Crypto & Blockchain Venture Capital - Q2 2021

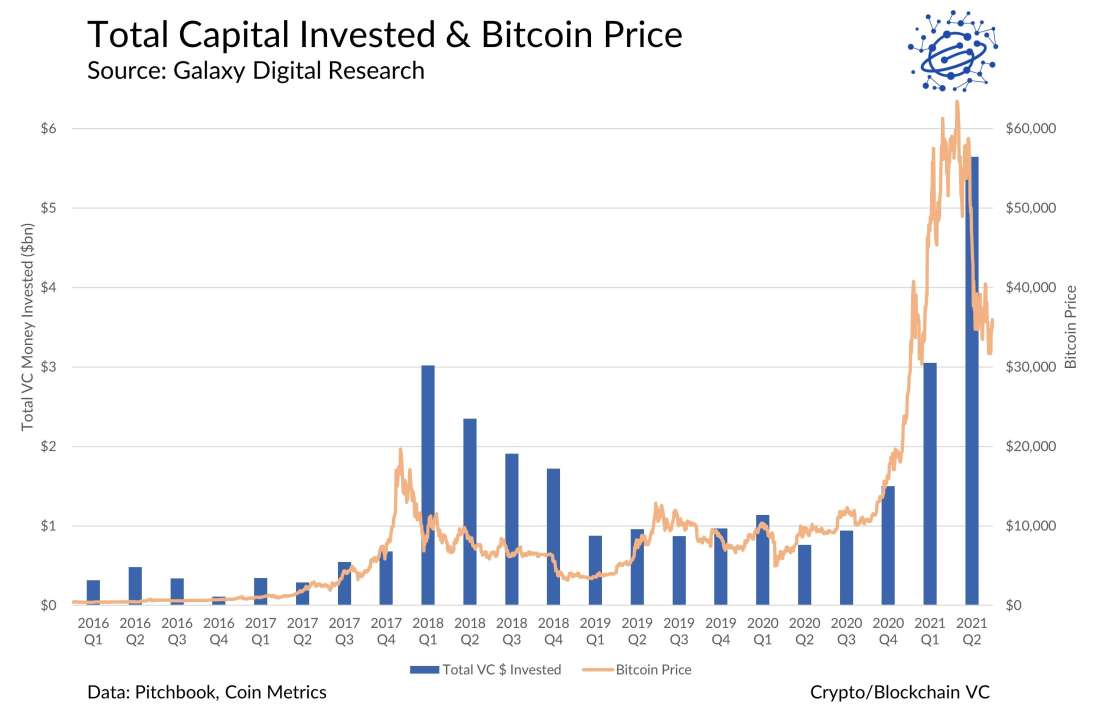

Q2 2021 saw all-time highs for digital assets like Bitcoin and Ethereum, but also significant corrections. The money flowing into venture-backed startups in the space also hit all-time highs, surpassing the previous all-time highs set in the prior quarter, even as the total number of deals remained below its Q1 2018 peak. The gap between crypto VC valuations and valuations in the broader venture market continued to widen.

Crypto markets were hot in Q2. BTC and ETH both soared to all-time highs above $60,000 and $4,000, respectively, and DeFi assets experienced even more dramatic spikes. While there was significant downward volatility in the second half of the quarter, major assets still ended the quarter at relatively high valuations.

In a volatile market, venture investing has continued to grow exponentially. Total capital allocated toward private crypto companies this quarter shattered previous highs, with over $5.6 billion invested. At nearly $2.6 billion, the quarter-over-quarter shift in total capital invested between Q1 and Q2 2021 was the largest in magnitude of all time.

Markets have been quieter going into Q3, with bitcoin trading in the $30k-$40k range, anywhere between 35-53% off its all-time high. Since 2016, private investment in the cryptocurrency startup ecosystem has tended to lag the price of bitcoin, venture investing is likely to remain elevated, even if markets remain below their Q2 all-time highs. Q3 could potentially see even more aggregate private investment, especially if bullish market activity resumes.

