Executive Summary

The Bitcoin mining industry has had a tumultuous start to 2022. A lack of capital market desire to invest in mining, energy prices trending upwards, and infrastructure delays have put Bitcoin miners in a precarious spot. In this report, we will examine the current state of the Bitcoin mining industry, reviewing the trends of the first half of the year. We will also evaluate how some of the macro trends of the world have affected Bitcoin mining and discuss the potential impact on the industry in the second half of 2022. This report builds on our year-end report from last year, “2021: Bitcoin Mining’s Big Year.”

Key Takeaways

As fundamentals declined, cash-constrained miners have become forced to rethink their treasury management strategies. While taking full bitcoin price exposure was rewarded in the market during the bull run, going forward, miners that are sufficiently hedged will likely have better executions in the capital markets.

The era of widely available capital has stalled, if not ended, challenging companies to find creative ways to finance their ongoing costs or future plans for expansion. Valuations for most miners have gravely suffered as bitcoin has tumbled, making it highly dilutive to raise additional equity and expensive to raise debt capital until market dynamics and fundamentals improve.

Energy prices soared during the first half of 2022, driven by macro factors such as the Ukraine-Russia war. As a result, miners without fixed Power Purchase Agreements (PPA) have had to either shut down, relocate, or rethink growth and expansion plans as their production costs have risen above breakeven thresholds.

A combination of worsened mining fundamentals and limited rack space has caused an abundance of ASICs to hit the secondary market, leading to a significant decline in machine prices. The supply/demand imbalance is likely to persist, and we anticipate low ASIC prices for the foreseeable future.

As the industry matures, there is still a need for enhanced and standardized metrics that can bring additional transparency and clarity to the industry. We propose several areas of improvement for publicly listed companies.

Trends in Bitcoin Mining

Bitcoin Hashrate

In the first half of 2022, the 10-Day Moving Average hashrate grew 23% from 174.9 EH to 215.9 EH. Miners have generated $6.1bn of total mining rewards compared to $8.2bn of mining rewards in the first half 2021, down 25.4%. The decline in profitability has been driven by a lower bitcoin price and a continued rise in hashrate from the end of 2021. Additionally, there were over 102 EH (worth $5.0bn) of ASIC purchase orders outstanding from public miners going into 2022, adding pressure to maintain a healthy cash balance to fund future growth obligations. Year-to-date, publicly traded bitcoin miners have installed approximately 14 EH of machines, implying the potential for an additional 88 EH of ASICs to be installed in 2H 2022. However, it is highly unlikely that all 88 EH will come online this year due to supply chain constraints, construction delays, worsened mining economics, and miners selling ASICs for liquidity. Some miners have already announced reduced end-of-year hashrate targets and have pushed their growth plans into 2023.

Hashrate growth has underperformed when we compare end-of-year 2021 expectations to data from the first half of 2022. This year has proven to be a difficult year for mining growth due to several events and trends including supply chain constraints, construction delays with infrastructure build outs, declining mining fundamentals, and rising energy prices, leading to underperformance relative to previous hashrate predictions. In this report, we unpack each of the primary areas that have impacted hashrate growth year-to-date and explain how they’ve shaped our revised hashrate forecast range of 230 EH/s to 270 EH/s with a baseline of 250 EH/s.

Geographic Mining Trends

At the beginning of May, the Cambridge Center for Alternative Finance (CCAF) published an updated mining report highlighting the distribution of hashrate across the US and the world. The report showed that the United States continues to extend its leading position of global hashrate with 37.84%, followed by China at 21.11%, Kazakhstan at 13.22%, Canada at 6.48%, and Russia at 4.66%. A major change between this report from CCAF and their prior report released in October 2021 was the “return” of Chinese hashrate. In reality, while CCAF’s report is useful, its methodology has known limitations. CCAF gathers data from IP addresses provided by a subset of mining pools accounting for 48% of hashrate as of today. Miners can use Virtual Private Networks (VPNs) to hide their locations, which can easily skew the data. Thus, it appears that prior CCAF reporting following the summer 2021 mining ban in China significantly undercounted the remaining Chinese hashrate and that the 21.11% reported in their May 2022 report represents a data correction rather than a “return” of Chinese miners. Although we applaud the efforts of CCAF to collect data attempting to show trends and geographical distribution of mining, this report highlights that Bitcoin mining is a decentralized industry where not one group can ever aggregate the exact breakdown of hashrate. That being said, CCAF’s data specifically on the US’ hashrate growth aligns with Galaxy’s expectation. Based on public filings, publicly traded bitcoin miners had approximately 44.81 EH of hashrate undermanagment, accounting for roughly 21% of network hashrate at the end of June.

