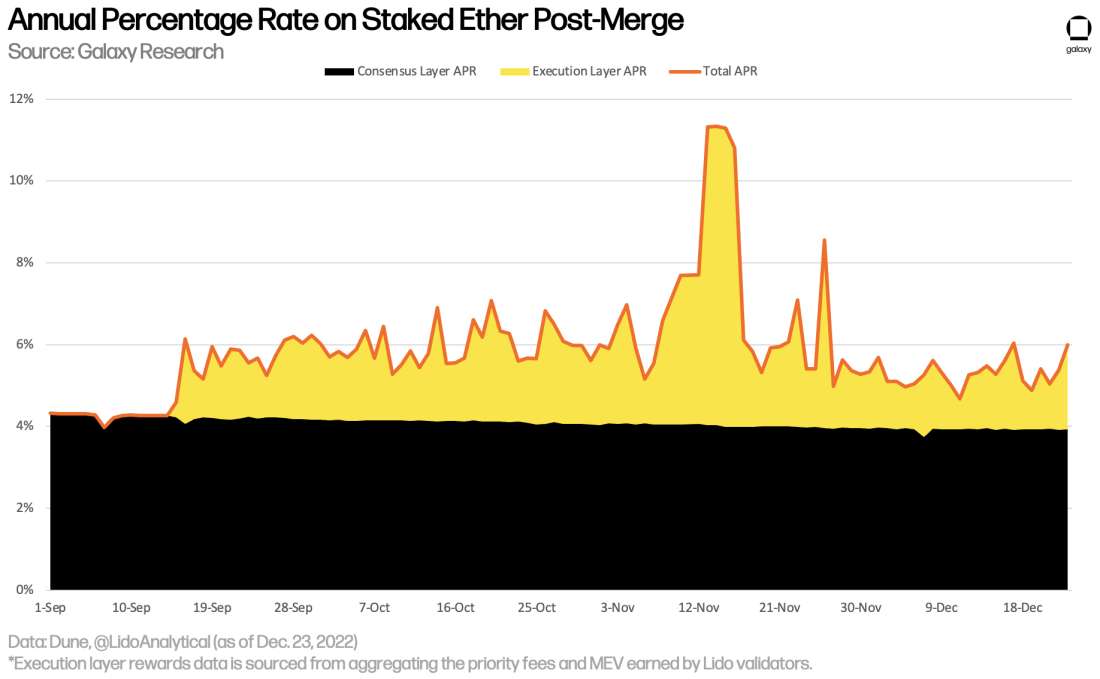

Staking rewards – Perhaps the second most anticipated impact from the Merge, second only to the reduction in the network’s overall electricity consumption, was the impact on validator rewards. Post-Merge, Ethereum validators have started to earn liquid rewards in the form of priority fees and MEV. No longer relegated to only those highly specialized operators who can manage large data centers of mining hardware, these rewards are now available to regular Ethereum node operators. Based on the amount miners were earning from priority fees and MEV prior to the Merge, total validator rewards, which accrue in the form of interest on a staked balance of 32 ETH, was expected to more than double. However, early estimations of validator rewards post-Merge did not account for worsening macro conditions drying up demand for block space and reducing gas fees on Ethereum after the upgrade, so actual accrued rewards have been lower than expected. Unlike rewards from the CL of Ethereum, rewards from priority fees and MEV are highly volatile and dependent on network activity.

Since the Merge, the annual return on staked ETH has increased from roughly 4% to between 5% and 6%. Unlike the rewards earned from the consensus layer (CL) of Ethereum, which remain locked until a future network upgrade, rewards earned from the execution layer (EL) are highly variable and dependent on user activity. The only time in the last 100 days when validator rewards more than doubled was in the wake of FTX’s collapse during the week of November 7th when DeFi activity on Ethereum spiked. If macro conditions improve and network usage of Ethereum increases, EL rewards are also expected to rise and increase the total annualized return on staked ETH.