Funds are Growing

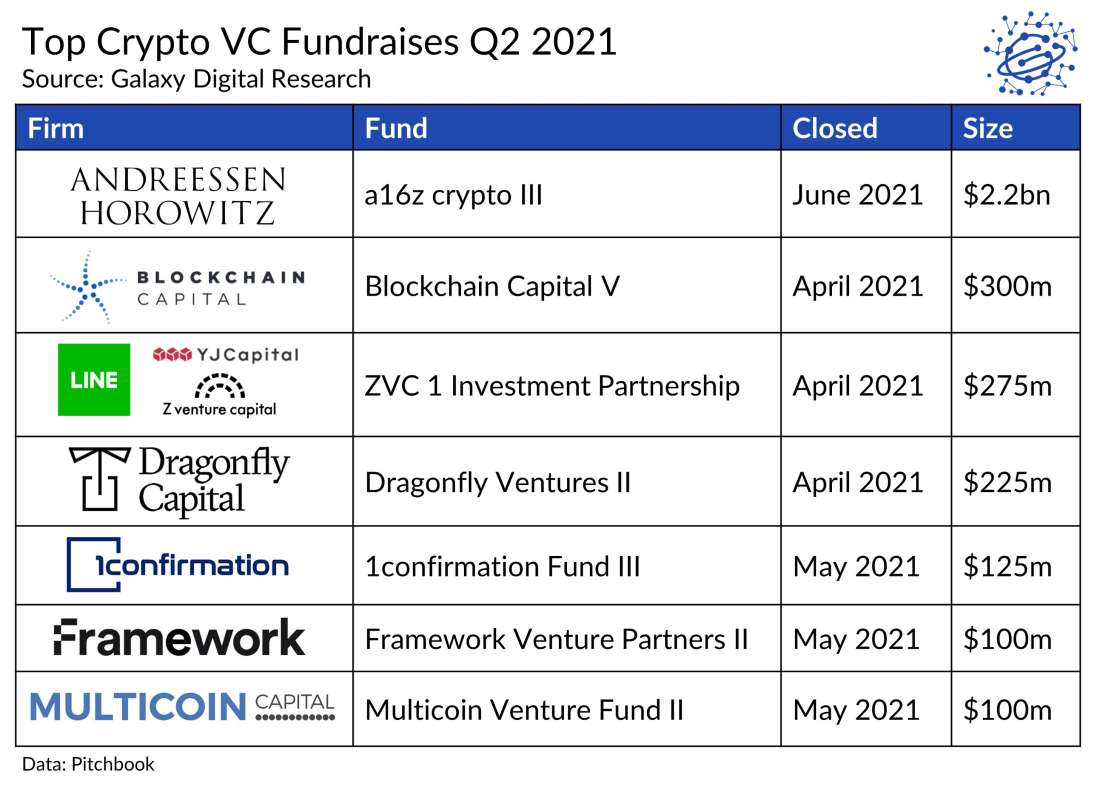

It’s a founder’s market, and the crypto VC space has become increasingly competitive as the crypto bull run materialized in the first half of 2021. Against the backdrop of this increased competition, fund size represents another dimension along which investors can differentiate themselves: larger funds are less price-sensitive, and as such are able to offer better terms and buy a greater share of each round.

Increasing fund size is also indicative of maturation in the ecosystem. Larger funds indicate growing interest from institutional investors. And with deal size growing and a larger number of late-stage deals occurring as companies get larger, more capital is required to participate meaningfully in fundraising rounds. These crypto-native investors will compete for allocation in later-stage companies with large traditional late-stage VC and private equity growth funds, which have become increasingly active in the space.

Last quarter saw the entrance or expansion of several large players in the space. Q2 2021 saw the close of several massive venture fundraises, with Andreessen Horowitz’s record-breaking $2.2 billion a16z crypto III leading the pack. Several other investors, including Blockchain Capital, the ZVC Investment Partnership, and Dragonfly Capital all closed funds in excess of $200 million.

