UPDATE: Infrastructure Bill's Crypto Language

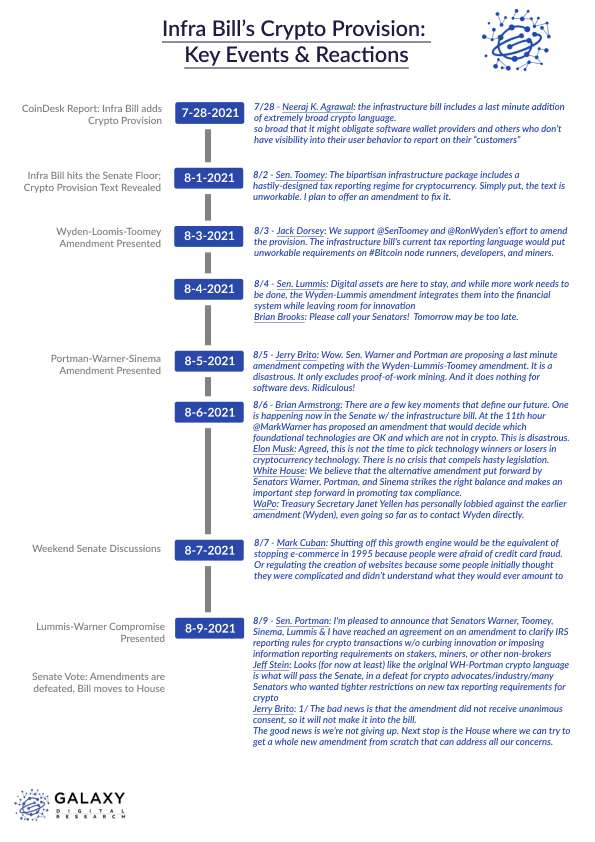

The bipartisan infrastructure bill appears set to pass the Senate this week with no amendment to the provisions that designate participants in the cryptocurrency ecosystem as “brokers” under IRS reporting rules. A consortium of cryptocurrency advocates had lobbied to ensure that network participants and software developers were explicitly excluded from any reporting requirement. While the failure of the industry-backed amendments is a setback, cryptocurrency advocacy made great strides over the last 10 days. In this report, we review the timeline of events, breakdown our view on the language in the bill, and discuss the implications, both good and bad.

This report is a follow-up to our August 2, 2021, initial report covering the infrastructure bill. Read it here.

Background

Over the last week, the US Senate has been debating a bipartisan bill to provide more than $1tn in funding to support and improve the nation’s infrastructure, with funding for ports, bridges, roads, high-speed broadband, and more. Included in the bill’s “pay for” section – items that either raise new revenue or cut spending to offset the cost of the bill – was language expanding the definition of a “broker” under IRS reporting rules to include components of the cryptocurrency ecosystem and market infrastructure.

Underlying Language

The original language expanded the definition of a ‘broker’ to include: “any person who (for consideration) regularly provides any service or application (even if noncustodial) to facilitate transfers of digital assets, including any decentralized exchange or peer-to-peer marketplace.” The original language was highly problematic and, in our view, could allow the IRS to classify participants in the cryptocurrency ecosystem that would be pragmatically incapable of complying. While the stated intent of the provision is to help raise lost tax revenue from cryptocurrency trading, the broad language could have ensnared entities that do not possess identifying information on users and who have nothing to do with taxable events. These entities include:

Network participants like nodes, validators, or miners

Non-custodial services like software wallets, hardware wallets, or multisig collaborative custody providers

Software developers who build applications for use by third parties

Decentralized exchanges, DeFi applications, or NFT marketplaces

Over the weekend before last, cryptocurrency advocates succeeded in narrowing the language slightly: “any person who (for consideration) is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person.” For several reasons, this language is a major improvement:

It removes the word “application,” which would make it more difficult to apply a “broker” designation to developers of wallet software, particularly if it’s free and open source

It removes the “(even if non-custodial)” qualifier, making it more difficult to apply a “broker” designation to non-custodial services

It replaces the word “facilitate” with the word “effectuating.” Facilitating is broader and means “to make an action or process easier,” while “effectuate” means to literally “put into force or operation.”

