How Much Does It Cost To Mine a Bitcoin

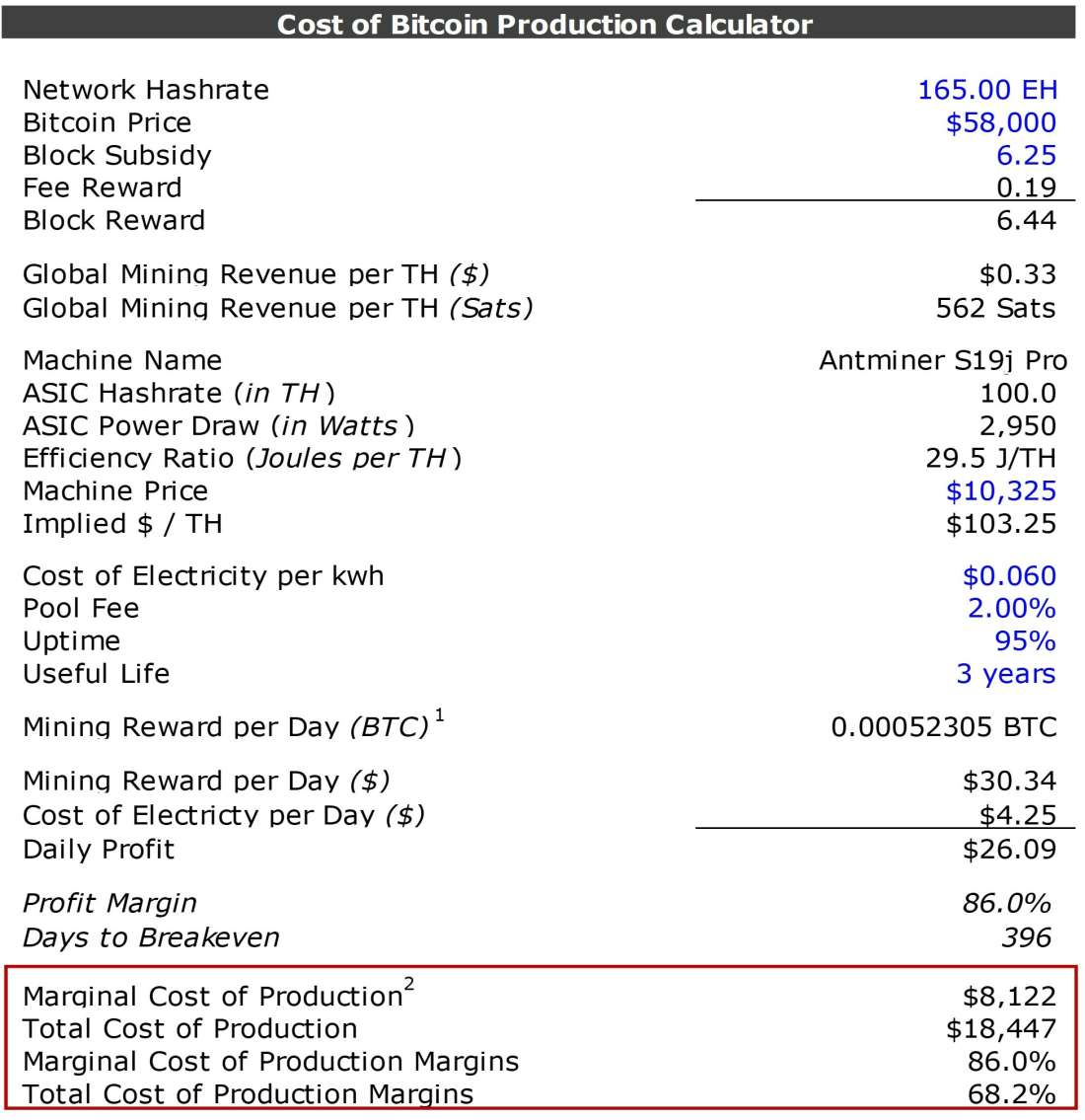

In this report, we explain and assess methods for accounting for Bitcoin miners' cost to mine a bitcoin. We also propose our own methodology, which we believe offers improvements over several other methods that exist in the market today. You can use the calculator we created by downloading this spreadsheet.

Key Takeaways

Accounting methods for bitcoin mining vary significantly, and results can differ substantially based on methodology.

Depreciation schedules, in particular, lack standardization and can tangibly impact reported margins.

We propose a common, straightforward methodology for accounting for costs in bitcoin mining.