The CCAF report also included a map of hashrate share by U.S. state. Based on CCAF’s analysis, Georgia has the largest share of hashrate. While miners operating in Georgia do control a significant amount of hashrate, our research suggests that Texas is the U.S. state with the largest share of hashrate. On a forward looking basis, Texas and ERCOT (Texas’s electrical grid) will be the most dominant region for North American mining hashrate, with around 2 GW in the development pipeline. For comparison purposes, we have put together a map that illustrates the mining locations of some of the largest hosting providers and publicly traded mining companies.

Worsening Mining Fundamentals

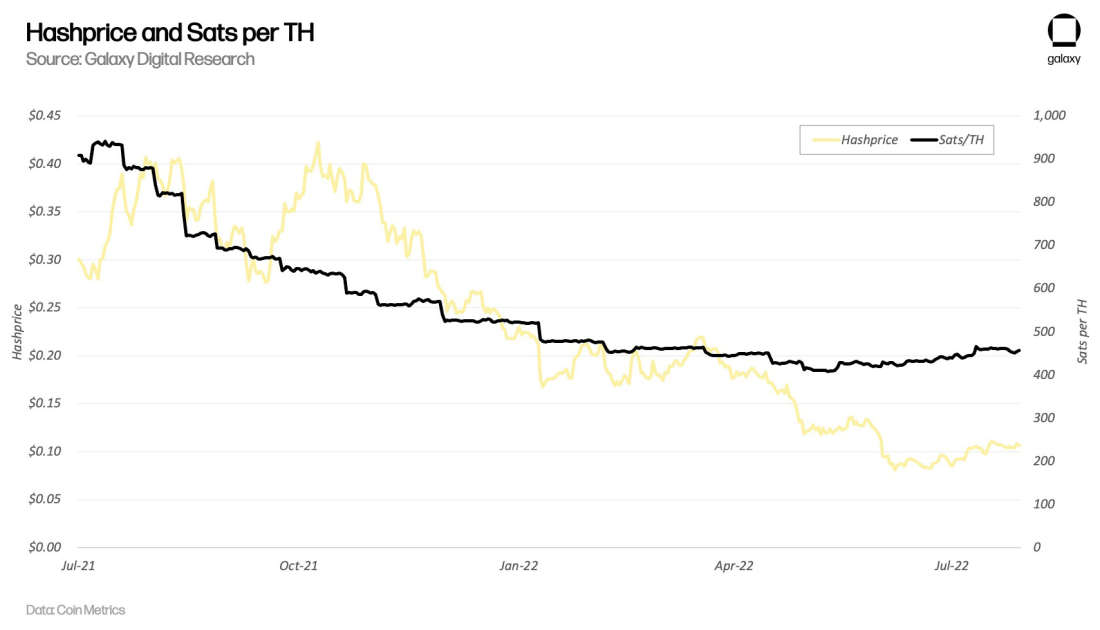

A variety of factors have caused mining revenue per terahash (TH) to drop, hurting overall profitability for miners. At the beginning of 2022, revenue per TH stood at $0.25/TH and has since decreased to roughly $0.10/TH. Conversely, Sats/TH, which measures the amount of nominal bitcoin units that can be mined rather than the dollar value, has held steady in the 400 - 435 Sats/TH range as older generation machines that are no longer profitable to operate continue to come offline. If hashprice drops, Sats/TH is likely to stabilize, as only miners with the lowest costs of production will be able to operate profitably, allowing them to grow their share of network hashrate.

Bitcoin price and network difficulty have notably diverged, with bitcoin price declining while difficulty has been steadily increasing. A trend we observed during the bull market was miners being rewarded by the market for future hashrate and that became a big part of their story with respect to raising capital. Large public miners that signed long-term ASIC purchase order contracts provided the industry with insight into forward looking hashrate for the first time. To determine their own economic viability, miners’ growth plans and forward looking revenue not only needed to consider their own planned hashrate expansion, but also their competition’s expansion plans.

In a bull market, mining is a spectacular business on a spreadsheet even if hashrate is trending up. In a bear market, however, growth in hashrate with depressed bitcoin prices makes economics very challenging. Because miners were on the hook for buying the machines they previously signed up for, hashrate continued to grow even as price declined significantly. Miners have already paid for the capex of the machines so, from their perspective, it makes sense to continue the growth plan as long as their marginal cost to mine is still positive. This trend further contributed to the deep decline in hashprice since the beginning of the year.

At the same time as outstanding machine purchases have pushed up the difficulty while bitcoin prices declined, energy prices have soared. And the broader bear market has reduced risk appetite across capital markets, making it more difficult for miners to raise outside capital through either debt or equity raises. These factors combined to pose a “perfect storm” for mining companies; we have seen significant selling of spot bitcoin by miners to raise capital and strengthen their balance sheets.

