Introduction

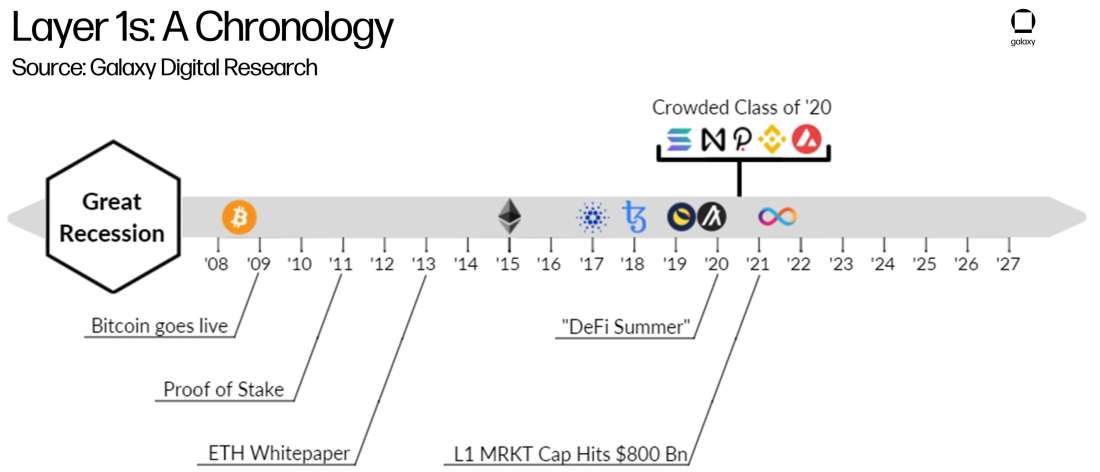

Since Bitcoin launched in 2009, the concept of decentralization has become more and more mainstream. While Bitcoin wasn’t the first decentralized system, Satoshi Nakamoto’s invention was the first to successfully create decentralized money, an innovation that gave anyone, anywhere in the world open access to a monetary network that utilized a scarce currency. By both design and community ethos, Bitcoin remains the most decentralized blockchain network in the world, but Bitcoin remains primarily a monetary network, not a composable smart contract platform.

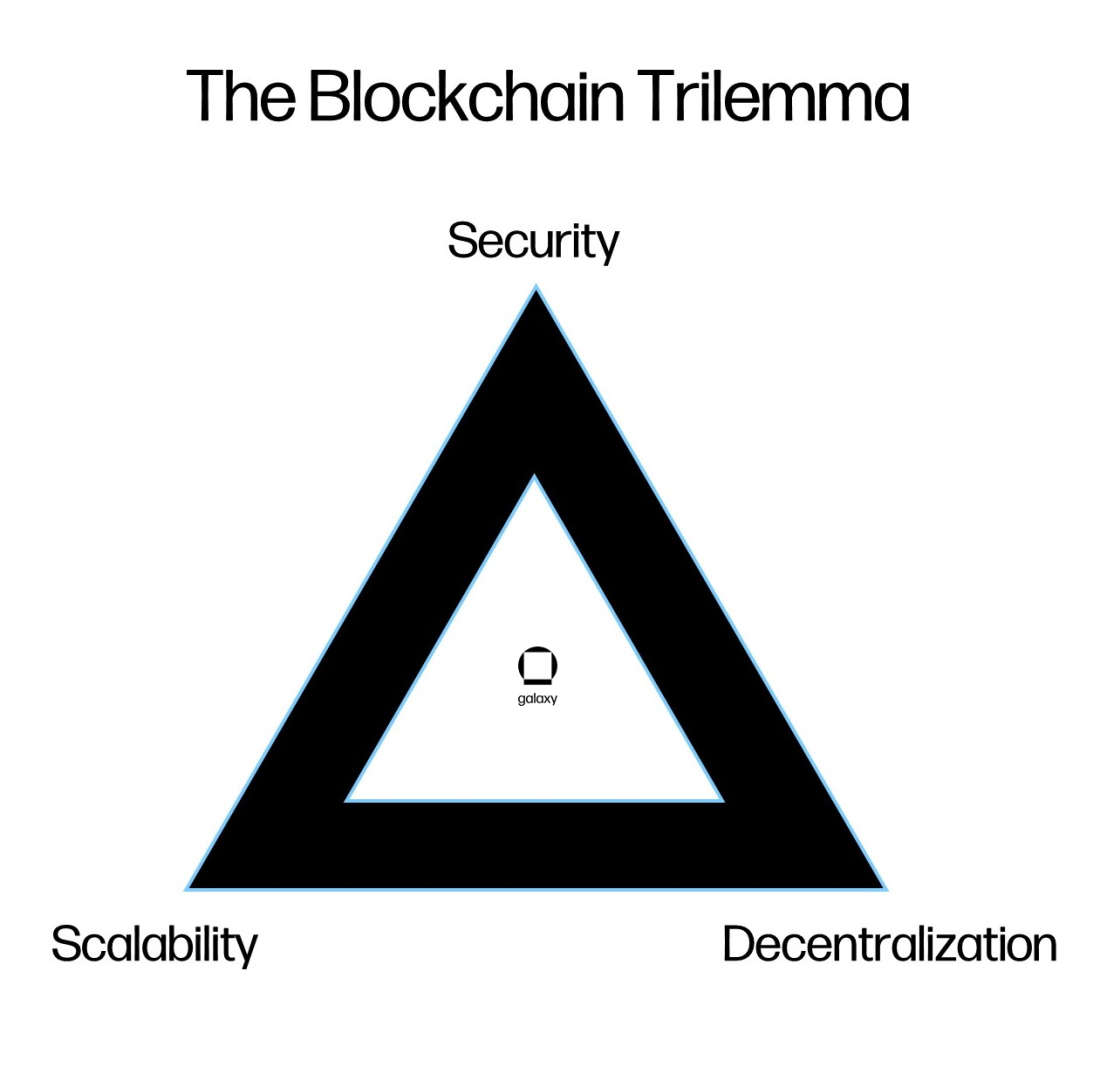

While the rigidity of Bitcoin’s focus on decentralization is a major selling point for the world’s most valuable cryptocurrency, its lack of composability means it has ceded design space and led to the creation of new networks with different priorities, most notably Ethereum. In contrast with Bitcoin, Ethereum adds a major composability enhancement with the addition of a virtual machine, allowing for the creation of stateful smart contracts that live entirely on-chain. In doing so, Ethereum placed an additional burden on full nodes that causes some centralization, but also opened the door to decentralized application-level innovation that has expanded the on-chain design space significantly. This design choice, sacrificing some decentralization to support the addition of more features, illustrates a blockchain design framework known as the scalability trilemma, which was first described by Ethereum co-founder Vitalik Buterin. The trilemma describes the difficulty of architecting a blockchain that meets all three design goals of scalability, decentralization, and security.

The success of this tradeoff begs question: what makes a blockchain a blockchain? This is an important question for any report comparing alternative Layer 1s. It is not necessarily easy to answer, nor is there necessarily one right answer depending on the circumstances the network participants are aiming for. But, in our opinion, it is possible to encapsulate a key defining feature for layer 1s in this report. That feature for blockchain mechanisms is credible neutrality, which can be defined as a protocol or mechanism that does not favor or disfavor a person or entity, but instead operates the same regardless of its uses. To offer credible neutrality, whereby network participants can be assured the protocol rules are exercised equivalently across participants, blockchains must be decentralized. For the platforms considered in this report, the majority of which use a staking-based consensus mechanism detailed below, stakeholders in charge of running the network must not be exclusively privileged or concentrated into cohorts.

Following in Ethereum’s footsteps, other smart contract platforms were launched that employed different designs to seek an appropriate balance between security, decentralization, and scalability in alternative ways. Many of these chains, in a bid to capture user and developer mindshare from Ethereum, have deployed capital and some form of compatibility with Ethereum on their chains. This approach has allowed these networks to accelerate and grow faster than Ethereum did but ultimately these networks are still struggling to scale. While Ethereum developers hope to sidestep the trilemma by employing sharding and layer 2 solutions like rollups, that development has yet to come to fruition and challenger networks have mostly grappled with the same set of design tradeoffs described in the trilemma. In a way, the challenge for Ethereum is akin to the innovator’s dilemma: can the incumbent (Ethereum) scale faster than the challengers find distribution?

In this report, we discuss several challenger smart contracting platforms that have taken different approaches to blockchain design. We discuss some of the tradeoffs and design decisions made to enhance functionality and performance, but we do not take a comprehensive assessment of these platforms (e.g. we do not assess whether any tradeoffs made are “worth it” to achieve the desired ends of protocol developers); we do, however, conduct an exposition of the design choices made by these challenger networks, discuss some of their burgeoning use-cases, and suggest a way forward for the growing multi-chain ecosystem.

Alternate Layer 1 Blockchains

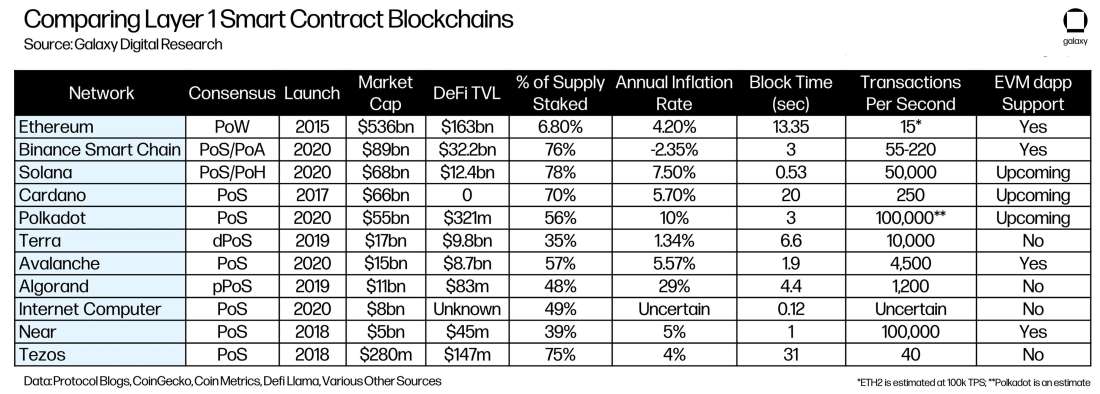

In this report, we focus on several smart contract-enabled blockchains that have grown in both value and usage over the last several quarters. We consider the following networks in order of market cap:

Ethereum

Cardano

Binance Smart Chain

Solana

Polkadot

Terra

Avalanche

Algorand

Internet Computer

Near

Tezos

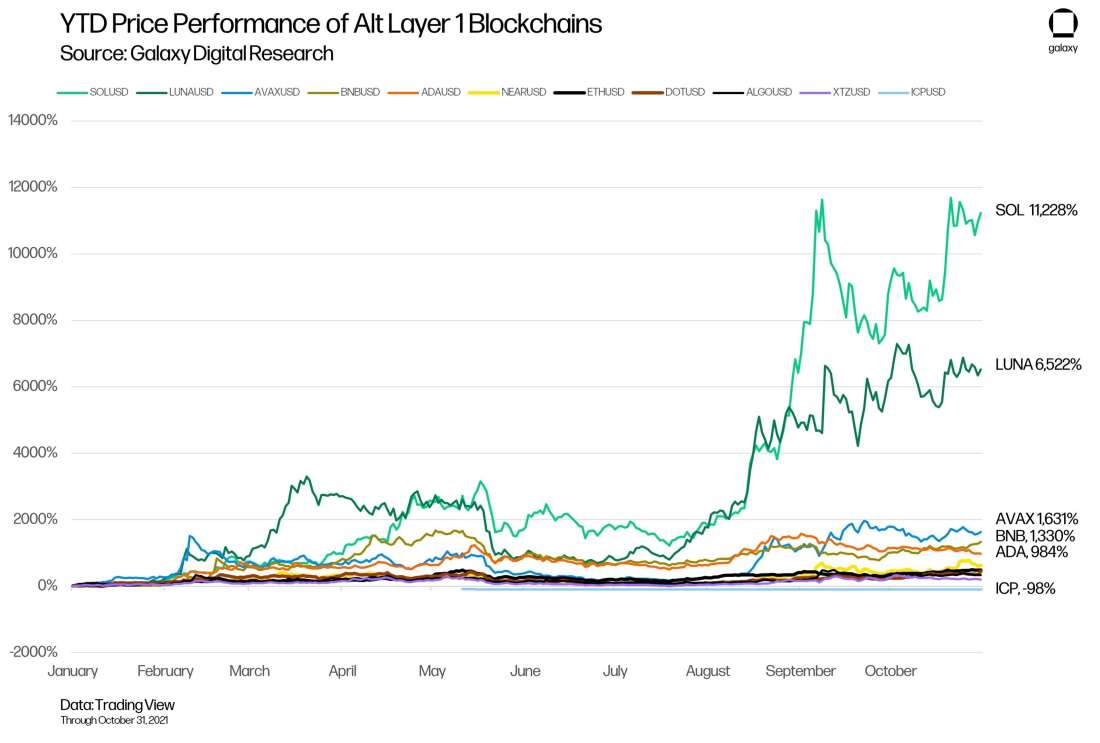

To date, most of these Layer 1s have performed quite well from an investment or trading perspective. This performance over the last 6 months stems from several factors.

Growing Adoption of Public Blockchain Use Cases

With more dapps and services being added to the cryptoeconomy has come a rekindled and growing demand to use public blockchains. The enormous growth in both awareness and usage of decentralized finance, for example, has led developers and users to seek new platforms upon which to deploy new applications. That growing interest has also led to an explosion of private capital interested in allocating to the space, with venture funding at record levels and much of that capital going to new blockchain platforms. However, growing demand has proven a double-edged sword for Ethereum, as high transaction fees have begun to price users out.

Congestion on Ethereum as Usage Rises

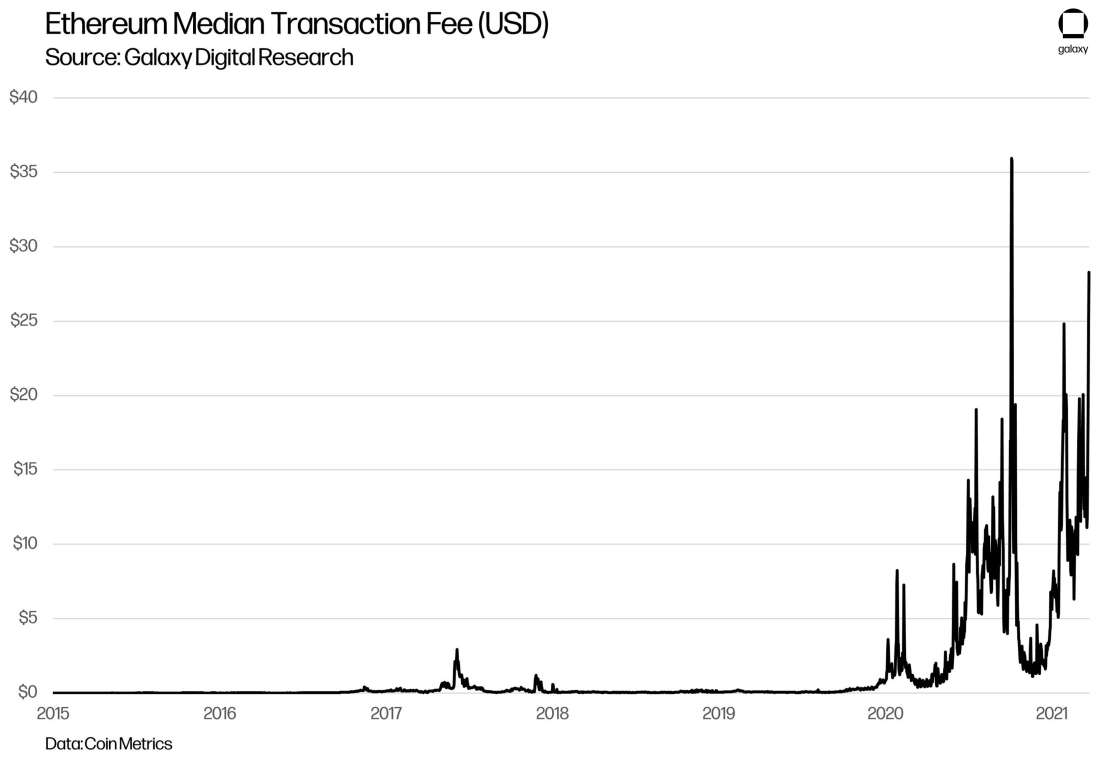

In Ethereum inventor Vitalik Buterin’s own words, the “internet of money should not cost 5 cents a transaction.” Unfortunately for the now congested Ethereum chain, the median transaction fee on the world’s largest smart contract platform has at times risen above $35 in 2021, well above the previous spike in 2017. But even this number, although high, is misleading, as it describes the median fee for simply transferring ETH on the network. More complex transactions, such as depositing collateral into a DeFi application or minting or trading an NFT, are significantly more complex and therefore require more computational power or “gas.” At times, the cost of gas for various DeFi operations has exceeded several hundred dollars per transaction, which is a radical jump from early 2020 when the cost hovered around ten dollars per transaction.

While increased demand and growing usage of smart contracts demonstrates Ethereum is realizing its original vision of serving as a decentralized computer, that usage has led to congestion, pushing some developers and users to leave the ecosystem in search of lower-cost alternatives. In turn, this has motivated a surge in research and development of scaling solutions like rollups, sidechains, and state channels, which should temporarily and (in all likelihood) alleviate the congestion on the Ethereum network, at least until the network shards and hits throughput capabilities equal to or better than the ones offered by centralized servers.

Bootstrapping a New Network

When congestion on Ethereum in 2017 led to high gas fees, there was not yet a thriving ecosystem of alternative smart-contract platforms to meet the demand for block space. To the extent that alternatives existed, there were not functional DeFi ecosystems or even developer tooling for users or developers to employ as they moved off Ethereum. There was nowhere for capital to go and remain productive. Today, the landscape is different, with several challenger smart contract networks not only in operation but carrying their own alternative DeFi and NFT ecosystems. The success of the Ethereum Virtual Machine and its open source accessibility, allowed many challenger networks to bootstrap applications and ecosystems incredibly quickly. But it didn’t necessarily allow these alternative Layer 1 platforms to quickly siphon off users and capital, perhaps the two best metrics for comparing blockchain success.

While high costs and a demand for faster transaction settlement have certainly pushed users off of Ethereum, or in the cases of some new users, kept them off it entirely, alternative chains, many of which are simple EVM copies on PoS wheels, still had to compete amongst themselves for users. Today, the most commonplace way to attract users (at least temporarily) has been to launch applications and offer early incentives for users to utilize these applications and deploy capital there. Additionally, organizations spearheading development funding have captured mindshare by building development funds and programs, some of which have ranged into the high nine figures.

While some Ethereum proponents have argued these incentives are perverse and fleeting, the early capital offerings coupled with new dapps have successfully attracted new users. An interesting trend has emerged out of this funding: the platforms that offer the largest funding tend to witness the highest surges in user volumes. For some of these networks, funding comes from private investment rounds, whereby investors receive a sometimes-outsized portion of the network’s native token supply. In some of these networks, reoccurring validation costs are minimal, meaning early adopters or investors who stake the token can reap new tokens in perpetuity at essentially no cost. While this may not sound problematic, for blockchain networks that are ostensibly defined and valued by their ability to be credibly neutral, the combination of large distributions to early holders and proof-of-stake as a consensus mechanism can result in a small cohort of entities controlling the network in perpetuity.

This trend has created a chicken and the egg problem for new alt platforms. Without early liquidity, it is much harder to attract new capital and users, but early liquidity also makes it much harder to offer users credible neutrality. Below, we conduct an exposition of 11 major smart contracting networks, offering insight into what makes each platform unique. Because the smart contract world is ever-expanding, we had to pick and choose what networks to include. Inclusion or exclusion is not meant as an indication of a favorable or unfavorable view and therefore selection should be considered somewhat arbitrary. Moreover, because sourcing data for these networks, which are typically still in their infancy, is difficult and takes time, our data range from throughout Q3 of 2021. If data is not listed it stems from the lack of data available on these networks.

Comparing Alternative Layer 1 Blockchains

It is worth noting that the 11 networks we compared in this report do not compose the entirety of the Layer 1 smart contracting world. Excluding certain chains was not an indication of a favorable or unfavorable view, but rather done on account of the limitations or impossibility of comparing certain networks. Some of the platforms we excluded, like the Cosmos ecosystem, are building networks out of application-specific chains, targeting scalability, security, and decentralization in a whole different way than the networks listed in this report, while it others were not included due to weak adoption metrics or inherently unsustainable design choices. These requirements for disqualification included (but were not limited to) chains having low levels of transaction volume, odd or hopeless network architecture, or simply being built in a closed-off box. In some cases, these networks have nonetheless performed well in the market, with performance tied more to effective community building than significant development, adoption, or technical viability.

