Summary

NFT sales ballooned from $59.3mn in 2020 to over $12B in 2021, taking the crypto world by storm. Seemingly every corner of the crypto industry, from legacy centralized exchanges to cutting-edge crypto protocols, built features centered on NFT use-cases. NFTs are more than just expensive Profile Pictures (PFPs)—NFTs unlock a myriad of use-cases across a multitude of applications, and they will be a key primitive for the metaverse (read our metaverse primer here). While NFTs have served primarily as profile pictures and digital avatars to-date, we anticipate that the usage of NFTs will expand significantly beyond these rudimentary use-cases in the future. Financialization will be key to unlock this additional utility from NFTs as the ecosystem develops and NFTs become more popular and used. To that end, there has been an interesting symbiosis between NFTs and DeFi that has birthed some novel applications in the space. As NFTs start to bring more mainstream users into the world of DeFi through these novel applications, we take note of some major protocols and ongoing challenges. Currently, the biggest headwinds to adoption of NFTs in the DeFi ecosystem are accurate pricing and liquidity. DeFi is attempting to solve for these two key headwinds to varying degrees of success.

Key Takeaways:

NFTs have been a massive adoption vehicle for mainstream users to enter crypto and NFTs will soon be a massive adoption vehicle for mainstream users to use novel DeFi products that center on NFTs

The DeFi space has cultivated cutting-edge products and protocols designed to make NFTs more liquid and easier to trade, putting their functionality at closer parity with that of fungible tokens

NFT x DeFi buckets include Fractionalization, Lending Markets, Investment DAOs, Derivatives, and Pricing

NFT collections are starting to implement DeFi-inspired token incentive mechanisms with varying levels of success and some areas for concern

The key challenges NFT holders face from a risk-management standpoint entail illiquidity, capital-inefficiency, and difficulty in appraisal

Fractionalization is beneficial for the development of pricing and liquidity in the NFT market, but it carries its own set of risks that might fly under-the-radar for unsophisticated users

The only successful NFT index funds and investment DAOs are those that can identify and execute on trends in the rapidly evolving NFT landscape which requires some level of coordination and centralization

NFT price prediction markets have seen limited success when employed for niche use-cases such as predicting post-mint price movements

The whole market of NFT financialization heavily relies on price oracles, which introduce a new set of challenges such as manipulation and/or opaqueness of valuation methodology

Introduction

NFTs are poised to serve as a key infrastructural primitive that will power both web3 applications and the oft-mentioned Metaverse. So far, NFTs have gone through their trials and tribulations as the market attempts to attribute a fair value to this burgeoning asset class. This dynamic is perhaps best embodied by Jack Dorsey’s first-ever tweet which initially sold as an NFT for $2.9mn in March, 2021 only to fetch less than $14k in public auction this past April. Suffice to say, NFTs are extremely difficult to value as the underlying community around the NFT, the rarity of an NFT’s attributes, and the overall state of the market usually factor into their prices. In addition, there are new collections popping up regularly that throw the classic NFT launch playbook out the window — one need not look further than goblintown which debuted with no roadmap, no Discord, and no purpose while commanding a respectable ~3ETH floor price.

Many view Counterparty, the peer-to-peer platform built on top of the Bitcoin network (and referred to as Bitcoin 2.0 before the term NFT was coined), as the precursor to NFTs. Because of the native capabilities and the accessible standardized token forms, the mindshare behind Counterparty moved over to the Ethereum ecosystem with time. The first Ethereum-based NFT, TerraNullius, launched in August 2015 and allowed the smart contract caller to state a “claim” on the Ethereum blockchain and add a unique message to it. Ethereum developers took note of this use-case and subsequently built the ERC-721 token standard. In particular, the ERC-721 token standard equipped developers with a toolkit to associate collections of unique non-divisible tokens with a single smart contract that encapsulates metadata embedded on-chain. Like the ERC-20 standard that propelled the ICO boom of 2017, the ERC-721 standard propelled the initial adoption curve for ETH-based NFTs throughout 2021.

Over 100k NFT collections have been deployed to-date since the launch of the ERC-721 standard. According to data from IntoTheBlock, over 50% of all NFT collections in existence were created in the last 5 months.

It turns out the runaway success of NFTs observed in 2021 was predated by several years of stagnation in the space. It was precisely during these NFT dark ages that eventual juggernauts like OpenSea were built. This NFT infrastructural development, happening in the shadows of a broader crypto bear market, allowed a frenzy of NFT activity to materialize on-chain in 2021. The on-chain volumes for NFT trades have amounted to ~$70 billion so far, with transaction volume peaking in August 2021. Volumes have since cooled considerably and fluctuated between $150 and $300 million per week as of July 2022. As Ethereum NFTs, in particular, tend to be power-law distributed, meaning a small number of NFTs make up a substantial proportion of on-chain trade volume, most of these transactions are secondary sales of marquee NFT collections such as CryptoPunks, Bored Ape Yacht Club (BAYC), and Mutant Ape Yacht Club (MAYC). Together, NFT collections owned by Yuga Labs account for ~70% of all Ethereum NFT market cap.

According to CoinMarketCap, the current NFT market cap for all ETH-based collections stands at ~$1.8bn. Solana-based NFTs are pegged at ~$870mn according to Hyperspace. Collectively, these two top NFT ecosystems command 1% of the entire $908bn crypto “fungible token” market cap. In other words, while NFTs are showing impressive adoption numbers from a market capitalization standpoint (Solana NFTs are worth ~7% of SOL’s market cap and Ethereum NFTs are worth ~8.6% of ETH’s market cap), they are still early when compared to the size of the fungible crypto market.

While the market cap of NFT collections is an interesting metric to observe over time, it should not be considered equivalent to comparing with other types of token market capitalizations, such as fungible tokens. NFT markets, in general, are quite different from traditional and cryptocurrency financial markets in that the tokens are unique and, thus, relatively illiquid. The floor price refers to the lowest “ask” price an owner of an NFT in a particular collection is willing to sell at and is the predominant gauge of value in NFTs these days. However, this metric is problematic because the trade volumes for a complete collection are often too thin to absorb any kind of significant selling pressure. In the event an NFT owner wants to sell their NFT promptly, they must either accept an offer that has been placed on their specific NFT or put it up for sale somewhere close to the floor price. So-called “Grail” NFTs (those with exceedingly rare traits) will also get the largest haircuts (pricing discounts) during liquidity crunches in the NFT space. While OpenSea recently introduced the “collection offer” feature, which allows users to bid on all NFTs of a collection at the same time, the market is still relatively illiquid and inefficiently priced compared to that of fungible assets. This is to be expected, however, as NFTs can only transact in whole-number amounts and are limited in collection size (many popular “PFP” collections adopt issuances of 10k NFTs for instance).

For “Grail” NFTs, the collection’s floor price is completely irrelevant as the grail can be worth as much as 60x its collection’s floor price. Pricing these ultra-rare grail assets is extremely difficult, resulting in significant market inefficiencies, much in the same way that rare artwork and collectibles are difficult to price. Finding buyers for rare NFTs that should be worth multiples of the floor price is a challenging endeavor that is compounded by broader crypto market conditions. In practice, this means that the capital tied to these grail NFTs is effectively locked for an indefinite period unless the seller is willing to take a massive haircut on the NFT’s value.