Capital Invested & Deal Count

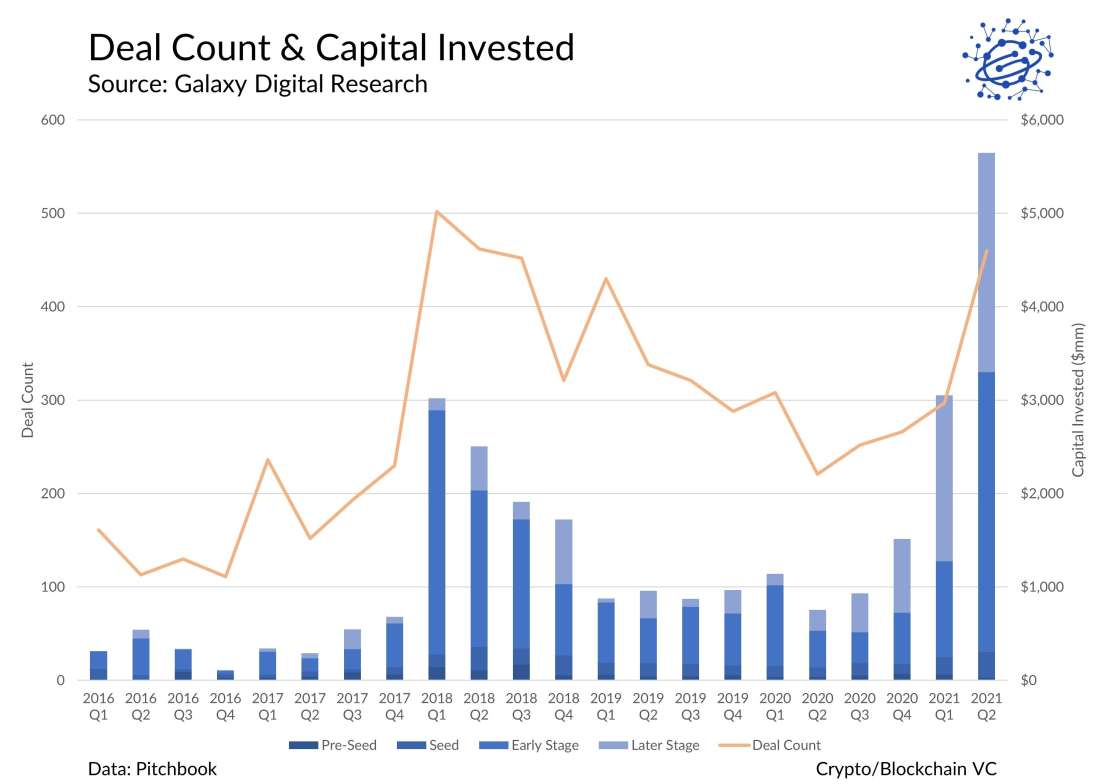

VC funding of crypto startups dramatically increased last quarter, making Q2 2021 the largest quarter in history for allocation to the sector. Despite this, total deal count still remained below the Q1 2018 all-time high.

