Examining the Latest China Bitcoin Ban

News that a high-level Chinese government committee included a goal to “crack down on bitcoin mining and trading” in a policy outline Friday May 21 has created additional uncertainty for cryptocurrency markets following a significant correction.

Key Takeaways

A Chinese government financial oversight committee signaled a “crack down on bitcoin mining and trading” is forthcoming in a notice issued following recent policy meeting.

Miners are taking the news seriously. Initial reactions from our contacts suggested responses ranging from accelerated migration to full capitulation, although some of the concern appears has receded this week.

A near-term dropoff in hashrate was already expected as miners conduct annual migration to seasonally wetter regions with inexpensive hydroelectric energy.

With the imposition of more government restrictions, hashrate will move primarily to Kazakhstan, Russia, and Pakistan, but North America stands to benefit from the migration as well.

An outright ban is unlikely, but restrictions and greater government scrutiny are imminent.

Dispersion of mining away from China would be beneficial for bitcoin’s resiliency, both countering the narrative that “China controls bitcoin” and actually making the network more robust as hashrate becomes more distributed.

What Happened in China?

At a meeting of the Chinese Financial Stability and Development Committee of the State Council (the “Financial Committee” or FSDC) on May 21 presided over by the country’s Vice Premier, a new government policy was announced restricting Bitcoin mining and trading. A statement from the committee was released at 10pm Beijing time Friday night detailing several goals for the financial system to “resolutely implement the decisions and deployments of the Party Central Committee and the State Council.” The second section outlines the country’s need to “prevent and control financial risks,” and included “crack down on Bitcoin mining and trading behavior” as a specific line item among the list of priorities.

The second is to resolutely prevent and control financial risks. Adhere to the bottom line thinking, strengthen the comprehensive scanning and early warning of financial risks, promote the reform of small and medium financial institutions, focus on reducing credit risks, strengthen the supervision of platform enterprises' financial activities, crack down on Bitcoin mining and trading behavior, and resolutely prevent the transmission of individual risks to the social field. It is necessary to maintain the smooth operation of the stock, debt, and foreign exchange markets, severely crack down on illegal securities activities, and severely punish illegal financial activities. [1] It is necessary to strictly guard against external risk shocks, effectively respond to imported inflation, strengthen anticipation management, strengthen market supervision, and prepare response plans and policy reserves.

The FSDC was created in November 2017 as a new, high-level government body to coordinate financial regulation, and includes as members Liu He (Vice Premier), Yi Gang (Governor of the People’s Bank of China), and Ding Xuedong (Deputy-secretary general of the State Council), along with the chairs of the regulatory bodies that oversee banking, securities, foreign exchange, economic affairs, and national development.

This isn’t the first time that the Chinese government has placed restrictions on Bitcoin use. In 2013, the Chinese central bank banned financial institutions from working with cryptocurrencies—since this ban, OTC desks have served as the primary fiat gateway into crypto. ICOs and exchanges were restricted in 2017: Binance exited the country ahead of the ban, while Huobi and OKEx temporarily suspended activity and established offshore entities in response to the crackdown.

As recently as 2020, executives from both Huobi and OKEx were interrogated as part of a broader crackdown on payments companies and their affiliated OTC desks were temporarily shut down. OKEx bore the brunt of the scrutiny, and the exchange was forced to suspend withdrawals.

With each event, the situation has ultimately normalized—the cryptocurrency ecosystem in China sits at an unstable equilibrium, but an equilibrium nonetheless. Fiat-crypto trading is still banned, but OTC desks continue to serve as an on-ramp into the asset class. Exchanges typically denominate trades in USDT to avoid interacting with the banking system but provide referral services to OTC desks for a relatively smooth UX. Exchanges continue to operate and some maintain close government ties. China still serves as the primary home of most hardware manufacturers and mining pools and the mining industry’s geographic center.

The recent announcements are the same, but different. They differ primarily in two ways: that they target miners and not just traders, and that they were shared by a top-ranking government committee that appears to have significant weight. While the story is still developing, our conversations with sources on the ground indicate that the most recent announcement is likely to lead to regulatory action by local governments, followed by restrictions from the central government.