Thus, non-fungibility presents itself here as the ultimate double-edged sword. On the one hand, non-fungibility is a key value proposition that has brought NFTs to the forefront of crypto’s mainstream audience. Mainstream users have a much easier time grasping the idea of valuable, non-fungible items since they, in some ways, parallel everyday goods like rare sneakers, designer clothes, and luxury cars. One key feature that makes NFTs better than the status quo is that they can combine the status-signaling nature of luxury goods with the composability of internet-native cryptocurrencies. As people continue to spend more time socializing in digital spaces compared to physical spaces, more users will flock to NFTs as a vehicle for distributing, signaling, and storing both value and social clout.

On the other hand, non-fungibility presents unique challenges that serve as major headwinds to their long-term sustainability. It is increasingly common to witness a knee-jerk negative reaction, among both crypto novices and long-term crypto enthusiasts, in response to the arbitrary pricing and lack of liquidity in the NFT market. Whether for the greater good or for personal gain, many new projects have been looking to address this core issue and bring liquidity, easy pricing, and diversification into the space by “financializing” NFTs through DeFi applications. DeFi seems poised to address some of the pitfalls of NFT ownership and bring this increasingly important asset class to the next level of usability and utility. While the financialization of NFTs may raise issues with securities laws in some jurisdictions, the focus of this report is on the economic issues, impacts, and questions rather than the legal ones. In this report, we will breakdown the key projects and protocols advancing the financialization of NFTs, as well as discuss both the positives and negatives of this trend on the broader NFT landscape.

DeFi x NFTS

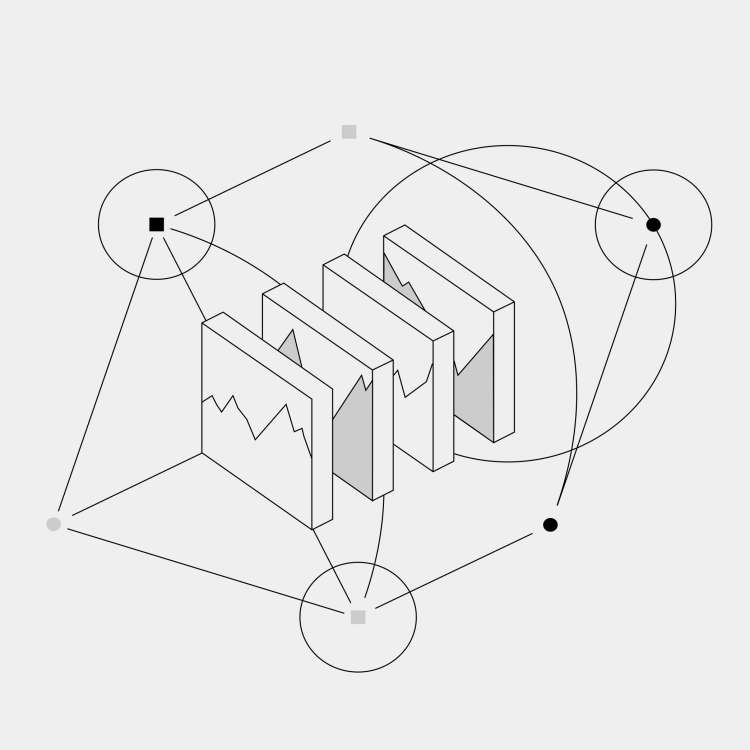

Over the last two years, we have witnessed a new category of cryptocurrency startups focused on building financial primitives for the NFT space. At a high-level these projects can be categorized into the following taxonomy:

Marketplaces – platforms for users to exchange NFTs

Fractionalization – projects that create the possibility of fractional ownership of an NFT

Lending – platforms where users can borrow fungible tokens by collateralizing the loan with their NFT

Indexes– on-chain investment vehicles that allow users to own a fraction of an NFT portfolio

Investment DAOs – DAO-based investment collectives that deploy capital into markets as defined via governance

Derivatives – financial contracts that derive their value from the price of the underlying NFT

Pricing – projects which appraise the value of an NFT and make that pricing data available on-chain

Renting - marketplaces where users can temporarily borrow NFTs, usually to play blockchain games

Additionally, many NFT collections have started embedding fungible tokenomics, staking features, and other incentive mechanisms borrowed from the Decentralized Finance (DeFi) space. While it is unclear how these DeFi features will play out over the course of the current bear market, we are already seeing signs of success and areas of concern based on early experiments within this vertical.

Fractionalization

One of the biggest criticisms of the NFT space is that marquee collections, like Bored Ape Yacht Club (BAYC), are exclusionary by virtue of their high floor prices. As of July 5, 2022, Bored Ape Yacht Club sellers ask for a minimum of 92 ETH, which is equivalent to about $105,000 at the time of writing. CryptoPunks, another marquee collection also managed by Yuga Labs, commands a 67 ETH ($76,400) entry price. Even derivative collections, such as Mutant Ape Yacht Club, command high premiums on the market at a current floor price of 17.5 ETH ($20,700). DeFi attempts to fix this key issue by leveraging fungible token mechanics and bringing these fungible token mechanics into the world of non-fungible tokens.

Fractionalization allows users to own fractional shares of an NFT. Fundamentally, when an NFT undergoes fractionalization, it is locked into an escrow smart contract, which then issues fungible ERC-20 tokens. These ERC-20 tokens represent ownership shares in the locked, NFT asset. These fungible tokens can then be traded in AMM pools in any arbitrary amount, inherently making the original, underlying NFT asset more liquid. Because users can usually trigger a liquidation of the vault that holds the NFT, arbitrageurs ensure that its fractions are accurately priced to the collection’s floor in the fractionalized AMM pool. There are several projects working on fractionalizing NFTs, and each project employs a different approach. The following section highlights some of the top projects within this vertical, emphasizing the trade-offs between each protocol’s designs.

Pooled Fractionalization

NFTX is a decentralized protocol that allows users to pool NFTs of the same collection in exchange for fungible shares proportional to the user’s deposit. In practice, a user is effectively securitizing a “floor” NFT that the market deems “similar enough” to other floor NFTs by creating 1:1 fungible vTokens that can trade against these securitized, floor NFT assets. Concretely, if a user locks a single CryptoPunk NFT into the CryptoPunk vault, and if the NFTX CryptoPunk vault already holds 3 CryptoPunks, the depositing user will subsequently receive 1 out of a total of 4 ERC-20 Punk tokens from the vault. These 4 Punk ERC-20 tokens each represent the 4 CryptoPunks locked into NFTX’s smart contract. The tokens are interchangeable and do not represent a claim on any particular punk in the vault. Upon redemption, a user has an equal chance of randomly receiving any CryptoPunk stored in the vault (unless the user pays an additional fee to select the Punk they want to redeem). The interesting thing to note here is that these ERC-20 tokens can then be traded on popular DEXes such as Sushi or Uniswap.

Liquidity in these AMM pools is subsidized by NFTX’s vault fees: a user pays a small fee 1.) when they fractionalize their NFT by locking it in the pool, 2.) if they choose a specific NFT from the pool to redeem with their ERC-20 token, and 3.) when they swap NFTs using the vault. Swapping NFTs through the vault is a feature that allows a user to directly exchange their NFT for any NFT in an NFTX vault of the same collection for a small fee.

With this design, there is no inflation mechanism in ERC-20 fractions, and the number of ERC-20 tokens is always equal to the number of NFTs locked into the protocol. In other words, these tokens are always fully backed by the underlying NFTs in an on-chain manner. One thing to consider, however, is that NFTX’s protocol design makes it susceptible to bank runs. Deep liquidity pools are extremely important since users can only redeem tokens for NFTs in integer amounts. If big chunks of liquidity left the pool, a 'bank run' scenario may occur where more users redeem their tokens for NFTs, all in integer increments, to protect themselves from liquidity crunches.