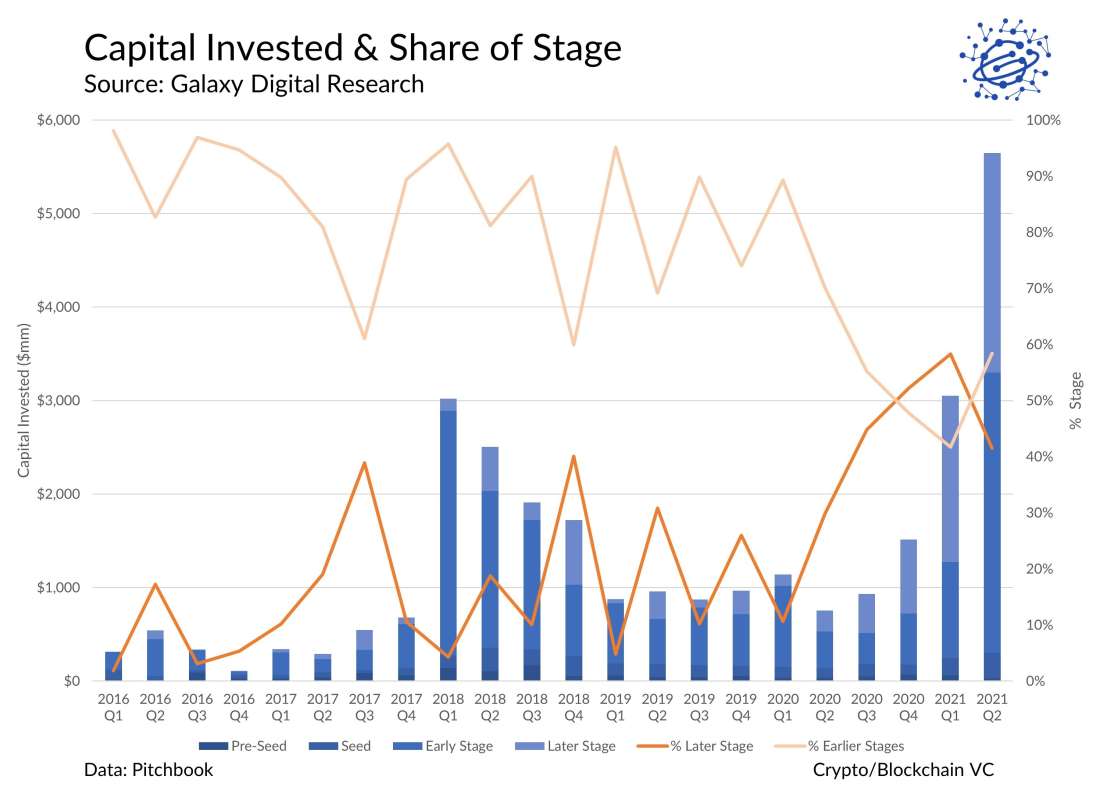

Investment by Stage

In Q1 2021, most capital went to later stage crypto companies for the first time in the history of the asset class; Q2 saw a return to the norm, with most VC money again going to earlier stage companies.

The enormous amount of capital invested in earlier stage companies last quarter shows a growing appetite to invest in the expansion of the crypto ecosystem and reverses a trend that culminated in Q1 2021 in which most capital was allocated to later stage companies.

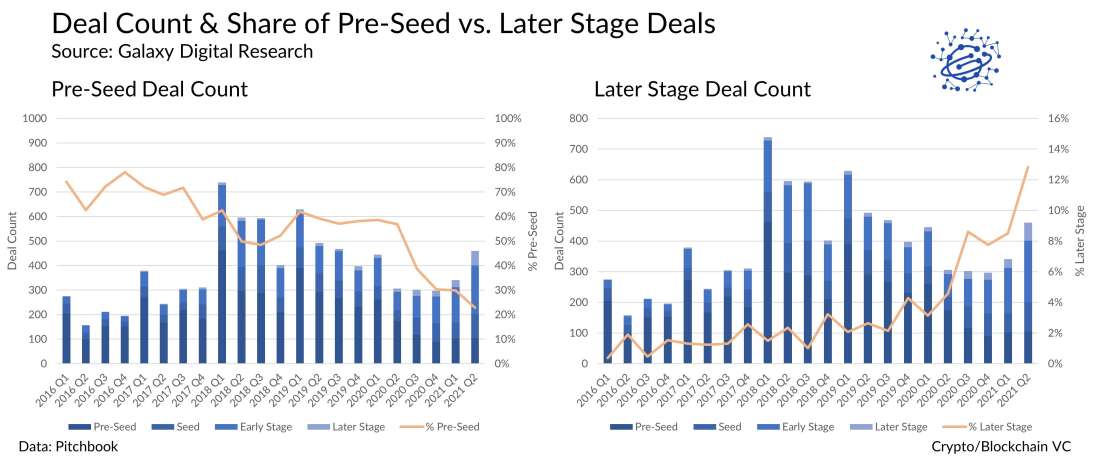

Despite the quarterly growth in capital allocated at earlier stages, the number of pre-seed deals continues to trend downward, accounting for only 23% of deals done, the lowest ever. Meanwhile, the portion of later stage deals continues to climb, reaching an all-time high of 13% of deals done.

The distribution of investment by deal stage reflects the cyclicality of the crypto industry, in which private market activity tends to be correlated to public market sentiment. The impact of the bull market is also visible in the continued uptick in deal count across all deal stages.

But while the share of capital going into early-stage companies grew this quarter, the percentage of late-stage deals by count also increased. This dynamic illustrates two intersecting trends: the growing size of early-stage deals and the increasing number of later stage companies, both of which can be seen to show the maturation of the crypto startup ecosystem. And we still haven’t seen a big influx of new entrepreneurs into the space, as exhibited by the fact that pre-seed deals continue to decline.