China is not one monolithic entity: the central government operates separately from the provincial governments, which are in turn distinct from companies domiciled in the country. Provincial restrictions have been enacted well into 2021, with the Chinese province of Inner Mongolia recently banning Bitcoin mining as part of a series of limitations on energy-intensive industries in the largely coal-powered province. With the recent policy announcement by the central government, other provinces are likely to follow. Central government policy is typically slower to be enacted; national restrictions on cryptocurrency trading and mining will almost certainly arrive, but an outright ban on either seems highly unlikely.

In anticipation of these restrictions, we expect to see an exodus of miners from the country, especially by those reliant on coal power. Hashrate will drop, initially as a result of an annual seasonal migration but later permanently abroad. Hashrate will relocate primarily to Kazakhstan, Russia, and Pakistan, but also to North America and other regions. The ongoing volatility will likely continue as the situation develops. The Chinese cryptocurrency ecosystem will survive but will become smaller and more tightly regulated: it’s just a new equilibrium.

How Did Markets React?

Markets were already trading tenuously following a major correction over the last 2 weeks, as we wrote in our May 20 report “Taking Stock of the Crypto Correction.” The news from China created additional uncertainty that further depressed markets.

The FSDC announcement was published on Friday, May 21 at 10pm Chinese Standard Time (GMT+8), or 10am Eastern Standard Time (GMT-5). BTC dropped 12.5% in that first hour and had dropped as much as 20% by 2pm EST. The asset continued to slide throughout the weekend, bottoming out around $31,100 at noon EST Sunday.

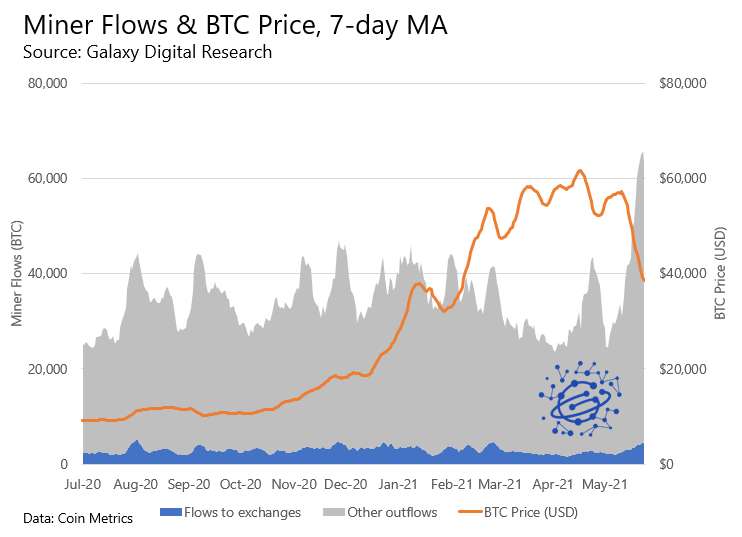

Information from regulators was scarce given the late announcement, with our contacts on the ground anticipating more clarity over the next week. Our sources reported that some miners were liquidating their machine inventories and panic-selling their Bitcoin. This was supported by on-chain data showing an increase in outflows from miner wallets, suggesting that miner selling played a role in the volatility.

Mining Dynamics in China

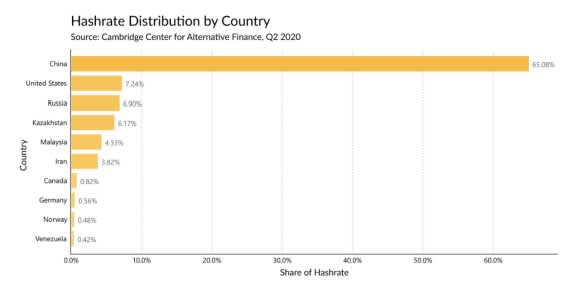

Distribution of Hashrate. Bitcoin is permissionless. Anyone can join as a user, validator, or miner. Because of this, Bitcoin is global. Estimating the breakdown of hashrate distribution is difficult since anyone can join and there is no centralized directory of participants.

Miners tend to operate in areas with inexpensive electricity. Because of this, mining has gravitated to areas with low-cost power like China, Russia, and North America. It’s difficult to estimate where miners are located, but Cambridge’s 2020 survey of several mining pools on their miners’ geographic locations provides some insights.[2]

Chinese miners’ heavy representation in Bitcoin’s hashrate has often been a point of contention. Traditionally, Chinese companies have led the way in mining not only due to their ingenuity but because of cheap electricity and network effects stemming from the presence of ASIC manufacturers and mining pools.