While not exhaustive, certain tangible qualities or metrics can be used to assess blockchain metrics. In the below sections, we offer a few qualitative and quantitative ways to think about network architecture and its inherent trade-offs.

Developer Mindshare

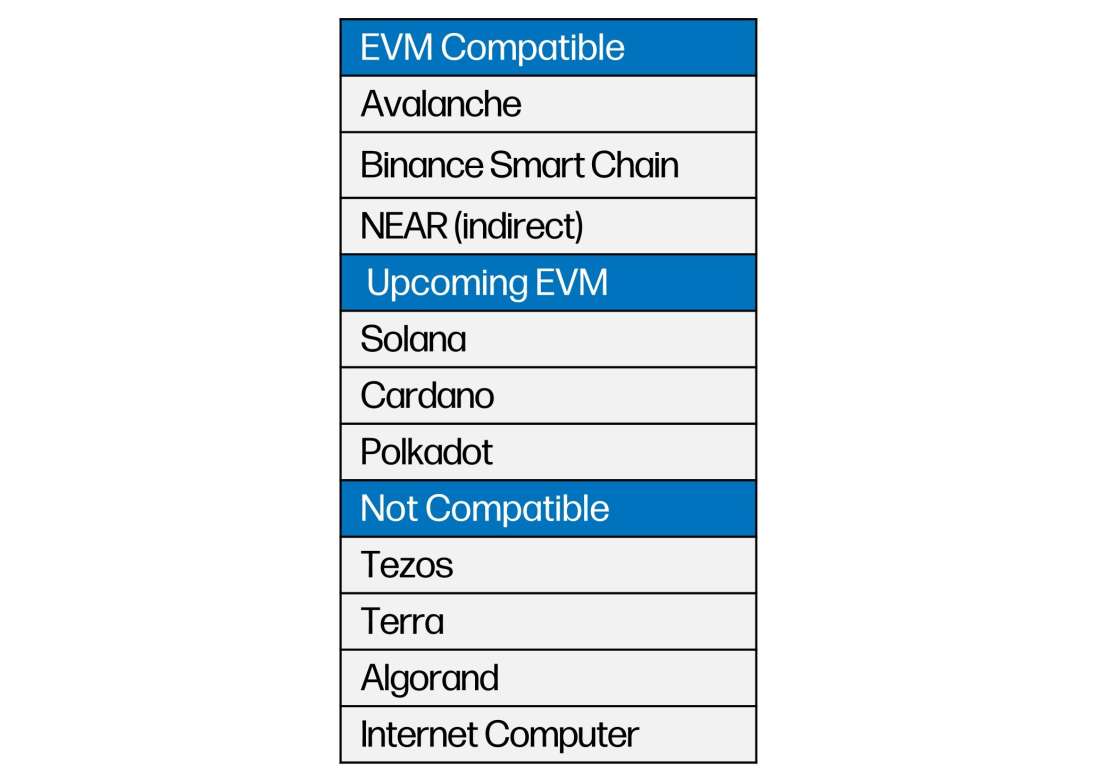

As network goods, value typically accrues to smart contract platforms with more developer mindshare and as a consequence, more decentralized applications. In turn, more applications draw in more users, which again attracts more developers, creating a flywheel. Since blockchain networks benefit from cycle feedback effects, smart contract platforms that are attempting to replicate or surpass Ethereum’s success often bootstrap their applications and ecosystems by forking or replicating Ethereum’s Virtual Machine. While this has proven to be successful for various alternative Layer 1s, enabling them to attract capital and users, initial compatibility with Ethereum and early value accrual are not the only sufficient ingredients for long-term success. Rather, success for smart contract platforms (in the long run) heavily hinges on the amount of developer mindshare platforms can attract. While difficult to directly measure, the number of bookmarks for core GitHub repositories is an indicative proxy of where talent is currently focused.

Based on this proxy, in addition to the plethora of smart contract platforms that rely on the EVM and Ethereum-based dapps for their networks, it is clear that the Ethereum ecosystem holds an outsized amount of developmental resources. Dominant developer mindshare, the best developer tooling, the largest DeFi total value locked, the most smart contract calls, and the biggest market cap, are all clear indications that the Ethereum network, despite its scaling woes, is the highest conviction smart contract bet within the crypto community.

However, as will be detailed below, alternative Layer 1s are closing in on Ethereum’s heels. Some, like Luna, are ostensibly more open to the broader development community (on account of being programmable in multiple languages) while others are putting pressure on Ethereum to scale by coupling its native programming language and virtual machine with faster consensus mechanisms, industrial grade nodes, or even subnets that allow new networks to be built in any language but utilize a base layer for security and consensus.

Consensus Mechanisms

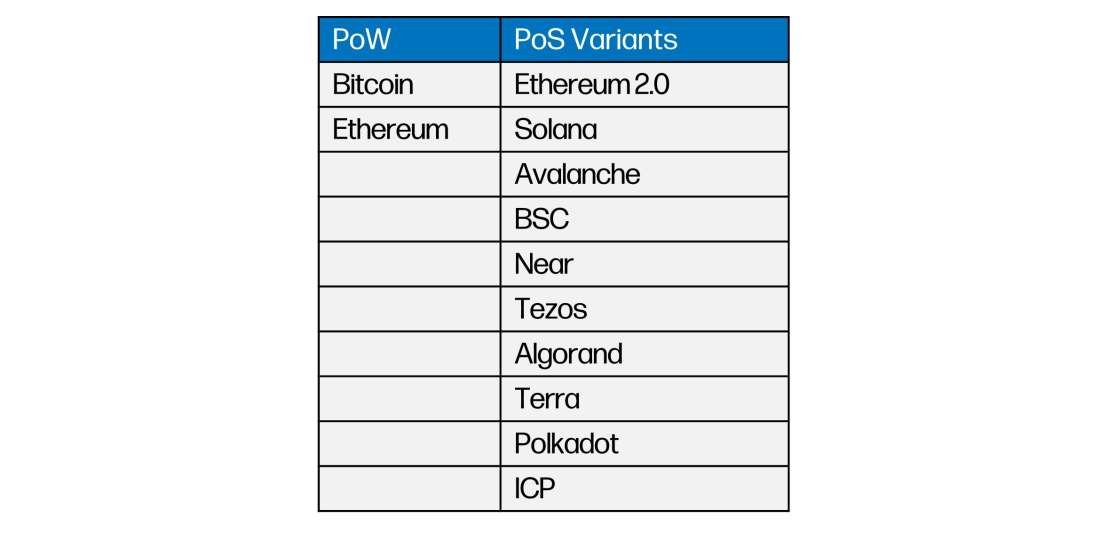

Proof of Work (“PoW”), which is the original blockchain consensus mechanism employed by Bitcoin and Ethereum, allows nodes to verify transaction inclusion based on the computational work completed by the miner who propagated the block of transactions. The work associated with generating a block incentivizes miners to act honestly and earn rewards while the ease of checking a block of transactions ensures that bad blocks are rejected. PoW is completely open, meaning no registration or regulation exists that limits certain entities from mining. You do not need to buy or own coins to participate in PoW mining. However, the highly competitive nature of PoW mining and the outsized cost of competing today does limit large scale mining activities to well-capitalized entities.

Unlike PoW, Proof of Stake (“PoS”) is less computationally demanding. Stakers (or validators), who are analogous to miners for the purpose of this discussion, collect and verify transactions before broadcasting them to the network. But instead of using computational work to secure the network, PoS requires participants to stake an asset, typically the network’s native token (e.g., ETH on Ethereum 2.0). Thus, capital rather than computation determines who can participate in block production. If a staker acts honestly, they earn more tokens; if a staker makes a mistake or acts dishonestly, their stake (or a portion of it) is slashed (destroyed). Some chains have added a delegation process to PoS whereby stakers are selected via votes by other token holders. This variant is called delegated proof of stake (“dPoS”), where tokens act as votes in elections that determine which nodes get to become validators. The likelihood that a validator is selected to add blocks is proportional to the size of their stake.

Unlike the above designs, which are new to blockchains, Proof of Authority (“PoA”) is not actually a method of distributed consensus but instead a euphemism for a network that relies on a centralized transaction sequencer. PoA blockchains aren’t based on any real innovation: while they use cryptographic signatures for transactions and sometimes opt for transparency on the base layer, the sequencer can arbitrarily write history while remaining within the confines of the protocol. In PoA, the only check on an operator’s power is their reputation. Proof of authority has primarily been utilized for testnets for other chains, like Ethereum.

The last consensus mechanism of note is Proof of History (“PoH”). Solana, which is discussed in more detail below, is the network that earned PoH its name. In coalescence with another consensus mechanism, such as PoS, PoH provides nodes and validators with a synchronous clock for ordering transactions. This enables throughput to increase, as the presence of a coordinated clock reduces computation costs for validators.

While specific implementations of PoW, PoS, and other consensus mechanisms differ on their respective chains, bright-line judgments can be drawn from the overall design. PoW networks like Bitcoin have both up-front capital expenses (the cost of the miner, facility, supporting equipment) and ongoing operational expenses (electricity, upkeep, physical security). While validators on PoS chains face both initial and ongoing operational expenses, their operational expenses are dramatically less than in PoW. Namely, the electricity cost tends to be much lower, which ostensibly means stakers can secure PoS chains anywhere in the world with internet, rather than congregating near sources of low-cost electricity. In contrast, miners on PoW need access to large amounts of low-cost electricity, limiting where they can operate geographically. In practice, however, PoW miners are well dispersed and tend to target remote regions with cheap electricity and cooler climates. On net, our analysis indicates PoW and PoS chains incentivize similar geographic distribution, hence neither consensus model can be weighted above the other in terms of geographic decentralization.

It’s also worth noting that PoS chains naturally face issues around both the early distribution of their native tokens and (later) the distribution of the stakers themselves. PoS networks cannot viably ensure a broad base of validators at launch since they only distribute tokens to existing holders of the asset, and the presence of staking rewards in perpetuity with essentially zero cost disincentivizes early holders from selling their coins into the market (which would serve to distribute supply). Once a network’s native token begins to appreciate in value, becoming a staker can be increasingly costly in native terms and therefore increasingly limited to a privileged group of early adopters. Because, on most PoS chains, new issuance is awarded proportionately based on the size of the stake, oftentimes supply distribution (and therefore governance control) of the network will become more centralized over time, not less. There are some methods to mitigate the centralizing effect of PoS, including the use of decentralized staking pools, but long-term supply centralization remains a larger concern in PoS systems than in PoW systems.