The remaining members of the pool may find themselves 'holding the bag' with insufficient liquidity to either sell their tokens or purchase more tokens to redeem an NFT from the vault. Tangibly, if a user holds 0.9 fractionalized tokens and another uncooperative user holds 0.1, they will not be able to redeem the NFT, rendering their shares essentially worthless. To guard against these bank run scenarios, NFTX introduced the possibility to dissolve a vault with 3 or less NFTs through a governance vote where fractional holders receive a proportional share of the proceeds from the sale. This emergency circumstance, however, may lead to sub-optimal outcomes for token holders who may see the underlying NFTs sold at a discount.

The BAYC serves as an interesting case-study to better understand the inner-workings of NFTX. After launching in July 2021, the vault quickly accumulated 17 NFTs, but it has since shrunk to only 4. During its lifetime, the vault has facilitated 44 deposits, 40 withdrawals, and 31 NFT swaps. As of July 5, 2022, its fractional ERC-20 token, BAYC, has been transacted a total of 4,917 times and currently has 167 holders with a maximum supply of 4, representing 4 NFTs in the NFTX vault. In a way, illiquidity on NFTX is a self-fulfilling cycle: the less NFTs there are in a vault, the less demand there is for the fractional shares (as the slippage gets higher in the AMM pool), and the less holders are incentivized to fractionalize their NFTs.

After the NFTX BAYC vault reached its maximum size of 17 NFTs in August 2021, it has endured a slow decline. As the price of Bored Ape Yacht Club NFTs has increasing steadily over this same timeframe, it appears that the demand from users to purchase fractionalized apes has decreased.

A possible explanation for the increase in NFT withdrawals, and subsequent decrease in vault holdings, is Yuga Labs’ airdrops. The economic incentive to hold the ape in one’s own wallet to prepare for airdrops has outweighed the benefit of depositing an ape into the vault and accruing fees. In just the last year, BAYC holders were airdropped mutants, kennels, ape tokens, and Otherside land. At their peak, the airdropped holdings from BAYC were worth more than a single ape itself. If one purchased a BAYC ape before June 18, 2021, and held all its airdrops, at floor prices their investment would be worth approximately $200,000 today, peaking at over $850,000 in early May 2022. By locking an NFT into NFTX, an NFT holder loses their ability to participate in airdrops. Fractional holders are only exposed to price action.

The most interesting BAYC airdrop as it pertains to NFTX was the ApeCoin airdrop. On March 17, 2022, BAYC and MAYC NFT holders became eligible for an airdrop of ApeCoin (APE), the governance token of ApeCoin DAO, which oversees the ApeCoin ecosystem fund and controls decisions related to ApeCoin (but not the actual NFT collections which are managed by Yuga Labs). On the same day of the $APE airdrop, a user took out an NFTX flash loan to claim the airdrop for all the NFTs in the pool. First, the user purchased Bored Ape #1060 on OpenSea. Then, they took out a flash loan of 5.2 vTokens (BAYC), which they then used to redeem 5 Bored Apes. After claiming the airdrop for the 5 borrowed apes plus the recently purchased ape, the user sent all 6 of the apes back into the vault, repaying the flash loan and selling the original purchased NFT through NFTX to cover the fees. By doing this, they claimed an airdrop of 60,564 ApeCoin while being eligible for only 10,094 (from the single Ape they purchased earlier on OpenSea). After loan fees, transaction fees, and losses on the purchased Bored Ape, it is estimated that the exploiter’s profit came out to ~$350k. This event, while profitable for the savvy user, underscored some of the challenges with implementing DeFi mechanics into NFT collections. Since the Apes are owned by NFTX, it would make more sense for the fungible token holders to receive a share of airdrop proceeds at the time of the airdrop. We expect future iterations of fractionalized protocols like NFTX may account for edge-cases like the ApeCoin airdrop.

Unlike other fractionalization protocols, NFTX has seen steady growth in both TVL and Volume right after peak NFT mania in Summer 2021. NFTX’s TVL surpassed $25 million in March 2022 and daily volumes have been steadily averaging over 250 ETH (approximately $285,000). Clearly, NFTX has achieved a level of product-market fit that has not been seen in other DeFi x NFT protocols. The reason for these strong adoption numbers boils down to composability. It is much harder to build complex applications and further financial markets on top of non-fungible tokens than on top of fungible ones. NFTX unlocks the ability to use infinitesimal fractions of NFTs which can power proven DeFi use-cases. Many projects have taken note of the utility afforded by this critical innovation such as the NFT marketing-making protocol FloorDAO.

Unicly is an NFT fractionalization protocol that lets users create vaults with any number of NFTs of their choice. The user can fractionalize their vault via ERC-20 uTokens. In essence, uTokens function as the governance token of every vault and can vote to unlock the vault, allowing anyone to bid on the vault’s NFTs. When a user first sets up a Unicly vault, they can arbitrarily decide to issue anywhere from 1k to 1tn tokens. The ETH derived from the auction sale of the vault is proportionately distributed to all associated uToken holders. Unicly can be best thought of as an ETF for NFT collections, regardless of whether the vaults are diversified.

Unicly recently released v2 of their protocol, where NFTs can be un-fractionalized individually when someone bids above the trigger price, set by the vault owner. The trigger price bid then kicks off an auction, which yields ETH that goes back into the vault. uToken holders are entitled to their proportional shares of the auction proceeds.

Unicly also has a partnership with Jenny Metaverse DAO, which is one of the main Liquidity Providers in their protocol. Jenny Metaverse DAO has a substantial portfolio of NFTs which they deploy into Unicly vaults to generate returns from auctions and liquidity provisioning.

All things considered, Unicly has struggled to gain traction since their v2 release. So far, only 14 vaults have been deployed during this time, and most of these vaults have seen little activity. However, the mechanics of Unicly seem to solve for a key problem in the form of diversified NFT exposure. Unicly also allows NFT holders to kill two birds with one stone by enabling both fractionalization and dynamic auctioning use-cases.

Individual Fractionalization

Fractional is a protocol that allows users to fractionalize either individual NFTs or entire collections. The original premise behind fractional was to give retail users price exposure to high-end, “grail” NFTs. The protocol distributes ERC-20 tokens that represent the investors' portion of the vault, effectively establishing a DAO around each fractionalized NFT. Fractional vault tokens can be traded through an interface on the website, which leverages Matcha, a DEX aggregator, to route the swaps.

Upon vault initialization, the creator sets the key parameters including the fee rate for minting vault tokens and the reserve price for the vault collection. A reserve price is the value at which the NFT can be fully bought out. After creation, each vault on Fractional is responsible for its own security and governance by virtue of its token holders who effectively have the power to initiate a buyout the underlying NFT. Vault token holders primarily have the power to decide on and update the reserve price for the vault’s NFT.

There are currently 2,836 vaults live on Fractional. In line with the broader NFT and crypto market, transaction volumes and vault creations are down to all-time lows from a peak in late August 2021.

Unlike NFTX and Unicly, Fractional targets illiquid, grail NFTs, which are traditionally unfit for pools. By allowing the vault creator to set an inflation rate (fee), it effectively creates the possibility for users or DAOs to purchase unique NFTs, fractionalize them, and sell them off entirely, pocketing the inflation yield from the vault.

Fractional is also partnered with PartyBid, a project which allows users to pool funds to purchase expensive NFTs. Once users purchase an NFT through PartyBid, the protocol then fractionalizes the NFT and gives its buyers governance through the PartyBid protocol. Currently, PartyBid supports Zora auctions, Foundation auctions, OpenSea instant buy, and Nouns DAO. The PartyBid party creation process is extremely flexible – it allows the party creator to choose from almost any NFT being currently sold, to token-gate party access, and to impose their own fees.

