Executive Summary

The forthcoming Cancun/Deneb upgrade on Ethereum is expected to reduce fees paid by rollup operators for block space and thus, in the near term, act as a headwind to Ethereum’s fee-derived protocol revenue. ETH may underperform as a result, especially as rollups built atop Ethereum become increasingly interoperable with other more performant and comparatively cheaper settlement and data availability chains. Over the long-term, if the blockchain modularity thesis proves correct, then the main network fee drivers for Layer-1 blockchains like Ethereum and Celestia will be Layer-2 rollup service providers, instead of end-users. Because of this and the growing adoption of account abstraction on Layer-2’s, the primary individuals holding ETH for the purpose of block space payment is expected to be rollup operators instead of end-users.

Introduction

An age-old question in the crypto industry is how to scale blockchains while still maximizing (or at least maintaining) the properties of network decentralization and security. The recent launch of Celestia represents the maturation of a new solution to the blockchain scalability trilemma. Celestia is the first public blockchain that is highly optimized to offer data availability (DA) to rollups. As a DA layer, Celestia has no native capabilities to execute transactions. Rather, Celestia offers block space for rollups to temporarily post batched user transaction data. As a DA layer, Celestia employs strategies like data availability sampling (DAS) to lower the cost of block space exclusively for execution layers such as smart contract rollups posting data on behalf of users on-chain.

Ethereum is also moving towards reducing the costs of block space for DA purposes but at the expense of higher node requirements. Proto-danksharding is the main code change going into the next network upgrade on Ethereum. The upgrade, called Cancun/Deneb, is expected to increase the temporary data storage space of Ethereum nodes by 768kB. The extra block space for rollup transactions is estimated to reduce the cost of DA on Ethereum by at least 10x. Read this Galaxy Research report for more information on proto-danksharding.

The crux of the modularity thesis as it relates to scaling blockchains is that rather than having a single network performing all core functions of a general purpose blockchain computation (i.e., the monolithic or integrated blockchains thesis), blockchains should outsource the responsibilities (e.g., execution or DA) to dedicated infrastructure providers for enhanced functionality and performance. Read this Galaxy Research report for more information on Celestia and “modularity.”

As Ethereum implements network upgrades to better support Layer-2 rollups, there may be a larger share of protocol revenue from rollup sequencers, who are the entities posting data from end-users to DA layers, than direct L1 end-users. Currently, rollups account for ~12% of all gas paid on Ethereum, up from 3% at the start of the year.

This report will dive into the short-term and long-term outlook for value accrual from Layer-2 (L2) rollups to Layer-1 (L1) blockchains, taking into account the impact of restaking and account abstraction. The activation of near-term upgrades like Cancun/Deneb coupled with increasing flexibility on L2s to migrate from using Ethereum as a settlement and DA layer may be near-term bearish for ETH value, though over the long-term, as rollup technology matures and DA capabilities on Ethereum improve, the value of Ethereum stands to outperform.

This report is an extension of our prior report on the blockchain modularity thesis, “Making Sense of Blockchain Modularity,” which introduces many terms and concepts relating to the modularity thesis and features additional insights on fee generation and revenue drivers for layered blockchains - we recommend reading it as a precursor to the discussion presented in this report.

L2 Adoption in 2023

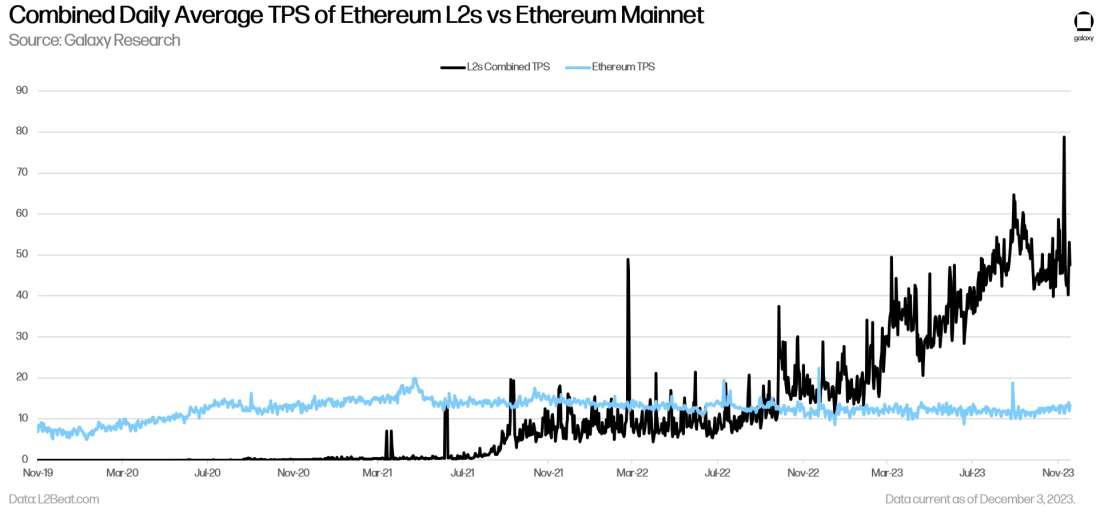

Since January, transaction activity on Ethereum L2s has more than tripled. 2023 saw the highest increase, both nominally and on a percentage basis, in total daily transaction count on L2s.