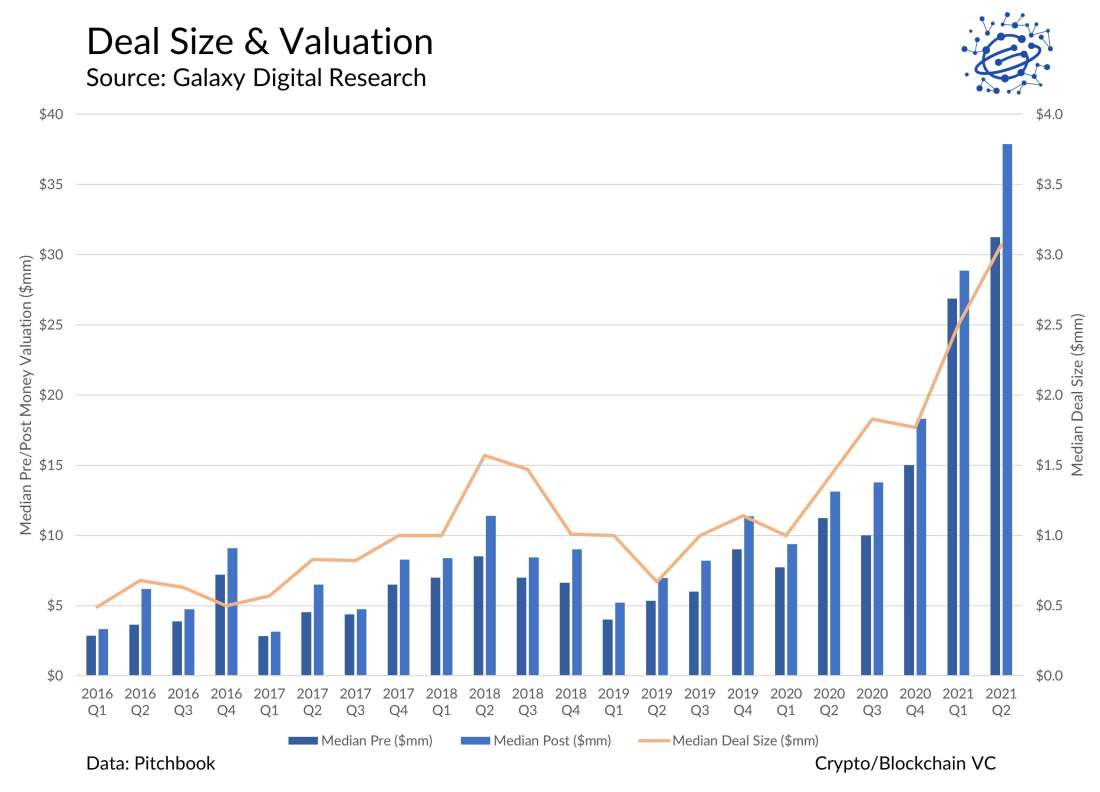

Crypto Venture Deal Valuations

Average deal size and valuation both breached previous all-time highs in Q2, continuing a trend of growth that’s largely persisted since Q1 2019. Demand (for allocation) has outpaced supply (available deals), resulting in an increasingly competitive market for investors seeking to allocate.

