EIP-1559: A Major Upgrade for Ethereum

A new improvement proposal (upgrade) will alter fundamental properties of Ethereum to simplify user experience and harden ETH's monetary policy, but the proposal has drawn criticism from miners who stand to lose as much as 50% of their revenue.

Developers of Ethereum, the world’s second most valuable blockchain network, have agreed to implement a major protocol change in a forthcoming network upgraded scheduled for July 2021. The change, known as Ethereum Improvement Proposal 1559 (EIP1559), overhauls Ethereum’s transaction fee mechanism in a way that impacts users, miners, and holders of ETH.

Public blockchains like Ethereum are open-source projects developed by anyone who wants to contribute. Determining which upgrades to enact requires conversation and collaboration among a range of stakeholders, including developers, users, miners, and sometimes businesses operating on the community. Achieving consensus on upgrades is laborious and often controversial, particularly with so much money at stake. For example, during the “block size wars” of 2015-2017 when portions of the Bitcoin community wanted to alter a fundamental property of the protocol—its block size, or the amount of data that can be included in each block—a multi-year debate culminated in a contentious chain split that resulted in the creation of a different coin (Bitcoin Cash, a minority fork of Bitcoin). Given the difficulty in achieving consensus on development roadmap, the technical complexity of developing cryptographic blockchain protocols, and the large amount of money at stake, major upgrades to public blockchains are quite rare. EIP-1559 is a significant upgrade, one of the most dramatic for any widely used public blockchain. In this report, we explain the changes it brings, examine the upgrade’s design goals, and explore its impact on the network and its native asset ETH.

What EIP-1559 Accomplishes

Simplifies the transaction fee process. Instead of performing rather complex calculations to estimate the appropriate transaction fee (“gas price”) to use for network transactions, under EIP-1559 users instead will pay an algorithmically determined transaction fee set by the protocol itself (“basefee”). This change will simplify the user experience, allowing wallets to display with certainty the fee for next-block inclusion and estimate future block fees with greater accuracy. Simplifying this process will reduce the likelihood that users overpay and ease user experience overall, both necessary steps to growing Ethereum adoption, particularly in the highfee environment users find themselves today.

Hardens ETH’s monetary policy. Whereas transaction fees today are paid to miners, fees paid after EIP-1559 activation will instead be destroyed (“burned”), constricting the total supply of ETH. To transact on Ethereum will require that users destroy an algorithmically determined amount of ETH, placing a constant disinflationary pressure that adds to the asset’s scarcity. It is theoretically possible that the ETH burned could exceed the newly minted ETH, resulting in a net-deflationary monetary policy.

Solidifies ETH’s long-term network utility. Transaction fees are mostly paid in ETH today, but because the miners select which transactions to include in a block, users can theoretically compensate miners for block inclusion with some fee paid entirely outside the protocol. EIP-1559 requires that the basefee be paid in ETH specifically, thus cementing ETH’s place in the protocol’s operation.

Background on Ethereum Transaction Fees (Gas)

To understand how EIP-1559 improves the transaction user experience, we must first start with background on how transaction fees work on Ethereum.

Users pay a fee when they send ETH or tokens either between wallets or to a smart contract. The fee is needed to pay for the computation required to execute the transaction. This transaction fee is set by the user and collected by the miner who includes the user’s transaction in a block. A user designates the fee they are willing to pay using the following formula:

gas price * gas limit

Gas price is the amount of Gwei the user is willing to pay for gas units.

1 Gwei = 0.000000001 ETH, or approximately $0.00000165 at current prices.

Gas limit is the total amount of gas units the user is willing to pay.

A standard ETH transfer requires a minimum of 21,000 gas units. Interacting with smart contracts or moving ERC-20 tokens requires more.

Current Ethereum Fee Environment

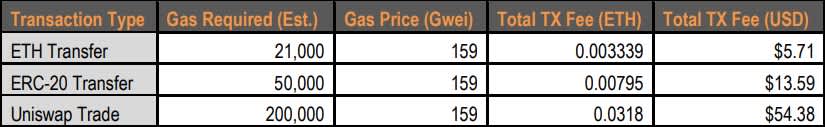

At the time of writing, the estimated gas price for inclusion in a block within 5 minutes is 159 Gwei[i] . For a simple transfer of ETH utilizing the minimum gas limit of 21,000 gas, this translates to a total transaction fee of 3.3m Gwei (0.003339 ETH, or $5.71). However, different types of transactions require different amounts of gas. While the minimum to transfer ETH is 21,000 gas, performing more complex transactions, like depositing tokens into a Uniswap pool, taking a loan from Aave, or even just transferring an ERC-20 token, require more computation and thus a higher gas limit. See the table below for some rough estimates on the transaction fees required for different types of transactions based on the average gas price for >5m inclusion times and the current price of ETH as of writing.