We’ve also open-sourced a spreadsheet for calculating costs based on the parameters of the user’s operation or public company filings.

Introduction

From a financial perspective, mining is a relatively straightforward industry. Miners generate coins, ideally below their fair market value, and hold them or resell them on the open market. If it costs less to mine a coin than the coin is worth, the miner is in profit; otherwise, the operation is running at a loss.

That said, accounting standards for miners are not standardized, and in practice vary substantially. In particular, there are differing practices around both hardware depreciation schedules and impairments, both of which can significantly impact overall profitability estimates. This makes it difficult to compare the profitability of different mining operations, since each operation is often calculating returns differently.

BTC is a liquid asset tradeable on many venues around the world, so while there are some discrepancies in prices across exchanges, it’s easy enough to calculate a representative price that’s a decent indicator of the asset’s fair market value. Instead, the main issue lies in how expenses are documented, or in other words, how much it costs to mine a coin. Miners have several costs, including machines, power, labor, and land. Figuring out which costs to include and how to value depreciating assets like machines can get complicated quickly and impact how returns are calculated.

As more mining companies go public, it becomes increasingly important to standardize these practices so analysts from outside the industry can appropriately assess their operations. In this article, we’ll present how we calculate our cost to mine a coin, and explain why we do it the way we do. We’ve also open-sourced a spreadsheet that can easily perform these calculations for any given mining operation.

Methodology

Our methodology for calculating the cost to mine a coin is broken out into three steps:

First, we calculate a marginal cost of production that includes power and hosting costs. Labor and capital expenditures such as machines and construction costs are excluded from this step of the calculation. This step gauges the cost of mining a coin at an already-operational site, assuming that maintenance is minimal and machines are already accounted-for.

Second, we calculate a direct cost of production by adding the cost of depreciating machines to the marginal cost of production. This figure serves as a more defensible estimate of the viability of a new project. The only capital expense included in the calculation is the cost of machines, since determining a reasonable depreciation schedule for facilities is difficult; however, if this figure is derived from a public filing, it may include all depreciation expenses if machine depreciation is not broken out into its own line-item.

Third, we compose a total cost of production by including the cost of labor. In addition to being more representative of overall costs and better-reflecting economies of scale, this metric can easily be calculated from public filings.

Our spreadsheet automates these calculations, outputting all three cost estimates for any given operation. The model’s inputs are shown in blue in the to the right.

Calculating Machine Depreciation

Machines often represent the bulk of a miner’s capital expenditures and a significant share of their overall costs. As depreciating assets, it’s important that machines are fit to a reasonable depreciation schedule. For Galaxy’s own internal calculations, we currently use a 3-year linear depreciation schedule. While this is a conservative standard, believe that erring on the side of caution is prudent when planning a multi-year project.

In practice, the lifespan of a machine is dependent on model, usage patterns, environmental conditions, and multiple other factors. The salvage value of a machine in good condition is dependent on the continued profitability of operating it, which in addition to the machine’s efficiency depends on the price of bitcoin, network hashrate, and the price and availability of hosting space and operational resources. As a result, linear depreciation is something of a poor fit, since older-vintage machines retain some value so long as they are even slightly profitable to operate; we mostly prefer it for its simplicity.

The oldest rig model with wide, continued usage is the Antminer S9, which was released in 2016 with a retail price tag of around $2,100. Today, S9s and related models still account for about 24% of the network’s hashrate according to Coin Metrics, and trade on secondary markets at about $530 according to HashrateIndex.

In this case, a 3-year depreciation schedule would have been too steep, largely owing to the appreciation in the price of bitcoin, which has kept mining on old hardware with a competitive power cost profitable. Plateauing ASIC efficiency, the appreciating price of bitcoin, and the global chip shortage have led to significantly longer-than-anticipated chip lifespans, but there’s no guarantee that these factors will continue into the future.

Surveying the filings of 14 miners with publicly available information, we found machine depreciation schedules ranging from 2 to 7 years, with a median estimate of 3 years. While the overall range is unreasonably wide, using the median is a reasonable and conservative approach given current market conditions.

Public Mining Composite

We can use our methodology to assess a public company’s cost to mine a coin by working backwards from filings. To calculate the total cost of production for a publicly traded bitcoin miner, simply add up the cost of revenues, depreciation expense, and selling, general and administrative (SG&A) expenses from the income statement, then divide that sum by the number of bitcoins mined during that period. The company’s operating margins can be derived from this figure and the average price of bitcoin throughout the period by dividing the difference between the two figures by the average price.