While the concept behind fractionalizing grail NFTs for everyday investors may be well-intentioned, in practice, this approach carries numerous risks for all parties involved. It may appear that dividing NFTs into fungible tokens removes liquidity constraints. However, this solution merely transfers liquidity issues from NFTs to ERC-20 tokens. Instead of a user having just one illiquid NFT, users are instead left holding many illiquid ERC-20 tokens representing fractional ownership of the original, grail NFT. In addition, for NFT owners, giving up control of their NFTs by indefinitely locking them into a smart contract limits ability to access benefits associated with holding the NFT, such as access to online communities, token-gated events, staking rewards, airdrops, mint passes, etc. For buyers of fractionalized NFTs, the risks include bank run scenarios, governance manipulation, value extraction through arbitrage, and rug pulls by vault creators. This is why Fractional has several disclosures on their website warning retail users that their partial NFT ownership may suffer from low liquidity and could go to zero. All these risks and forfeited opportunities must be carefully considered before engaging with fractionalized NFTs. At this point, most NFT investors seem to have realized the downside of fractionalization and are avoiding these protocols —evidenced by diminishing volume numbers. As grail NFTs continue to represent an underserved market segment from both an owner’s and an investor’s perspective, it will be interesting to watch how fractionalization of NFTs evolve over time. Many suspect that NFTs which focus more on yield generation as a core feature, such as NFTs tokenizing yield-generating assets like real estate, may benefit more from fractionalization use-cases. As indicated earlier, the utility from Art and PFP NFTs is derived primarily from holding the underlying NFT asset, and this utility does not translate over to fractional ownership outside of speculative price exposure.

Lending Markets

Two hallmarks of protocol development through the bull market of 2021 involved capital efficiency and composability. Teams that built products with these principles front-of-mind took the volatility and illiquidity of NFTs as an opportunity to create novel DeFi products that cater to the needs of this rapidly growing userbase. One of the obvious challenges of NFT ownership boils down to treasury management. While an NFT investor may be long-term bullish on a given NFT project, they may be reluctant to lock up a significant amount of capital into what is almost always an illiquid instrument. It turns out the solution to this conundrum has been central to DeFi since its earliest days. Overcollateralized lending protocols in DeFi, such as Compound, Aave, and Maker, allow users to free a portion of the liquidity of their portfolio without losing exposure to their long-term investments. In other words, they get to practice more active treasury management of their personal assets and effectively “kill two birds with one stone.” Lending markets collateralized by NFTs work much the same way.

The projects covered in this report fall into three categories: peer-to-peer lending, peer-to-pool lending, and Collateralized Debt Positions (CDPs). These approaches vary in risk tolerances, percentage collateral requirements, NFTs accepted as collateral, and interest rates.

Peer-to-Peer

Peer-to-peer lending, where borrowers are matched directly with specific lenders, has not fared well historically for fungible tokens. Fungible token lending markets are primarily dominated by the likes of Aave (peer-to-pool) and Maker (collateralized lending). However, peer-to-peer lending has gained substantial traction in NFT markets. In fact, peer-to-peer lending is the predominant mechanism by which NFTs are lent against today. Peer-to-peer lending platforms include NFTfi, TrustNFT, Pawnfi, and Yawww (on Solana). Usually, these are set up in a manner such that users lock up an NFT as collateral in an escrow smart contract and then request a loan for a fixed amount of time. The user will subsequently receive bids from liquidity providers for collateral / interest rate parameters, and the user will choose the combination that best suits their needs. For example, a user collateralizing a CryptoPunk worth $75,000 may ask for a 14-day loan. The user may then choose an offer from a liquidity provider which lends them 50,000 USDC under a 50% annual interest rate (approximately 2% or 1000 USDC over 2 weeks).

NFT holders often use peer-to-peer lending markets to hedge their long positions in popular NFTs. Effectively, an NFT-collateralized loan is a put option with the money up front: if the NFT’s true value falls below the loan amount during the loan duration, it is in the interest of the debtor to not repay the loan, forfeiting their NFT for the borrowed amount. By holding the NFT (locking it in the contract), the user creates a put + long payoff profile, which is similar to that of a call option, according to the concept of put-call parity.

Another NFT lending transaction that has been used by sophisticated NFT traders is adding leverage to potential positions. For example, an NFT trader may decide to make short-term price bets with the capital unlocked through a loan collateralized by their NFT portfolio. If this theoretical user believed the Yuga Labs ecosystem would increase in value short term (due to an NFT conference or a feature debut), they may borrow $50,000 against their NFT portfolio to buy two MAYC NFTs. The user might then sell the NFTs at a profit after some time, repay the loan, and keep the difference between the profit and the accrued interest rate. The main risk in this scenario would be if the NFTs the user bought on margin dropped in value. This scenario would be further exacerbated if the user’s NFT collateral also dropped in value, yielding a loss on the trade and additional margin required to prevent liquidation.

Peer-to-peer loans typically have high interest rates and moderate Loan-to-Value ratios. Of the platforms listed, NFTfi has had the most traction with a cumulative loan volume of $209 million and $28.6 million in current outstanding debt. In the past month, the average loan APR on the platform has been 63%.

Peer-to-Pool

NFT-collateralized lending platforms also employ the peer-to-pool design pattern. Drops is one example of this that operates like a Compound-like money market where users can collateralize their NFT portfolios to take out loans in USDC and ETH. Like ERC-20 tokens, NFTs are priced by Chainlink oracles, adjusting for outliers, and averaging over a period. To ensure sufficient liquidity for withdrawals, Drops uses a piecewise interest function like Compound and Aave, which targets a specific utilization rate and starts to significantly increase the rate borrowers pay and lenders earn if there are insufficient funds.

To limit risk exposure of liquidity providers, Drops separates the protocol into isolated pools, each with their own NFT collection. This approach mirrors the design patterns seen in DeFi protocols like Rari Capital Fuse Pools. This approach ensures lenders can select to which collections they are comfortable exposing themselves by weighing the risks and volatility of each. Drops currently has approximately $2.7 million in supplied capital and $380,000 of outstanding borrows. Drops offers a moderate LTV ratio to buttress the solvency of the protocol and provide ample time for liquidations, but a relatively low interest rate for borrowers (approximately 10% at the time of writing). That being said, its liquidations appear to be somewhat buggy as a certain BAYC debt position has been observed to be in liquidation territory for several days without actually being liquidated. This could be attributed to the 5% fee from every OpenSea sale (2.5% to OpenSea and 2.5% to Yuga Labs) or the recent market volatility.

Another protocol working on the peer-to-pool NFT-collateralized lending model is Bailout. Bailout is optimizing the design of Drops to allow for further flexibility and risk consideration by liquidity providers. In addition to the piecewise interest rate function, Bailout also caps all loans at 30 days (although they can be rolled over by repaying all accrued interest) to insure solvency and liquidity flow. Additionally, each NFT collection on Bailout would not only have a separate pool, but they would be able to have several pools with different collateralization requirements, rates, and loan duration.

Generally, peer-to-pool lending projects only provide funding pools for blue-chip NFT collections because these tend to have strong price consensus among traders and investors. When compared to long-tailed NFT collections, these blue-chip collections also tend to have more liquidity on the market. Take the case of BendDAO, another peer-to-pool lending marketplace: BendDAO currently accepts only the following blue-chip NFTs as collateral types (as of mid-July, 2022): Azukis, Bored Apes, CryptoPunks, CloneX, Doodles, Space Doodles, and Mutant Apes. An interesting feature that sets BendDAO apart from other peer-to-pool NFT lending protocols is its 48-hour liquidation protection, which allows users, for a small fee, to repay their loans within 48 hours after a liquidation of their position was triggered. Additionally, to address the concern that the user loses the utility of holding an NFT when depositing it into a protocol, BendDAO issues boundNFTs, which represent the depositor’s position and contain the same metadata as the original NFT, allowing the depositor to still display their NFT as their profile picture.