On the debt side, uncertainty over future cash flow generation has increased the cost of capital. And on the equity side, given the drops in share prices alongside bitcoin, it has become nearly impossible to raise sufficient capital without significantly diluting existing shareholders’ stake. As a result of the difficulty of raising cash through capital markets, miners are being forced to sell bitcoin to cover their costs. In the first half of 2022, publicly traded miners sold 24,501 bitcoin. This compares to only 650 bitcoin sold over the same period last year.

As miners are crunched for capital, they may turn to alternative solutions, like hosting to bring in a higher revenue stream, selling equipment for more access to cash, or even considering mergers and acquisitions.

Miners that have cash on hand that were prudent and didn’t become over levered during the bull market are in a unique position to be opportunistic. By the conclusion of the second quarter of this year, miners accumulated over 2.1 EH of ASICs on the secondary market in distressed sales.

Miners that did not have a treasury management strategy and took on large amounts of debt to fund ASIC purchases are facing significant challenges. Going forward, having a strong treasury management strategy in-place will become a survival tactic if miners want to endure bear markets and still remain in a position to grow their business and meet obligations.

Energy

Texas has been the predominant location for the expansion of the bitcoin mining industry for many reasons including its deregulated energy market and pro-bitcoin mining policy stance. During the first half of 2022, we’ve experienced a challenging energy market with rising prices in the forward strip in ERCOT due to macro driven factors such as the Ukraine and Russia war. These macro factors have also led to a spike in natural gas prices, which in ERCOT and many other power markets serves as the price-setter and has an outsized effect on real-time forward contract pricing.

The rise in energy prices has increased the cost curve for mining and increased average hosting rates for miners to $75 - $90 per MWh ($0.075 - $0.09 per kWh). On average across the U.S, industrial electricity prices have increased by 24.44% since last year while hashprice fell by over 57% over the same time period.

In cases where hosting providers and miners are exposed to variable pricing, they could be paying as much as $120 per MWh. The rise in energy prices should push all miners to think hard about their power strategy and the risk/reward trade-offs between hosting and operating their own infrastructure.

The North American Electric Reliability Corporation (NERC) reported that existing drought conditions throughout much of North America have created heightened reliability risks due to reduced hydro capacity, increased probability of wide-area heat events and increased demand, and decreased cooling capability from thermal generators that rely on nearby sources of water in specific areas. NERC’s assessment found that Northern and Central areas of the United States are at risk of energy shortfalls, writing that “Midcontinent ISO (MISO) faces a capacity shortfall in its North and Central areas, resulting in high risk of energy emergencies during peak summer conditions.” The assessment also highlighted other potential reliability issues stemming from a variety of supply chain concerns that may affect generation commissioning and transmission projects, as well as general fuel supply for coal and non-fuel consumables. While concerning, the assessment concluded that all other areas (besides MISO) had sufficient resources to manage normal summer peak demand and are at low risk of energy shortfalls from more extreme demand or generation conditions. The implication on miners from NERC’s report is potentially more downtime for miners as they have to curtail power for emergency response.

In the first half of 2022, ERCOT announced a new interim large load interconnection process. This new process aims to ensure that large loads with accelerated interconnection timelines are interconnected reliably and NERC’s reliability standards are met. ERCOT published their market notice of the process in March and included applicability requirements for new or increased standalone load greater than 75 MW in the next two years, new or increased load co-located with a resource greater than 20 MW in the next two years and loads not modeled and studied in a completed RTP, FIS, or RPG review. The significance of this process is that it extends the timeline to get through the interconnection process, which has contributed to the construction delays that many miners have experienced to date.

Supply Chain Delays

As economies have begun to emerge from pandemic lockdowns, supply-chains still remain disrupted, which is having an impact on miners along with price inflation of key infrastructure. In the first half of 2022, lead times on key electrical infrastructure equipment such as switch gears and transformers expanded, pushing back construction timelines for new datacenters anywhere from 2 - 6 months. Supply chain issues have also impacted semiconductor chip supply, which has caused delivery delays and put miners behind on reaching their 2022 hashrate targets. The bottlenecks on key electrical infrastructure to energize new MW capacity has been the biggest challenge for miners and the biggest contributor to reducing our 2022 end-of-year hashrate forecast. The lack of available rack space has caused a significant supply-demand imbalance for ASICs that is likely to continue to be stretched as miners are forced to sell machines either for liquidity reasons or because they can no longer mine above their marginal cost of production at current economics.

Regulatory Environment

At both the state and federal level, several regulatory developments have occurred in the United States in 2022. On a state-by-state basis, the actions have been varied. New York became the first state to significantly limit the expansion of Bitcoin mining, enacting a law that banned new mining operations that run on carbon-based power sources. For the next two years, the law requires new Bitcoin mining operations to run on 100% renewable energy. However, existing mining operations were grandfathered, allowing them to continue to mine, but they are at risk of not being able to expand or reapply for certain permits.