As illustrated in the chart below, CL rewards have slightly declined over the past 100 days as the number of total validators has increased, which is a design feature of the Merge. The return on staked ETH issued by the Beacon Chain dynamically adjusts downwards as the number of Ethereum validators increases and increases as the number of validators decreases. For more information about the reward dynamics of Ethereum post-Merge, read this Galaxy Research report.

008

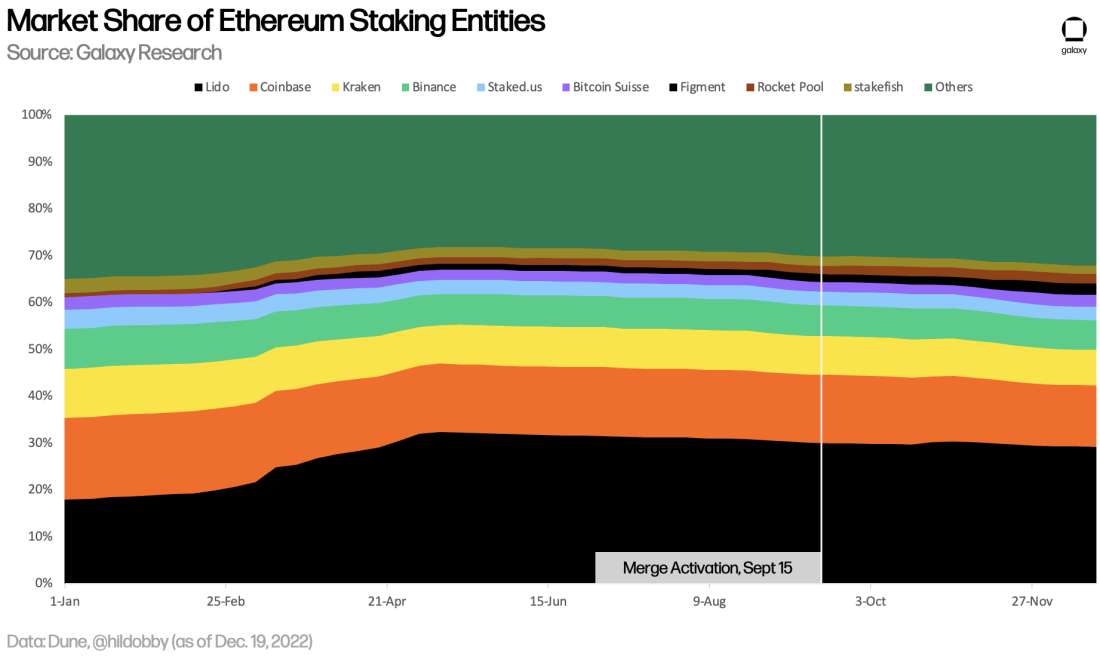

Market share of Ethereum staking-as-a-service entities – Since the Merge, the number of active validators has increased by 22,517, a 15% increase in the total amount of ETH staked on Ethereum compared to pre-Merge levels. Notably, the addition of new validators over the past 100 days has not noticeably changed the distribution of staking market share by large entities such as Lido, Coinbase, and Kraken. Lido continues to dominate the Ethereum staking market by controlling close to 30% of validators. From the perspective of validator node operators and the supply of staked ETH they control, the Merge has had virtually no impact on staking market topography.

009

Market share of Ethereum block builders - However, from the perspective of Ethereum block production, the Merge has considerably impacted the role of validators by delegating the responsibility of block building to third-party entities such as Flashbots, BloXroute, Eden, and other pseudonymous “builders.” The percentage of Ethereum blocks produced by validator node operators not using MEV-Boost has declined dramatically over the past 100 days as the adoption of MEV-Boost has risen. Ethereum staking entitiesare not the same entities including transactions from the public Ethereum mempool into blocks—they solely receive blocks from relays. More than 80% of blocks on Ethereum are built off-chain through builders and relays, which adds an additional layer of complexity, as well as regulatory risk, to Ethereum.

