Crypto and Blockchain Venture Capital Q1 2021

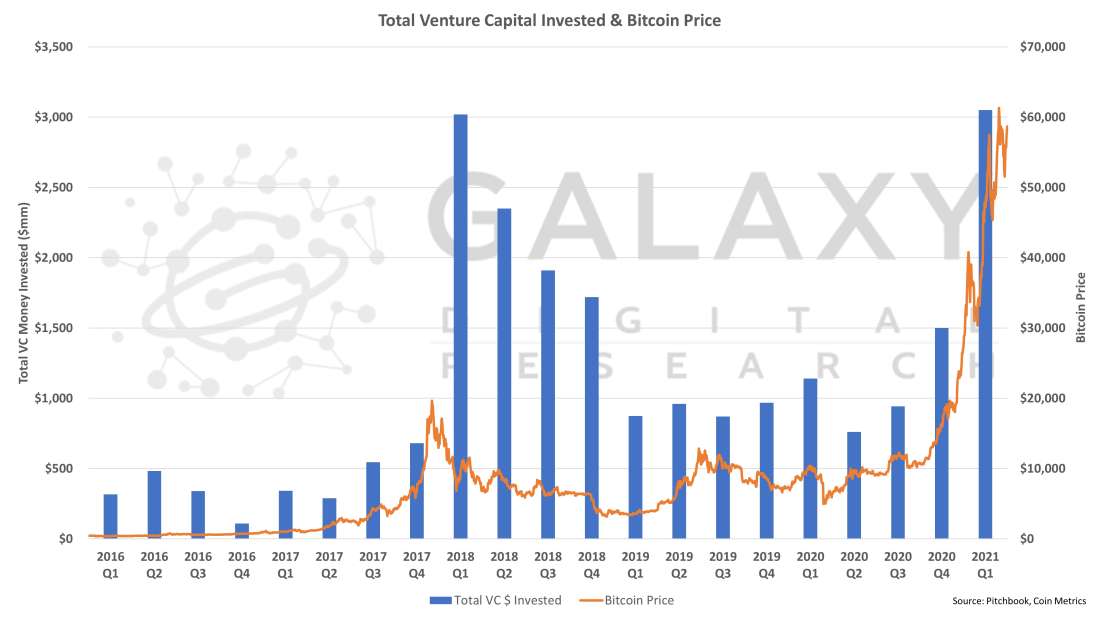

Q1 2021 saw a record advance for bitcoin and other digital assets. The money flowing into venture-backed startups in the space also hit all-time highs, even as the total number of deals remained below its Q1 2018 peak. The data shows a maturation of the private markets, with more money flowing to later stage companies in absolute terms and as a share of capital invested than any prior quarter, while investment in pre-seed companies has consistently declined since it peaked in Q1 2018.