In another attempt to discourage Bitcoin mining, Chelan County in Washington state announced that it would introduce a 29% tax hike on miners for using hydroelectric power in the county. This energy tariff, known as “Tariff 36” went into effect on June 1st and impacted 3 major mining companies in the region.

Despite these actions, several other jurisdictions maintained or enacted policies to encourage the development of Bitcoin mining businesses:

The state of Wyoming has maintained a favorable view of Bitcoin mining and the broader industry and implemented the “Blockchain Interruptible Service” tariff, which provides miners the ability to receive a $2 credit adjustment per kWh for having their power disrupted. This is a very similar service to what Texas bitcoin miners have with ERCOT.

Kentucky provides energy and tax breaks for companies that choose to set up their Bitcoin mining operations in the state.

In Texas, ERCOT recently created the Large Flexible Load Task Force (LFLTF) to help build out the interconnection between ERCOT participants and bitcoin miners. LFLTF is working with the Texas Blockchain Council to learn how Bitcoin mining can make grid management more robust.

The inclusion of the Methane Emissions Reduction program within the latest reconciliation bill is possibly going to become a major catalyst for “Off-Grid” mining, giving an additional incentive for O&G companies to use ASICs in order to reduce methane emissions. The $1.55bn in grants and rebate funding for companies will be made available immediately, providing a great opportunity for existing companies involved in flare gas mitigation.

On the federal level, the Biden Administration has organized a team to investigate the environmental impact of Bitcoin mining. The focus will be on a range of topics, including energy consumption, emissions, and noise.

With increasing regulatory scrutiny of proof-of-work in the United States, Bitcoin miners that are publicly traded will likely feel pressure to combat the negative narrative on energy usage more directly, and some may adjust their strategies altogether. The additional regulatory oversight will likely lead to more jurisdictional arbitrage and impact the distribution of hashrate in the US over the next 18-36 months. The result may be a shift away from strategies that rely on investing in single location mega-mines in lieu of diversifying mining operations across multiple states and in smaller MW capacities to hedge jurisdictional risk.

Some of the debates over new legislation and regulation, both at the federal and state level, have highlighted the need for further education on how Bitcoin mining can be beneficial to electrical systems across the United States, particularly their ability to serve as an active load management tool that makes systems more robust. Miners can quickly curtail operations when needed and in numerous instances, such as in Texas during extreme heat, have already done so. In Riot Blockchain’s June production report, the company cited that it had begun its annual participation in ERCOT’s Four Coincident Peak (“4CP”) program, in which Riot curtails its energy consumption when called on by ERCOT during the four summer months of peak energy demand in Texas. As part of Riot’s participation in the 4CP program, in June, they curtailed their energy consumption for a total of 8,648 megawatt hours. While groups such as the Bitcoin Mining Council have made a great effort, more voluntary and data-driven approaches are needed from mining companies to help educate and dispel energy consumption misnomers to regulators and communities.

ASIC Price Pressures

ASIC prices have declined alongside bitcoin’s price over the course of the first half of the year. Based on data from Luxor’s Hashrate Index, ASICs with efficiency under 38 j/TH have declined 66% since the beginning of the year from $103 per TH to $35 per TH. The 66% decline in $/TH compares with a 50% decline in bitcoin’s price since the beginning of the year and a 60% decline in hashprice, which is representative of mining revenue per terahash. Despite the large ASIC price declines we’ve already seen, several factors suggest further stress is forthcoming. Declining hashprice, rising energy/hosting costs, and distressed selling of machines will each push ASIC prices lower.

Understanding miner profitability is at the core of understanding ASIC pricing. Bitcoin’s price and network difficulty are the two components that determine the revenue-generating ability of an ASIC. Hashprice captures these factors and shows the network's current daily revenue per terahash. Observing historical movements in hashprice helps explain the current dynamics of the ASIC market. With bitcoin price falling and difficulty steadily rising due to a backlog of future machine purchase orders that are now being plugged in, hashprice has fallen dramatically since the beginning of the year.

Data from Luxor’s Hashrate Index was used to quantify the relationship. Due to the short-term volatility of hashprice, the data was first smoothed using a 2-Month Moving Average. The regression run between ASIC prices and 2-Month Moving Average hashprice shows that there is a strong correlation between the two. ASIC price data is updated once a week by Hashrate Index, making longer-term correlations more meaningful to view. The below table illustrates the relationship as one-year and two-year correlations with 2-Month Moving Average hashprice average above 0.65. Older generation machines appear less correlated with 2-Month Moving Average hashprice overall, while prices for newer generation machines have the highest correlation with 2-Month Moving Average hashprice. According to Luxor, the ASIC price index compiles data from a variety of sources, including “forums, broker-dealers, manufacturers’ websites, and Luxor’s ASIC trading desk.” It’s important to note that these reflect asking prices and tend to overestimate the actual clearing price for ASICs. Although hashprice has reached a local bottom, it could remain at these levels for some time and keep ASIC prices subdued as hashrate grows for the remainder of the year and bitcoin price remains range bound.