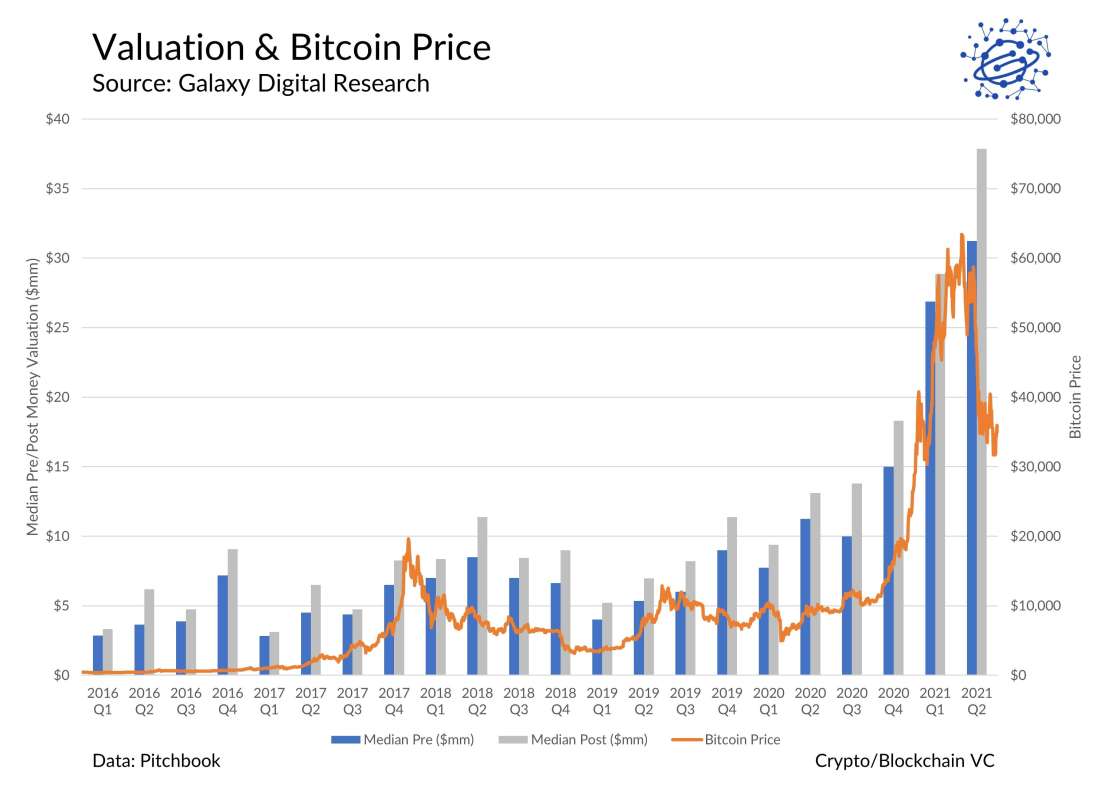

Deal valuations remain correlated with the price of Bitcoin, a trend that’s persisted over the last few cycles. Given the large amount of capital awaiting allocation and the fact that private investment tends to lag public investment, it’s likely that valuations and capital invested will remain elevated over the next quarter despite the stagnation in the public crypto markets.

