Executive Summary

This report examines the current state of the Bitcoin mining industry going into 2022, evaluates some of last year's events, and assesses how they impacted the market. We also discuss both mining-specific and macro considerations and their potential impact on the future of the industry.

Bitcoin Mining’s Breakout Year

2021 was a revolutionary year for Bitcoin mining. The third halving in May of 2020 brought broader attention to mining, and the growing interest has never subsided. Favorable economics made mining profitable for almost all participants, drawing in more and more participants. The emergence of flare-gas mining, Elon Musk’s comments about Bitcoin’s ESG footprint, the creation of the Bitcoin Mining Council, and a western migration that accelerated as a result of Chinese regulation all contributed to a rapidly expanding and shifting mining landscape marked by greater transparency. In spite of all the attention that the historically-opaque market has received, volatility, regulation, and supply chain disruptions made 2021 one of the more surprising years in the history of mining, and one of the most formative.

The year started in the thrill phase of a bull market. Throughout the course of the year, several different local all-time highs were broken, each of which was followed by a significant dip. Bitcoin mooned, dumped, ranged, and rallied. Most of the year, uncertainty was the only constant in the markets.

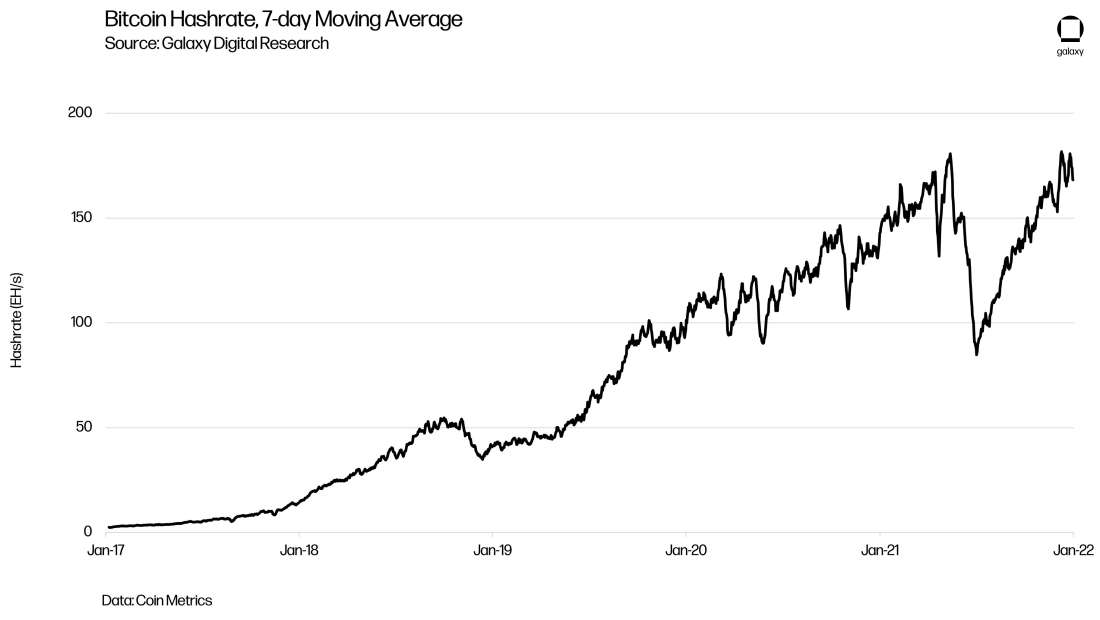

While the volatility was felt by both miners and other industry participants, price was far-enough removed from hashrate that mining was profitable throughout the year for virtually all mining operations. While hashrate nosedived as a result of idiosyncratic events, namely the convergence of the global chip shortage and the Chinese ban on mining, its V-shaped recovery occurred more quickly than most analysts predicted. Hashrate ended the year back near all-time highs, and substantially above where it started the year.

Event-driven risks are hard to price in, and most models released at the start of the year were ultimately far from accurate. The mining industry experienced several majorly disruptive events this year, many of which resulted from the prolonged effects of the pandemic and overengineered supply chains.

Early in the year, securing machines was a major bottleneck, as a result of supply chain disruptions and a global chip shortage. With BTC trading high, ASICs were in demand, and long lead times became standard. The secondary market, which trades relatively thinly, reflected a strong appreciation in ASIC prices.

By the middle of the year, the on crypto in China, historically the center of the mining industry, led to significant market volatility, but also a massive drop in hashrate that caused mining profitability to soar. The ban briefly eased the hardware shortage as a large number of Chinese miners began selling their machines on secondary markets. The year ended with another shortage, albeit less-intense than the shortage at the beginning of the year, affecting everything from machines to transformers. This time, the shortages stemmed from covid-related supply chain disruptions that manifested in both higher prices and much longer delivery times.