010

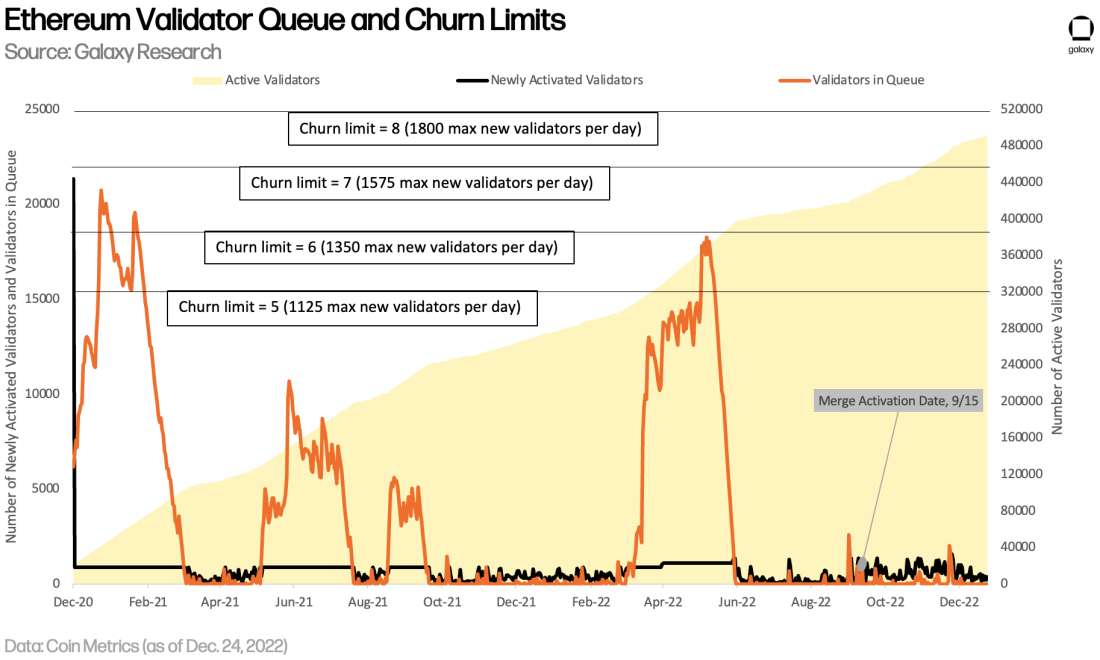

Validator queue and churn limit – 49 days after the Merge, the churn limit of Ethereum, which dictates the maximum number of new validator entries and exits, increased from 6 to 7 per epoch as the number of total validators surpassed the threshold of 458,752 on November 3, 2022. The limit on the number of validators that can enter the entry and exit queue of Ethereum daily is now 1,575, instead of 1,350. The churn limit will increase again to 8 per epoch once the total number of active validators reaches a threshold of 524,288 validators.