Collateralized Debt Positions (CDPs)

Collateralized Debt Positions (CDPs), pioneered by MakerDAO, encapsulate the final model of NFT-collateralized money markets. JPEG’d is a decentralized lending protocol that leverages CDPs to enable borrowing against NFTs as collateral. These CDPs are referred to as Non-Fungible Debt Positions (NFDPs), and the stablecoin users can borrow through JPEG’d against their NFTs is called PUSd.

JPEG’d allows PUSd debt positions up to 32% of the collateral value, which is a conservatively low threshold. As such, user’s position can be liquidated when loan-to-value ratio exceeds 33%. The protocol charges 2% in annual interest and a 0.5% one-time debt fee on the size of the loan. While most NFTs are priced through Chainlink oracles composed of floor prices and recent purchases, prices of grail NFTs are hardcoded and adjustable only via governance vote. For example, Alien punks are currently valued at 4,000 ETH and Ape punks are currently valued at 2,000 ETH.

JPEG’d also released a collection of their own NFTs, called JPEG Cards, which have utility within the protocol. JPEG Card holders were originally able to stake their card NFTs to earn a share of 1% of JPEG fungible token supply over a month period. Cigarette Cards, of which there are 99, can be locked and used to gain boosts on the credit limit, raising a user’s max LTV to 40%. Unstaking a Cigarette Card may lead to liquidations on undercollateralized positions.

On JPEG’d, liquidations are executed exclusively by the DAO when the debt / collateral ratio of a given user exceeds 33% (or 40% with a staked Cigarette). When users are liquidated, the DAO repays the users’ PUSd debts by burning PUSd in the DAO. Liquidated NFTs are then either kept by the DAO or put up for a 24-hour, member-only auction.

JPEG’d also introduced a novel insurance model for NFT liquidations. In this model, a user can purchase insurance on any of their CDPs for a 5% one-time non-refundable payment when they draw the debt. If the user has insurance during a liquidation event, they will be able to recover their NFTs from the DAO after repaying the outstanding loan and a 25% liquidation fee within 72 hours of liquidation. This gives users an additional safeguard against potentially losing their NFTs during periods of extraordinary volatility.

JPEG’d raised $72 million in February 2022 through a “Token Donation Event” over the course of 3 days for 30% of total JPEG token supply. Despite the recent market downturn, the JPEG’d treasury is currently valued at multiples of the JPEG governance token market cap. JPEG’d has a crypto-native following and is run by prominent DeFi 2.0 evangelists and thought leaders. JPEG’d also has partnerships with Olympus DAO, Tokemak, Abracadabra Money, and Dopex.

Lending Outlook

While it is true that P2P loans free up cash for long-term investors while also improving capital efficiency in the NFT market, the risks involved with utilizing these protocols frequently outweigh the benefits. NFT valuations have plummeted dramatically in recent months, jeopardizing the health of many NFT x DeFi protocols (as evidenced by falling usage). Human nature is also prone to falling victim to the dangers of underestimating the probability of negative events happening in future, which can lead to difficulties from a risk-management standpoint. These situations may have disproportionately severe consequences for a retail-centered audience as liquidations trigger large losses for a cohort of users who may already be overexposed to this volatile asset class. As a result, users who engage with these novel lending protocols ought to exercise extreme caution and conduct a thorough risk assessment before committing large sums of NFT capital.

The other major issue with NFT-backed loans is that the vast majority of NFT-collateralized lending applications and price derivatives rely on price oracles. These oracles usually use algorithms or AI to factor in several or all the following into their respective pricing feeds: floor prices, recent sales, sales averages over a time period, and outlier removal/anomaly detection. These oracles are not perfect, however, and currently represent a weak link in the infrastructural underpinnings of NFT-focused DeFi protocols. If NFT lending markets were to gain widespread adoption, we could see scenarios where users and institutions attempt to game oracle mechanics to trigger cascading liquidations. It is also highly probable that we will see edge cases of rapid price fluctuations, causing time-averaging oracles to fail to catch up and resulting in untriggered liquidations and subsequent insolvency of the protocols.

Renting NFTs

The purpose behind NFT renting protocols differs from that of the lending markets, even though both involve ‘borrowing’ NFTs. While lending protocols center on users taking out loans collateralized by NFTs, renting protocols involve users both lending and renting NFTs. Within this niche, yields flow from NFT renters to NFT lenders (depositors). If lending markets commoditize capital, then renting platforms commoditize NFT utility.

Launched in October 2020, reNFT is an example of an NFT rental protocol that allows for peer-to-peer NFT renting and white-label integrations of the technology into any Web3 projects to enable renting, lending, and scholarship automation. Play-to-Earn gaming dominates NFT renting demand because players can create new earning potential through the NFTs they rent. Oftentimes, the floor price for P2E game NFTs can be steep. Thus, renting the NFT is a more economically feasible onramp for new players. Renting NFTs through reNFT involves renters picking a specific NFT from the list, choosing the duration of the loan, and providing minimum collateral. When users repay the borrowed amount plus interest accumulated during the term, they can reclaim their assets.

Other NFT rental protocols include Double, IQ Protocol, Rentable, and Prom. Most of these specialize in their own niche, such as NFTs in specific games, virtual land, blue chip NFTs, or general NFT series. An important distinction worth noting is collateralization requirements. Some NFT collections and Play-to-Earn games explicitly allow NFT renting, without the explicit transfer of ownership. This protocol-native design choice effectively removes any collateralization requirements.

NFT rentals will eventually become a key feature for Play-to-Earn and other NFT-backed games that seek to reach mass markets. Historically, P2E game usage has been driven by less wealthy userbases who commit the most amount of time and energy to earn an income. Projects that keep this userbase front-of-mind with widely accessible NFT renting protocols will be able to make the next wave of NFT games compelling for all markets.

Diversification

Diversification and risk management are two traditional investing principles that are difficult to source in the newborn NFT market. Given the uncertain and unpredictable nature of NFTs, one would expect a large number of index funds, ETFs, and Investment DAOs to cater to demand for modular and risk-optimized solutions to NFT investment. However, while such initiatives do exist (or did in the past), most have not been successful in meeting product-market fit.

Indexes

So far, the Index Coop DAO is one of the few success stories in building broad-based, NFT investing products. Their NFT index, JPG, launched in April of this year, and its underlying tokens are project tokens and fractional shares of vaults in various fractionalization protocols. The obscureness of the underlying NFT assets compounded by a lack of hype-driven demand for users to gain exposure to these obscure NFTs has so far resulted in a very underwhelming launch of the index. The JPG NFT Index market cap currently stands at only $100k. The challenges of Index Coop’s fumbled NFT index launch highlight some of the pain points of DAOs that are described in more detail in our research report here. Specifically, NFT investing requires an active and agile investment team capable of latching onto rapid trends in the market, yet Index Coop’s investment process struggles with the coordination problems of DAOs resulting in a basket of NFT assets that poorly reflect the forefront of the rapidly evolving NFT space.