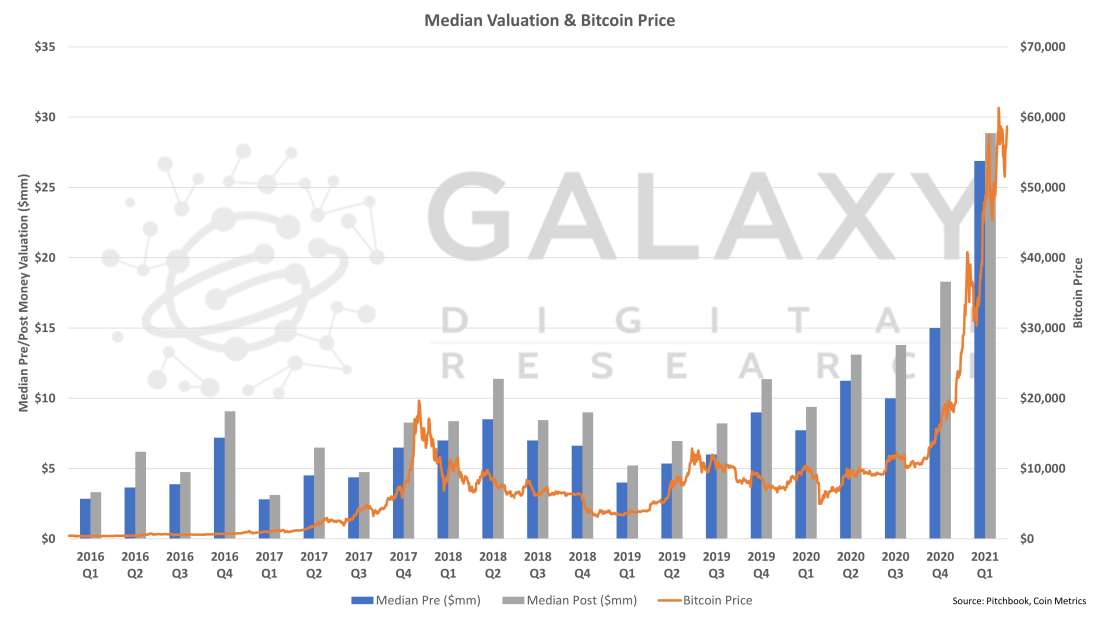

As the price of Bitcoin soared to new all-time highs in Q1 2021, so did the amount of capital invested by venture investors in the cryptocurrency ecosystem. Historically, we have seen venture capital lag the bitcoin price slightly—both in 2017-2018 and in 2019—but that trend appears to have dissipated in the last four quarters.

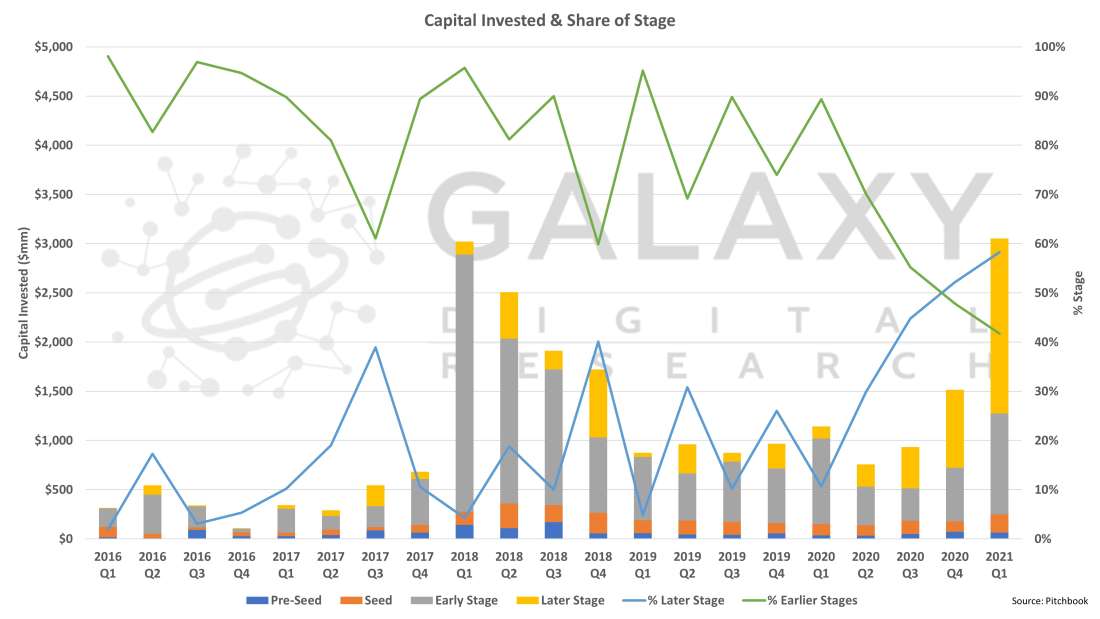

Capital Invested by Deal Stage

Until very recently, the vast majority of capital invested in the cryptocurrency and blockchain ecosystem went to early-stage startups. Capital invested in pre-seed, seed, and early-stage deals peaked in 2018. In Q4 2020, capital invested in early and later stage deals reached parity, and in Q1 2021 most venture capital went to later stage companies for the first time.