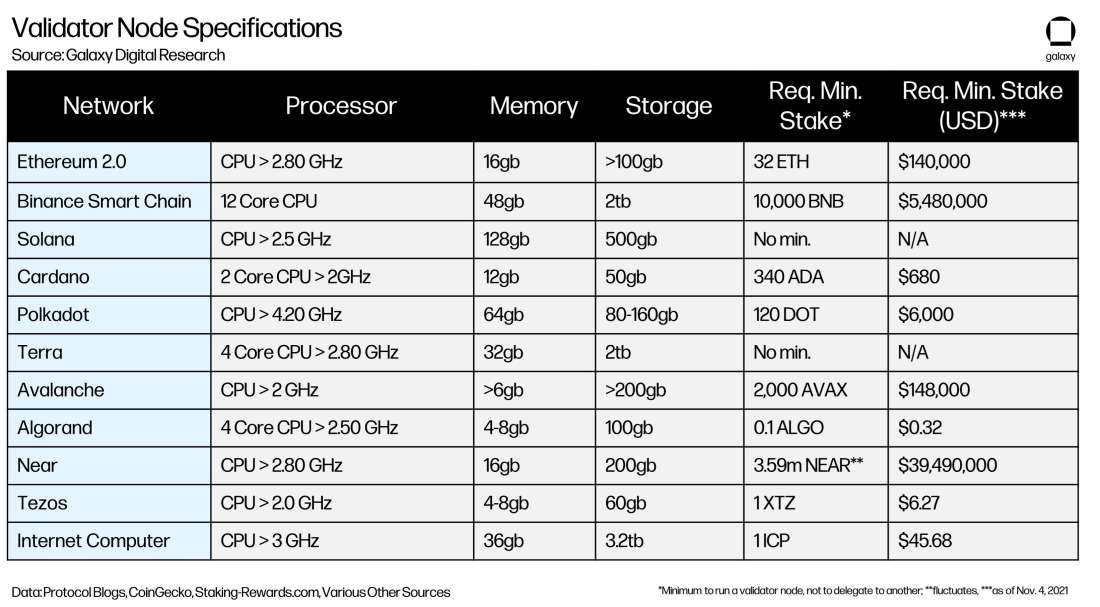

Validator Nodes

Nodes are the core infrastructure that validate and secure a chain. They run the network applications, secure coins, and typically act as a check on other nodes, helping to ensure that the network is and stays credibly neutral. Although there are various types of nodes, in general, validators do the following: validate blocks (rejecting or accepting them), propagate blocks to other nodes, attest to blocks from other nodes, and maintain the chain’s history. Additionally, nodes serve as the access point for users and organizations to utilize network protocols and dapps.

Gathering data on node topology is challenging, but by comparing various node requirements like size, memory, and stake requirements, we can assess the cost of operating the network, which can then inform decisions like whether to join the validator set or evaluate how decentralized a network can be.

Why Decentralization Matters

While networks are structured differently and therefore have inherent trade-offs, these networks, to be considered blockchains, must ultimately offer certain features, namely security, openness, and most importantly, credible neutrality. To that end, these networks must not privilege insiders or allow certain groups or actions to be excluded. The key attribute underpinning these features then is decentralization.

In many cases, systems naturally centralize in search of efficiency. While centralization can bring significant feature enhancements, like efficiency and convenience, centralized systems are inherently more fragile. Systems that rely on the benevolence of a small clique of actors are inherently nimbler than ones governed by a large body, but they’re also subject to that group’s whims. It’s easier to corrupt a small group than a large one, and it’s easier to knockout one node in a network than a hundred.

Decentralized systems, whose components are not controlled by central intermediaries, are highly resilient to disruption. Pushing power out to the endpoints helps prevent concentration of control, which makes it more difficult for value-extracting intermediaries to emerge. Distributed systems expand the commons: they improve access to goods and services and reduce the likelihood of censorship and exclusion. That said, decentralization is a generally inconvenient trait that pays dividends in the face of duress: in other words, decentralization doesn’t matter until it does.

Even in cases where a decentralized system is preferable, it’s typically hard or impossible to implement. It’s difficult for participants in these systems to reach consensus and complexity often results in stagnation or stalemate. Thus, markets have typically sought trusted parties to mediate the consensus process, sacrificing decentralization to achieve higher system functionality. The beauty of Satoshi’s invention was employing a system design in which distributed participants could effectively and quickly agree on the state of affairs without the use of a centralized intermediary. In other words, creating a system that doesn’t rely on trust but rather validation.

Assessing Decentralization

Because failures can result from different aspects of centralization, it is impossible to delineate exactly what decentralization is, how exactly to measure it, or what quantifies sufficient decentralization. Attacks, which can reorganize chain history and previous transactions or lead to consensus changes that invalidate blocks, can ostensibly be geographic, political, direct, or infrastructure-based. This multitude of attack vectors, when mixed with the various consensus mechanisms and protocols that Layer 1s employ, makes comparing levels of decentralization hard. One network might be more geographically centralized but more decentralized in terms of development and funding, making comparisons often subjective. Moreover, as networks are not stagnant and constantly evolving and growing, achieving decentralization over time is possible, meaning any assessment, should it be objective, can quickly become outdated. However, that does not mean certain metrics can’t be employed to give a snapshot of decentralization.

The most popular and widely used measuring stick for decentralization today is the Nakamoto coefficient. This metric assesses decentralization by determining how many of the essential sub-components of a system need to be shut down or co-opted by an attacker for the system to be compromised. In other words, it measures the number of colluding nodes (whether validators or miners) necessary to seize, halt, or otherwise alter the chain’s protocol rules.

While the Nakamoto coefficient is useful, it is still imperfect, as comparing coefficients between chains is often more complex than a simple one-to-one conversion because it requires context. Coefficient comparisons that fail to take into account alternative consensus mechanisms of networks, their varying validation costs and manufacturing infrastructure, and node distribution is not geographically equivalent are useless.

For instance, when looking at Ethereum’s mining pool topography, it's evident that two mining pools, Ethermine and F2Pool, control just under or just over 50% of the network on a given day. This gives ETH a Nakamoto coefficient of 2 or 3, depending on the day. While this seems radically more centralized than a PoS network with a coefficient of 10 or 20, in reality, Ethereum is still one of the most decentralized networks. Hashpower employed by pools is typically more liquid. In other words, miners themselves are widely distributed and can hop from pool to pool at will and, therefore, hashpower can be redirected from an offending pool more easily than staked funds, which must typically be locked for a period of time. Given this context, while the Nakamoto coefficient suggests that Ethereum is more susceptible than PoS chains to attacks through node takeover, the reality is different.

Given the difficulty in measuring decentralization in an evolving blockchain landscape, we did not make any quantitative assessments of the networks’ current levels of decentralization. However, we did include Nakamoto coefficients in our review of Layer 1 platforms in the hopes that it would provide some color on where networks are today. Again, we emphasize that comparing Nakamoto coefficients of various chains without context can be like comparing apples and oranges, particularly when comparing PoW and PoS chains.

Same Bricks, Different Layers

The smart contract platform that does find a way to achieve security, scalability, and decentralization (from the aforementioned scalability trilemma) has a high likelihood of becoming the de-facto platform for all global blockchain transactions. It’s possible none ever achieve this, but different groups are taking different approaches to tackle the trilemma. These include reaching scale after decentralizing, progressively decentralizing network control while reaching scale, or doing them concurrently. Regardless of the way chains are targeting mass adoption, there is clearly no one size fits all method or golden path; if there were deterministic routes, alternative platforms to Ethereum would not exist to begin with. The idea behind the scalability trilemma is that blockchains can only achieve 2 of these 3 features: scalability, decentralization, and security. Blockchain designers need to pick 1 side of the triangle.

Blockchains can be built in different ways and in different formats. Some of the chains we highlight below opt for greater speed at the expense of less security or decentralization. Others, like Polkdato still opt for composability and seek to become the Layer 0 network of all these other networks. Regardless of how they are built, the success of these networks will ultimately hinge on how much mindshare they can attract, how accessible they are to the everyday user, and how robust they are to both attacks and internal malfunctions. Since these networks are all taking different approaches to achieve these ends, it is hard to measure and therefore predict which, if any, will be successful in the long run. Moreover, with different networks targeting different primary use cases, speeds, and user experiences, it is more likely, in our opinion, that no one network wins but rather that the blockchain landscape is composed of a series of interoperable networks.

Examining Ethereum and Alternative Layer 1 Blockchains

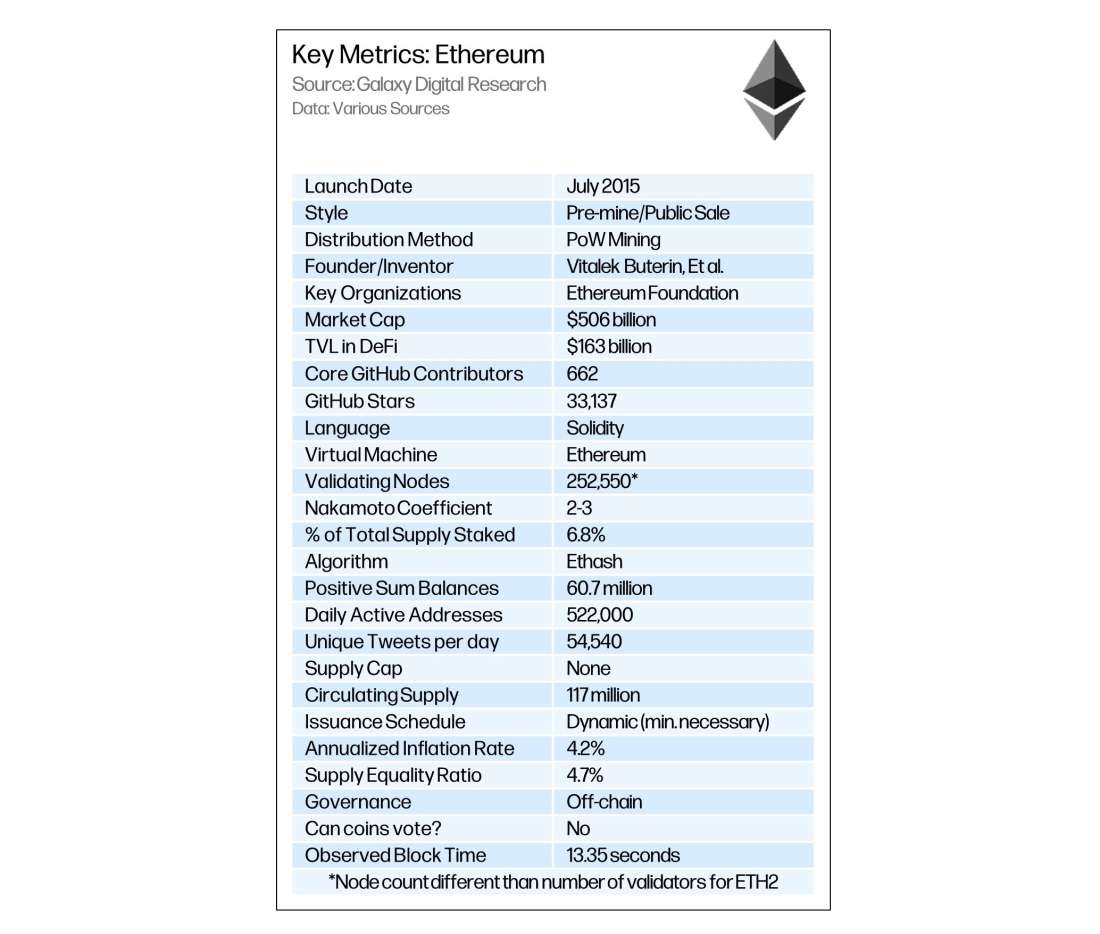

Ethereum (ETH)

