Learnings from Ethereum's Devconnect: A New Ethereum Developer Conference

Galaxy Digital Research’s Christine Kim attends the first-ever Devconnect, an Ethereum developer-focused conference hosted in the Netherlands. She explains in this note what made the conference so unique in terms of programming and organization. She also summarizes the main topic of discussion by developers at Devconnect, which centered around the fast-approaching realities of a multi-chain future for Ethereum.

A Distributed Conference

Last week, I attended an Ethereum developer-focused conference called Devconnect. Organized loosely by the Ethereum Foundation, the conference was a series of independently hosted events scattered across seven days in multiple different locations within the city of Amsterdam. Most events lasted a day at a minimum and focused exclusively on a specific area of development in the Ethereum ecosystem.

From light client development to decentralized finance, maximal extractable value, zero-knowledge proofs, blockchain public goods funding, governance, security, smart contract programming languages, non-fungible tokens, and more, the programming for Devconnect events fostered in-depth conversations and real-time collaboration between subject matter experts on a niche area of study in small group settings. Being the first of its kind, Devconnect was unlike any crypto conference I had attended before.

The quality of conversations I had at Devconnect were much richer than those at other cryptocurrency conferences I’ve attended. Each event at Devconnect was highly curated for an audience with specific interests and domain-level knowledge by independent organizers who share those same interests and knowledge. So long as I knew which event I would be attending for the day, I could be completely immersed in a single area of Ethereum’s development and ecosystem and be confident I’d meet the key players pushing progress in that area. Normally, at other Ethereum conferences such as ETHDenver, EthCC, and Devcon, it’s easy to learn a little bit about a variety of topics but difficult to dive deep into any one topic because of the way conference programming is focused on covering the breadth of the entire industry as opposed to its depth.

Of course, the “choose your own adventure” style of Devconnect also had its drawbacks. Most events were oversubscribed due to their limited capacity which was usually capped at around 50-60 people. The independence of each event placed a greater burden on attendees to apply for multiple tickets in advance and figure out transportation to and from new venues around the city throughout the week. In addition, attendees who didn’t have domain-level expertise or interest could easily find themselves limited by the focused style of Devconnect events, which were not conducive to cross-domain knowledge sharing.

As the most productive crypto conference I’ve ever attended, I gleaned a lot from Devconnect about different niche areas of the Ethereum ecosystem. You can find summaries of the topics I learned about at the conference, like formal verification, distributed validator technology, and light client development on my Twitter here. I participated in 10 events spread out across 6 days, and the overarching question discussed most frequently by developers across all domains of Ethereum development was how to best build for a multi-chain future.

The Multi-Chain Future

In one sense, the multi-chain future of Ethereum begins with the Merge. The Merge will separate the settlement of transactions from their execution such that these two operations take place on separate networks. Transaction finality will come from Ethereum’s consensus layer (CL), which is currently a proof-of-stake blockchain called the Beacon Chain running in parallel to Ethereum mainnet. Transaction execution will remain on Ethereum mainnet, which post-Merge will become the execution layer (EL) and cease to rely on its own proof-of-work consensus algorithm. (Read more about Ethereum’s Merge upgrade in this Galaxy Digital Research report.)

One major area of testing for the Merge upgrade is the communication protocol responsible for synchronizing Ethereum CL and EL software clients. At Devconnect, core developers simulated the coordination of clients through executing mini-hard forks, also called “shadow forks,” of the Goerli test network and Ethereum mainnet. The outcomes of both simulations were positive, suggesting that preparations for the Merge are nearing completion. Today, core developers are expected to reach a consensus on a new updated timeline for Merge activation.

In addition to the core developers’ focus on the dual-network structure of Ethereum post-Merge, decentralized application (dapp) developers are looking ahead to the network’s long-term scalability roadmap, which is expected to offload most users transaction activity to Layer-2 networks. The underpinning technology of L2’s on Ethereum are rollups, which essentially verify transactions off-chain and only recommit a compressed proof of verified transactions back to Ethereum mainnet. There are multiple kinds of rollups that rely on different cryptographic schemes, which presents dapp developers with tradeoffs for building on one L2 over another. (Read more about the L2 landscape in this Galaxy Digital Research report.)

Given that the scalability roadmap of Ethereum will make rollups increasingly more efficient and cheaper to execute, it seems like only a matter of time before all user transaction activity migrates to Ethereum’s L2 ecosystem and beyond. Discussions around the potential fragmentation of the dapp ecosystem across different L2 chains are closely related to the conversations around the interoperability between Ethereum and alternative L1 blockchains. To this end, a large amount of dapp developer mindshare at Devconnect was dedicated to discussing the available tools and necessary research needed to build for a multi-chain future.

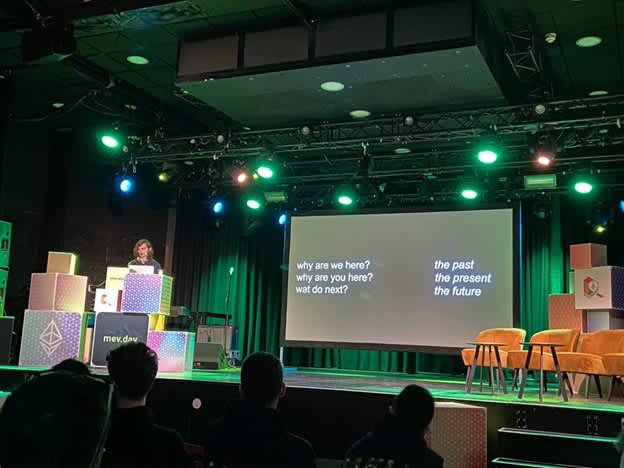

The mix of excitement but also apprehension from protocol and dapp developers alike for the multi-layer and multi-chain future was especially pronounced at Devconnect’s MEVDay. The programming for the day split talks into a Light and a Dark room. The talks in the Light room were generally focused on presenting and debating different solutions for mitigating maximal extractable value (MEV) on Ethereum, while talks in the Dark room mainly focused on the negative consequences of MEV manifesting today and possibly in the future. (Read more about MEV in this Galaxy Digital Research report.)

In both rooms, the talks that garnered the most attention and debate from attendees were the ones discussing cross-chain MEV. In an increasingly multi-layer and multi-chain world, the security of a single network such as Ethereum’s CL or EL can be exploited by targeting the security models of other connected networks. The risks of compounding impacts from exploits on one chain to many chains are why Ethereum research and development teams like Flashbots are actively working on developing robust cross-chain interoperability standards and communication protocols for combatting the MEV of tomorrow.

Looking ahead to the Merge and beyond, it is becoming increasingly clear to developers that the future of Ethereum is multi-chain. To that end, Devconnect created a space for developers to openly collaborate on how to best prepare and build for this kind of a future. The fragmentation of Ethereum’s dapp ecosystem across different layers of the network and alternative L1 blockchains presents new challenges to Ethereum’s long-term security and resiliency and is likely to remain a topic of further discussion and debate for the future conference yet to come.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email contact@galaxydigital.io. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.