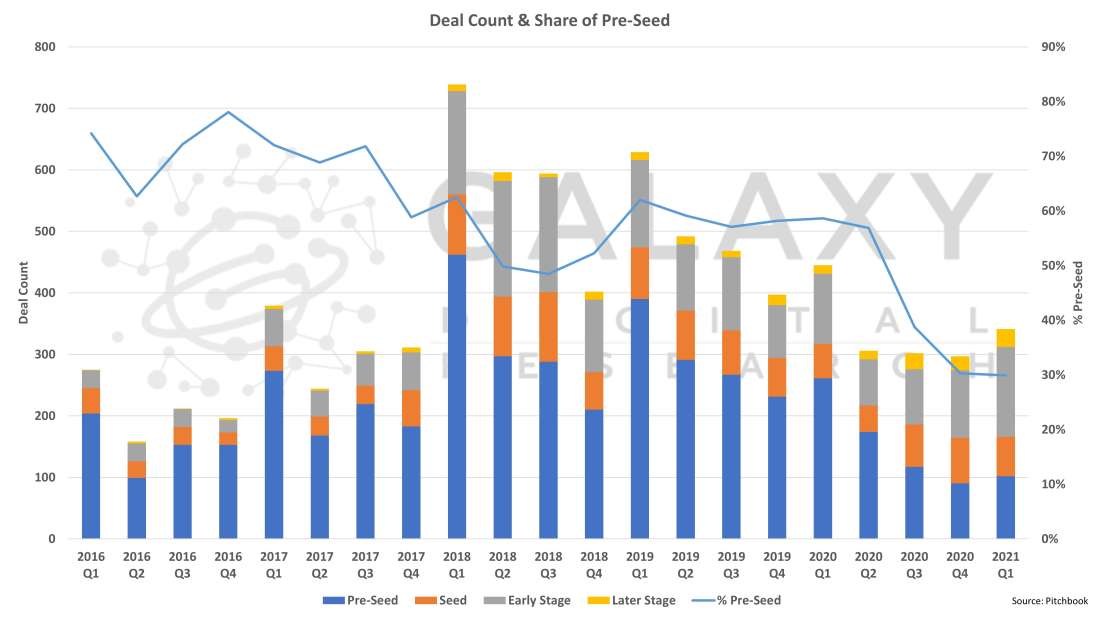

Deal Count by Deal Stage

Along with capital invested, the number of later stage deals in the cryptocurrency/blockchain ecosystem reached a quarterly all-time high at 29 in Q1, surpassing the prior all-time high of 26 in Q3 2020. While the number of early-stage deals has been rising since the COVID-19 bottom in Q2 2020, it has remained in a range of 75-142 since Q4 2018. The real story over the last few years is the decline in pre-seed deals, which have persistently reduced since reaching highs in Q1 2018. In Q4 2020, the number of pre-seed deals was lower than any quarter since before 2016. The decline in pre-seed deals appears to show a slowing of new entrants into the ecosystem.

The decline could be cyclical—if so, we will see an increase as the current bull market progresses as we did in 2017-2018. It is also possible that the unmet needs of the crypto ecosystem as it exists today have been largely met by the most recent wave of startups, leaving little room for new entrants. Alternatively, we must acknowledge rise of revenue-generating decentralized finance protocols with value accretive tokens. These new decentralized “businesses” may be attracting the newest wave of entrepreneurs and, crucially, data about their fundraises is mostly not included in the Pitchbook dataset upon which this report primarily relies.