Launched in July 2015, Ethereum was the first major blockchain network to gain notoriety after Bitcoin. Built out by a team of developers spearheaded by Vitalik Buterin, Ethereum is designed to be a general-purpose blockchain that ostensibly enables any application to be built on its decentralized foundation. In Buterin’s own words, the Ethereum network is designed to be “a foundational layer for a very large number of both financial and non-financial protocols.”

ETH’s early adopters and developers believed Bitcoin’s scripting language was too stiff and limiting, motivating them to create Ethereum’s native language, Solidity. The chain has been the catalyst for a plethora of decentralized finance applications, including exchanges like Uniswap, lending platforms like Maker, and other innovations like non-fungible tokens and flash loans. These applications drove up the cost of a single transaction on Ethereum from an average of $0.06 at the start of 2020 to today anywhere between $60 to $100. In turn, these costs priced out users, leading to both the development of some of the alternate layer 1 smart contract platforms discussed below and also an increased emphasis on lowering transaction costs as quickly as possible via scaling. Notably, Ethereum’s VM and Solidity programming language have become the de facto standard for smart contracts across multiple platforms.

Ethereum is the only PoW chain we considered for this report, and for good reason: as the oldest, most active, and most successful general-purpose smart contract blockchain, Ethereum settles roughly half the volume (or more) that Bitcoin does on any given day by a number of different metrics. Unlike Bitcoin, however, Ethereum transactions are not only simple payments, but more commonly smart contract calls. Since it pioneered the DeFi space, Ethereum has been the king of the smart contracting world, capturing the most value and the greatest developer mindshare. However, its day in the sun may not last forever, as challenger networks are hot on its heels.

To that end, developers have been emphasized scaling PoW Ethereum via a few different scaling solutions, which include sidechains, state channels, and most importantly, rollups. While these scaling solutions should relieve some of the pressure on Ethereum’s base layer in the short term, developers are banking on sharding the network to scale the platform to perform at a global level. Unfortunately for users, however, sharding still appears years away and will only be deployed after mining is jettisoned in the merge, which will see PoW be replaced by Proof-of-Stake. Because the merge has not taken place yet, our focus remains on PoW Ethereum. Based on our analysis, Ethereum is still the leading smart contracting platform, offering the best assurances of credible neutrality, most DeFi applications, and greatest developer mindshare. But no network is perfect. Ethereum, as a base layer blockchain with set parameters, offers less composability than some of the networks examined later in this report. Moreover, if it is to remain in the top spot, it must scale and innovate before alternative Layer 1 chains achieve distribution and gain sufficient credible neutrality.

Ethereum 2.0 or ETH 2, utilizes a set of PoS validators (currently more than 16,000) to process transactions. These validators must deposit 32 ETH, worth almost $150,000 USD at the time of writing, in order to secure a staking position. The Beacon Chain, which is the backbone of Ethereum 2.0, launched in late 2020 during “phase 0” and is expected to link with the Ethereum mainnet in “The Merge” sometime in the first half of 2022. The chain is the cumulation of hundreds of hours of research and tinkering with blockchain tech by core developers. Should it perform as advertised, the new version of Ethereum will offer almost equivalent security, while also reducing the need for large amounts of electricity and paving the way for sharding, which ostensibly will ready the smart contract platform for truly widespread global use. Given PoW Ethereum has existed for years and the relatively large portion of the current circulating supply that was sold in its public initial coin offering (~70%), PoS Ethereum’s validator set seems poised to be markedly more decentralized than many other general-purpose blockchain networks. Whether its level of decentralization is sufficient and can weather the seemingly inevitable storm of global transaction volumes remains to be seen.

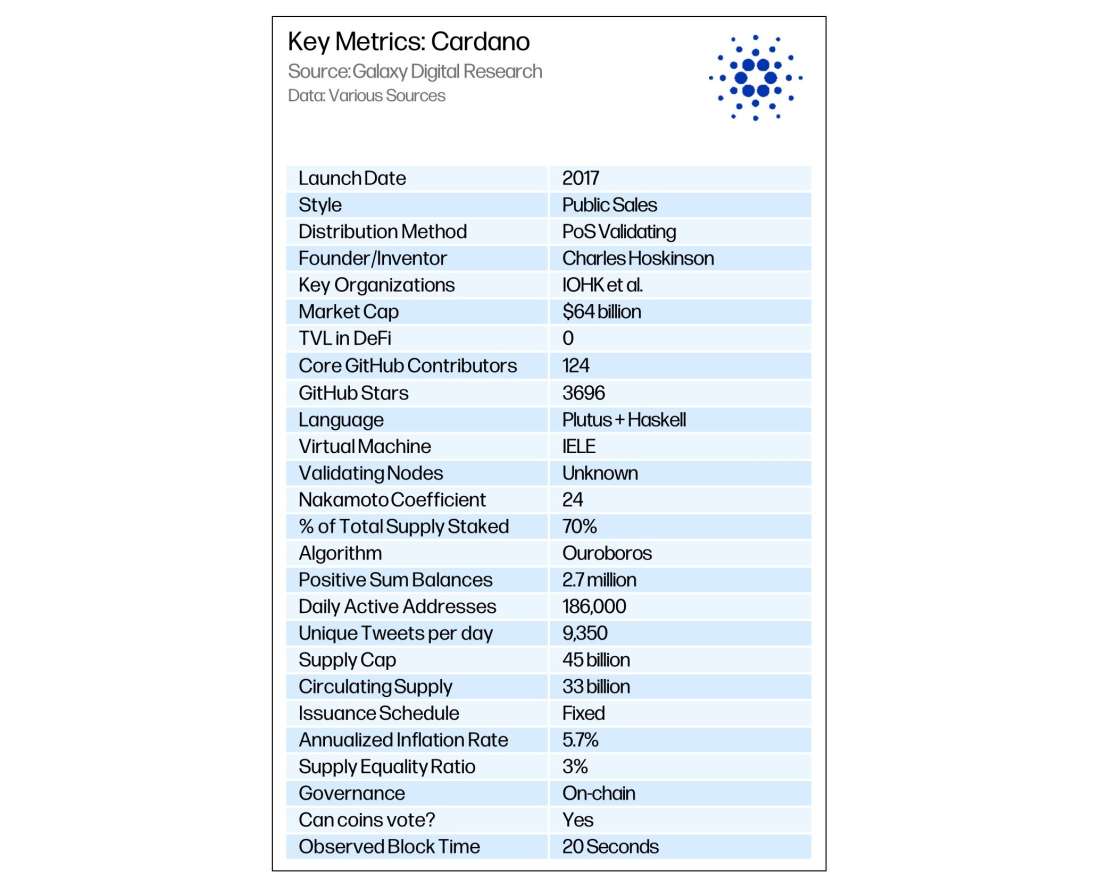

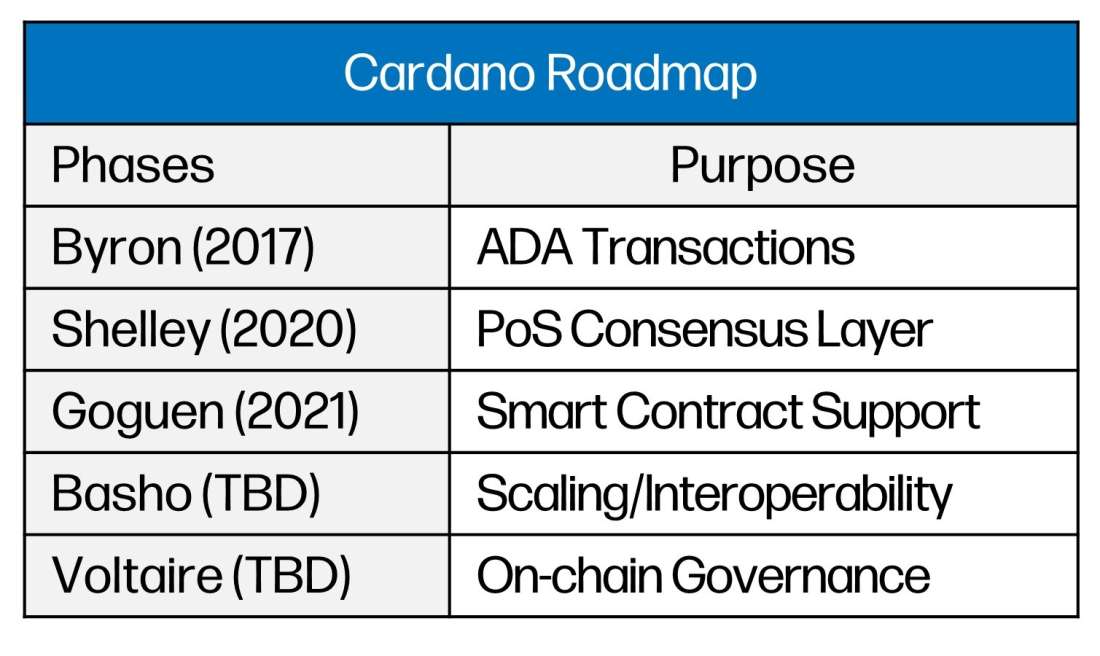

Cardano (ADA)

Led by the one-time Ethereum founder Charles Hoskinson, Cardano is a general-purpose blockchain network that bills itself as a “peer-reviewed network” and the next generation blockchain after Bitcoin and Ethereum. Primarily researched and built by academics, the PoS chain first launched in 2017. Operationally, Cardano is the least developed platform in this report, but that hardly makes the chain unworthy of note. Thanks to institutional and global partners, a developer community that’s been second in size to only Ethereum as of June 2021, and its near-religious following, the network has become one of the most (in)famous chains, earning it a top-five spot by market cap.