Another project that has captured attention is Bridgesplit. Bridgesplit is an NFT fractionalization protocol on Solana which focuses on NFT indexes and fractionalization. The project stands out from others by supporting many interesting features including fractionalization, floor indexes, curated indexes, swapping, liquidity pools, farms, group bidding, and NFT analytics. While the project’s adoption is still low, they are betting on the long-term success of the Solana NFT market and NFT financialization becoming one of the key drivers of the next bull run. Bridgesplit currently has 33 floor indexes and 8 curated indexes.

Investment DAOs

While indexes have struggled to build traction, actively managed investment DAOs have found some success in the market. The most notable example of an NFT investment DAO is Flamingo DAO, which was launched in October 2020. Through its sale of “Flamingo Units,” it raised approximately 6,000 ETH ($6m at the time). Flamingo DAO’s activities include purchasing NFTs and investing in core NFT infrastructure projects, such as OpenSea and nameless. The current holdings of the DAO are valued at approximately $1bn and include 218 CryptoPunks, 22 Bored Ape Yacht Club NFTs, 286 Meebits, and 247 Squiggles by Art Blocks.

Another notable investment DAO is PleasrDAO, a collective founded on March 26, 2021. Its first purchase was “x*y=k” for $525,000. Since then, PleasrDAO has purchased the Snowden NFT “Stay Free,” for $5.5m, Tor NFT “Dreaming at Dusk” for $2m, and the original Doge meme. On July 16, 2021, PleasrDAO posted four NFTs as collateral for a groundbreaking DAO-to-DAO loan. This undercollateralized loan was structured between PleasrDAO and Iron Bank, and was initiated when PleasrDAO transferred four of its priciest NFT’s to Iron Bank’s vault in exchange for $3.5 million of borrowed tokens. The NFTs were returned to PleasrDAO when the loan was paid in full.

Derivatives

Derivatives are by far the most important component of the global financial system when measured in terms of notional value, which is estimated at $610 trillion. Given their importance in financial markets, the introduction of derivatives into the NFT market appears to be a logical next step in the maturation of the NFT x DeFi space. However, most NFT derivative products have yet to find product-market fit. The next section of this report will examine NFT derivatives through three buckets: prediction markets, perpetual futures contracts, and options.

Prediction Markets

Prediction markets allow users to bet on binary outcomes, such as whether a team will win in a match, whether a politician will win an election, or if a cryptocurrency will cross a specific price by the specified time. Historically, the most well-known prediction market on Ethereum has been Augur, which was originally launched in 2018 and initially gained an impressive level of traction. Unfortunately, Augur was unable to maintain its product-market fit and was converted to a DAO in November of 2021, going radio-silent shortly after.

While real-world scenario and cryptocurrency price prediction markets have yet to achieve mass adoption, NFTs may offer a sliver of optimism for this longtime concept. On Ethereum, the most well-known prediction market is SOSMarket. SOSMarket allows users to bet on any NFT-related event, ranging from how much an individual wallet spends on OpenSea throughout the year to whether the floor price of a specific collection is above or below the defined value. SOSMarket was launched by OpenDAO, the project which airdropped tokens to active OpenSea users, in early January 2021. While SOSMarket hasn't maintained its levels of engagement from early 2021, it did demonstrate the nascent demand for NFT-driven prediction markets.

This demand for NFT prediction markets appears to have been captured partially by Cubist Collective. This protocol, which has achieved significantly more traction than SOSMarket, is a prediction market which has found a niche in the form of floor prices for new collections launched on Magic Eden (Solana’s #1 NFT marketplace). Specifically, most binary outcomes revolve around whether the collection’s floor price will be above or below the mint price. Magic Eden sees over 20 million unique sessions per month and generates significant demand for new drops which are promoted by the marketplace through its Launchpad. Naturally, participants want to either hedge or speculate on their mint, resulting in consistent substantial demand for the Cubist Collective prediction market. Cubist Collective currently processes 2-3 prediction games per day.

Perpetuals

On the fungible token side of the crypto derivatives market, many point to the success of Perpetual Futures powered by centralized cryptocurrency exchanges, which often see more volume than spot trades. The NFT derivatives market, however, doesn’t currently have investment instruments similar to perpetual futures. The lack of ‘Perps’ for NFTs makes it difficult for users to long or short collections on margin (borrowed capital). In August 2021, Dave White of Paradigm published a paper on this topic, "The Floor Perpetual: A Framework for the Design of Synthetic Assets that Track the Floor Price of an NFT Project Using NFT Collateral and Funding Rates," which introduces the floor perpetual and suggests a framework for the creation of a synthetic asset that tracks an NFT project's floor price using NFT Collateral and Funding Rates. On the surface, this appears to be a viable framework for introducing NFT Perpetual Futures, and new protocols may attempt to make this framework a reality.

Options

In addition, the NFT market lacks established options players. Several projects have launched over the past year attempting to gain traction in the market, including Putty Finance, Nifty Options, and Fuku. Unfortunately, these protocols have not seen much traction and have remained dormant since their introduction. The lack of options infrastructure for NFTs means that traders lack instruments for shorting and/or hedging their NFT positions, severely limiting their toolkit for managing risk. This is especially important considering that the NFT market has cooled off significantly in the past couple of months with floor prices dropping across the board. In the absence of options infrastructure for NFTs, asset allocators and investors may be hesitant to add exposure to this asset class since their only entry-point now is expressing a long view.

Pricing

Like the lending market, the NFT derivatives market is incredibly reliant on price oracle performance. To make an analogy, one could expect the oracle risks and the value at risk to be like that of bridges seen with fungible tokens, which have been hacked for almost a billion dollars since the beginning of the year over several instances. Creating strong pricing and liquidity fundamentals will be imperative for the market to have robust oracle infrastructure, and this will be a prerequisite for a flourishing NFT derivatives market.

While floor pricing has attracted a lot of research and development, pricing grail NFTs has been one of the most neglected areas of the market. Usually, rare NFTs remain listed on exchanges for multiples above floor price for months without demand. Several projects are working on alternative pricing models which would allow for rational pricing of grail NFTs and faster exit liquidity for their owners.

Abacus is an NFT valuation project for grail NFTs which uses an optimistic proof-of-stake system to value assets and give them instant liquidity. In its current implementation, the project allows appraisers to value specific NFTs by staking an amount of ETH behind their best guess. When the valuation window expires and the estimates are revealed, an average is taken and those close to the average (within 10%) receive a payout. Those outside the range, on the other hand, have their stake slashed in the amount proportional to their deviation from the settlement price of the appraisal. To get their NFT valued this way, users must purchase the next appraisal slot at an auction. This auction fee is later distributed to appraisers to improve their expected payout.

In their next stage, Abacus plans to debut a tranched valuation system, where appraisers would be able to stake capital into tranches of the NFT price, betting on the eventual valuation via NFT liquidation. A tranche of an NFT price could be 0 < x < 1 ETH, 1 < x < 2 ETH, and so on. While the lower tranches get little premium, the higher, riskier tranches earn more. If the pool closes and the NFT is liquidated via auction, the original supplier of the NFT gets all the value from the pool, and the stakers get the proceeds of the auction on a tranched first-in-first-out basis. Therefore, betting on higher tranches carries significantly more risk, but is also compensated with receiving most rewards in excess of the staked capital.

While Abacus provides a workable solution for grail NFT appraisal, its approach is slow and extremely capital-inefficient. Stakers must stake their tokens for a large amount of time before receiving the payoff. The approach is not extremely scalable and is unlikely to gain significant traction outside of niche collector circles and valuations for high-value NFT auctions such as Sotheby’s.