When evaluating a bitcoin miner's total cost of production relative to peers it is important to understand whether or not the company owns its own infrastructure or relies on a hosting provider through co-location. If a miner largely operates machines through co-location then it will likely have lower depreciation expense than a company that owns its own infrastructure and thus has to depreciate it. Over time, as miners’ margins decrease, vertically integrated miners will have better cost to mine since they have longer-term control over power costs.

To understand the financial performance of publicly traded miners, earnings before interest, taxes, depreciation, and amortization (EBITDA) and earnings before interest and taxes (EBIT) provide a great comparative view. EBIT is just as important if not more important than EBITDA as a financial performance indicator for bitcoin miners due to the high capex nature of the industry.

We take this financial metric a step further by tailoring it to account for certain nuances of the industry in what we call Adjusted EBIT. To calculate Adjusted EBIT, start with net income, add taxes, interest, any non-cash expenses such as share-based compensation, impairments of digital assets, and marketable securities. Lastly, we also make an adjustment to depreciation expense based on the median useful life of bitcoin mining equipment according to the filings of public companies, which we determined is 3 years.

The reason why we make this adjustment to depreciation is to account for one of the shortcomings of EBIT, which is the varying amounts of depreciation expense that can be driven by a company's assumption for the useful life of its mining equipment. By normalizing this one assumption and putting all companies on equal terms it provides greater insight into their financial and operational performance on relative terms.

As the miner financing (MiFi) industry grows and miners actively choose to fund growth of their operations, it will become critically important for miners to have a robust treasury management, financial forecasting, and market timing strategy. For example, miners will need to carefully manage capex cycle timing strategically, and generate positive return on assets, and return on equity as there will ultimately be a limit to how much debt and equity capital a miner can raise.

Our open-source calculator can perform these calculations on any mining operation, using information found in public filings.

Running the numbers across our sample set of 8 miners for which public figures were available, we find an average marginal cost of production of $14,852, an average direct cost of production of $24,697, and an average total cost of production of $37,229.

Conclusion

Today’s accounting methodologies for public mining companies are lacking in a few elements. The most glaring gap, in our opinion, is in the calculation of a miner’s cost to mine a coin. This methodology represents our best-effort attempt at standardizing this calculation.

Our approach is relatively straightforward, and costs for public companies can typically be derived from publicly disclosed information.

We’ll continue to publish benchmarks based on this methodology, and we hope it becomes a more widely accepted standard for comparative analyses.

Glossary

Cost to Mine a Bitcoin Definitions

Marginal Cost of Production - The marginal cost of production is representative of a miner’s cost of electricity and hosting to produce 1 bitcoin. It does not, however, capture the capital expenditure for the mining equipment itself. To calculate the marginal cost of production for a publicly traded bitcoin miner, simply divide the cost of revenues excluding depreciation expense by the number of bitcoins mined during that period.

Direct Cost of Production - The direct cost of production takes the marginal cost of production a step further by including depreciation expenses in the calculation. This gives a sense of how much a miner is spending on ASICs. When derived from filings, this figure may also include depreciation of hosting facilities for their machines, depending on the level of detail included in the filing. To calculate the direct cost of producing a bitcoin for a publicly traded bitcoin miner, simply add the cost of revenues and the depreciation expenses from the income statement and then divide by the number of bitcoins mined during that period.

Total Cost of Production - The total cost of production accounts for the overhead of running the business, including payroll of employees, by including SG&A in the equation. It is important to exclude any non-cash or one-time expenses from this equation, such as impairments to cryptocurrencies or any marketable or related securities, and employee-based stock compensation. While stock-based compensation is excluded from this calculation, it is important to note the level of stock-based compensation as it is dilutive to shareholders. To calculate the total direct and indirect cost of producing a bitcoin for a publicly traded bitcoin miner, simply add the cost of revenues, depreciation expenses, and selling, general and administrative expenses from the income statement, then divide by the number of bitcoins mined during that period.

Cost of Production Margins - The cost of production margins are calculated by dividing the difference between cost of production and the average market price of bitcoin through the period by the average market price of bitcoin. If a publicly traded mining company’s total cost of production margin is 30%, then they are able to generate bitcoin at a 30% discount to the average market price of bitcoin based on their full expense load.

Bitcoin Mining Network Definitions

Network Hashrate - The network hashrate is the cumulative processing power of mining machines securing the network.