After leaving the Ethereum project in its youth due to concerns over interoperability and scaling, Hoskinson helped secure funding for the Cardano Foundation, the entity in charge of development and ecosystem growth, and Input-Output (IOHK), which leads research and development, via a public sale of the chain’s native currency, ADA. Additionally, Hoskinson helped secure institutional partnerships from several universities and nations, including the University of Edinburgh and the Ethiopian government. However, years after launching, Cardano still has yet to find a major use case in production.

Besides its impressive mix of partners, Cardano’s technical design makes it unique. Unlike the other networks in this report, Cardano abandons an account-based model utilized by Ethereum and most of its competitors, instead using the Extended Unspent Transaction Output model (EUTXO), which is more commonly utilized on monetary networks like Bitcoin. The technical differences of these models are small but important; the account model is indeterministic (unpredictable) while the EUTXO model is deterministic (predictable), which ostensibly offers more security, privacy, and lower fees. While at face value those benefits sound nice, the EUTXO model is far from perfect, and detrimental to the creation of complex smart contracting ecosystems.

Because transactions in the EUTXO model are funded from old inputs, which are then destroyed after being used, the EUTXO model, at least in its current iteration, allows anyone to access a dapp’s asset pools to spend funds deposited into the pool. Additionally, this architecture restricts users who access the same dapp by essentially forcing them to compete to spend the same transaction output within the same block period. In other terms, smart contracts, without further development, can only be called once per block, severely limiting the adoption potential of smart ontracts on such chains. To mitigate that problem, dapp developers must put limits on which addresses can access which outputs. Put more simply, the EUTXO model is structurally more complex for dapp developers to build on, meaning it’s far harder to build the interoperable DeFi apps Cardano needs to compete with other smart contract platforms. Workarounds are being developed, but current iterations require some degree of centralization.

Notably, much of the community was in the dark about the design process and system architecture, as the chain’s developers continue to build Cardano in a mostly closed fashion, with IOHK and the Cardano Foundation determining developmental decisions. In the meantime, Cardano users are left to utilize minimally accessible applications and watch as applications on other chains continue to grow, perform, and evolve.

While the chain’s design specifications are concerning, it is important to note that the outcome is not predetermined. Cardano is certainly behind almost every other smart contracting platform considered in this report, but that doesn’t mean it can be written it off – its developers are experienced and the chain is somewhat battle-tested as evidenced by the successful launch of its third phase, Goguen. Moreover, the chain should have EVM compatibility sometime in early 2022 and continue to see other upgrades come closer to fruition. But more than anything, Cardano can bank on the strong community it has formed, which has been the bedrock of its success to date and continues to be one of the most important and underestimated drivers of blockchain’s success. So, while the technology behind Cardano is undoubtedly complex and lagging other Layer 1s, it cannot be counted out – after all, it’s never prudent to bet against a large global community of adherants.

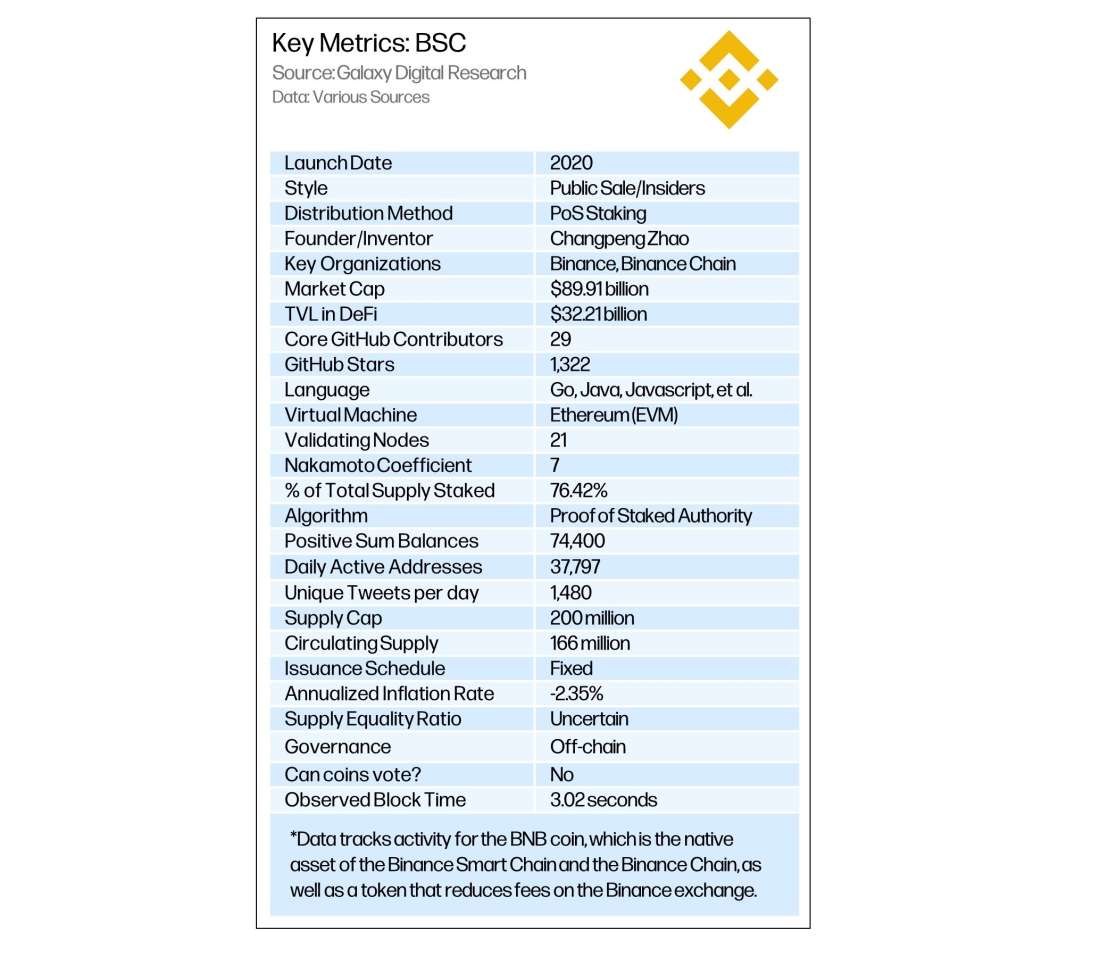

Binance Smart Chain (BNB)

Binance Smart Chain (BSC) is an EVM-compatible blockchain largely supported by its namesake company, Binance, one of the world’s largest cryptocurrency exchanges. BSC was designed as a faster, cheaper alternative to Ethereum, and scales primarily by having a more centralized consensus process and larger blocks. The native asset (BNB) is also the currency of Binance Chain, a separate blockchain previously launched by the Binance team. BNB entitles holders to lower fees on Binance, and Binance buys and burns BNB on a regular basis in proportion to the exchange’s trading volumes. BSC launched in August of 2020, and gained traction in 2021 due to a number of DeFi projects launching on the blockchain with liquidity mining incentives. At the time of writing, BNB is the cryptoasset with the third-highest market cap, making up ~3.28% of the total crypto market cap.

BSC uses a mixture of two consensus models, proof-of-stake and proof-of-authority, to finalize blocks and transactions. Validators on the network are decided upon by total value staked. The top 21 validators controlling the most BNB tokens get to participate in network consensus and governance. Apart from high uptime and secure private key management, BSC validators generally require 48 GB of RAM and 12 cores of CPU, which is on the more costly end of hardware requirements for Layer-1 blockchain protocols. In addition, a minimum of 10,000 BNB is required to be an eligible validator on BSC. However, any amount of BNB can be used to be a delegator on the network. Delegates stake their coins with a validator and receive a share of the validator’s earnings. The annual percentage returns for validators according to StakingRewards.com is 12.35%. In comparison, the interest for delegators is 10.56%.

As of October 29, 2021, there are roughly 166 million BNB coins in circulation. Over three quarters of the total coin supply are used to stake and earn rewards on the network. Apart from staking, holding BNB also gives users the added benefit of saving on trading fees when using the cryptocurrency exchange Binance. As the largest trading platform for cryptocurrencies, Binance is responsible for a quarter of total crypto trading volume, and as the initiator and key participant in the BSC ecosystem, Binance plays a big role in shaping the circulating supply of BNB. Every quarter, the exchange announces a burn of BNB tokens that are removed from circulation. The value of burned coins is equivalent to one-fifth of the company’s profits for that quarter. The 17th BNB burn took place on October 18, 2021 and removed 1,335,888 BNB, worth roughly $639 million at the time, from total supply, suggesting Q3 profits of more than $3bn. At launch, when the BNB coin ran on the Ethereum blockchain as an ERC-20 token, there were 200 million in circulation. Since then, 17% of tokens have been burned and will continue to decrease via such burns by Binance until 50% of the initial supply is removed.

Beyond reducing the supply of BNB, which helps to push up the coin’s valuation, Binance is also bankrolling a $1 billion growth fund for pushing adoption of BSC and the broader blockchain industry forward. Half of this money will go to growing decentralized computing, gaming, the metaverse, virtual reality, and financial services that leverage blockchain infrastructure. According to a Binance blog post written in October 2021, the BSC ecosystem has grown to more than 1 million daily active users spread across more than 900 active decentralized applications.

In terms of protocol development, developers of BSC are working towards implementing a similar upgrade to that of Ethereum’s EIP 1559 upgrade which would introduce a new BNB burn mechanism tied to transaction fees. Instead of the full share of fees being awarded to validators, 10% would be burned and removed from circulation to further accelerate the goal of burning half of the initial supply of BNB. BSC is also expanding its capabilities for interoperability with other blockchains with the introduction of the Wormhole protocol. Wormhole is a communication bridge between Solana and other Layer 1 blockchains which kicked off in August 2021 with inter-blockchain message transfers. Finally, BSC has partnered with blockchain analytics firm CipherTrace to offer its users a more regulatory-friendly network by creating ways to easily assess know-your-customer (KYC) activity across dapps.