Cheap Electricity. China’s energy grid has a significant amount of hydropower centered around the Three Gorges Dam in Sichuan. From May to October the region experiences a rainy season, lowering the cost of hydropower.

In the north and west of the country, electricity is economically competitive by global standards year-round. However, the rates in the Sichuan valley are better during the rainy season. To exploit this, miners in China practice seasonality, moving machines annually between Inner Mongolia/Xinjiang and the Sichuan valley, optimizing for the lowest cost of energy. This great miner migration is typically seen as a drop in hashrate as machines are in transit.

This year’s rainy season has begun and we will continue to see hashrate drop over the next few weeks. Because of how hashrate is estimated, network hashrate can only be observed accurately with a lag of about seven days and real time estimates are unreliable. Miners pre-pay for their electricity monthly, so we anticipate the hashrate dropoff will be most acute near the end of the month and reliably observed at the beginning of next month.

The initial drop in hashrate will likely be followed by at least a partial recovery as miners come back online in the Sichuan valley. Still, a sustained drop in hashrate is likely since it will take a while for cautious miners displaced by regulatory action to come back online in other jurisdictions. Given the scale of Chinese mining compared to mining in other countries, hosting capacity will represent a significant bottleneck. This represents a reversal from the last year or so, in which the limiting factor in hashrate growth was a severe shortage of machines.

ASIC Markets. Almost all competitive ASIC manufacturers are based in China. This has historically provided Chinese miners quicker access to machines. Public data on machine scales by manufacturers is scarce, in large part because market opacity allows for greater price discrimination.

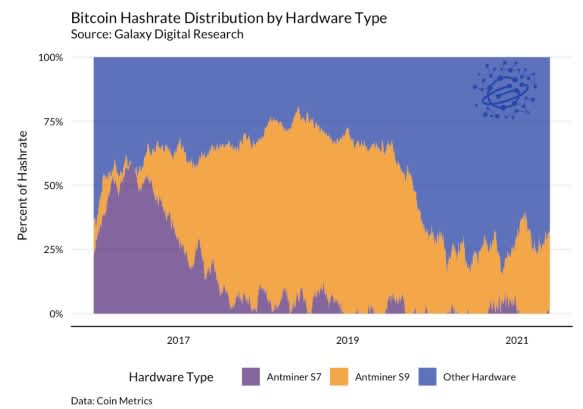

A breadcrumb trail left by miners on the blockchain offers some clues. Using nonce analysis, we can estimate the proportion of hashrate provided by some types of hardware. Today, this technique is most notably applicable to the Antminer S9, Bitmain’s flagship product from two generations ago.

At the peak of their dominance in June 2018, Antminer S9s and related hardware were responsible for about 75% of the network’s computing power. Even today, two hardware generations later, S9s and related hardware contribute about 31% of the network’s hashpower.

Figures derived from nonce analysis have been corroborated at several points in time by surveys from CoinShares and Cambridge. In the future, the technique may be used to identify other types of hardware, including newer models from both Bitmain and other manufacturers, allowing for better estimation of network health and decentralization at the hardware level.

In light of last week’s events, ASIC resellers are leaving China. B.top, a reseller afilliated with the mining pool BTC.top, announced that it would stop servicing Chinese customers, as did Huobi Pool’s machine brokerage. We expect a significant number of machines to become available for sale on the secondary market. This will likely lead to a dislocation between the Chinese and overseas rig markets as Chinese miners liquidate their inventories.

What does this mean for Bitcoin?

Bitcoin is resilient and isn’t at the mercy of any individual country’s regulation. In the short term, we’ll see hashrate drop as miners continue their annual migration. Hashrate will likely continue to be suppressed as miners shut down machines and redomicile.

Government bans on stores of value have a long history. In 1933, President Roosevelt signed Executive Order 6102 banning the possession of gold by private entities in the United States. That ban did not survive, and private ownership of gold did not cease. As of 2021, gold continues to hold value. Bitcoin’s censorship-and seizure-resistance makes the effective global suppression of ownership of the asset by governments even more unlikely.

In the long run, this is good for Bitcoin. Substantively, the Bitcoin network will emerge from these events more robust and decentralized. And the ban should also a massive boon from a PR standpoint: when Bitcoin survives these restrictions, the narrative that it is controlled by China will be dispelled.

In a phrase: long bitcoin, short the banners.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.