It removes entirely the references to “decentralized exchanges” and “peer-to-peer marketplaces.”

It appends “on behalf of another person,” limiting the scope of coverage to those “persons” who “regularly” provide “services effectuating the transfer of digital assets on behalf of another person.” Consensus is that “on behalf of another person” implies a contractual relationship between the “broker” and the “user,” which doesn’t exist between network stakeholders (users, nodes, miners, validators), users, and developers of open-source software, or traders and decentralized exchanges.

The updated language seeks primarily to exclude those network participants who would be unable to comply at all – nodes, miners, validators, etc. – which should be viewed as making the regulation smarter, not more permissive. But the language itself is still very broad and can still be viewed as applying to several types of entities that really shouldn’t be covered, as they have no knowledge of the nature of their users’ transactions and may not even know their users at all:

Miners and validators. Technically, they can be seen as “effectuating” the transfer of digital assets “on behalf of another person,” and they may do even do “for consideration” (i.e., payment in the form of TX fees), but pragmatically speaking, they have no ability to know their “users” or have any insight into the nature of the transactions they confirm during block production.

Lightning Network routing nodes. Lightning Nodes can be seen in a similar light, though perhaps they are even more literally “effectuating” the transfer of digital assets “on behalf of another person.” While two counterparties can exchange BTC trustlessly and without any intermediary, without a routing node, a payment can’t flow from point A beyond point B to point C.

Wallets and multisignature providers. Non-custodial wallets could still be caught up in the “broker” definition if they are able to track and report on their users’ behaviors, particularly those that charge money for the service. This could include “collaborative custody” providers utilizing multisig who, though they are unable to unilaterally move client funds and therefore cannot be considered “custodial” services, nonetheless may be able to monitor and report on the activities of their users and, by virtue of the services they provide, can be said to be “effectuating the transfer of digital assets on behalf of another person.” Depending on their design, sidechains could also be ensnared here.

DAOs and protocol treasuries. Given the broad language, it’s possible that DAOs, treasuries, and other multisig arrangements could be ensnared by this language if interpreted broadly, particularly if the governance powers are not widely distributed.

Battle Over Amendments

In an effort to add clarity and help exclude some of these entities who can’t reasonably be considered “brokers,” on Wednesday of last week Senators Lummis (R-WY), Wyden (D-OR), and Toomey (R-PA) introduced an amendment that would specifically exclude validators, hardware and software wallet makers, and protocol developers from the definition of a “broker.” The amendment was the product of intense work by the Senators, their staffs, and outside advocates. But then, late Thursday, Senators Warner (D-VA), Sinema (D-AZ), and Portman (R-OH) introduced a separate, less accommodating (but still clarifying) amendment which received support from the White House.

To compare, the Lummis/Wyden/Toomey amendment would exclude the following from being considered “brokers” under IRS tax reporting rules:

Validating distributed ledger transactions

Selling hardware or software for which the sole function is to permit a person to control private keys which are used for accessing digital assets on a distributed ledger, or

Developing digital assets or their corresponding protocols for use by other persons, provided that such other persons are not customers of the person developing such assets or protocols.

While the Portman/Warner/Sinema amendment would exclude the following from being brokers:

Validating distributed ledger transactions through proof of work (mining), or

Selling hardware or software the sole function of which is to permit persons to control a private key (used for accessing digital assets on a distributed ledger)

A massive lobbying effort ensued last weekend, with cryptocurrency advocates pushing for the Lummis-Wyden-Toomey amendment and the White House and Treasury Department pushing for the Warner-Portman-Sinema amendment. Fight for the Future, a non-profit advocacy group that led an effort to make it easy for constituents to lobby their Senators, estimated that more than 40,000 phone calls had been made to Senate offices to advocate on behalf of the Lummis-Wyden-Toomey amendment.