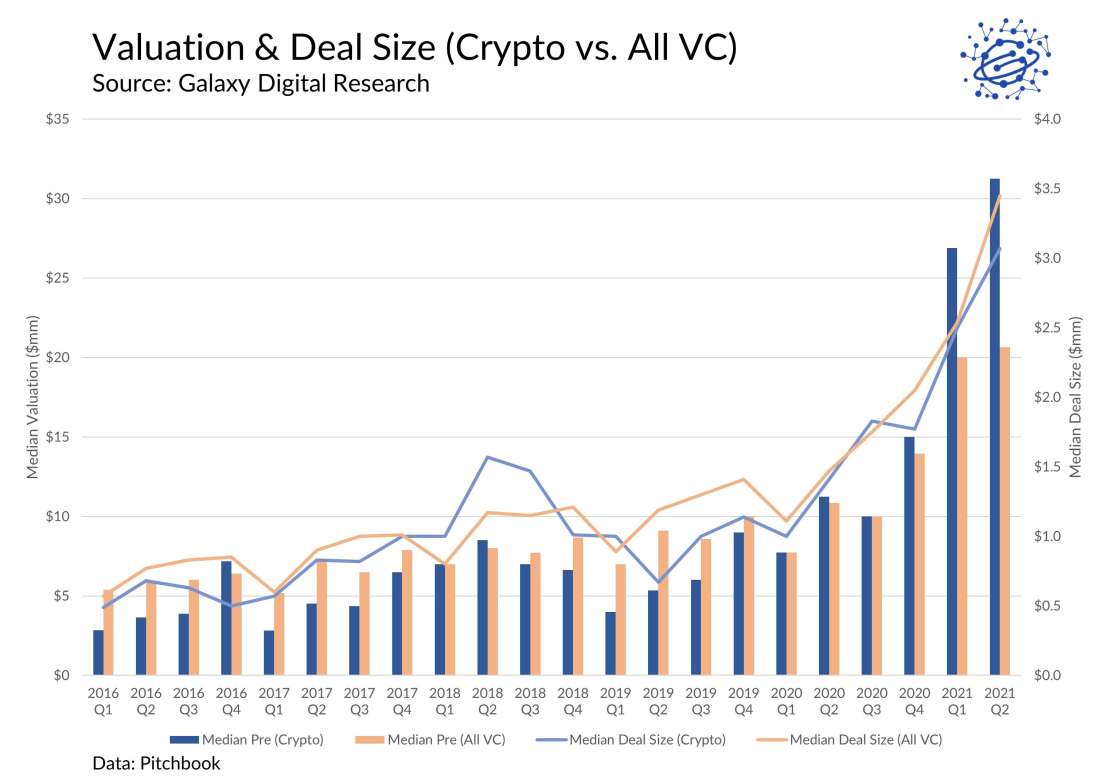

Comparing Crypto VC to the Broader VC Market

Since Q1 2020, valuations in crypto have equaled or exceeded the broader market. In both Q1 and Q2 2021, crypto valuations have exploded, outpacing the growth in the rest of the market. Crypto deals are, on average, smaller than average, indicating that crypto companies are selling a smaller share of their equity than other companies.

As we discussed in our Q1 report, industry valuations exceeding those in the broader market could provide data despite smaller deal sizes supports the thesis that there’s a surplus of capital in the space, leading to an exceptionally founder-friendly environment. With larger funds continuing to enter the space, the environment for investors may get more expensive before it gets cheaper.

Key Takeaways

Sky-high crypto valuations show strong VC interest, founder-friendly environment. In Q2 2021, crypto valuations continued to outpace those in the broader market. Last quarter, crypto valuations exceeded the broader market by more than 50%. This trend has been accelerating QoQ – in Q1, crypto valuations exceeded the broader market by 34%. The delta in median valuations demonstrates that institutional capital continues to seek allocation to the crypto ecosystem in outsized proportion to other industries. And with these increases in valuation occurring while median crypto deal size continues to lag the broader industry slightly, crypto founders are able to sell equity more efficiently compared to the broader market. Simply put, growing valuations are a sign of founder-friendly market. As this trend continues, investors (particularly large, well-connected, and knowledgeable investors) will compete for allocation in top startups, while undifferentiated capital allocators will struggle to access top founders.

Fund size is exploding. Crypto VC funds are getting larger, and the ecosystem is bifurcating between larger and smaller players. As the race for allocation heats up, fund size opens another dimension for VCs to differentiate themselves: larger funds are less elastic in their demand, and as such are able to offer better terms and purchase larger chunks of startups’ rounds. Larger funds also offer additional value-added services, like security audits, design resources, media support and placement, and assistance with hiring whether direct or through their extensive networks. Late-stage deals are increasingly inflated, with larger growth equity funds increasingly entering the market.

Crypto VC is still cyclical. Venture investing is tied to public crypto markets in both magnitude and deal composition. In bull markets, more deals are struck, and early-stage companies receive funding they perhaps wouldn’t otherwise. Q2 manifested both trends: overall investment and deal count accelerated dramatically; and early-stage investment picked back up from its relative lull in Q1, once again outpacing late-stage investment.

However, we continue to see a decline in pre-seed deal counts, indicating that a flood of new entrepreneurs has yet to enter the market. As we speculated in last quarter’s report, it’s possible that the decline in pre-seed deals is indicative of the growth of new decentralized protocols, whose fundraises may not be sufficiently captured in our dataset. However, the decline could also indicate a lack of major infrastructure gaps in the maturing cryptocurrency market. The 2017-2018 bull run exposed significant gaps in lending, settlement, brokerage, and more, and many entrepreneurs started companies to address these opportunities.

Because private markets tend to lag public markets, and the abundance of crypto VC capital, we’ll likely continue to see elevated deal count and valuations, especially in early-stage companies, despite the sideways movement of the public crypto markets.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email contact@galaxydigital.io. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.