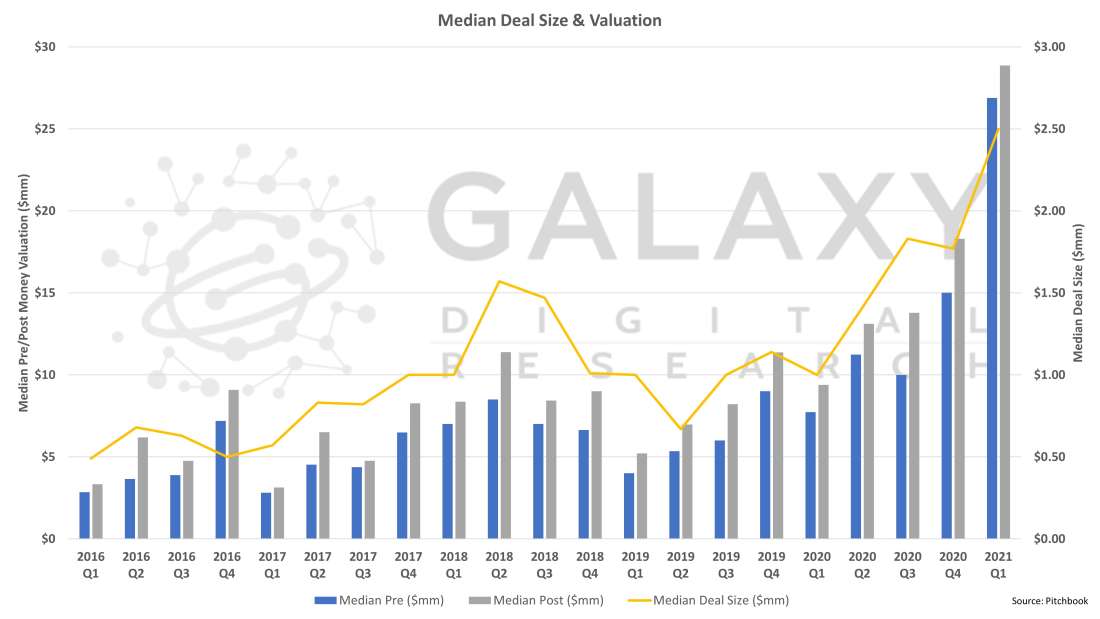

Crypto Venture Deal Valuations

We can also see the maturation of the startup ecosystem when we look at median deal size and valuation. Both metrics spiked noticeably in Q1 2021 to all-time highs. Apart from Q1 2020, round sizes and valuations have consistently increased since Q1 2019. Median pre-money valuations in Q1 2021 were up 3.4x YoY from Q1 2020.

A quick comparison of crypto deal valuations and bitcoin’s price shows some correlation.

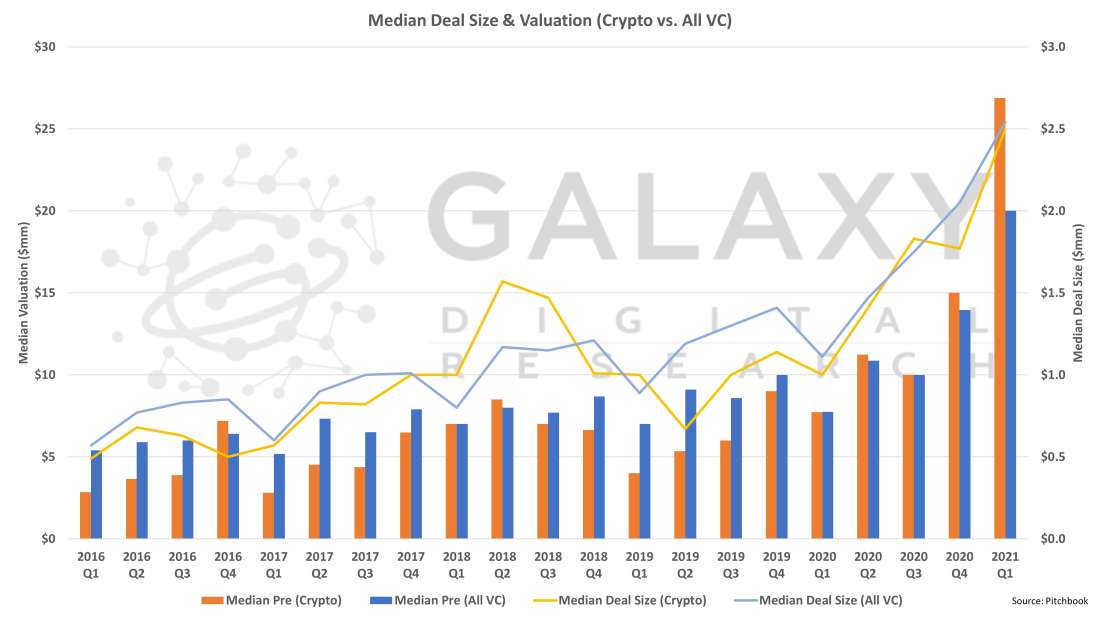

Comparing Crypto VC to the Broader VC Market

Crypto deal valuations have also mostly tracked the broader market, albeit a bit lower, until Q1 2020. Since Q1 2020, valuations in crypto have equaled or exceeded the broader market, enormously so in the last quarter, despite median deal sizes matching the rest of the market. In Q1 2021, deal valuations in the crypto sector exceeded the broader VC market by 34%.