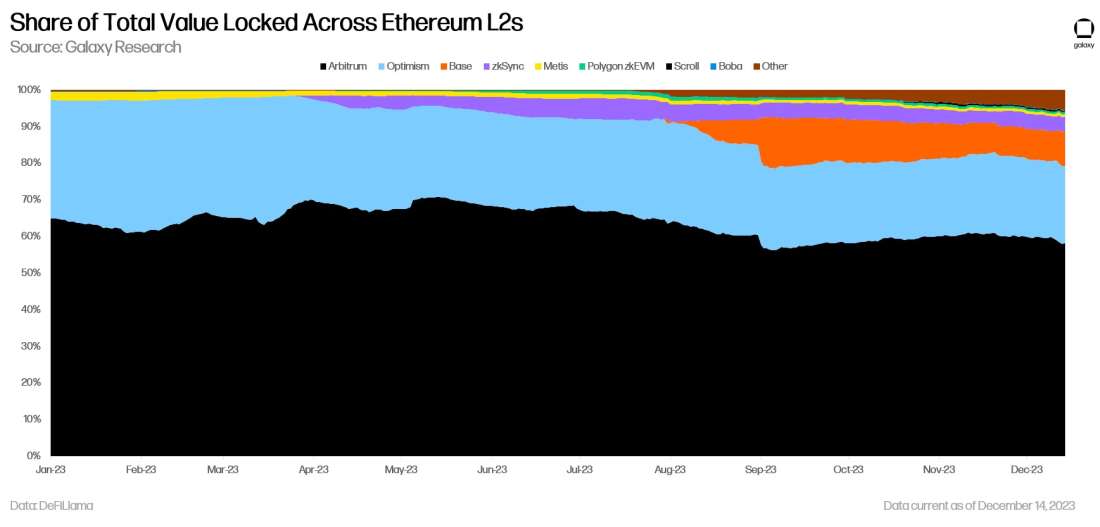

Among L2s, Optimism and Arbitrum saw the largest decline in share of total value locked in Ethereum L2s in 2023, declining 11% and 7% respectively. Base and zkSyncEra saw the most value growth, rising 9% and 4% respectively in their share of total value locked in L2s. Note: The metric total value locked is based on the dollar value of tokens and does not necessarily represent changes in the nominal amount of tokens deposited into a protocol.

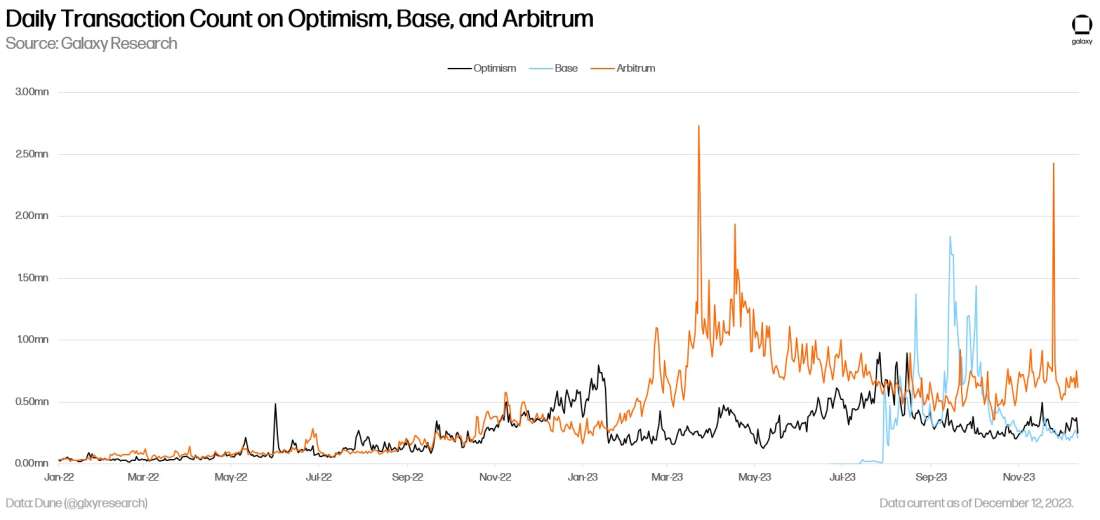

Notably, the rollup launched this year by cryptocurrency exchange Coinbase, called Base, has quickly risen in adoption and popularity among L2 users. As of December 12, Base has amassed the third highest amount of total value locked (TVL) among L2s. In terms of transaction activity, the daily transaction count on Base has, at times, trended higher than both Arbitrum and Optimism, the two most widely used L2s on Ethereum by TVL.