However, there is a lag in how ASIC prices move in relation to hashprice as miner capitulation and forced selling take time to materialize into the market. The following chart demonstrates this as spot ASIC prices tend to lag spot hashprice and move more in-line with the 2-Month Moving Average hashprice, which is naturally a lagging data point.

Payback period analysis is another way to frame the analysis around profitability. The S19j Pro is one of the most popular ASIC models in the market, and as illustrated in the table below, if a miner wants to target a 1 year payback period on an S19j Pro with $0.06 per kWh cost of power at the current network hashprice of $0.10, they should only pay about $20 per TH. This number doesn’t take into account any potential downtime or pool fees which would reduce profitability. Based on this, ASIC prices would need to correct an additional 43% from their current levels as per the data from Hashrate Index. At $35 per TH, hashprice of $0.10, and a cost of power of $0.06 kWh, it would take roughly 1.75 years to recoup the hardware cost.

Analyzing the various popular ASIC models from a breakeven dollar per MWh helps depict the level below which energy/hosting costs must be in order for an ASIC to be mining profitably. Mining margins are being squeezed from all sides as hashprice has declined and energy/hosting costs have risen. In particular, the combination of higher energy costs and lack of rack space have propelled hosting rates into the $75 - $90 per MWh range. The first chart shows how the breakeven dollar per MWh has progressed overtime and the table that follows shows a sensitivity analysis of breakeven dollar per MWh for an S19j Pro under different network conditions. This perspective reveals that many home miners can no longer mine profitably at residential rates of power. The breakeven cost of power for some of the most efficient miners, such as the S19j Pro, now sits at $140.10 per MWh assuming manufacturer specifications and stock firmware. The steady decline in the breakeven level puts miners with the highest costs in unprofitable positions and will force them to sell ASICs in the secondary market, putting downward pressure on ASIC prices.

The ASIC cost of production sensitivity table below illustrates at what price an S19j Pro can generate bitcoin given changes in network hashrate and cost of power. The cells highlighted in green showcase in which scenarios the specific ASIC can produce bitcoin below a threshold of a $15,000 bitcoin price.

Declining mining margins have put many miners in tough situations as those that took on too much leverage or have significant purchase order payments remaining find themselves short of cash. Although some miners have begun to sell portions of their ASICs, there will likely be further liquidations on the secondary market, leading to more reductions in price. The abundance of ASICs available on the secondary market at deeply discounted prices is putting additional pressure on manufacturers such as Bitmain and MicroBT. ASIC manufacturers run the risk of miners defaulting on existing contracts due to better opportunities available on the secondary market and a lack of ability to pay due to cash constraints and a tight capital market. The supply glut in the ASIC market will force Bitmain and MicroBT to decide whether or not they want to maintain their existing capacity at their respective chip foundries over the next 18 months. Given the global shortage of chips and supply chain delays, getting allocation at the foundries currently is very difficult and there’s tremendous demand. If Bitmain and MicroBT decide to keep their existing allocation at the foundries, and Bitcoin miners remain constrained, the ASIC supply imbalance will be further exacerbated and bring additional deflationary pressure on ASIC prices.

Mining Tech

One of the brighter spots in the mining industry during the first half of the year has been the progress made on Stratum V2. Since the inception of Bitcoin, growth in hashrate has been accompanied by upgrades in mining protocols. As Rachel Rybarczyk discusses in detail in this post, mining protocol enhancements are needed to support further growth in hashrate and help make Bitcoin a more secure network. Alongside increasing hashrate has come a growth in pooled mining as miners try to reduce the variance in their revenue stream.

Stratum is a messaging protocol for communication between miners and pools that organizes the creation of blocks and submission of hashes by miners. Stratum V1 was a significant improvement over previous mining protocols but is still far from robust. Currently, a number of firms, including Galaxy Digital, are working to build Stratum V2 to address the flaws of Stratum V1 and create a protocol to further support the growth in hashrate.

Some of the main issues that Stratum V2 addresses include insufficient documentation, inflexibility, communication inefficiency, and security issues. Stratum V1’s poor documentation has resulted in several interpretations and implementations, leading to mistakes and complexity. Developers are trying to make Stratum V2 a more well-defined and documented protocol to ensure standardization. Stratum V2 is also flexible in that it allows individuals running various machines to continue utilizing the protocol. Communication between miners and pools is far more efficient in V2 which allows for a reduction in CPU load and bandwidth, which ultimately maximizes miner profits. Finally, V2 not only enhances miner security but it also improves network security. On the miner side, V2 uses encrypted channels to prevent Man in the Middle (MitM) attacks and has made some progress on verifying payouts to prevent pool skimming.