That crypto industry valuations have exceeded the broader VC market despite comparable median deal sizes perhaps shows what VC investors know anecdotally: that there is elevated competition for allocation to the sector. Investors find themselves jockeying for position as increased demand, relatively low deal count, and a maturing crypto startup ecosystem all contribute to a founder friendly environment.

Key Takeaways

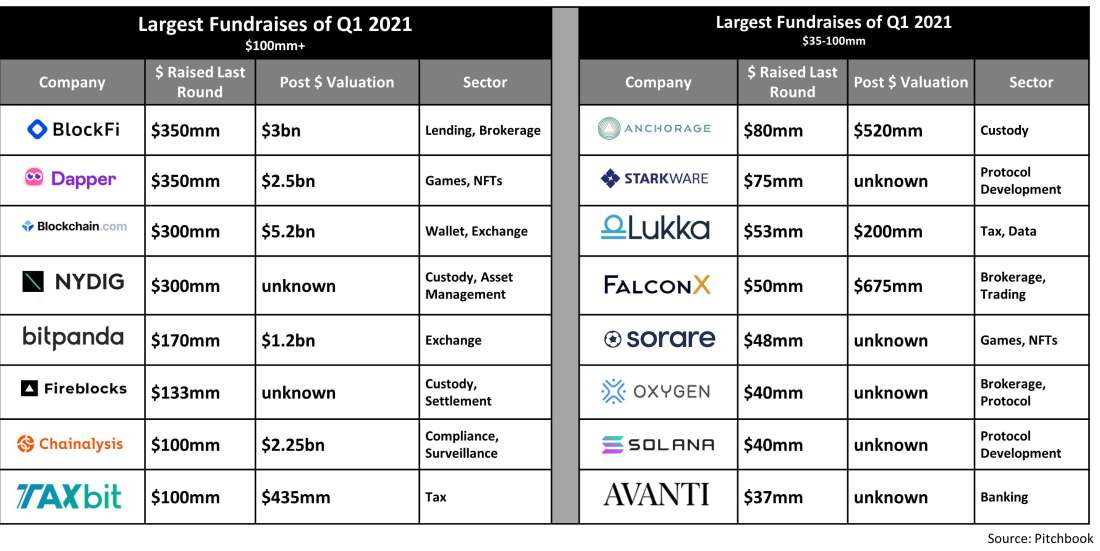

Crypto startups are maturing. For years there have been large companies operating in the cryptocurrency markets and ecosystem, but until recently only the exchanges were big players. Exchanges are still the most valuable companies in the space today, but we also see highly valuable companies operating the lending, custody, brokerage, market making, asset management, compliance, tax, gaming, and settlement verticals. Mature companies have begun raising significant growth capital, skewing the share of capital raised by later stage companies to all-time highs. The growth of business models beyond pure exchange shows the maturation of crypto market infrastructure, which in turn has allowed for the entrance of more sophisticated institutional investors in digital assets.

Crypto VC valuations are outpacing the broader private markets. In Q1 2021 the median valuation of venture deals in the cryptocurrency and blockchain ecosystem soared well past the broader VC market. While median deal valuation in the industry has tracked the broader private markets historically, crypto deal valuations exceeded the broader industry by 34% in Q1. That crypto valuations outpaced the market while median deal sizes remained consistent between crypto and non-crypto VC indicates significant competition by venture investors for allocation to crypto companies.

Crypto VC is cyclical. Broadly, bull markets in digital assets bring new entrepreneurs, with the last big influx of new entrepreneurial talent beginning a quarter after the prior Bitcoin market top in Q4 2017. Companies founded in that era that have been successful are now integral parts of the crypto markets and many are now raising significant capital at high valuations. At the same time, the decline in pre-seed deals indicates a lack of new entrepreneurial entrants in the space. Consequently, last quarter a majority of the capital invested in startups went to later stage companies for the first time ever. It is likely that the current bull market will bring a new wave of entrepreneurs and new startups, but the data shows it has not yet occurred at scale. Where in this cycle that influx occurs, or whether it occurs at all, remains to be seen.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.