Luckily, if a transaction uses less gas than the gas limit specified by the sender, the excess ETH will be returned to the user. Thus, the standard practice is to err on the higher end when setting a transaction’s gas limit. But knowing how high to set the gas limit and estimating an appropriate price for gas is difficult and creates a daunting user experience. As a result of the complexity, users often pay more gas than needed, resulting in extremely high miner revenue. Reducing this complexity is one of the main goals of EIP-1559.

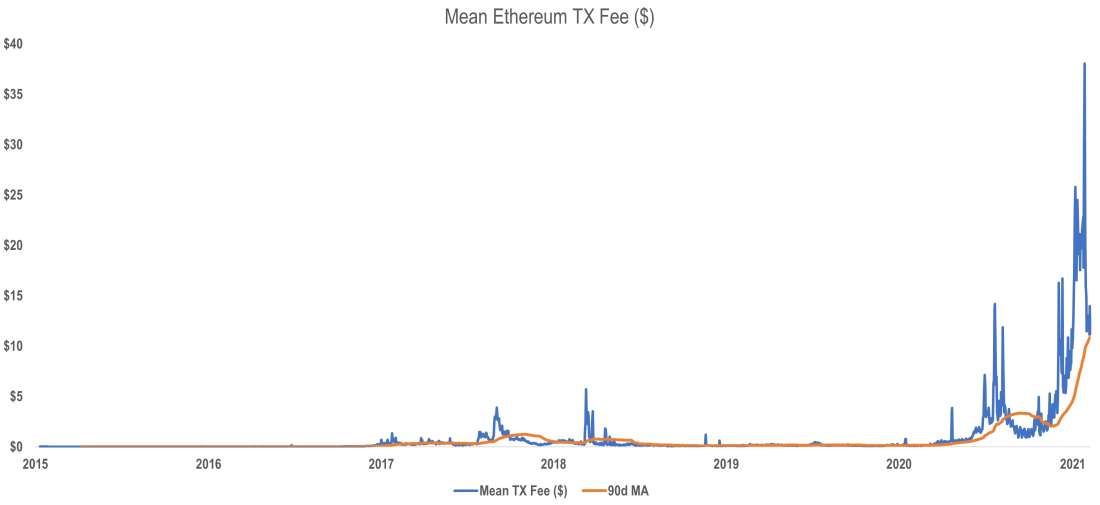

The rise of decentralized finance (“DeFi”) on Ethereum has created unprecedented demand for Ethereum block space. DeFi transactions tend to have higher time preference and represent higher economic value than other types of Ethereum transactions. The availability of KYC-free, globally accessible decentralized exchanges, lending and leverage platforms, synthetic asset issuers, and yield-farming opportunities has drawn in whales with low sensitivity to high gas prices. The rise of time-sensitive, high-value transactions sent by wealthy users has contributed to a highly competitive and expensive fee market, pushing up the fees required to transact on the network and amplifying the economic impact of gas price miscalculations. Overall, network congestion and competition for inclusion in blocks has resulted in significant fees for Ethereum users:

Source: Coin Metrics

How EIP-1559 Improves the Transaction Fee User Experience

EIP-1559 will not necessarily reduce fees, but it will make it much easier to estimate an appropriate transaction fee while reducing the likelihood of overpaying. As stated above, rather than bidding gas in a first price auction, users will instead pay an algorithmically determined basefee and only revert to direct competition (paying tips) during short times of extreme congestion and urgency.

Think of the basefee as a market rate for gas prices—algorithmically established by the network based on the current level of network usage. Each block (about every 13 seconds), the network will adjust the basefee up or down depending on the level of network congestion. When block space is >50% utilized, the basefee rises slightly; when <50% utilized, the basefee declines slightly. And because the amount that the basefee can move up or down each block is fixed (maximum 12.5% in either direction), wallets and their users can predict future fees with much greater accuracy.

Currently, wallets display estimated gas prices to their users by weighing prices recently paid by users against the pool of pending transactions (mempool), which is as much an art as science. EIP-1559 creates a native rate for gas prices, relieving each wallet of the burden of creating their own gas price estimation mechanism. The simplification will improve user experience, which should help grow the Ethereum ecosystem.

EIP-1559’s Impact on ETH’s Monetary Policy

Because EIP-1559 requires that users destroy ETH to transact on the network, rather than pay that basefee to miners, the change impacts ETH’s monetary policy attributes. Changes to a blockchain’s supply dynamics are inherently significant and a coin’s emission schedule is a key factor weighed by investors when evaluating cryptoassets given the diversity of approaches taken by projects across the ecosystem.