A different approach to valuation of grail NFTs involves machine learning and artificial intelligence. Upshot is an NFT analytics tool which that uses complex algorithms to price NFTs which trade above floor prices to determine how lucrative specific listings are. Apart from providing a suggested price for the requested NFT, Upshot also outputs error bounds around the predicted price. All this data will be accessible through the Upshot API, allowing for NFT composability that isn’t limited to floor NFTs. Out of all NFT pricing approaches, machine learning seems like the most rational way of evaluating the distinct factors that go into pricing, such as market conditions, floor price, specific traits, and past sales history. One of the key challenges with ML-based pricing approaches is the lack of transparency in the pricing models. Since these models are not open-source, users are unable to evaluate the extent to which the models can be manipulated, biased, or otherwise gamed. These types of issues have plagued recommender system models powering Web2 companies for years, and there has not yet been an easy solution that satisfies all stakeholders.

Another protocol that is working to improve the pricing of NFT collections is Sudoswap. Sudoswap has recently debuted a new kind of NFT marketplace – an NFT Automated Market Maker (AMM). The SudoAMM will leverage liquidity pools and user-defined bonding curves between ERC-721 and ERC-20 tokens to trade floor NFTs. Like NFTX, the protocol only works with common NFTs, between which users make no distinction. SudoAMM allows for both exponential and linear bonding curves for NFT pricing.

Ultimately, having AMM pools with deep liquidity will provide an objective way to price NFTs in the collection and would guarantee exit liquidity for any portfolio liquidations, unlocking limitless possibilities for composable applications. While this approach offers an interesting alternative to peer-to-peer NFT trading, it remains to be seen whether users would prefer it over what they are used to. AMM exchanges became popular because on-chain orderbooks were too gas-inefficient. In the case for NFTs, however, purchasing one NFT on OpenSea would consume a commensurate amount of gas to purchasing one NFT through a SudoAMM, rendering the main value proposition of AMMs less applicable to this market.

DeFi Incentives Built into NFTs

NFT collections with DeFi incentive structures built into the DNA of their ecosystems must not be overlooked when discussing the intersection of DeFi and NFTs. An optimist may view DeFi incentives as a positive for NFT collectors to accrue more economic value from their collections while incentivizing pro-community behavior. A cynic may view DeFi incentives as yet another vehicle through which protocols can potentially extract value from a relatively unsophisticated user base. These days, some NFTs go as far as positioning staking rewards, airdrops, and yield farming as key selling points.

One important trend to note from the rise of NFTs in 2021 is that this new use-case for crypto brought in an entirely new base of users with little prior experience in cryptocurrency markets. Many of these new users have little overlap with DeFi power users who were pioneering users during the "DeFi Summer" of 2020 and acquired the scar tissue that came with the various exploits, failures, and “rug-pulls” that happened throughout the past bull cycle. As a result, many retail-oriented NFT users may not be as familiar with DeFi’s checkered history of propping up protocols for the sake of creating exit liquidity for smarter, earlier players. To illustrate the point, we will give brief overviews of progressively financialized NFT collections from least to most “financialized.”

In March 2022, BAYC and MAYC NFT holders received an airdrop of ApeCoin, the product of ApeCoin DAO, which governs the ecosystem of the collections. This move introduced an element of fungibility into their non-fungible ecosystem spanning multiple collections. For long-term NFT holders, the airdrop meant an unlock of a portion of the value behind their collections and the whole Yuga Labs ecosystem. The airdrop also spawned new community-led initiatives and allowed significantly more members to participate by virtue of the token’s fungibility (vs owning a Yuga Labs NFT). It also created a new incentive structure for BAYC holders to gain and hold exposure to a fungible asset class whose price is ostensibly tied with the roadmap of Yuga Labs. In one specific example, Ape Coin spiked in value just before the Otherside mint, and subsequently tanked in value immediately after the mint was over. It is unclear the extent to which this additional volatile exposure to Yuga Labs’ product launches is beneficial or harmful to its community, and it comes down to each user’s risk/reward preferences. Some users from the Otherside complained about losing large sums of money for swapping ETH (a more stable asset) to acquire APE tokens (a less stable asset) only to miss the mint and watch their APE tokens fall in value for no benefit.

Another example NFT project with interesting, DeFi-inspired incentives is DeGods. DeGods is a deflationary NFT collection on Solana that minted in October 2021, selling out within seconds after launch. DeGods initially introduced a 33.3% “paper hand tax,” which was levied on all sales below mint price or secondary purchase price (this tax was removed in early 2022). While the tax was active, the treasury would use these collected funds to burn DeGods from floor prices, driving the entire collection’s floor price upwards. In addition, DeGods introduced fungible tokens in the form of DUST. These DUST tokens are earned through staking one’s DeGod NFT. DUST emissions, like bitcoin, have scheduled halvings, ensuring an eventual supply cap. Using DUST, DeGods can also be transformed into DeadGods, which yield higher DUST earnings when staking the transformed “DeadGod” NFT. All these DeFi mechanics combine to form an ecosystem where DeGods minimize the supply of NFTs available on the market, increasing interest towards and value of their collection, and earning the collection more fees from royalties as a percentage of sale prices.

“Move to Earn” app STEPN recently gained a tremendous amount of attention for rewarding users for walking, jogging, or running. STEPN was built primarily on Solana by FindSatoshi Lab and is exclusively a smartphone app (needed for tracking users via GPS). Initially, users had to buy NFT sneakers for hundreds or even thousands of dollars (prices have since cooled off significantly). Different sneakers offer differing returns and perks, such as resilience, luck, comfort, and efficiency. STEPN operates with a two-token structure (first popularized by Axie Infinity): GST and GMT. Green Satoshi Token (GST) is a utility token which is unlimited in supply and earnable through daily movement. To ensure price discovery, GST has burn mechanisms such as upgrading sneakers, unlocking gem sockets, repairs, and minting of new shoes. Green Metaverse Token (GMT) is the deflationary governance token with a fixed supply of 6 billion. The unfortunate reality is such that for older STEPN users to recoup their NFT sneaker and GMT investments, value must continually flow in from newer users. STEPN frequently changes its tokenomics to maintain the viability of the protocol. For Play-to-Earn games to be sustainable, they must offer users more increased earning potential with each update. That said, move-to-earn is still in its early days and the team has had plenty of time to learn from unsustainable Play-to-Earn tokenomics – time will tell if this case is different. According to the most recent data from Dune, new user signups have slowed down and the floor price of STEPN sneaker NFTs has fallen from 14 SOL in April to 3.4 SOL in early July 2022.

Finally, DeFi Kingdoms stands as the canonical example of financialization in NFT collections. DeFi Kingdoms is a multi-chain play-to-earn game built around a DeFi protocol that has become the central liquidity hub on the Harmony blockchain and is fighting to gain market share on Avalanche. The game features a decentralized exchange built with the AMM model and liquidity pools, earnings that are dependent on the properties of a user’s heroes (NFTs). DeFi Kingdoms originally launched with a one-token structure but has added an additional token as it expanded to Avalanche. JEWEL acts as the main token of the ecosystem and can be staked, used to purchase hero NFTs, combined with heroes to mint new heroes, and spent on upgrades. CRYSTAL has the same role as JEWEL but operates within the Avalanche realm. As fascinating as the gamification of DeFi mechanics was initially, many users have since lost interest in the game due to its repetitiveness, and DeFi Kingdoms’ usage has fallen significantly since its peak at the end of 2021. Upon close examination, it is clear that DeFi Kingdoms, as the name suggests, boils down to a “yield-farming” DeFi protocol with a thin veneer of NFT game mechanics bolted on. Once users saw past this veneer of “fun,” usage fell off a cliff.