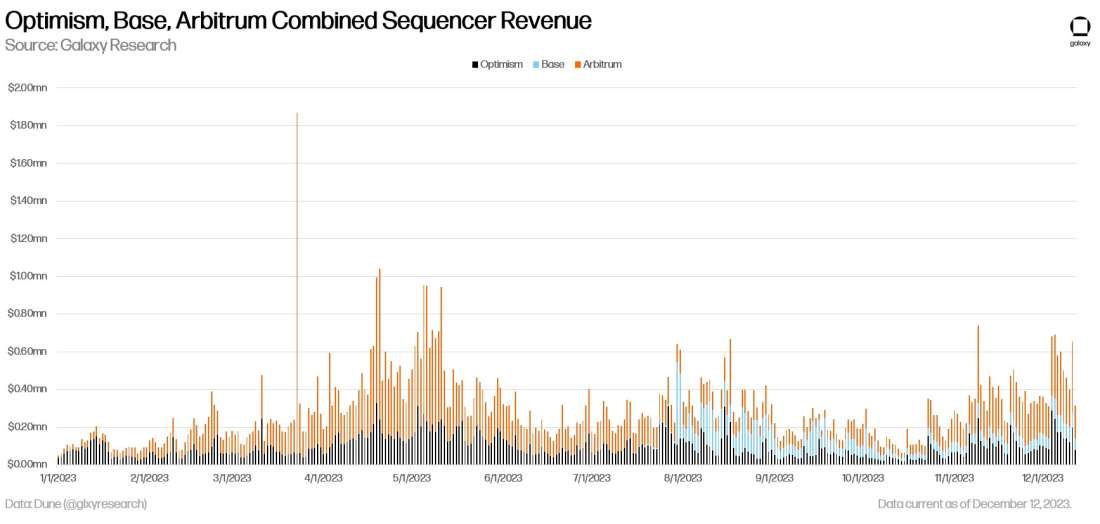

Among the top three L2s on Ethereum by TVL, the Base sequencer generates roughly 20% of total combined revenue from ordering user transactions and batching them into blocks. YTD the Optimism, Base, and Arbitrum sequencers have generated $140mn (USD) in revenue from user fees.

Looking ahead to 2024, the cost of batching user transactions and finalizing them on Ethereum will dramatically decrease with the activation of the Cancun/Deneb upgrade and thereby increase the profit margins of rollup sequencers whilst decreasing fee revenue on Ethereum.

Cancun/Deneb Upgrade

The main code change in the Cancun/Deneb upgrade is Ethereum Improvement Proposal (EIP) 4844, also called proto-danksharding. Proto-danksharding creates dedicated block space for rollup transactions. These transactions, called “blobs,” will be priced according to a separate fee market from regular user transactions and only store transaction data temporarily for a period of roughly three weeks. Through the activation of EIP 4844, an additional 768kB of data space per block will be created for use by rollups. For more information about EIP 4844 and its implementation details, read this Galaxy Research report.

The Cancun/Deneb upgrade will likely reduce Ethereum’s fee revenue in the short-term as EIP 4844 reduces fees paid by rollups to Ethereum for block space by over 10x. Further, due to ongoing technical challenges with rollups related to their lack of scalability, decentralization, and interoperability, the bulk of Ethereum’s fee revenue will likely continue to come from end-users executing their transactions directly on Ethereum, as opposed to an L2. Until rollup technology matures, it is unlikely that Ethereum revenues will significantly benefit from EIP 4844.

Short-Term Technical Challenges

The following is a deeper dive into three key areas of development that rollup operators have prioritized in 2023 and will continue to push forward for in 2024:

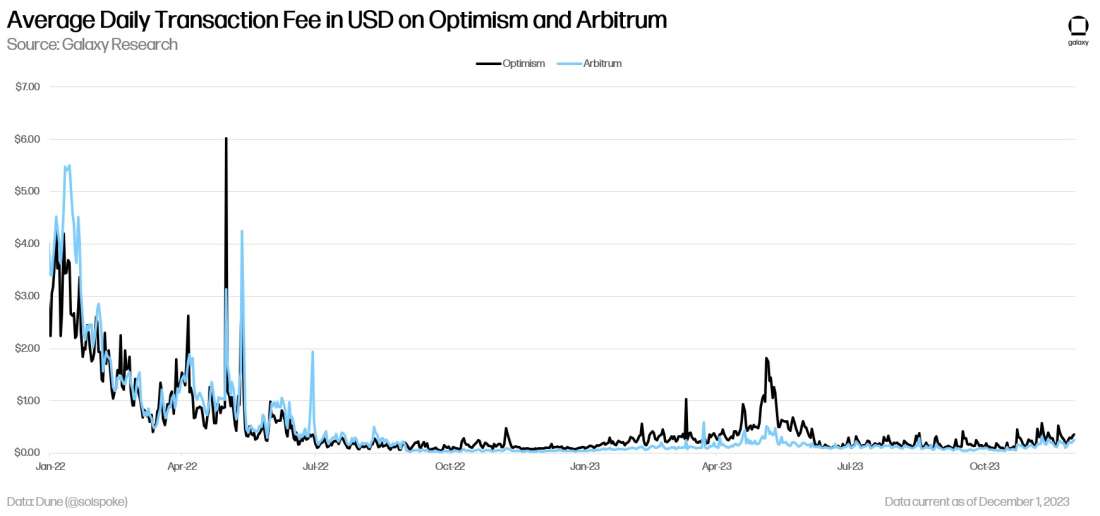

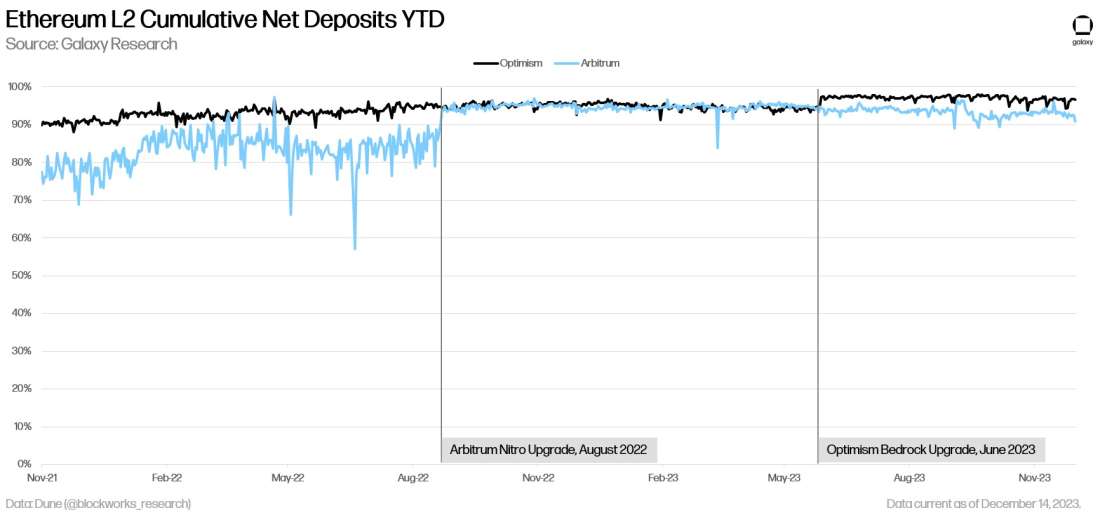

Scalability: Rollups are not immune to fee volatility. As highlighted in our prior report about blockchain modularity, transaction fees on Arbitrum, Ethereum’s leading rollup by total value locked, were briefly costlier than Ethereum in June 2022 when the Arbitrum Odyssey marketing program by Project Galxe sparked an influx of on-chain activity. Since then, fees on Arbitrum have noticeably receded, especially with the release of Nitro in August 2022. Optimism’s Bedrock upgrade, completed in June 2023, was also aimed at improving network scalability and lowering gas fees. The scalability of rollups is an active area of development that developers are focused on improving.

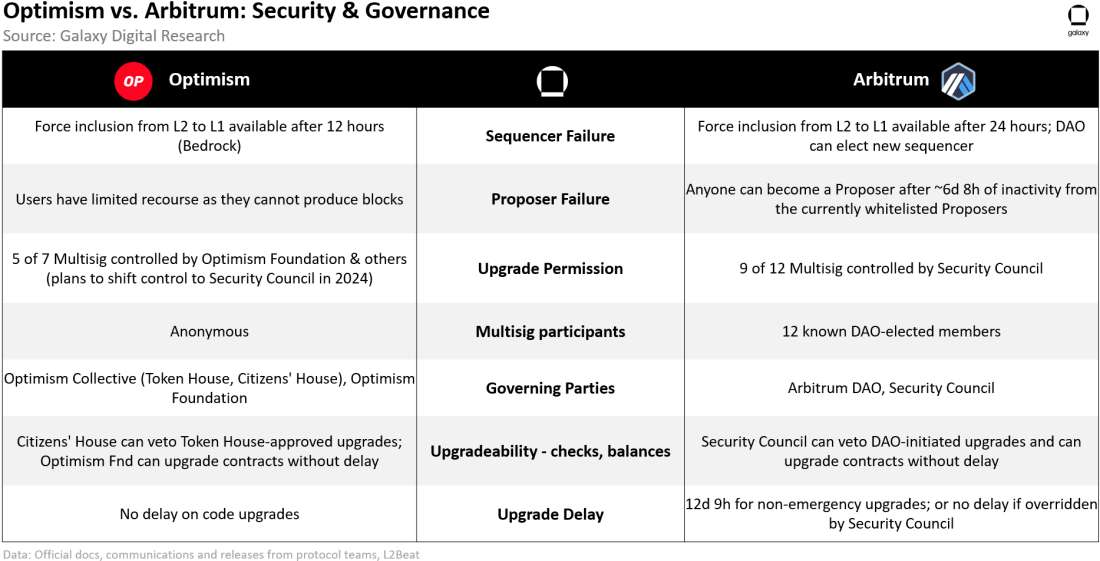

Decentralization and Security: Another area of development for rollups that developers are focusing on is decentralization. All rollups on Ethereum are vulnerable to centralized attack vectors as they rely on a single node operator to sequence or order transactions and produce blocks. Three core focus areas for rollups to improve decentralization and security include: (i) implementing validity/fraud proofs, (ii) expanding the operator set for validating and sequencing, and (iii) removing admin privileges & distributing control of the rollup through governance. To learn more about rollup decentralization and security, read this Galaxy Research report.

Interoperability: One of the main reasons why Ethereum has dominated the market share of general purpose blockchains is because of strong network effects. As more users were onboarded to Ethereum and the liquidity of assets that users interacted with on Ethereum grew, the value of the network also increased in a positive feedback loop. The fragmentation of this liquidity is a hurdle for rollup adoption. Decentralized finance (DeFi) ecosystems benefit from the concentration of liquidity and composability of dapps to one protocol. Therefore, solving for the seamless migration of assets not only from L1 to L2, but within the L2 ecosystem, is an important area of development that will help advance the migration of end-users from Ethereum to L2s.