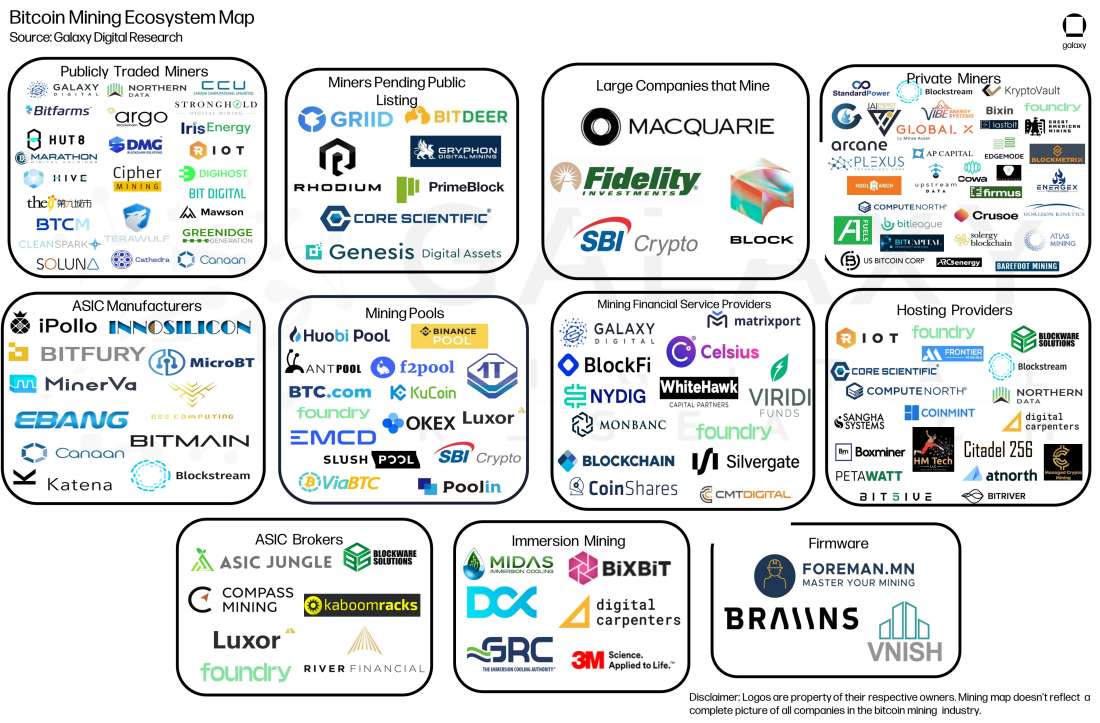

Bitcoin Mining Ecosystem Map

More than anything, China’s ban on bitcoin mining showed the network’s robustness. Hashrate returned to all-time highs faster than most expected, and 2021 was a critically important year for the maturation and growth of the industry.

2021 was a growth year for bitcoin mining also defined by maturity. The mining ecosystem has both deepened and broadened. Several verticals, including brokerage, off-grid mining, and hosting saw a significant number of new entrants. Most notably, the industry has seen large capital inflows through a record number of public listings, driven by demand for liquidity and capital that only the US public markets are able to provide.

The Great Mining Migration

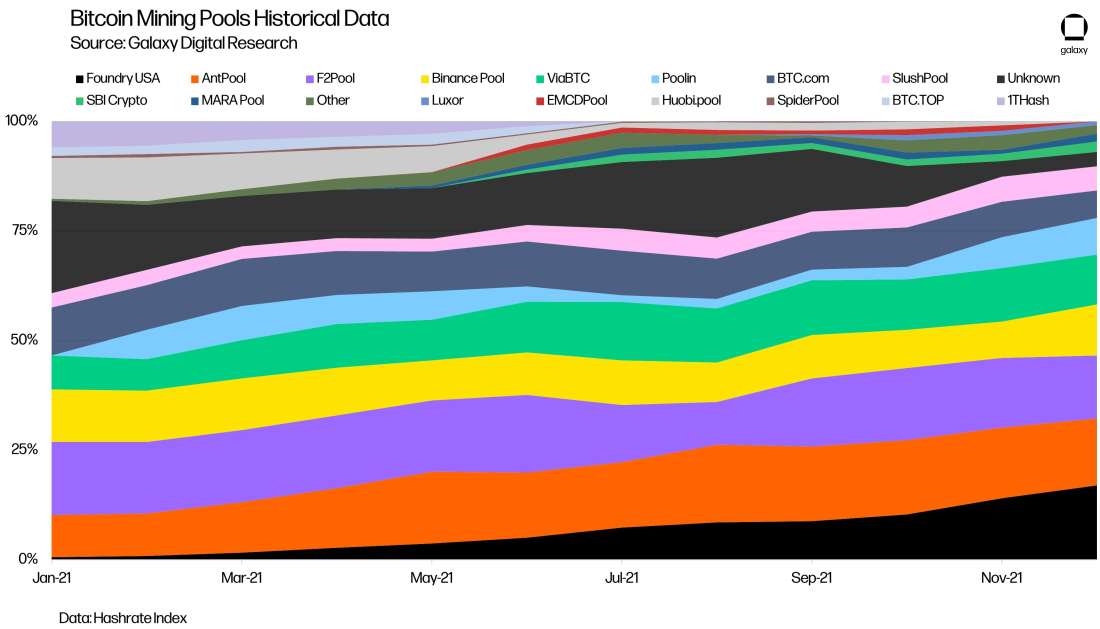

The geographic migration of miners is one of the most pronounced ongoing phenomena in the industry, and arguably the year’s defining feature. A year ago, China was by far the leading country by online hashrate, with over half of the total network hashrate being generated in the country. While both Chinese miners and hardware manufacturers and international competitors had already been expanding operations outside of the country, the floodgates opened when China announced a ban on mining in May. This ban, which to date remains the single largest geopolitical attack on the Bitcoin network, spurred massive growth in Kazakh, Russian, and American mining operations while dramatically decentralizing the network out of China.