There have been a variety of incentivization tactics borrowed from DeFi and implemented by builders to better engineer value accrual for (or in some cases value extraction from) members of various NFT communities. The methods are similar across the board and include airdrops, staking, burning, locking, and spending – all financial primitives backed mainly by promises of greater economic prosperity or future utility. However, the results so far appear to line up more with yield farming in traditional DeFi projects: mercenary liquidity enters, farms the token, and then dumps on future investors. While our view is that some of these NFT projects with DeFi primitives will be successful eventually, it's often difficult to distinguish the good ones from questionable rivals. Users should continue to exercise caution when encountering NFT collections that leverage these types of DeFi-inspired incentives.

Outlook

The NFT financialization space is one of the most rapidly evolving in the cryptocurrency ecosystem. The financialization of NFTs is a trend that will only continue to grow in importance, and the composability between NFTs and DeFi will ultimately make both ecosystems combined more valuable than each separate ecosystem summed together. It is critical to note, however, that it isn’t established protocols implementing NFT compatibility, but rather new teams breaking into the space by porting DeFi technologies over to a new market.

Early experiments in the intersection of NFTs and DeFi, while promising, also underscore a variety of risks and challenges that will need to be addressed as these protocols evolve. Some of these key risks include:

Bubble and burst tendency of the NFT market. Seeing that NFTs are backed by nothing outside of perceived value, have not been around for very long, and haven’t seen institutional adoption, the whole market could go to zero very quickly.

Bank runs on pooled fractionalization. As mentioned previously, pooled fractionalization is susceptible to bank runs, in which the last individual to head for the door will not get to leave

Creation, popularization, and crash of NFT-backed loan CDOs. It is clear that securitizing and tranching pools of NFT-backed loans would improve capital efficiency. It Is, however, also likely that this idea would meet improper risk management and eventual collapse.

Mass adoption of a retail focused NFT index or ETF which becomes the final exit liquidity. There is a risk that the first (or first several) retail focused NFT index fund to gain mass adoption is used by insiders to dump unworthy projects on new retail investors.

Mass oracle manipulation in the derivatives market. If the derivative market grows to substantial size, it would make sense to influence the illiquid floor prices and tamper with the oracles.

Success and massive hacks of NFT bridges to other chains. Over a billion dollars has been stolen from bridges in the past year. If NFT bridging is introduced, it is critical to understand and properly factor in the risks of their security.

Lack of standards. Given how new these spaces are, there are no universal set of standards for tasks such as pricing an NFT. Instead, we see multiple approaches being used across each vertical with trade-offs between each approach. Over time, we would expect to see some convergence around best practices that may eventually lead to some standardization.

Lack of utility. Most NFTs are concentrated on PFPs and gaming, which are rudimentary use-cases of NFTs that will limit adoption. The challenge here is that new DeFi protocols can unlock additional NFT utility, but developers may be reluctant to build these protocols until NFT demand can expand beyond speculative PFP use-cases.

While the growth of financialization in the NFT market carries significant risks, it may also host the most innovation around tokenomics and incentive structures in the coming years. Looking ahead, we see innovation taking place in several areas of projects, including NFT collections experimenting with DeFi 2.0 primitives, solutions built on top of NFT-native AMM exchanges, and protocols for risk hedging that leverage previously discussed or novel NFT derivatives. The development of these projects could significantly advance the NFT market, taking it way beyond the limited set of actions you can do with traditional collectibles. For example, imagine the ability to sell an NFT into a liquidity pool seconds after withdrawing it from staking, or hedge exposure to the NFT's price with only a few clicks, or even burning a part of the NFT in exchange for a set of future cash flows in a novel token. All of these would make a collector's experience significantly more interactive and fluid, attracting more users to the entire space. That being said, few DeFi x NFTs projects have retained traction beyond the hype of the first weeks after launch, and thus it is too early to tell who the winners and losers in this space will be.

Key Takeaways

On-chain reputation is a prerequisite for mature NFT x DeFi infrastructure. In crypto, creditworthiness evaluation is still in its infancy, and therefore many protocols crudely rely on over-collateralization to power lending use-cases. Over time, we expect on-chain user behavior to be synthesized with user identities to both better evaluate an NFT holder's creditworthiness and recommend DeFi products suited to that user's risk profile. Just as Artificial Intelligence has enabled huge strides in NFT pricing, it will also be leveraged heavily for building credit worthiness models. Nansen's "Smart Money" labels offer an interesting first look at what these models may eventually look like.

Consolidation may accelerate in a down-market. As various NFT project funds start to dry up, we may see Investment DAOs step up to acquire and/or merge various collections under one roof. These actively managed collections may benefit from economies of scale by unifying creators, builders, tooling, and resources across multiple collections while reducing operational redundancy. This may give struggling collections a better chance to emerge from the crypto bear market stronger.

Investment DAOs and Indexes are equipped to give retail users better access to mints and deal flow into high-potential collections. Instead of looking backward at NFTs from collections that have historically done well, DAOs will start to look forward toward investing early into collections that have high potential. This may prove beneficial to all stakeholders as newly launched collections may want to seek the endorsement of a prominent DAO instead of attracting retail interest or relying on influencer marketing.

Backlash against high-royalty collections may spur demand for DeFi x NFT products. While the prevailing meta for NFT collections in recent months has been a free mint + high single-digit percentage royalties on secondary sales (the goblintown model), this model will likely change considering recent pushback from the community. Already, protocols like Yaww have announced new products that will limit creators' ability to instantiate high royalties on collections. If this trend gets popular, collections may have to increase mint prices to compensate for lost revenue on secondary sales. Higher mint prices would then increase demand for fractionalization products and/or investment/index products for retail users with lower levels of capital.

Vertical integration is starting to heat up. Top NFT collections want to control the user experience of ancillary DeFi products such as trading, renting, token swapping. CryptoPunks started this trend with their proprietary marketplace for buying and selling Punks. STEPN recently surpassed Orca to become the largest DEX on Solana after building their DEX in-house. Game developers in particular seem most poised to capture the additional revenue opportunities from building out DeFi x NFT products (such as a renting marketplace for their gaming NFTs). We expect innovation to stem from popular collections that know their users' pain points well and that seek to vertically integrate as much of the user experience as possible.

Institutions will learn from early experiments in NFT lending markets. The importance of institutional lending cannot be understated for enhancing liquidity in the overall market. While institutions have been averse to lending against NFT collateral, we expect them to study the DeFi x NFT space closely for insight into how to potentially structure these types of loans. As the NFT space grows, it will only be a matter of time before institutions start lending against NFTs. Once the institutional lending infrastructure gets built, we expect the demand for NFTs to also increase as institutional money can flood in by virtue of the additional utility unlocked by collateralizing their NFTs.

Token-gated NFT events may spur demand for short-term NFT borrowing/renting. The renting vertical will not be limited to gaming. Token-gated events will create new demand for participants to test the waters of burgeoning web3 in-person events that are governed by NFT ownership. For instance, instead of buying a PROOF Collective NFT at a floor price of 50 ETH to attend a party, that same user may be more willing to PROOF Collective NFT for 1 ETH for a weekend trip. This allows the user to keep more liquid capital for investing into other projects while earning the owner of the NFT a new stream of income.

Tokenization will spur innovation. As more assets and behaviors are tokenized, more DeFi x NFT protocols will be built. Today, we are still in the early days of NFTs in terms of utility. As real-world assets, consumer loyalty programs, and networks of people are all tokenized (among many other assets and behaviors), we envision hyper-specific DeFi products and primitives to emerge to suit all these unique use-cases. DeFi protocols will follow utility, and it is unlikely that one protocol can service all the disparate use-cases for NFTs better than multiple purpose-built protocols.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.