On the network front, V2 allows miners to construct their own block templates and decentralizes the network further as control shifts from pools to miners. Allowing miners to construct their own block templates and determine which transactions go into blocks distributes the attack surface for actors who seek to censor transactions by applying pressure to pools. Even if miners do not make use of this feature–and in V2 they are not required to do so–that it exists at all can serve as an important backup measure and, thus, a disincentive for censorship by pools or actors attempting to exert censorship upon them.

Areas for Miner Improvement

Many miners, particularly the publicly traded ones, have continued to provide more information and transparency about their operations in the form of monthly production updates. These updates include information about changes in hashrate growth, bitcoin mined, and the pace of ASIC deliveries. Despite the trend of increased transparency from these companies, there is still lots of room for improvement, particularly in standardizing and enhancing reported metrics in monthly updates and quarterly filings.

Treasury Management: During the bull market, there was a lack of demand from miners wanting to execute on hedging and treasury management solutions. Instead of opting for downside protection, miners wanted maximum bitcoin price exposure. Now miners are force selling bitcoin towards the lows of the bear market. In all other major industries exposed to commodity price risk, such as in the oil and gas industry and the airlines industry, risk is hedged. The leading miners in the space and surely the ones that will be successful in the long-run will hedge their bitcoin price exposure and their energy costs. As the industry matures it is likely that capital providers will extend better terms and larger amounts of capital to the companies that are sufficiently hedged.

Miner Fleet Updates: Miners should provide fleet updates in their monthly production reports that include the exact ASIC makeup of the company’s operational hashrate. This would allow mining analysts to better understand the mining company’s breakeven cost of power and hashprice. Providing information on machine installations and deliveries on a monthly basis would also allow mining companies to differentiate themselves from an execution perspective and make it easier for analysts to project their hashrate ramp-up schedule.

Power Curtailment: Miners should provide information around MWh’s curtailed in their monthly production updates. This information would start to provide data points for how mining can be utilized as a load management tool for grid stabilization and help miners educate the market on the benefits of Bitcoin mining for energy infrastructure. Additionally, these metrics could be used to provide more transparency around machine downtime as there are often large discrepancies between miners’ quoted hashrates in a given month and their implied operational hashrates based on bitcoin mined in that given month (as well as actual network data). Installed hashrate and active hashrate are two very different things that should be delineated in public miners’ production updates as the distinction can be confusing for investors.

Bitcoin Hashrate vs. Bitcoin Equivalent Hashrate: Publicly traded miners should clearly delineate how much of their existing hashrate both installed and operational over a given period of time was directly attributable to SHA256 ASICs vs. GPUs or miners for other cryptocurrencies. In this same vein, publicly traded miners should clearly outline how much bitcoin mined in a given period of time was directly attributable to SHA256 ASICs vs. alternative miners for other cryptocurrencies. Providing a blended hashrate is particularly problematic if a significant percentage of the growth of a miner's hashrate undermanagement is attributable to mining alternative cryptocurrencies that may switch to proof of stake, as it overstates the hashrate that will be durable long-term.

Cost of Power: Publicly traded miners should provide more details in their quarterly filings about their cost of power. Most miners only report a blended average cost of power that is contingent upon several different dynamic factors that aren’t guaranteed to persist. Instead, if miners provided the face value rate of the cost of power in their power purchase agreements or hosting agreements along with a reconciliation of how they could achieve whatever blended rate they deem achievable, they would provide greater consistency and transparency to investors and analysts. The miners that host should provide more context and details on any maintenance and revenue or profit-sharing agreements. Ideally, miners would provide the face value rate agreed upon in the hosting agreement along with an estimated blended cost of power inclusive of all recurring fees.

PPA and Hedging Strategies: Over the course of the year, many miners have suffered from their lack of understanding of power market dynamics, and this has resulted in many of them having to temporarily halt operations due to high electricity prices. Miners without a power purchase agreement have to deal with more downtime at their facilities as electricity prices, driven by a rise in the price of natural gas, spike above their breakeven cost of production. As a result, it would be useful for some miners to invest more time into hedging their power costs and creating viable power market strategies.

Cost of Production Metrics: There still lacks a consistent methodology for calculating cost of production metrics in the mining industry. Galaxy Digital has put forth its own framework for how public miners should consistently calculate cost of production metrics. In the same manner that many miners provide adjusted EBITDA reconciliations, public miners should provide cost-of-production reconciliations in their quarterly financial statements based on the actual line items included on the income statement. This would allow investors and research analysts to be able to distinguish between high-quality operators and low-quality operators, which could allow miners to command a premium over peers.