Finally, on Monday morning, a compromise emerged between the two sides which mostly leaned towards the Warner-Portman-Sinema amendment. This language generalized the exclusion for validators but included no exclusion for software or protocol developers. Despite its limitations, the compromise amendment nonetheless represented an improvement over the underlying text. (It’s worth noting that Senator Ted Cruz (R-TX) also introduced his own amendment which would entirely strike the section related to crypto from the bill, although this was generally seen as a non-starter since the crypto provision was a “pay for” in the bill and removing it would make the broader infrastructure bill no longer revenue neutral.)

Amendments Defeated

On Monday afternoon, the two amendments finally made it to the floor of the Senate, where they could only be adopted with unanimous consent – that is, if only one Senator objected, the amendments would fail. Sen. Pat Toomey (R-PA) gave an impassioned speech defending the bipartisan compromise amendment and asked for unanimous consent that it be adopted. Importantly, Sen. Toomey explained that the amendment would specifically exclude developers, validators of all types, and any entity that was technologically or pragmatically unable to comply.

Sen. Richard Shelby (R-AL) asked for his unrelated amendment (2535) to be appended to the compromise amendment. Shelby’s amendment included $50bn in additional military spending, much of it to revitalize Navy and Coast Guard shipyards, and Sen. Bernie Sanders (I-VT) objected. With his amendment excluded, Shelby objected to the compromise amendment, killing it. Then, Sen. Ted Cruz (R-TX) offered his own amendment, which would strike the entirety of the crypto broker language from the bill. Shelby again asked for his amendment to be appended, but Sen. Cruz denied the request, leading to Shelby objecting to Cruz’s amendment.

Ultimately, more than a week of heavy lobbying and significant work by cryptocurrency advocates both inside and outside the US Senate was derailed by a completely unrelated issue—the desire of a retiring senator to add $50bn in military spending, much of which would benefit his home state. A vote is expected Tuesday on the broader infrastructure bill and it is expected to pass.

What's Next?

Assuming the infrastructure bill passes the Senate (a vote is scheduled for Tuesday), the bill will then move to the House, where cryptocurrency advocates are planning yet again to push for changes. Several members of Congress have already signaled their concern with the Senate’s language and intent to introduce their own amendments.

Rep. Patrick McHenry (R-NC), a supporter of Bitcoin and cryptocurrencies, wrote on Twitter that he will “work to ensure [the bill] provides protection for American innovation, and will put forwarded needed changes to achieve this goal.” Referring to the battle over language in the Senate, McHenry continued to say “If the Senate can’t get it done, we’ll fight it out in the House. #Crypto.”

Rep. Tom Emmer (R-MN) said the House’s Blockchain Caucus had sent a letter to all House members raising concerns about the Senate language, urging the House to “consider amendments to this provision that exempts entities that don’t conduct crypto transactions and keep blockchain software development, cryptocurrency mining, and more in the United States.” The bipartisan letter was signed by Emmer and Rep. Darren Soto (D-FL), Rep. Bill Foster (D-IL), and Rep. David Schweikert (R-AZ).

Positive Takeaways

Regardless of whether the underlying text can be changed before this infrastructure bill becomes law, several things about both the bill and the process should be seen as positive for the cryptocurrency industry:

The underlying text is much better than the original text CoinDesk reported, as described above. And statements on the record from the White House and authors of the infrastructure bill, including Sen. Rob Portman, are more exclusionary for a broader set of cryptocurrency stakeholders than the text of the bill. Those statements can be useful if courts are forced to assess Congress’s intent in passing the bill.

The crypto industry demonstrated notable sway in Washington and its arguments were heard and adopted by powerful policymakers. An honest, intelligent, and relentless lobbying effort was mounted on short notice, with advocacy groups and general counsels convening in Washington and legions of popular support organizing powerfully online. Vocal, thoughtful bipartisan cohorts in both the Senate and House have emerged as advocates for the nascent industry. Statements on the floor of the Senate showed a remarkable understanding of both the technology and its promise. And there’s no doubt that the cryptocurrency industry won over some skeptics during this confrontation – among Congressional members, staff, and the public. The reach of the cryptocurrency movement extending deep into the national conversation demonstrates how far the industry has come since Satoshi’s first block. This power was important to experience, demonstrate, and wield as the industry advances.