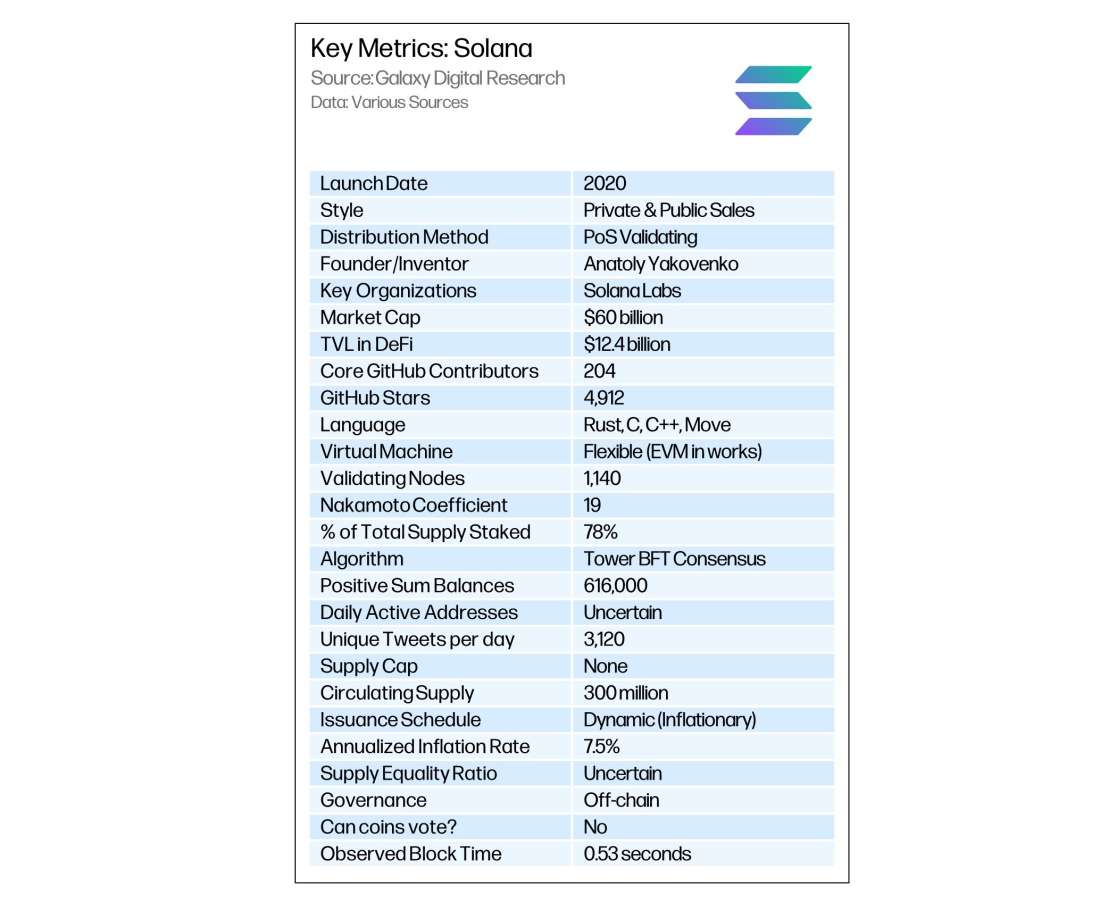

Solana (SOL)

Solana is a network with an emphasis on quick speeds and high throughput. The network launched in March of 2020, and its popularity exploded in 2021 with a massive runup in the price of SOL, which has gained 9300% YTD. Solana relies on a novel proof of history (PoH) algorithm to supplement PoS and enable it to operate with a 400-millisecond block time (0.4 seconds). The network’s low latency has led to a rapid ascent in adoption as users can access various dapps that are mostly equivalent to the ones seen on Ethereum without paying high costs or waiting for slow confirmations. But Solana’s speed isn’t costless, as running a Solana node carries a heavy price tag, making auditing the chain pricey or impossible for average users. Moreover, at just 19 months old, Solana users are arguably sailing on less chartered waters.

Solana utilizes PoS for its consensus and security. So, unlike Ethereum today, Solana needs over 66% of the network to come to an agreement on a block to finalize transactions (instead of just over half the network hashrate in PoW networks like Ethereum and Bitcoin). PoS chains like Solana depend upon the security of the stake validating the network and the IP addresses connecting the validator to the network, thus validator dispersion matters far less than miner distribution. In conjunction with PoS, Solana uses PoH, which enables validators to cryptographically verify how much time has passed between events via a Verifiable Delay Function and, as a result, increase throughput by decreasing latency.

Two security concerns for the network are the high cost of running a node and therefore the high cost of auditing the chain. For Solana, validation costs are upwards of thousands of dollars, as validators need equipment with a 12 core CPU and at least 128 GB of RAM. Moreover, to actually have a net zero or net positive return on a node, validators must stake upwards of $1 million of SOL, meaning the validator set is unlikely to expand to do the outsized cost of running a node. During preliminary analysis of Solana, we connected various data providers within the crypto space, none of whom could provide accurate data due to the high cost of running a validating node.

It is notable that acquiring over 33% of the staked supply is likely impossible for all but the most well-capitalized attackers. Such attackers would have to be willing to see their stake, worth roughly $26 billion at current prices, slashed, and hence, only be attacking the network based on malicious action and not any nominal gains.

At its core, Solana aims to break the blockchain trilemma, increase throughput, and scale by utilizing Moore’s Law, which states that computational capacity doubles roughly every 24 months. Industrial grade hardware and increased bandwidth – not Layer 2s nor sharding – is Solana’s pathway to scale. While questions still abound how feasible or advisable a strategy of scaling via relying on the development of new and powerful hardware is, in the near-term it’s been proven to be a popular alternative to other scaling solutions, garnering significant interest and adoption and ascending to perhaps become Ethereum’s biggest competitor.

While quick speeds and low costs have enabled the network to gain quick adoption, that adoption has not come about without hiccups. Solana has had multiple outages since going live. One of these outages resulted from sporadic forking after the network failed to properly direct transactions during a surge in use. The outage is perhaps the best warning to would-be users and investors alike that even though the chain has seen rampant adoption it is still in its infancy. Needless to say, Solana’s developers and key players, like the aforementioned Solana Foundation, need to emphasize progressively decentralizing the chain if it going to beat Ethereum and the other smart contract platforms and not merely offer more speed and higher throughput at the expense of a more credibly neutral network.

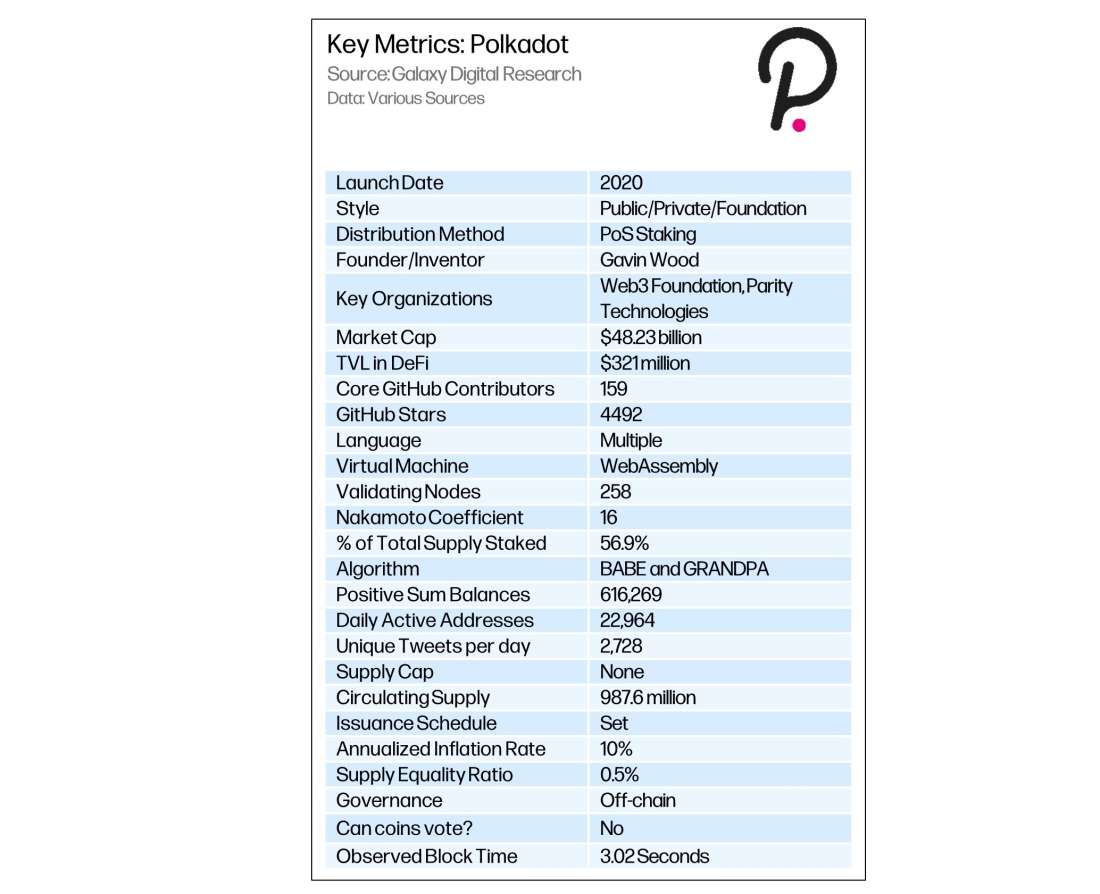

Polkadot (DOT)

The Polkadot network is the contrivance of former Ethereum co-founder Gavin Wood and in his opinion, it is the true fulfillment of the original vision for a sharded general-purpose blockchain network. Polkadot has two components: one half, the relay chain, runs security, consensus, and governance while the other half is made up of application-specific “parachains.” The PoS network’s mainnet has been live since 2020, but parachain support is still under development by both the Web3 Foundation and Parity. While the network is still unproven in many respects, it has managed to garner interest from traders, media, and developers alike.

Unlike the other networks discussed in this report, Polkadot bills itself as a Layer 0 chain or ‘protocol of protocols.” Parachains, which can run smart contracts or be application-specific, connect and ultimately rely on the base layer’s validator set for security, unlike Cosmos, in which each app chain can have its own validator set. Since the performance of the various parachains varies, the base layer Relay Chain, as the bedrock of the network, is what is most applicable for comparison to other Layer 1 networks.