Since the Chinese mining ban, geopolitical risk has become a much better-understood force in the mining industry. Miners increasingly choose to base their operations in stable political environments, hoping to avoid regulatory uncertainty like that encountered in China, or more recently Kazakhstan. Within the United States, miners gravitated to friendly jurisdictions with excess energy like Wyoming, North Dakota, and Texas, a trend that we expect to continue.

In addition to the migration of actual mining hardware out of China, non-Chinese pools’ hashrates have grown significantly. Slush Pool, Foundry Pool, SBICrypto Pool, and others grew substantially this year, another sign that miners are reducing their geopolitical risk.

Public Companies in the Spotlight

The ban on mining in China dramatically accelerated the existing hashrate migration out of the country. While the United States was already gaining market share before the ban as a result of its superior regulatory and financial infrastructure, at the beginning of the year the US was still a frontier market for mining. Following the ban, the United States and North America rapidly became the center of the mining industry. At the end of Q3, publicly traded miners on US exchanges represented approximately 12% of the Bitcoin network’s hashrate. Simultaneously, we saw several private miners begin taking steps to list publicly in order to gain access to capital markets enjoyed by the publicly traded miners.

The State of Public Markets

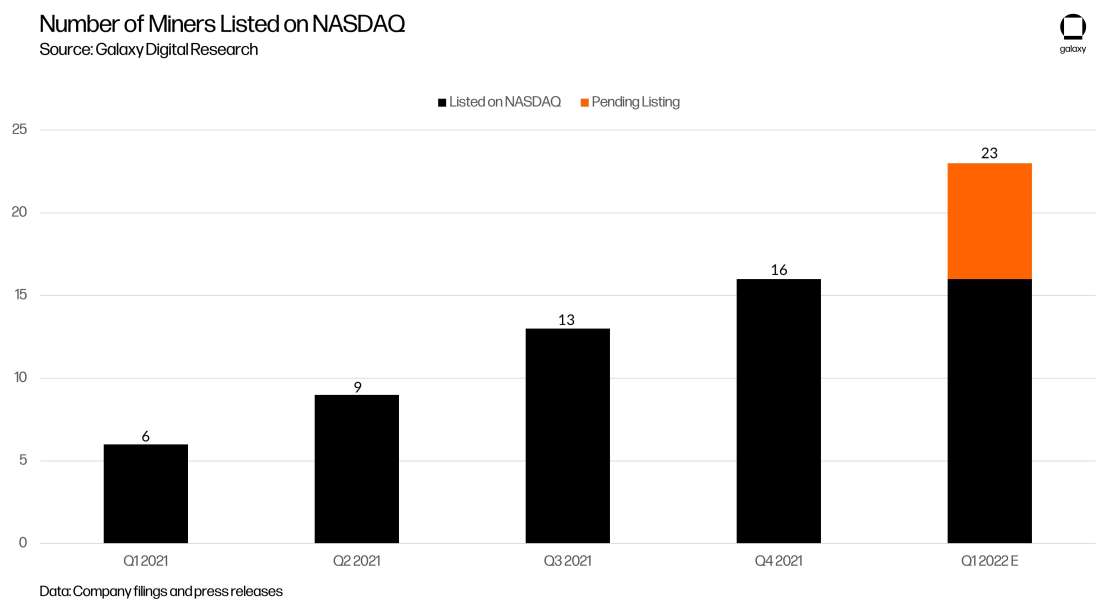

At the start of 2021, there were only two bitcoin mining companies listed on the NASDAQ, Marathon Digital (MARA) and Riot Blockchain (RIOT), with several others traded on Canada’s TSX ventures exchange. By the end of 2021, 16 bitcoin mining companies are listed on the NASDAQ, with 7 additional listings pending.

Over the course of 2021 and particularly the second half of the year, there was significant investor demand for exposure to BTC price action without directly holding the asset. Institutional and retail investors looking to get exposure to bitcoin have invested in publicly traded mining companies. Demand for mining company stock has also been driven by the prolonged denial of a spot bitcoin exchange-traded fund by the SEC, China’s mining ban (which has made the US the leading geographic region for mining), and an increasingly common view on mining as an infrastructure play. As a result, we’ve seen a boom in the equity capital markets with a series of mining companies going public on the NASDAQ.

Over the course of 2021, the number of bitcoin mining companies listing via IPO or SPAC continued to increase, as did uplistings to the NASDAQ from the TSX and other foreign exchanges. This number will continue to grow throughout 2022 as there are currently 7 pending listings between IPO’s and SPACs.

Financing

As bitcoin investors rode the bull market of 2021, we saw an increasing number of miners tap the public markets for both debt and equity financings, typically after selling equity in private markets.