More Effective Communication of Individual Strategies to Sell-Side Research Analysts and Investors: Currently, mining companies trade with a high correlation and beta to bitcoin’s price. Miners currently trade as a means to get exposure to bitcoin in an equity portfolio and thus trade as more of a macro risk asset instead of trading and being valued for their fundamentals. Miners should do a better job at communicating the value proposition of their individual strategies to analysts in an effort to differentiate themselves. High-quality operators in the space with a track record for execution and strong treasury management should command a premium over peers as opposed to simply being a correlation trade.

Outlook for 2H 2022

The first half of the year was characterized by several headwinds for the industry, including rising energy prices, a bear market, reduced risk appetite across capital markets, supply chain delays, and regulatory challenges. Looking forward to the second half of 2022 and beyond, we expect to see some of the following trends remain, and some new trends emerge:

Hashrate Seasonality: Prior to the China ban on Bitcoin mining, hashrate exhibited seasonality as the large concentration of Chinese miners plugged in machines during the rainy season to exploit cheap hydropower. A similar sort of dynamic is coming to fruition now, though in the opposite direction. To take advantage of typically favorable long-term power purchase agreements in Texas, a number of large miners currently have facilities hashing in the state. They have provided enormous support to the stressed grid by curtailing operations as demand for energy skyrocketed over the summer. Over time, this may result in network difficulty drops in the summer months, with sharp increases occurring in the fall and winter months as miners come back online.

ASIC Price Decoupling: If a larger recovery takes place in bitcoin’s price in the second half of the year, we could see newer generation ASICs such as the S19 XP and M50 start to decouple from older and mid-generation machines. Miners will seek to maximize profit margins on the upswing, causing potential over-investment in the latest generation of machines. As bitcoin’s price and hashprice rise in value, the correlation and beta coefficient of new generation machines will outpace that of older and mid-generation machines. This lag in price reflexivity for older and mid-generation machines can create interesting opportunities in the market, as they may present better payback periods versus newer generation machines despite being less efficient.

Conversely, if we stay in a sustained bear market, the prices of older and mid-generation machines will become increasingly more correlated and sensitive to bitcoin price changes as opposed to newer generation machines. This is due to higher breakeven cost of production levels for older and mid-generation machines on account of their lower overall efficiency. The result of this is older and mid-generation machines trading at a deeper discount than historical averages relative to newer machines. This could present an opportunity for a miner to buy older and mid-generation machines at deep discounts and install Braiins OS+ on them or take advantage of immersion cooling where they could optimize the efficiency of the machines to lower the breakeven production point and thus achieve a better payback period vs. newer generation machines. As more miners implement immersion strategies, there will likely be less demand for newer generation machines, which could serve as another headwind for ASIC prices.

Emergence of immersion and water cooling, particularly in warmer climates: Over the past year, miners have largely invested in immersion cooling infrastructure, and ASIC manufacturers like Bitmain are betting big on water-cooled ASICs with the 255 TH/s S19 XP Hydro. This paradigm change in ASIC cooling methods is expected to become more broadly adopted in a couple of years, especially for miners with operations based in warmer climates such as Texas. With over 1 GW of immersion-cooled infrastructure planned and announced by miners, the impact on overall hashrate and machine pricing dynamics has been largely factored in, especially during a bear market where efficiency is vitally important in order to maintain a profitable operation.

Immersion cooling allows for significant efficiency improvements in terms of j/TH, with companies expecting between 20-40%higher efficiency compared to regular air-cooled machines where a traditional S19j Pro could be boosted to over 130 TH/s. While there are a lot of reported benefits to immersion cooling, questions still remain about whether or not it can actually improve the life expectancy of ASICs, and if it’ll impact the resale value of these machines once they have been modified and stripped of their air-cooling apparatus, and whether or not lenders will accept these machines as a form of collateral.

Treasury management becoming a survival tactic: Over the past year and a half, there has been little interest from miners to execute hedging and other treasury management strategies. Most miners have prioritized having max exposure to Bitcoin upside because it’s what the market has rewarded. Now that we are firmly in a bear market with little capital market activity, miners have been forced sellers of their bitcoin at the lows in order to generate liquidity. Some miners are now even in dire financial health on account of not having a proper risk management strategy in place with respect to hedging and treasury management. Going forward, the experienced miners will have dedicated resources towards hedging energy price risk and bitcoin price volatility. We anticipate that miners with a comprehensive risk management strategy will be rewarded by not only investors but lenders and capital markets participants as well.