Under EIP-1559, revenue generated by the protocol due to growing use will accrue to users in the form of deflation. A mechanism that results in ETH being constantly destroyed, in any amount, is new for the protocol. While each block will continue to emit 2 newly minted ETH, each block will also result in some amount ETH being destroyed, reducing the net-new per-block supply issuance. Indeed, it is possible that the basefee (burned ETH) could even exceed the net-new issuance, rendering the protocol deflationary on a net basis, at least during times of heavy congestion. Regardless of the ratio of basefee and issuance, the change in supply dynamics is viewed positively by most holders of ETH because it places downward pressure on the network’s monetary supply expansion (inflation), making ETH scarcer.

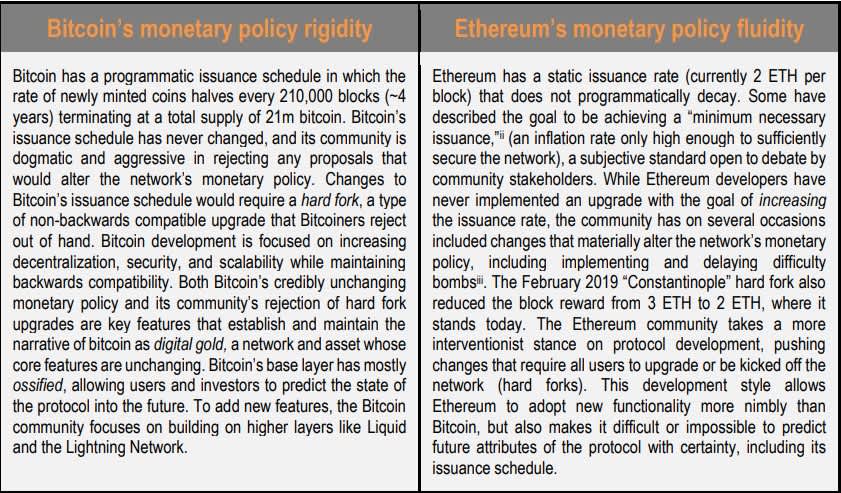

Comparing Bitcoin and Ethereum: Monetary Policy & Development Style

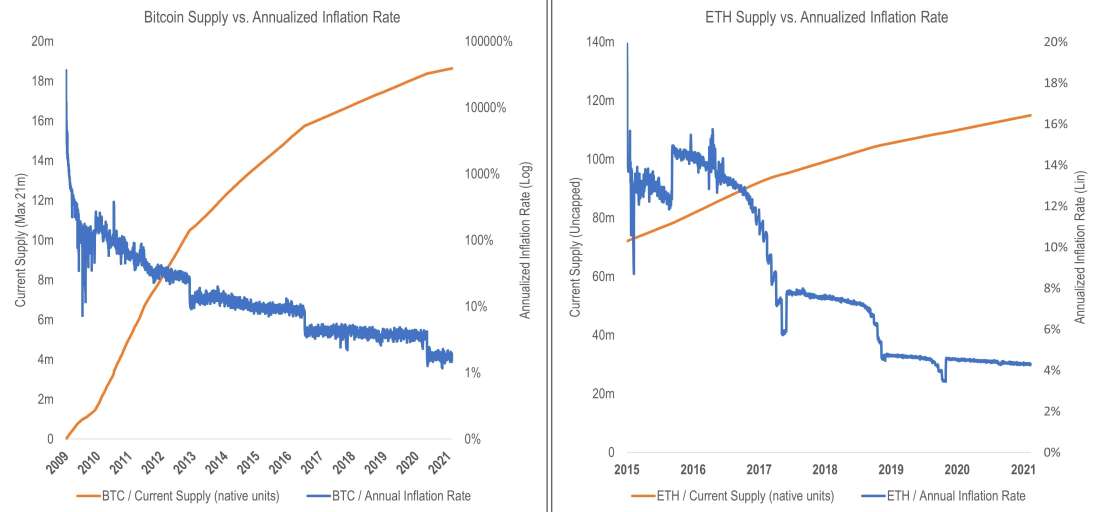

To further put this change into context, we compare the monetary policies and development styles of Bitcoin and Ethereum. The charts below show the annualized inflation rates and circulating supplies of BTC and ETH. At the time of writing, BTC’s supply was growing at an annualized rate of 1.78% and ETH’s supply was growing at an annualized rate of 4.27%. Examining the annualized inflation (in blue) reveals the programmatic decay of bitcoin’s supply and several of the artificial interventions in ether’s supply:

Source: Coin Metrics

*Note, ETH launched with an existing supply of 72m units, which were sold to investors in its initial coin offering

The different approaches taken by the Bitcoin and Ethereum communities on monetary policy and overall development style are a defining fault line in the public blockchain space.[ii] Each side makes or rejects different tradeoffs to achieve or defend different ends. Bitcoin’s scarcity and predictable issuance schedule is core to its value proposition but maintaining the rigidity and predictability of the issuance schedule is less important for narratives supporting ETH’s value proposition.[iii] While Ethereum lacks monetary policy predictability when compared to Bitcoin, its on-chain composability has driven a wave of innovation to its platform. Ethereum’s style is one of quick innovation, not conservative predictability, an important distinction for ETH supporters and detractors alike.