The provisions in the bill don’t take effect until 2023, which leaves time for new discussions, advocacy, legislation, and litigation if necessary.

Decentralized network participants are still incapable of complying. The entities industry wants specifically excluded remain incapable of complying, regardless of whether the government decides to use this language to claim they must. Open-source developers, miners, validators, and nodes simply cannot comply with the IRS reporting rules. These entities don’t facilitate taxable events, so they wouldn’t generate revenue to pay for the bill anyway. That is the reality and it serves as a strong defense against any attempts at extending these requirements to them.

The entities that can comply with IRS tax reporting rules are mostly fine with doing so. These include exchanges, OTC desks, brokerages, etc. In fact, crypto exchanges have been asking for clarity around tax reporting for years. If this reporting requirement can generate any lost revenue (we haven’t seen models from proponents or the CBO), then this bill will capture those entities within the broker definition, and rightly so.

Concerns

The legislation is still problematic, and some of the process raises concerns for the near and medium-term.

The language is still vague and grants substantial power to the IRS to determine who should be included. Statements from the administration and key Senators slightly reduce the likelihood that the language will be interpreted expansively, but statements don’t carry the force of law.

This may have just been an opening salvo. The White House’s involvement, and the personal lobbying efforts conducted by Treasury Secretary Janet Yellen, likely indicates the presence of a broader administration agenda. Given pressure from Senator Elizabeth Warren (D-MA), last year’s proposed rule form FinCEN, recent hawkishness from the SEC Chairman, and crackdowns on other companies in the ecosystem both US-based and overseas, further policy announcements, regulatory actions, and legislative initiatives were already very likely. The industry’s profile is sky high, and the involvement of high-level officials pushing new, restrictive policies is a new reality.

SEC Chairman Gary Gensler gave a hawkish speech at the Aspen Security Forum last week in which he called for additional powers to regulate crypto exchanges, lending, and DeFi. Gensler owes Senator Elizabeth Warren (D-MA) a response to her July letter seeking guidance on what powers the SEC needs to reign in the “wild west” cryptocurrency industry, which could set the stage for additional legislation. How the SEC’s power and involvement develop will have material impact on the ecosystem, and we will see clarity on a gameplan in the coming weeks and months.

FATF guidelines on travel rules and anti-money laundering policy for digital assets are still forthcoming, and in many member nations, the development and application of AML policy towards digital assets are ongoing and evolving. Along similar lines, the proposed FinCEN rule from December 2020, which would have increased AML surveillance and reporting requirements on crypto brokers and follows in the same vein as FATF’s guidelines is likely to reappear in the coming months.

Conclusion

The legislative scuffle in Washington presented the cryptocurrency industry with an unexpected and fast-moving challenge, and in response the industry banded together to act quickly with its allies, demonstrating cryptocurrency’s growing clout in Washington. The industry pressed key policymakers and legislators to go on the record and saw several amendments brought to the floor for consideration. Prior to the amendments, advocates had already won modifications to the underlying language, which was a significant improvement from the reported starting point. The White House and Treasury ostensibly moderated their position in the face of criticism, which can be seen as a victory.

Crypto markets seemed to agree. Throughout the debates, Bitcoin and Ether continued to rise and are up 20% and 50%, respectively since CoinDesk first reported on the language. Galaxy OTC has seen significant and growing buyside interest across all assets, with overall volumes double or triple a few weeks ago. Institutional interest has grown over the last several weeks. While the recovery from local bottoms began before the battle in Washington, its continued strength in the face of uncertainty in Washington shows both retail and institutional investors remain resilient in their interest in the space.

Throughout the legislative battle, advocates both inside and outside Congress made a strong case to the American people, explaining the benefits of the technology movement and warning against stifling innovation. Ultimately, the industry succeeded in rallying significant support that will benefit as this legislation moves to the US House and in future legislative battles. Now, the industry must advocate for a more orderly legislative process when policymakers seek to consider the future of our innovative industry.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.