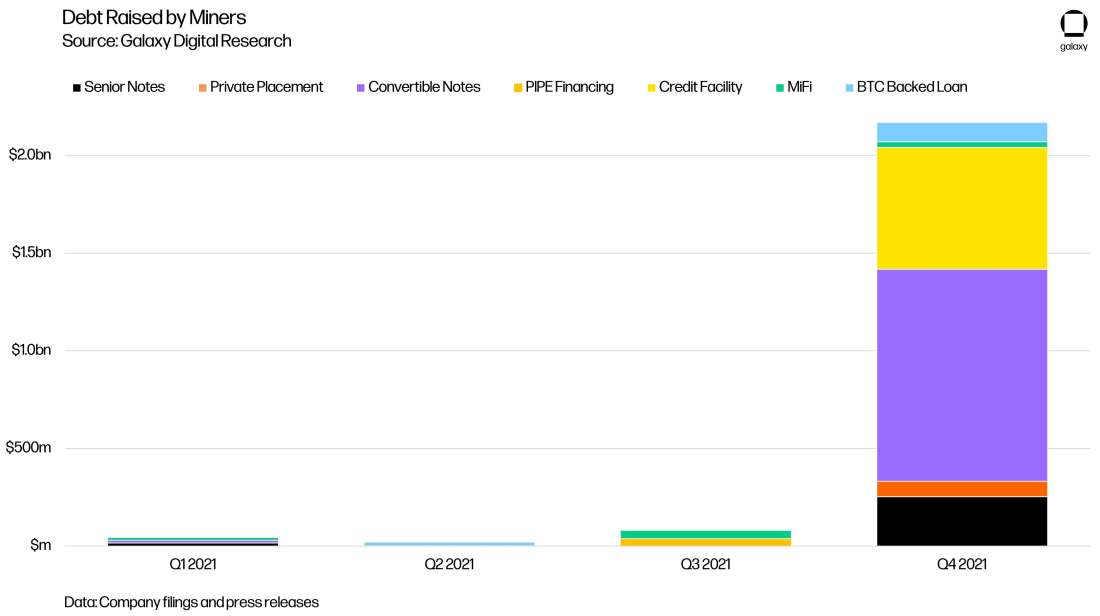

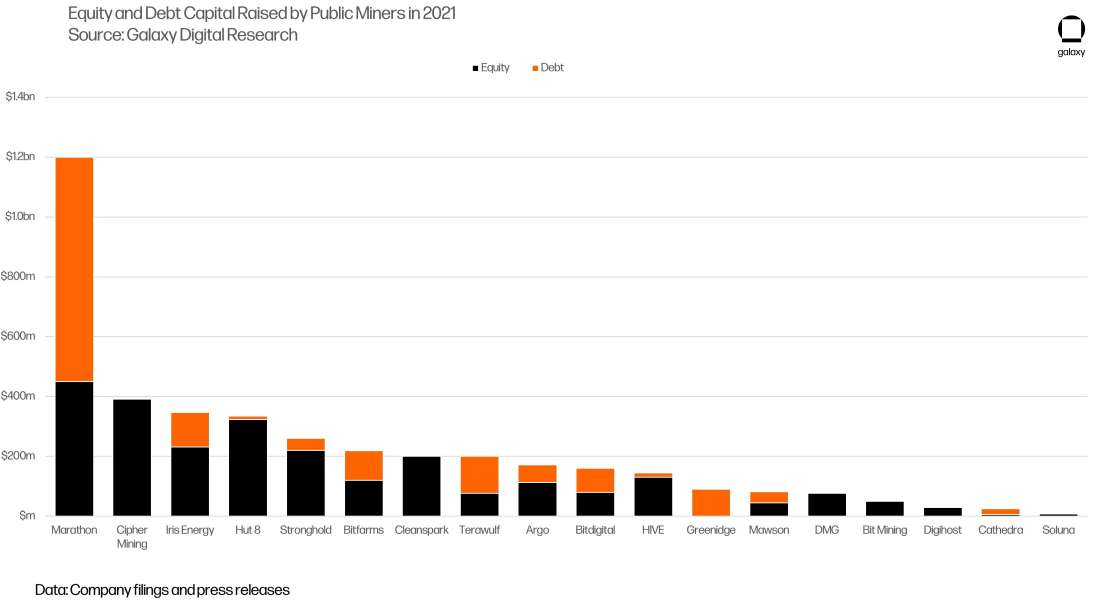

Bitcoin miners raised a total of $2.3bn in publicly announced debt, of which private miners raised $914m and publicly traded miners raised $1.4bn. This figure should be seen as a lower bound, since it’s likely that a significant amount of unannounced debt was also raised. Of the publicly announced debt raised by miners in 2021, $2.1bn (93%) came in the 4th quarter of the year. The issuance of convertible notes was the most common type of debt issuance by bitcoin miners, with a total amount raised of $1.1bn.