Miner Opposition

While EIP-1559 has overwhelming support from developers and users, it is opposed by a majority of Ethereum miners, who stand to lose significant fee revenue. These concerns have been publicly voiced several times, but developers have opted to move forward over miner objections. Changing economic incentives or monetary policy attributes creates a form of platform risk, particularly for miners in this case, something Ethereum was originally created to avoid. However, this upgrade has significant support within the broader Ethereum community and from some other miners who argue the usability and ETH-scarcity benefits will grow Ethereum adoption and ultimately outweigh the concerns of lost miner revenue.

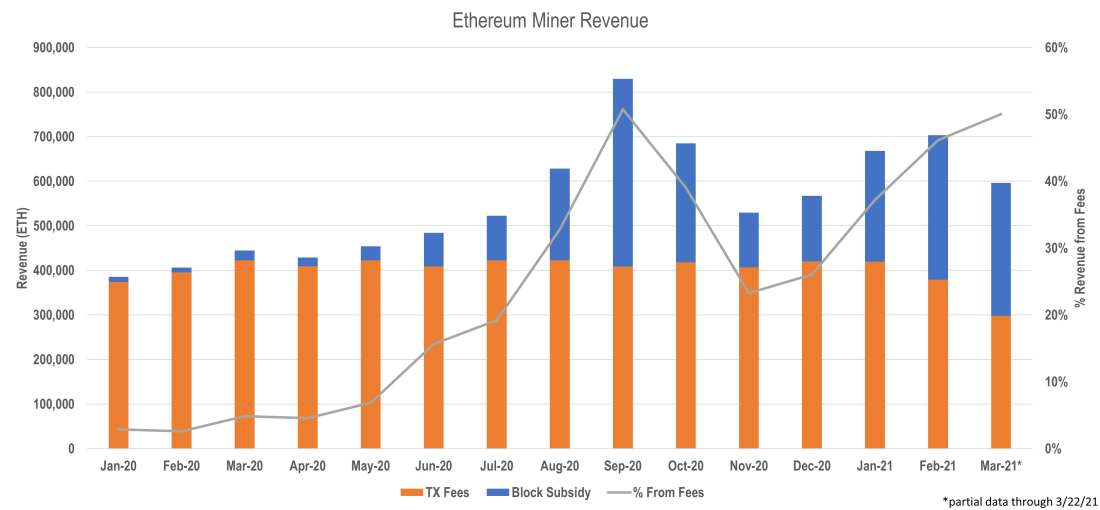

Miner revenue on Ethereum is comprised of a block reward (currently fixed at 2 ETH per block) and the transaction fees included in the block (the sum of gas paid by all transactions in that block)[iv] . Paying a higher gas price increases the likelihood that a miner will include a transaction on the blockchain more quickly. As network usage has increased, competition for block inclusion has pushed the percentage of miner revenue comprised of fees to all-time highs:

Source: Coin Metrics

Under EIP-1559, miners would no longer receive transaction fee revenue (blue bars in the chart above), currently comprising more than 50% of their revenues. In practice, however, miners would still receive some transaction fee revenue as users can still include a “tip” during times of extreme congestion to incentivize quicker block inclusion. It is difficult to predict how much revenue miners will lose under EIP-1559, but one analysis by researchers at Deribit Insights placed the figure between 20-35% when revenues from miner extractable value (MEV) are considered.[v]

Conclusion

Public blockchains can be thought of as public utilities—anyone can transact on them for almost any reason, so long as they adhere to the rules of the protocol. Major changes to existing protocols are somewhat rare, and practically nonexistent in Bitcoin, particularly those that alter a network’s economics. When enacted, EIP-1559 will constitute one of the most dramatic changes to Ethereum in its history, one that impacts users, miners, and long-term holders of ETH. The changes should be viewed positively for Ethereum users and holders of ETH, as they generally improve user experience and make ETH scarcer, though stakeholders relying on longer term predictability, like Ethereum miners, are critical of the upgrade. While some miners have suggested opposing the upgrade, which could result in a chain split—two competing versions of Ethereum—we have not yet seen evidence that vocal opposition will turn to determined action to block the upgrade or fork the chain. Ultimately, we expect the upgrade will be enacted in the London hard fork tentatively scheduled for July 2021.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.