New entrants in ASIC manufacturing and the potential impact of the CHIPS Act: A greater emphasis is being placed by policymakers on bringing chip development closer to home to reduce reliance on Chinese manufacturers. U.S. President Biden signed the CHIPS Act into law in August, which provides $52bn in incentives for domestic chip production and research and authorizes $200bn over the next 10 years. Although it will take time for the impact to be felt across industries, the hope is to relieve supply chain backlogs and ultimately lower prices.

On the mining side, chip manufacturers such as Intel stand to benefit tremendously from this law by allowing them to ramp up production at lower costs. This could incentivize other ASIC manufacturers to enter and take advantage of lower chip costs to compete against existing juggernauts Bitmain and MicroBT. The added competition to the market will benefit miners as they can diversify their fleet and reduce the risk of shipment delays related to one specific manufacturer. Given the first mover competitive advantage that Bitmain and MicroBT have, the near-term effects of thoutlis remain limited but is a noteworthy topic for miners to follow long-term.

Glossary

Bitcoin Mining Network Definitions

Marginal Cost of Production - The marginal cost of production is representative of a miner’s cost of electricity and hosting to produce 1 bitcoin. It does not, however, capture the capital expenditure for the mining equipment itself. To calculate the marginal cost of production for a publicly traded bitcoin miner, simply divide the cost of revenues excluding depreciation expense by the number of bitcoins mined during that period.

Direct Cost of Production - The direct cost of production takes the marginal cost of production a step further by including depreciation expenses in the calculation. This gives a sense of how much a miner is spending on ASICs. When derived from filings, this figure may also include depreciation of hosting facilities for their machines, depending on the level of detail included in the filing. To calculate the direct cost of producing a bitcoin for a publicly traded bitcoin miner, simply add the cost of revenues and the depreciation expenses from the income statement and then divide by the number of bitcoins mined during that period.

Total Cost of Production - The total cost of production accounts for the overhead of running the business, including payroll of employees, by including SG&A in the equation. It is important to exclude any non-cash or one-time expenses from this equation, such as impairments to cryptocurrencies or any marketable or related securities, and employee-based stock compensation. While stock-based compensation is excluded from this calculation, it is important to note the level of stock-based compensation as it is dilutive to shareholders. To calculate the total direct and indirect cost of producing a bitcoin for a publicly traded bitcoin miner, simply add the cost of revenues, depreciation expenses, and selling, general and administrative expenses from the income statement, then divide by the number of bitcoins mined during that period.

Network Hashprice - Network hashprice, often simply referred to as hashprice, is a measure of dollar-denominated daily expected revenue from mining with a single terahash per second of hashrate on a daily basis given current conditions around bitcoin price, block rewards and network hashrate.

Sats per TH - Is a measure of bitcoin-denominated daily expected revenue from mining with a single terahash per second of hashrate on a daily basis given current conditions around block rewards and network hashrate. 1 satoshi represents one one-hundred millionth of a bitcoin.

Operational Breakeven Cost - Operational breakeven cost attempts to quantify all recurring expenditures that require a true cash outlay and includes cost of revenues, selling, general, and administrative (SG&A) expenses, and interest expenses, while excluding all non-cash expenses such as employee stock-based compensation and depreciation and amortization.

Network Hashrate - The network hashrate is the cumulative processing power of mining machines securing the network.

Block Subsidy - The block subsidy is the amount of new bitcoin minted in each block. The block subsidy halves every 210,000 blocks (roughly every 4 years) according to Bitcoin’s issuance schedule and is currently 6.25 BTC.

Transaction Fees - Blocks can contain many transactions with fees attached to incentivize their confirmation and prevent spam. In addition to the block subsidy, miners also receive the transaction fees for all of the transactions included in the block that they mine.

Block Reward -The block reward is the combination of the block subsidy and all transaction fees paid by transactions in a specific block.

Hashrate - Hashrate is a measure of the computational power per second used when mining.

Power Draw -Power draw is a measure of the amount of electricity consumed to operate an ASIC or mining machine per hour.

Mining Pool -A mining pool is a middleman that aggregates multiple miners’ hashpower. Mining pools aggregate pool members’ hashes, submit successful proofs of work to the network, and distribute rewards to contributing miners proportionately to the amount of work performed. Mining on a pool reduces payout variance for miners, who would otherwise have to deal with significant risk from finding blocks at unpredictable intervals.

Terahash - A terahash (TH) is one trillion (109)hashes, which is equivalent to making one trillion guesses at solving the puzzle to add the next block to bitcoin’s blockchain. The hashrate of most mining rigs is measured in terahashes per second (TH/s).

Exahash - A exahash (EH) is one quintillion (1018) hashes, which is equivalent to making one quintillion guesses at solving the puzzle to add the next block to bitcoin’s blockchain. The total network hashrate is typically measured in exahashes per second (EH/s), as is that of some large mining operations.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email contact@galaxydigital.io. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.