The Advantage of Alternative DA Solutions

In the short-term, Ethereum’s revenue will remain largely generated by end-users initiating transactions directly on the L1. As cost savings from transacting on L2s increase from scalability upgrades on L2s, and the decentralization and interoperability of rollups are improved, user adoption of L2s will grow. Further, rollups that opt to use alternative DA layers like Celestia for cost efficiencies could generate higher margins by only passing on a portion of the cost savings to rollup users. Aside of Ethereum and Celestia, other L1 blockchains such as NEAR have already announced intentions to pivot to better service rollups as DA layers.

Users on L2s can spend over 90% less on transaction fees than on Ethereum, as depicted by the chart below:

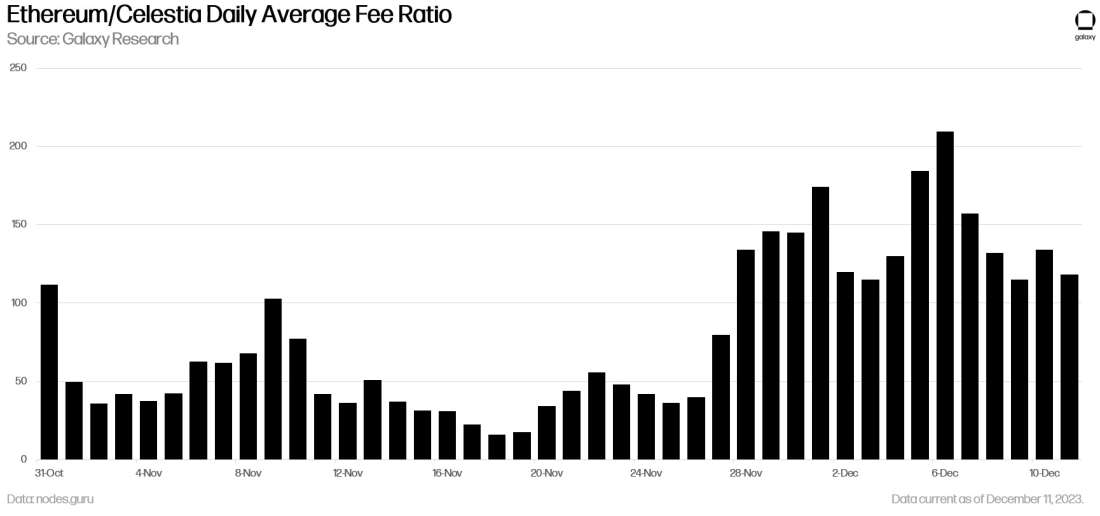

By posting user transaction data on rollups to Celestia instead of Ethereum, rollup operators stand to generate higher profit margins due to lower transaction fees on Celestia. On average, fees on Celestia trend multiples lower than on Ethereum, though this is in large part due to the nascency of the Celestia blockchain, which launched on mainnet October 31, 2023. The following chart depicts the fee ratio between Celestia and Ethereum based on each protocol’s daily average transaction fee in USD. Daily transaction fees on Celestia are on average 80 times cheaper than on Ethereum. (Note: The following data depicts fees from all types of user transactions on both Celestia and Ethereum, not exclusively transactions paid for by rollup sequencers.)

As an extremely nascent blockchain that has been live less than two months, Celestia is not yet widely used for DA by L2s like Ethereum is. The bulk of transaction activity on Celestia is not the confirmation of blob transactions, but rather activity related to staking and stake delegation of Celestia’s native asset. As blob transaction activity on Celestia increases, transaction fees may fluctuate and trend higher. However, due to optimizations on Celestia for DA that do not currently exist on Ethereum, it is unlikely that fees for rollups trend higher on Celestia than on Ethereum all else being equal.

In summary, we expect Ethereum network revenues to fall as the cost of block space for rollups on Ethereum decreases with the activation of the Cancun/Deneb upgrade in 2024, or at least underperform where they would be without the Cancun/Deneb upgrade. Further, the bulk of Ethereum network revenue is still expected to come from end-users rather than L2s due to ongoing challenges related to rollup scalability, decentralization, and interoperability. Finally, profit margins for rollups are expected to increase in the short-term if sequencers do not pass all the DA cost savings to fee-paying rollup users and migrate to using alternative DA solutions like Celestia.

Long-Term Outlook

In the long-term, five years and more, Ethereum revenues may rise as mass adoption for blockchain-based applications and services takes off, and the usage of rollups for transactions execution dwarfs that of Ethereum’s by 10x and higher. Cheaper fees on L2s can unlock new use cases for blockchain-based applications across several industries including gaming, social media, entertainment, sports, and others. New uses cases that drive wider adoption for blockchain-based apps, also called decentralized applications (dapps), are expected to increase overall demand for block space, and therefore total revenues, on Ethereum. In this scenario, Ethereum’s primary revenue source comes from servicing rollups as a settlement and DA layer. Further, profit margins for rollup sequencers tighten as competition for end-user activity increases.