Block Subsidy - The block subsidy is the amount of new bitcoin minted in each block. The block subsidy halves every 210,000 blocks (roughly every 4 years) according to Bitcoin’s issuance schedule and is currently 6.25 BTC.

Transaction Fees - Blocks can contain many transactions with fees attached to incentivize their confirmation and prevent spam. In addition to the block subsidy, miners also receive the transaction fees for all of the transactions included in the block that they mine.

Block Reward - The block reward is the combination of the block subsidy and all transaction fees paid by transactions in a specific block.

Hashrate - Hashrate is a measure of the computational power per second used when mining.

Power Draw - Power draw is a measure of the amount of electricity consumed to operate an ASIC or mining machine per hour.

Efficiency Ratio - The efficiency ratio is measured in Joules per Terahash, and reflects how many watts are required to hash one trillion times a second with a particular bitcoin ASIC. The higher the ratio, the less efficient the machine is. The lower the number, the more efficient the machine is. The newest generation of Bitcoin ASICs currently have efficiency ratios below 38 J/TH.

Mining Pool - A mining pool is a middleman that aggregates multiple miners’ hashpower. Mining pools aggregate pool members’ hashes, submit successful proofs of work to the network, and distribute rewards to contributing miners proportionately to the amount of work performed. Mining on a pool reduces payout variance for miners, who would otherwise have to deal with significant risk from finding blocks at unpredictable intervals.

Pool Fee - The pool fee is the rate you pay for participation in a mining pool

Uptime - Uptime is the percentage of time for which your ASIC or mining machine is online and hashing.

Useful Life - Useful life is the estimated lifespan of a depreciable fixed asset, in this context an ASIC, during which it can be expected to continue to hash.

Terahash - A terahash (TH) is one trillion (109)hashes, which is equivalent to making one trillion guesses at solving the puzzle to add the next block to bitcoin’s blockchain. The hashrate of most mining rigs is measured in terahashes per second (TH/s).

Exahash - A exahash (EH) is one quintillion (1018) hashes, which is equivalent to making one quintillion guesses at solving the puzzle to add the next block to bitcoin’s blockchain. The total network hashrate is typically measured in exahashes per second (EH/s), as is that of some large mining operations.

Satoshi (Sat) - A satoshi is the smallest unit of account for bitcoin. A satoshi represents a hundred-millionth (10-8) of a bitcoin, or 0.00000001 BTC.

Financial and Accounting Definitions

EBIT - Earnings before interest & taxes (EBIT) is a measure of a company's overall financial performance. It is important to note that EBIT does not normalize for differences in depreciation and amortization expense based on useful life estimates for capital investments like property, plants, and equipment (i.e. ASICs and hosting facility infrastructure).

EBITDA - EBITDA, stands for earnings before interest, taxes, depreciation, and amortization, and is reflective of a company's overall financial performance and is used as a proxy for free cash flow. EBITDA, in certain cases can be misleading because it removes the cost of capital investments in property plant and equipment (i.e. ASICs and hosting facility infrastructure).

Adjusted EBIT - Earnings before interest & taxes is a measure of a company's overall financial performance inclusive of a few adjustments to more accurately measure the financial performance of mining companies. Adjusted EBIT adds back any share-based employee compensation, changes in fair value of market securities like derivative assets, impairments on investments, and impairments on digital assets. To adjust for one the key shortcomings of EBIT as a financial metric which is the lack of normalization of depreciation and amortization expenses, we recommend setting the useful life of mining equipment to the median of 3 years and calculating the adjustment to depreciation expenses based on this and factoring it back into EBIT.

Mining Operating Profit - A company's operating profit is its total earnings from its core business functions for a given period, excluding the deduction of interest and taxes. It also excludes any profits earned from ancillary investments. Mining operating profit is calculated by taking net mining revenue less cost of revenues, less depreciation and amortization, and less selling, general, and administrative expenses.

Digital Currencies Under GAAP - Under the generally accepted accounting principles (GAAP), digital currencies such as bitcoin are viewed as intangible assets requiring them to be recorded at cost, and have impairments recorded.

Return on Assets - Return on assets (ROA) is a metric used to illustrate the profitability of a company relative to its total assets. ROA is useful because it gives insight into how efficient a company's management team is at using its assets to generate earnings.

Return on Equity - Return on Equity (ROE) is a metric for evaluating investment returns. ROE can provide insight into how a company's management team is using financing from equity to scale the business.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email contact@galaxydigital.io. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.