Looking ahead to Shanghai

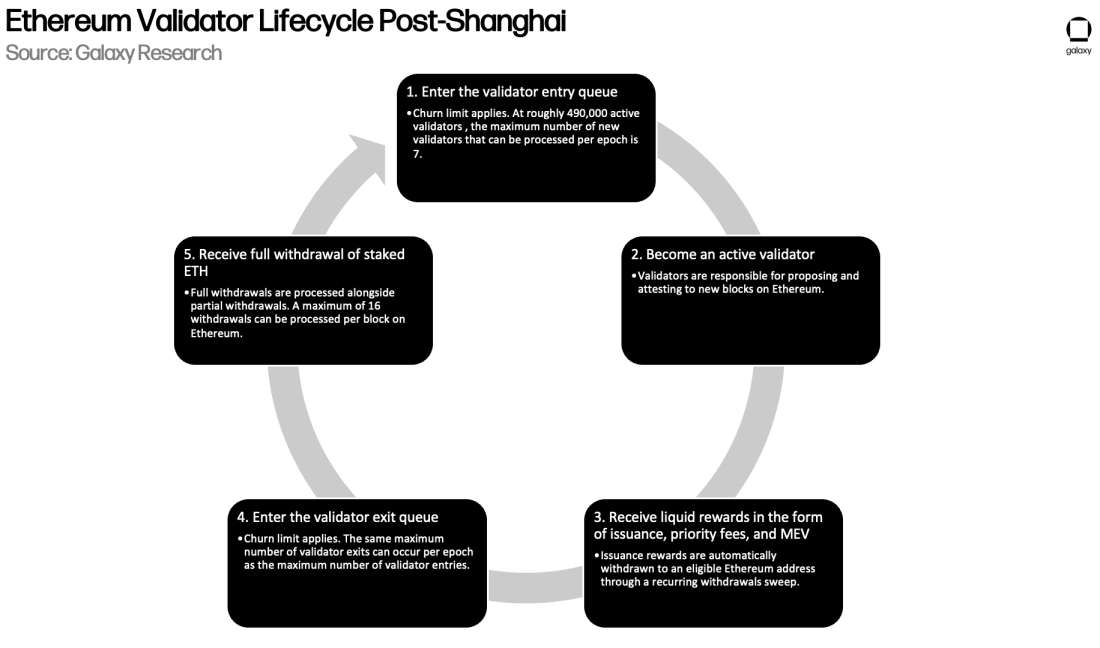

With the Merge complete, Ethereum core developers have started work on the next major network-wide upgrade, Shanghai. Technically, Shanghai is only the upgrade name for the EL of Ethereum, while Capella is the upgrade name for the CL of Ethereum. However, given that the upgrades on both networks will happen simultaneously, Shanghai is oftentimes used to refer to both upgrades. The main component of Shanghai is the addition of staked ETH withdrawals, ability of validator node operators to withdraw their CL rewards, as well as the full amount of their staked balance on the Beacon Chain.

Both partial and full withdrawals of ETH from the Beacon Chain remain disabled and social pressure on Ethereum core developers to quickly enable this functionality has grown since the Merge. Planning for Ethereum’s next major upgrade after the Merge started in earnest in late October. After weeks of debate and discussion, Ethereum core developers agreed in early December to limit the scope of Shanghai as much as possible to expedite staked ETH withdrawals. The activation of staked ETH withdrawals is now expected sometime around March 2023.

The following is a detailed overview of what the process for withdrawing staked ETH will look like for validator node operators post-Shanghai.

Partial withdrawals

All validators wanting to withdraw their CL rewards will have to ensure their withdrawal credentials are updated to the new “0x01” format. This is also a requirement for validators wanting to withdraw their full balance of staked ETH. Initially, when the Beacon Chain first launched, validator node operators were required to specify a withdrawal address that would deposit to an address on the CL of Ethereum. At the time, the plan to transition Ethereum by hotwiring the Beacon Chain to the existing network of Ethereum had not yet been formulated. Therefore, there was no reason to require validators to specify a withdrawal address on Ethereum, instead of the Beacon Chain.

However, given the design of the Merge and the fusing together of the Beacon Chain with Ethereum, validators are required to update their withdrawal credentials to a 0x01 format, which enables withdrawals directly to an Ethereum EL address. Newer validators that were spun up after 0x01 withdrawal credentials were added to the Beacon Chain back in March 2021 had the option of specifying an Ethereum withdrawal address, though the majority chose to create a default withdrawal address to the Beacon Chain according to the 0x00 format. According to Ben Edgington, an Ethereum core developer and product lead for CL client Teku, there is roughly 302,154 validators with 0x00 credentials, and 186,722 with 0x01 credentials on the Beacon Chain.

Once Shanghai is activated, withdrawal credential changes will start to be processed on the network in a similar manner to withdrawals. The network can only process a maximum of 16 partial or full withdrawals every block, which is produced every 12 seconds. Similarly, the network will only be able to process a maximum of 16 withdrawal credential changes per block. This means it will take about 100 hours for the network to run through and update the withdrawal credentials for the entire validator set of Ethereum. For validators whose withdrawal credentials are already in the 0x01 format, the network will automatically sweep their CL reward balance to their specified EL address with no additional action required by validator node operators.