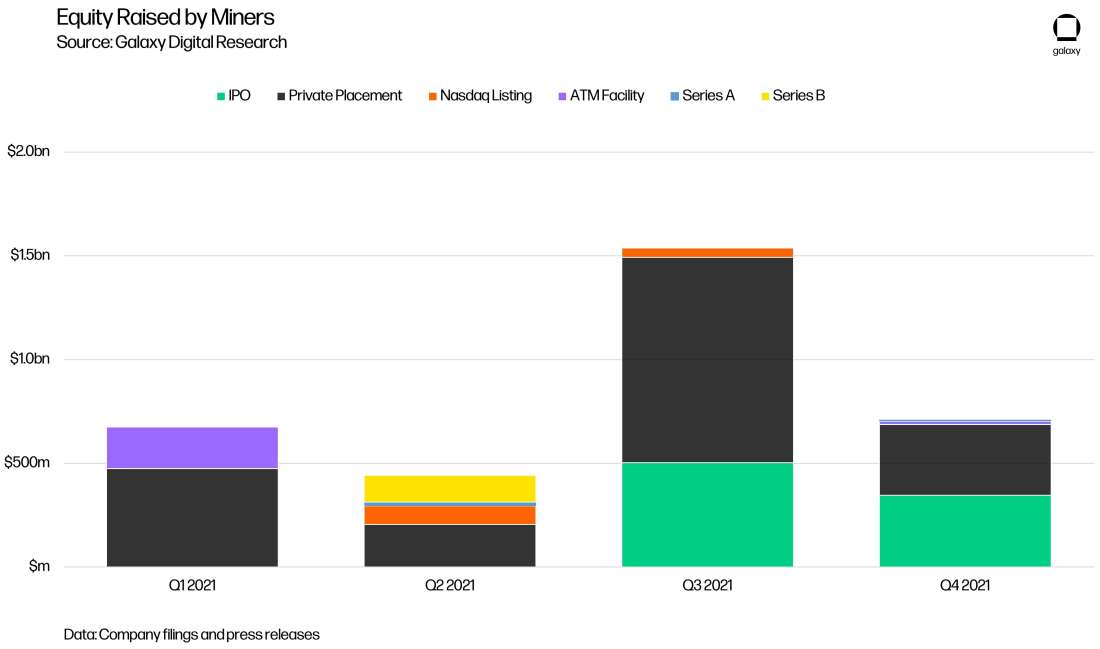

The equity capital markets were the largest source of financing for bitcoin miners. Miners raised a total of $3.9bn in publicly announced equity, of which private miners accounted for $1.5bn. After the Chinese government’s ban on bitcoin mining, there was a major uptick in the amount of equity and debt capital raised by North American mining companies. In Q3 of 2021, multiple companies completed their SPAC mergers and IPOs, and some were uplisted to the NASDAQ from OTC exchanges.

As the industry becomes more competitive and building economies of scale becomes more crucial, we expect to see even more mining companies attempt to take advantage of the unparalleled liquidity in public equity markets and use the capital raised to invest in additional equipment and infrastructure buildout. This trend will be particularly pronounced if the BTC price remains high enough that most miners continue operating profitably. In the event of a sustained BTCUSD market downturn, a spike in M&A activity seems likely, as larger and leaner miners opportunistically purchase less-efficient competitors for hard assets like machines and transformers.

As the industry matures, miners will continue to explore other financing options, including debt backed by bitcoin and ASIC machines, and become increasingly sophisticated with their treasury management strategies for yield enhancement and risk protection. Like other commodity producers, miners carry a substantial amount of price risk, which they can hedge through the careful use of derivatives. Under a tax regime that favors long-term asset holders over short-term speculators, miners look to derivatives to derisk without selling spot bitcoin.

Transparency

2021 saw the acceleration of an ongoing trend toward transparency and openness in the industry. Long considered one of the more opaque and hard-to-navigate verticals in the cryptocurrency space, Bitcoin mining has become more accessible and easier to understand through the efforts of a growing and diverse set of public market participants, researchers, working groups, and service providers.