The existence of multiple highly optimized DA layers over the next few years may accelerate the migration of Ethereum L2s from posting data exclusively to Ethereum to other DA layers that offer cheaper block space. These new DA layers may end up challenging Ethereum more directly, which could erode its current position as the most widely used base layer for rollups. However, as discussed in the prior section, network effects matter and rollup developers are working on improving the interoperability and composability between dapps launched on differing rollup protocols. To ensure that users and their liquidity can easily switch between differing DA layers in the future, projects like Caldera, Hyperlane, and Polymer are building tools that allow rollups to operate smoothly atop multiple DA layers without disruption in the user experience. To the extent that a shared settlement and DA layer like Ethereum offer advantages in the user experience when migrating their assets between rollups and the dapps that operate across these rollups, it is likely that Ethereum will continue to dominate as the most valuable DA layer.

Ethereum’s Competitive Edge

Though Ethereum dominates the market in 2023 as the settlement and DA blockchain with the highest level of security, value, decentralization, and network effects, there will be an increasing amount of competition from chains like Celestia and others that are designed from the ground up to exclusively support rollup activity. Though small in number and nascent in development compared to Ethereum, there is the possibility, albeit still small, for Ethereum’s dominance as a DA blockchain for rollups to wane over time. To this end, Ethereum core developers are working to ship upgrades like the Cancun/Deneb upgrade and others that will enhance Ethereum’s DA capabilities. However, one scenario that must be considered when discussing the long-term impact of Layer-2 rollups on Ethereum revenue is the scenario where rollups never succeed in offering users the same level of decentralization, security, and interoperability as the base layer.

Despite the advantage of cheaper fees, the fragmentation of liquidity in the application layer through Layer-2 rollups may anchor a large portion of user transaction activity to Ethereum in the short and long-term. In this case, even if Celestia outperforms Ethereum as a DA layer, Ethereum’s competitive edge as the world’s most decentralized monolithic, general purpose blockchain may continue to win out and attract new users. Ethereum’s revenue then will continue to be extremely volatile and dependent on the number of users interacting with applications directly on its base layer. Compared to cheaper L2s and alternative L1s, some users may execute their transactions on Ethereum to take advantage of the network’s unmatched decentralization and security as a general purpose blockchain.

In the short-term, as discussed, the majority of end-user activity staying on Ethereum instead of migrating to L2s will lead to bouts of high fees and temporary spikes in network revenue. However, without scalability, Ethereum revenues will remain capped by limited transaction throughput and remain unpredictable due to a lack of adequate block space for incoming demand. Short bursts of revenue from user fees that are ultimately weighed down by the network’s inability to support higher magnitudes of user activity will in the long-term detrimentally impact Ethereum’s value as a general purpose blockchain.

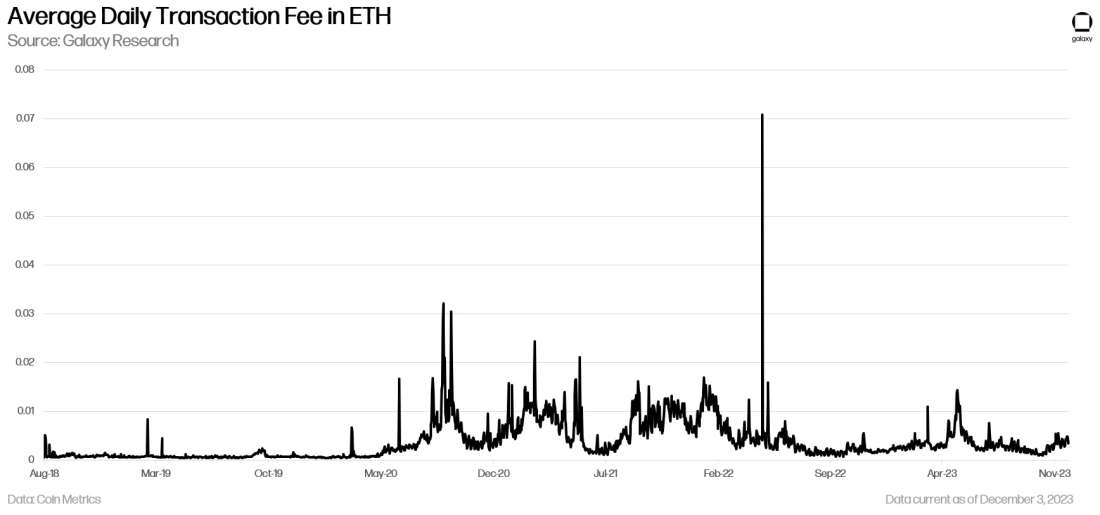

The following is a chart depicting the volatility in the daily average fee to transact on Ethereum in native ETH units:

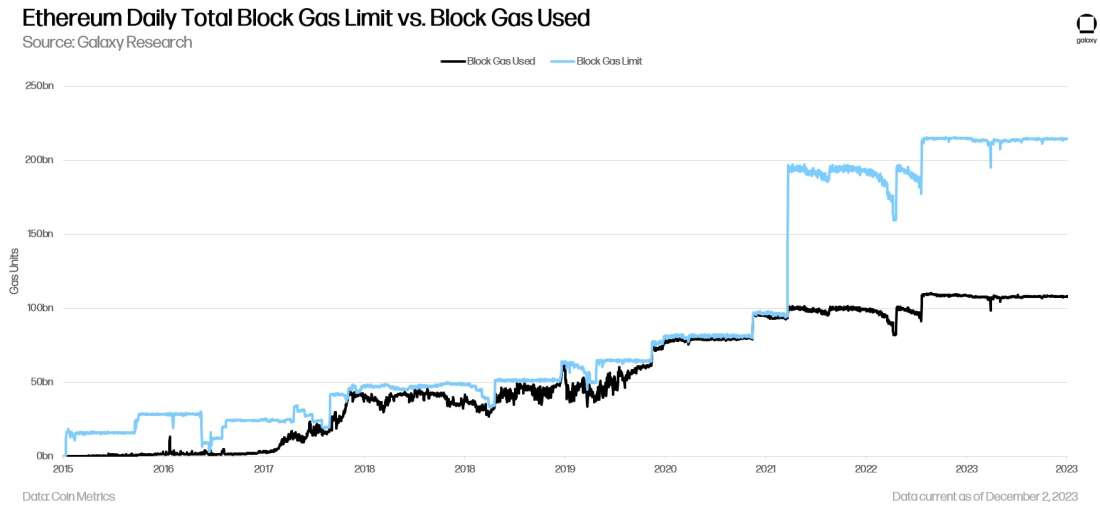

In the first six years since Ethereum’s genesis, miners, who were the block producers on Ethereum, collectively voted to increase the block gas limit, effectively increasing the number of transactions that could fit into a single block, at least 12 times. In August 2021, Ethereum core developers executed a hard fork (a backwards-incompatible network-wide upgrade) to double the maximum block gas limit from 15m to 30m and revamp the fee market to reduce fee volatility.

The following is a chart illustrating block gas limit increases on Ethereum due to overwhelming user demand for block space since the genesis of Ethereum:

Despite these changes to the Ethereum block gas limit over the years, fee volatility and limited network scalability remains a persistent issue that will require a long-term solution if rollups prove to be ineffective in inheriting the bulk of end-user activity over the long-term.

Other Considerations

Two other considerations worth discussing on the topic of L2 to L1 value accrual in the long-term are trends toward the activation of native account abstraction on L2s and re-staking solutions on Ethereum.

Account Abstraction

If L2 rollup sequencers do end up becoming the intermediary service providers that end-users rely on to interact with blockchain-based applications, instead of Ethereum directly, then it is also likely that, in this future, users will cease to hold ETH directly but rather be able to pay for transaction fees in stablecoins and even fiat currencies depending on the design of the sequencer and the rollup that then converts these payments on behalf of users to ETH to pay for Ethereum transaction costs.

The heightened flexibility and programmability for how fees are paid on L2s is primarily enabled by a technology called “account abstraction” that has not been implemented on Ethereum and likely will not in the near future. Though the benefits to the user experience from account abstraction are numerous, there is a lack of coordination among Ethereum core developers to prioritize the implementation of this technology ahead of other more pressing code changes, including an increase to the maximum effective balance of validators, Verkle trees, Ethereum Virtual Machine Object Format, enshrined proposer builder separation, and more.

While there is a proposal to implement account abstraction without changing the core Ethereum protocol (ERC 4337), the proposal is unlikely to gain wide adoption due to its dependency on dapp developers updating their smart contracts and end-users opting into the use of an alternative mempool. Rollups, on the other hand, as a nascent technology itself, are perfect testing grounds for implementing native account abstraction on the protocol level. Already, rollups like zkSync and Starkware do this, meaning accounts that end-users create on these protocols automatically come with enhanced programmability and usability.

Native account abstraction on rollups will be a game changer for the user experience when it comes to interacting with dapps because account abstraction unlocks several new capabilities for user transactions, including but not limited to:

Improved user experience for recurring or frequent transactions: For certain on-chain games and DeFi applications, users are required to submit multiple transactions. ACs may be programmed to automatically allow transactions with certain dapps so that users can avoid having to authorize interactions with the same smart contract repeatedly using their private key.

Ability to halt asset flows in the event of a hack: A user’s account may have the embedded logic of halting movement of funds if certain withdrawals limits are exceeded.

Support social recovery of private keys: A user’s account may also be designed to rely on a user’s private key and other social recovery devices to move funds. If a user loses their private key, an account may be programmed to regenerate a new key using 2 out of 3 or 3 out of 5 other social recovery devices.