Every 12 seconds, the network scans through the active validator set by validator index number. Developers are currently discussing bounding the network scan for withdrawals to a maximum of 1,024 validators at one time. A bounded scan would prevent edge case scenarios such as the network scanning through the majority (or the entirety) of the validator set and this delaying block times because there are little or no eligible withdrawals to process. Based on the number of active validators on Ethereum as of December 24, 2022, the scan for withdrawals should almost always result in the maximum number of 16 withdrawals being processed per block. To reiterate, the network will automatically withdraw a validator’s CL reward balance, if the balance is greater than zero, to their specified Ethereum address.

All Beacon Chain withdrawals will be processed as system-level operations on Ethereum that are pushed to the Ethereum Virtual Machine (EVM) instead of transactions that are first processed by the EL. Therefore, withdrawals will not be identifiable as a normal user or smart contract-initiated transaction on the blockchain. Withdrawals will be identifiable as a new type of object in an Ethereum block and will possess its own dedicated data field in the block header. In addition, there will be no gas costs associated with withdrawals given that there is a maximum number of withdrawals that can be processed per block on Ethereum and the additional operational costs of processing this maximum number of withdrawals is negligible relative to the costs of executing user and smart contract transactions.

Full withdrawals

A full withdrawal of a validator’s staked ETH balance is first subject to the same churn limit as new validator entries, meaning there is a maximum of 7 validator exits that can be processed on the Beacon Chain per epoch or 6.4 minutes. Once a validator has successfully gone through the exit queue, they are placed in the withdrawals queue. For the full balance of staked ETH to be withdrawn, a validator node operator must have already updated their withdrawal credentials to the new “0x01” format, as mentioned above.

Assuming the update has been made, full withdrawals will be processed alongside partial ones. The network periodically scans through the active validator set and processes a maximum of 16 withdrawals, partial or full, per block. To reiterate, the withdrawals sweep is conducted according to validator index number and is likely to be bounded to a maximum scan of 1,024 validators per block to prevent any edge cases resulting in delayed block times. Assuming the network needs to process withdrawals for all validators in the active set, a full withdrawal would take roughly 100 hours to process post-exit queue.

Technically, there are already 1,084 validators that have exited Ethereum and are currently waiting to enter the withdrawals queue (Step 5 in the diagram above) after the activation of Shanghai. 864 of these exits were voluntary. They were likely initiated by validator node operators that wanted to retire their staking operations and not be penalized by the network for going offline. The other 220 validators were exited forcefully through slashing. Slashing is a penalty imposed on validators for behaving against the rules of the network. These penalties are most applied to validators that are detected of proposing multiple blocks or making multiple attestations during a single slot. The existence of 1,084 exited validators on Ethereum suggests that there will likely be at minimum 1,084 full withdrawals processed and 34,688 ETH un-staking from the Beacon Chain shortly after the activation of Shanghai.

Conclusion

As expected, the Merge has radically impacted issuance, block times, and the MEV supply chain. However, due to unexpected market downturn and volatility, the returns on staked ETH have been lower than expected trending around 5%-6% rather than the envisioned 10% and above. In addition, the impact of the Merge on Ethereum’s censorship resistant qualities because of the activity of censoring relays and third-party block builders has been alarming. Since September 15, over half of all blocks produced on Ethereum were produced by a censoring relay. However, the trend of increasing on-chain censorship has been declining slightly since November with the growth of new non-censoring relay operators and pseudonymous builders.

With Ethereum’s most anticipated and complex upgrade out of the way, Ethereum core developers are preparing for Shanghai, which will primarily activate staked ETH withdrawals. The ability to withdraw staked ETH is a key functionality that has been missing from the validator lifecycle since the launch of the Beacon Chain in December 2020. Once enabled, the network will likely be processing the maximum number of withdrawals every block. At 490,000 validators, it will take roughly 100 hours for the network to process withdrawals and withdrawal credential changes for every active validator. There is likely to be a surge in the number of pending validator entries, exits, withdrawals, and withdrawal credential changes shortly following Shanghai as users and business re-evaluate their staking operations and recoup gains. Ethereum has passed a significant milestone through the activation of the Merge, but there are several more important milestones yet to be reached on Ethereum’s development roadmap.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email contact@galaxydigital.io. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.