Public Company Data

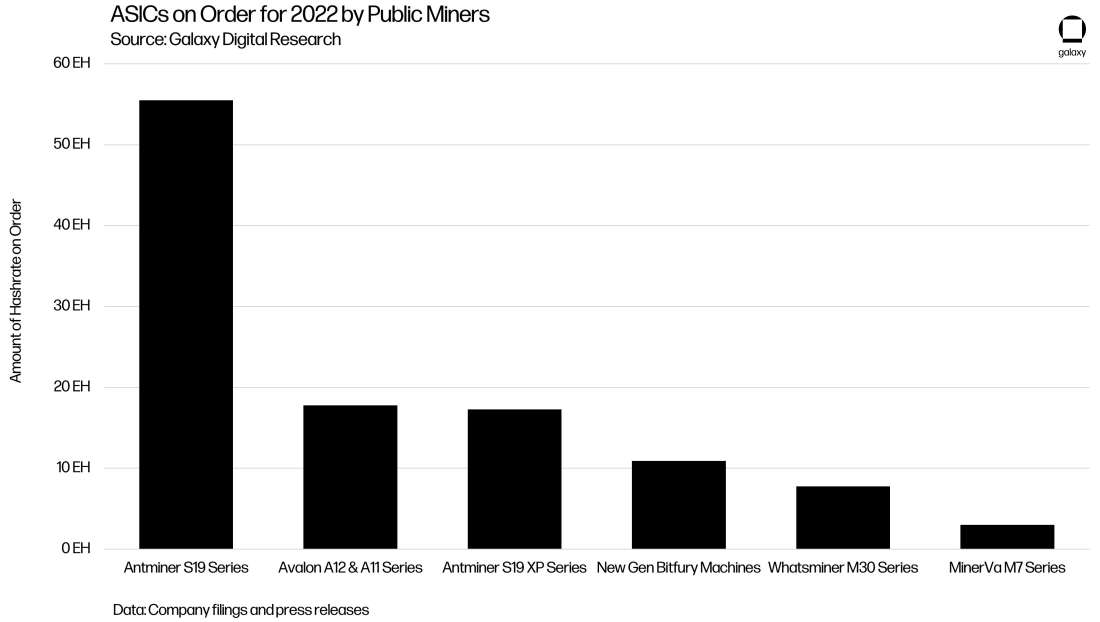

With more bitcoin mining companies now listed on US exchanges, reporting requirements for public companies have opened the door for industry participants to gain key insights into Bitcoin mining operations. One of the biggest benefits of having many publicly listed miners is that it’s easier for researchers to estimate future hashrate growth by observing press releases detailing companies' machine purchase orders. Not only does this provide more detail into companies’ growth plans, the total capital investment in new hardware, and how much additional capital they may need to raise to finance purchases, but it provides valuable information about pricing in the machine manufacturing markets as well. Based on these public filings. We can gain a better understanding of the market share dominance of various ASIC manufacturers to help determine which machines comprise what portion of the network’s hashrate today and in the future. At the end of Q4 2021, publicly traded miners represented approximately 18% of the network’s hashrate, and we expect this share to increase to 40-45% of the network’s hashrate by the end of 2022 based on the 100+ EH of machines on order for 2022.

As more mining companies go public via IPO or SPAC, it will become increasingly important to standardize the methodology for calculating cost to mine a coin and other metrics so that analysts and investors can appropriately evaluate the operations of these companies. To help analysts assess the bitcoin mining companies’ operational performance in a standardized way, Galaxy introduced a methodology for calculating the cost to mine a bitcoin.

Tooling, Data, and Content

2021 saw the emergence of better data and tooling for bitcoin mining for both retail and institutional investors. Luxor upgraded their Hashrate Index, which offers several insightful metrics like their rig price index, which tracks the ASIC prices at various efficiency levels. The rig price index data when paired with bitcoin price data allows users to understand the correlation between bitcoin and ASIC pricing as well as to more easily determine the fair market value of machines. The Braiins team also launched a new version of their Mining Insights page, which provides several useful tools including a breakeven electricity price chart for various ASIC models and a profitability forecasting calculator.

Companies like Coin Metrics provided additional datasets for mining, and Clark Moody upgraded his dashboard, which offers real-time metrics for network hashrate and difficulty. On the content side, podcasts including those by Compass, On the Brink, and Bitcoin Magazine covered a wide range of mining content.

ESG

2021 brought increased attention to the environmental sustainability of bitcoin mining and a keen focus on the energy mix used by miners. To contribute to the discussion and help educate the public, the mining community quickly rallied to provide more data and insight into the energy sources and energy mixes of their operations. Most notably, the

Cambridge Center for Alternative Finance published updates to its Bitcoin Electricity Consumption Index and Mining Map. The index provides an estimate of the bitcoin network’s daily electricity load, while the bitcoin mining map uses IP address data submitted by mining pools to estimate where miners are globally. While the mining map serves as a great data source, it’s important to note that it is limited by the fact that miners can easily obfuscate their IP addresses by using VPNs. Similarly, the electricity consumption index is the gold standard today for assessing Bitcoin’s energy consumption, but the methodology would stand to benefit from further segmentation by hardware type.

As part of the effort to increase transparency and educate the public, large North American miners created the Bitcoin Mining Council (BMC), a voluntary and open forum of Bitcoin miners committed to the network and its core principles. The BMC promotes transparency, shares best practices, and educates the public on the benefits of Bitcoin and Bitcoin mining. Over the course of 2021, the BMC published two quarterly reports illustrating the energy mix of bitcoin mining and published the results of two surveys tracking the sustainable power mix of electricity used by bitcoin miners. The second report concluded that Bitcoin mining consuming only 0.12% of the world’s energy production as of Q3 2021. While the BMC data is self-reported by mining companies and therefore prone to bias, this information is helpful for better understanding the industry’s energy consumption.

The Future of Bitcoin Mining

Bitcoin mining is changing rapidly, and this year saw the initiation and acceleration of several ongoing trends including professionalization, geographic migration, and integration with the energy industry. These trends will continue and accelerate in 2022.