Re-staking

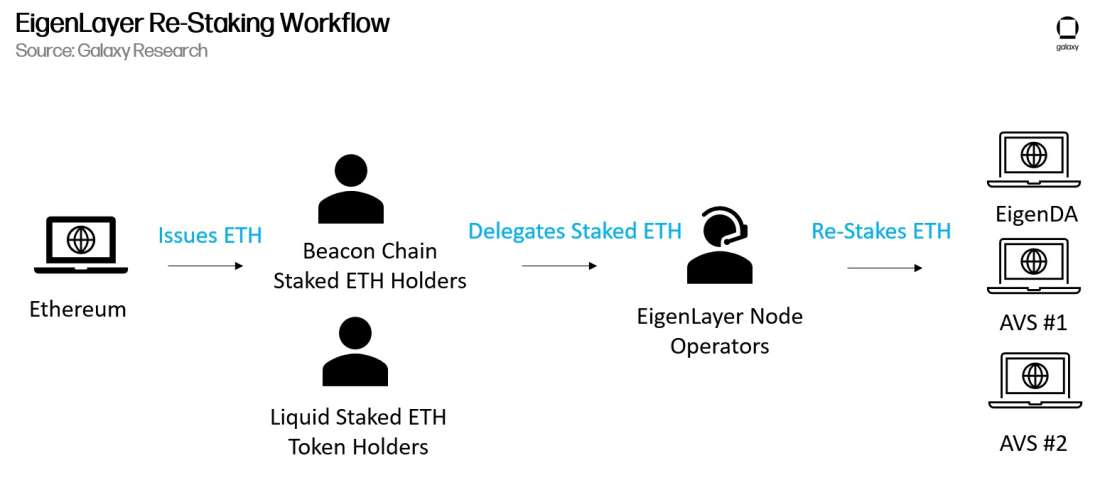

One other consideration as it relates to value accrual from rollups to Ethereum over the next five years is the maturation of re-staking protocols like EigenLayer. As explained in a Galaxy Perspectives article about re-staking, EigenLayer will enable end-users to repurpose their staked ETH for securing additional protocols and dapps for increased yield. As of December 2023, EigenLayer developers are in the process of testing the re-staking workflow for EigenDA, which is an additional DA layer secured by staked ETH that rollups will be able to post data to instead of Ethereum directly. Validator node operators that opt-in to re-staking through EigenLayer will be subject to additional slashing conditions (penalties) for their validation of transactions on both Ethereum and EigenDA, but also in return, receive higher yield from staking two protocols, instead of one. The EigenLayer team expects to launch EigenDA on mainnet in the first half of 2024. Thereafter, EigenLayer will onboard new protocols that validator node operators can re-stake to outside of EigenDA.

It will likely take several years for re-staking protocols like EigenLayer to mature on Ethereum and become widely used. The first sets of actively validated services (AVS) on EigenLayer that will become available for node operators to support through re-staking will initially be carefully curated and battletested. EigenLayer developers have intentionally limited the amount of ETH and liquid staking tokens that can be deposited into the protocol. For now, the EigenLayer team has capped preliminary staked ETH deposits from liquid restaking for the EigenDA AVS to 117,000 ETH. This limit will increase to roughly 200,000 ETH on December 18, 2023. Additionally, on December 18, EigenLayer will start to accept deposits from six new liquid staking tokens, osETH, swETH, oETH, EthX, WEBETH, and AnkrETH.

As of December 14, 2023, the amount of staked ETH deposits from both liquid staking tokens, which include, rETH, stETH, and cbETH, as well as native ETH tokens, is less than 1% of total ETH staked on Ethereum. The EigenLayer team will incrementally increase its capacity for staked ETH deposits to EigenDA and other AVS over time to ensure that the economic security of Ethereum and connected AVS are not jeopardized before the protocol is sufficiently battletested. The full development roadmap for EigenLayer will likely take years and involve a few unexpected bugs, especially as the pool of AVS grows.

To the extent that re-staking becomes a reliable and scalable activity on Ethereum similar to the activity of liquid staking, which has already become prolific through the Lido protocol, rollups are expected to benefit from deriving additional security for operations (such as sequencing) through the repurposing of staked ETH. Further, staking yields are expected to increase on Ethereum even as issuance declines from additional validator node operators over time, which may increase demand for ETH beyond rollup sequencers to DeFi apps and foundations. The activity of re-staking creates the potential for lucrative yields even as the utility of ETH for transaction execution on Ethereum declines and rollup adoption increases, which may encourage individuals and entities, outside of rollup operators, to buy and stake ETH.

Conclusion

Ethereum revenues will benefit from being able to sustain larger magnitudes of transaction activity through L2s, though in the short-term the network may face reduced revenues from a lack of rollup adoption and the implementation of upgrades subsidizing the costs of rollups. Because the looming upgrade should diminish rather than enhance fee payments, ETH may underperform in the near term, at least insofar as investors value Ethereum based on its fee-derived protocol revenue. Rollups are a nascent technology that in the short-term faces several technical challenges and hurdles to adoption. Over time, as the scalability, decentralization, security, and interoperability of rollups improves, the bulk of end-user activity is likely to migrate from Ethereum to L2s. As this happens, competition between L2s for users will increase and profit margins for rollup operators are likely to decrease. Over the long-term, technologies such as native account abstraction on L2s will further reduce demand for end-users to hold ETH directly. More likely, with the existence of liquid staking solutions and the maturation of re-staking solutions such as EigenLayer, end-users and DeFi protocols will hold token representations of staked ETH and its accumulating yield. The main holders of native ETH will likely be rollup operators using the token to purchase block space on Ethereum on behalf of end-users. Areas of further research as it relates to L1 value accrual from L2s is the impact of maximal extractable value on modular blockchain ecosystems and the evolution of zero-knowledge proofs on the design of rollups, their bridges, and economics.

Disclosure Regarding Coin Ownership

Coin: ETH

Author(s): YES

Galaxy (including its affiliates): YES

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email contact@galaxydigital.io. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.