Hardware, Firmware, and Facilities

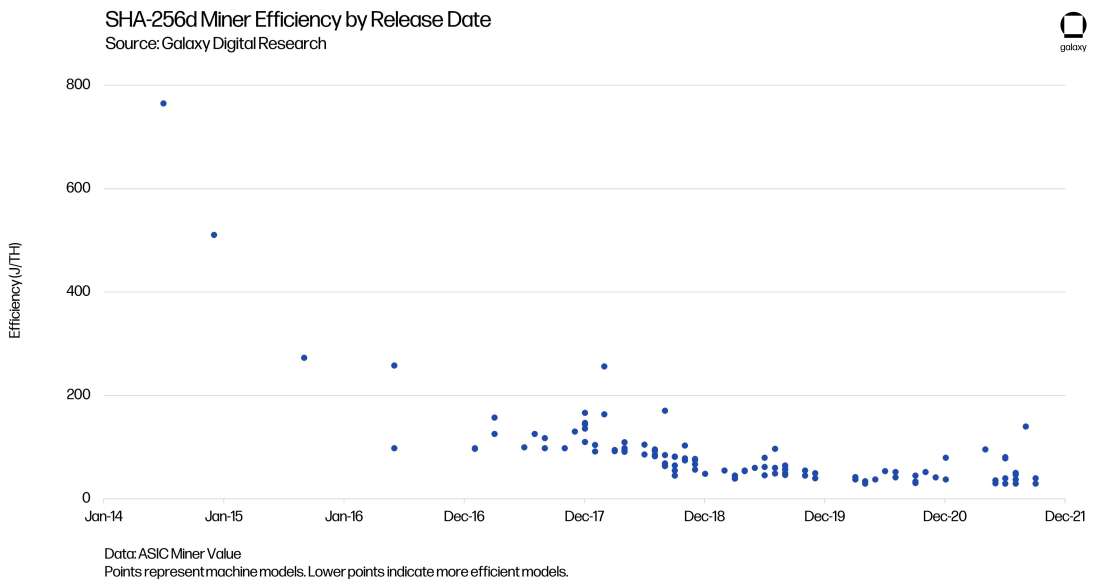

The mining industry has professionalized significantly since the Bitcoin network’s inception, with increasingly efficient

hardware being one of the primary catalysts for this trend. Mining began as a hobbyist activity: long before bitcoin had

a price, the network was producing blocks, fueled by CPU miners running spare consumer hardware. Mining entered

its GPU era in May of 2010, with the release of the first open-source GPU miner code by Laszlo Hanyecz (of bitcoin

pizza fame). After a brief period in which FPGAs were the most efficient mining hardware on the market, machines built with application specific integrated circuits (ASIC) began to dominate the network in 2012 and 2013. ASICs are designed specifically for one purpose and optimized to do that operation with incredible speed and efficiency—in this case, mining bitcoin.

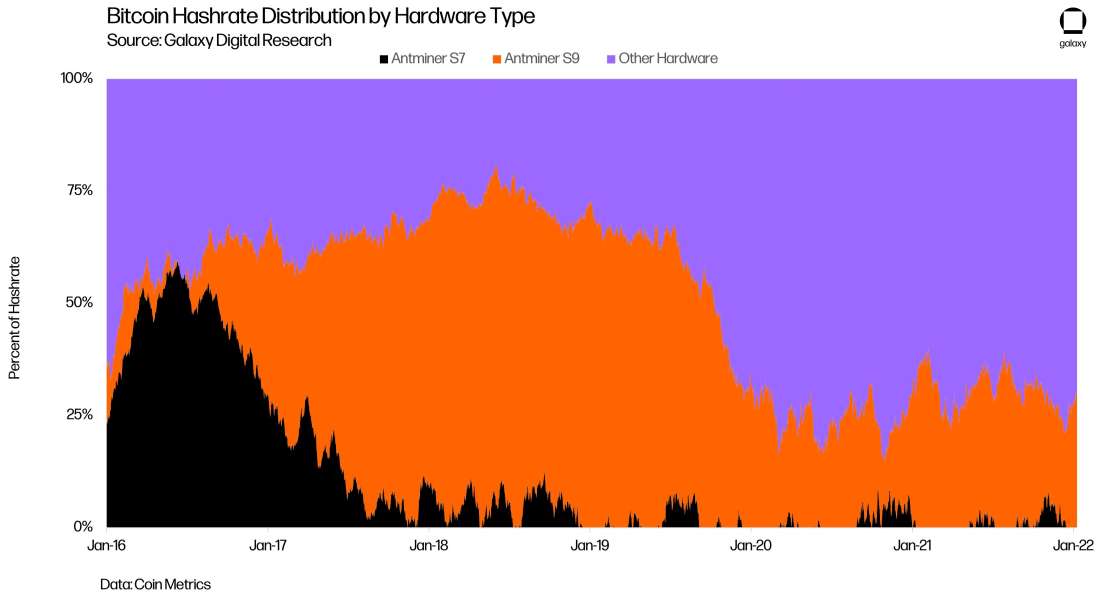

ASICs remain the state of the art in hardware, but today’s mining rigs are astronomically more efficient than the first generation of ASICs. Even the Antminer S9 (and related models), a popular miner released in 2016, has fallen from contributing roughly 79% of the network’s hashrate at peak to about 28% at the end of 2021.

The hardware upgrade cycle has played a substantial role in contributing to mining’s economies of scale, an effect that’s been particularly acute in this cycle’s hardware-constrained market. Hardware upgrades, along with other capex and labor efficiencies, typically favor large players with greater bargaining power against manufacturers and more flexible access to financing. This dynamic is partially responsible for the rise in significance of public companies, a trend that was accelerated by China’s ban on mining.

While per-generation marginal gains in efficiency are shrinking and the reported performance gain of the brand new Antminer S19 XP remains to be tested, winning the race to secure hardware in order to remain competitive against new-generation miners will continue to be a significant driver of success in the market. This holds especially true with long delivery times on both ASICs and general-purpose electrical equipment. Economies of scale inherent to the industry are accentuated by manufacturers giving more preferential terms to larger miners, though even large miners are somewhat weak in negotiating with manufacturers, since the ASIC manufacturing industry is so concentrated. So long as the global chip shortage continues, larger operations will continue to carry an outsized edge in the market, even as gains in hardware efficiency slow.

Because per-machine hashrate is increasing, rigs can be difficult to procure, and units are becoming more expensive, miners are beginning to use auxiliary capex to realize efficiencies in other parts of their operation. We’ll likely see spending increases on facilities, cooling, and other non-machine assets. These expenditures will be offset by increased uptime, efficiency, or total hashrate, ultimately leading to greater profit.

Immersion cooling, in particular, seems likely to garner more adoption in the coming years, owing to improvements in the underlying technology and this trend of heavier capital outlay on auxiliary equipment. Already, larger public miners are deploying immersed miners at scale. Part of the impetus for immersion cooling deployment is to signal to the market that they are forward-thinking and that their operations are mature. Challenges to immersion adoption remain, including difficulties in reselling, moving, and financing immersed ASICs. Still, the technology is promising, and adoption is growing at a pace that suggests more significant impact in 2022.

Similarly, we expect to see an increase in the use of third-party firmware (the software that runs on machines themselves), as it provides a way for miners to optimize their hashrate and efficiency in a hardware-constrained environment. As far as optimizations go, firmware is particularly interesting because it typically does not require an additional capital investment; instead, it’s usually paid for through a developer fee that comes out of the machine’s increased hashrate. The main barrier to the adoption of third-party firmware is the voiding of the manufacturer warranty, but as the market becomes more competitive, it’s likely that miners will accept this risk as a cost of doing business.

Mining and Energy

Finally, we see mining as integrating more closely with the broader energy sector over the medium term. Since bitcoin miners are incentivized to seek out low-cost energy, this presents a natural opportunity for off-grid and behind-the-meter mining operations to expand, due to their access to nearly-free electricity. Miners will also continue to set up operations in areas with excess power, especially in former manufacturing centers, bringing jobs to economically distressed rural areas.

While Bitcoin has been criticized for its energy consumption, an increasingly common view holds that Bitcoin mining is as much an innovation in the energy sector as it is in the financial markets. We’ve already seen several mining firms partner with both traditional and renewable energy providers, and expect to see more as mining becomes a more well understood mechanism for controlling energy load.

Hashrate

Beyond these more philosophical trends, there are certain ongoing market trends that seem likely to continue. Network hashrate follows price; hashrate currently lags price by enough that mining is incredibly profitable, incentivizing more miners to come online.

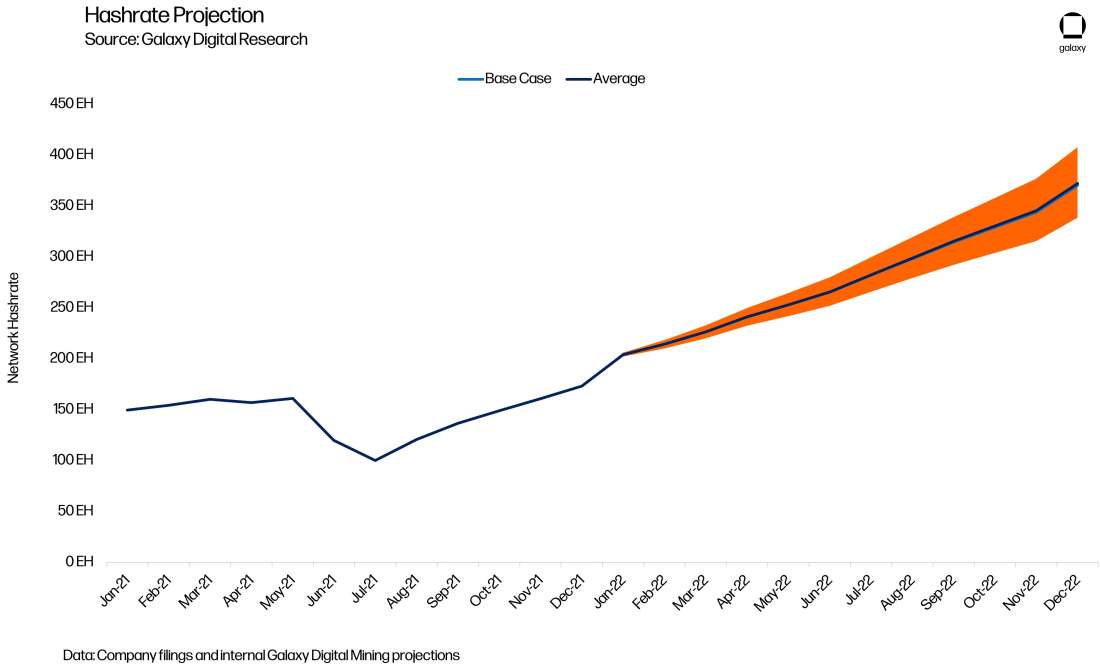

Although hashrate growth will be constrained by the global chip shortage, we expect hashrate a year from now to be much higher than it currently is, barring another major geopolitical upset. This will compress operating margins if price stays constant, but for the most part, hashrate is so dislocated from price that only a severe, sustained bear market could put any real downward pressure on hashrate. With the above factors in mind, we see network hashrate landing somewhere between 300 EH/s and 370 EH/s by the end of the year, with a baseline estimate of 335 EH/s. Even with projections of strong hashrate growth it is likely that many of the public traded miners will still remain highly profitable. Based on Q3 earnings, we ran the cost of production numbers across our sample set of 10 miners for which public figures were available and we found an average marginal cost of production of $10,725, an average direct cost of production of $19,543, and an average total cost of production of $29,619.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.