Polkadot is a proof-of-stake blockchain that relies on users called “validators” to propose blocks and finalize transactions. The minimum amount of DOT required to be a validator changes in accordance with how many active validators are already operating on the network. The expected annual yield from new issuance on staked DOT as a validator is roughly 10%. The earnings for a validator can increase from other users’ nominations. A nominator in the Polkadot ecosystem is responsible for selecting good validators, meaning validators that run nodes reliably without much downtime and follow the rules of the network. By nominating validators, a nominator can also share in the staking rewards of the validator of their choice without having to run any of the associated hardware or software.

To run a Polkadot validator node, a user needs to have a computer with 64 GB of RAM, 80-160 GB of storage, and CPU power greater than 4.20 GHz. Compared to other PoS blockchains such as Avalanche, Cardano, and Ethereum, these requirements are slightly more costly. It is possible for a single node operator to run multiple validators at the same time to earn more rewards, but this would require additional stake.

In addition to the PoS network that supports the Polkadot ecosystem, there are also custom, project-specific blockchains that can easily be built on top of the network and share in the underlying protocol’s security, consensus, and transaction settlement processes. These additional blockchains, called “parachains,” are designed to process transactions faster and at lower costs than if users were directly interacting with the Polkadot blockchain itself, sometimes referred to as the “relay chain.”

In an effort to push the boundaries of the types of applications and protocol development that can occur on parachains, developers can also make use of the Kusama network, which is a version of the Polkadot network meant for testing out ideas and code deployments. Kusama and its native coin KSM is significantly cheaper on the crypto markets than the main chain, however, it does still hold real economic value. At the time of writing, KSM was trading at $429 with a market cap of $3.8bn. The Kusama “Treasury,” which is a dedicated fund to support development on the Kusama, holds $2.1 million worth of KSM which it regularly distributes to applicants through an on-chain system of voting.

Since launching in May 2020, close to 1bn DOT has been issued by the protocol. 10 million was the initial supply, 33% of which went to investors such as VC’s who participated in Polkadot’s private funding round and Parity, the company that developed Polkadot’s underlying technology. 42% of the initial supply was allocated to the Web3 Foundation to fund community grants and dapp development on the network. The rest of DOT’s initial supply was distributed through a public token sale. Since the network’s launch, Polkadot has risen to be the eighth-most valuable blockchain by market capitalization at $52 billion. There are over 50 active dapps operating on Polkadot, one of which is a decentralized exchange called Karura Swap. Marketed as the “all-in-one DeFi platform,” Karura Swap launched with over $3.4 million in total value locked and has since garnered attention from top fintech companies like Current.

Terra (LUNA)

Terra, founded by South Korean entrepreneurs Daniel Shin and Do Kwon, was born in 2018 out of Terraform Labs. Terra’s thesis is that stablecoins and payments-focused use-cases are key to increasing adoption of crypto and disrupting traditional finance worldwide. To that end, the Terra protocol was developed with an eye towards stability and integration with existing fiat currency payments infrastructure, particularly in Asia where mobile is the dominant payments mechanism. Terra’s adoption is anchored by a number of partnerships with key e-commerce companies in Asia such as TMON, Qoo10, Tiki, Carousell, and Baemin. The Terra protocol was built using Cosmos SDK and, as a result, leverages the Tendermint Delegated Proof-of-Stake consensus mechanism.

Terra can first and foremost be thought of as an algorithmic stablecoin. There are two primary components of the Terra ecosystem: the protocol’s stablecoins or “Terra Currencies” and the protocol’s native currency “LUNA”. In order for the protocol to mint a new Terra stablecoin, such as UST, the protocol must burn a portion of LUNA. The idea behind this algorithmic monetary policy is that as demand for Terra stablecoins such as UST rises, LUNA supply will be burned and diverted to UST’s supply. This mechanism has the effect of both stabilizing UST’s price to its $1 peg, by adding more supply, while increasing the value of LUNA by reducing its supply (and vice-versa).

The Terra stablecoins can be thought of as region-tailored electronic cash which leverage blockchains for both faster payments and lower fees than what is normally possible through traditional fiat currency. LUNA can be thought of as the protocol token used to both lock money into and govern the Terra ecosystem. The key concept driving Terra’s token economics is encompassed by seigniorage. In simple terms, seigniorage is the spread between newly minted currency and the cost of issuing the new capital. Because all seigniorage in the Terra protocol is burned, the LUNA token is deflationary in nature. This incentivizes people to inject capital into the Terra ecosystem.

Similar to other PoS chains, validators on Terra secure the network by running full nodes which verify each transaction. Validators earn staking rewards from transaction fees in exchange for proposing blocks, voting on blocks, and adding new blocks to the ledger. Any user with a LUNA balance can delegate their balance to a validator and share in that validator’s staking rewards. While the protocol only allows the top 130 validators to actually participate in consensus, the composition of each validator’s bonded LUNA balance comes primarily from outside delegators. A given validator has a higher chance of being chosen to propose a new block based on its staked balance relative to the rest of the network. It is important to note that end-users delegating their balance of LUNA to a validator maintain control of their LUNA. The only caveat to this is when a user “unbonds” their balance from a validator, there is a 21-day lockup period where their LUNA can neither accrue rewards nor be freely traded. However, this 21-day lockup period can be bypassed if an end-user simply wants to delegate their balance to another validator (though this process will trigger a 21-day lockup if the user tries to do this consecutive times). In line with other COSMOS-based blockchains, validators on Terra can have their balance slashed for the following reasons: double signing, downtime, and missed votes.

From a governance standpoint, new proposals can be generated by anyone in the Terra community. In order to guard against spam, the proposing party must then collect at least 512 LUNA within two weeks of the initial proposal. Only when this threshold is met will the user’s proposal go to a community-wide vote. If >40% of all staked LUNA casts a vote on the proposal and < 33.4% of the total vote is not “NoWithVeto” and the number of “yes” votes is >50%, then the proposal is immediately accepted by the protocol. In the case that >33.4% of the vote is “NoWithVeto”, all of the deposited Terra for that proposal gets burned in order to disincentivize abuse in the system.

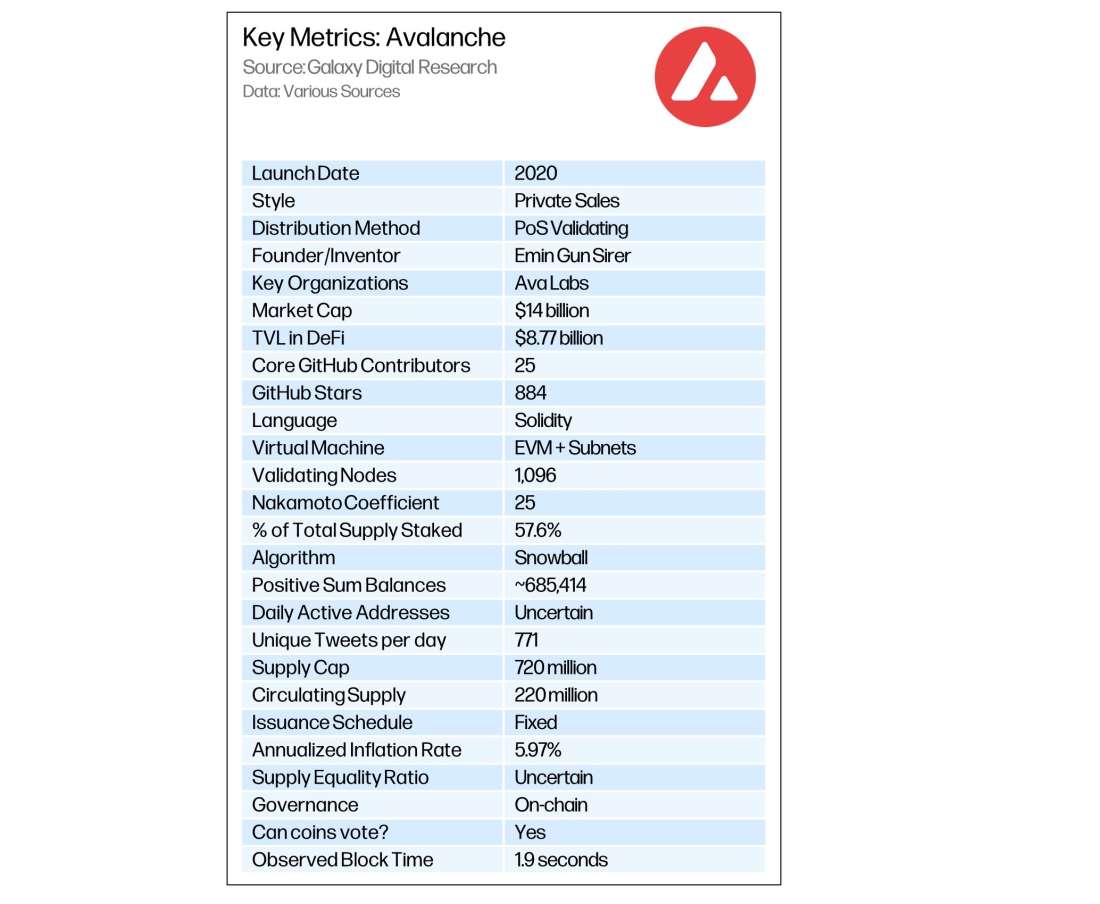

Avalanche (AVAX)

Avalanche was developed to address scaling concerns with Ethereum. The network uses an alternative consensus mechanism based on PoS that purports to ease transaction bottlenecks stemming from block validation in Ethereum’s consensus process. While at face value Avalanche may just seem like another fast alternate Layer 1 for smart contracting, Avalanche is an innovative network made up of three interlocked chains that offer near-instant transaction finality. Fully compatible with the EVM, the network was able to quickly grow in popularity thanks to both its ability to port developer mindshare directly from Ethereum and due to an outsized liquidity incentive program. Avalanche launched in March 2020 and is the brainchild of Emin Gün Sirer, a computer scientist and professor at Cornell University.

The three chains that make up the core of the Avalanche Network are the C-Chain, which executes EVM smart contracts, the X-Chain, which handles the creation and exchange of assets, and the P-Chain, which coordinates validators. Validators and subnets (which are secondary networks connected to Avalanche) stake AVAX onto the P-Chain to validate the three core chains.

When compared with Solana, the cost to validate Avalanche is cheaper, but on the whole still somewhat expensive. While any PC with 2GHz of CPU and a 4GB RAM can validate, nodes must stake at least 2000 AVAX tokens (~$123,000) to secure a staking spot.

Interestingly, Avalanche, unlike every PoS chain, does not slash the stake of malicious or negligent validators. Instead, it uses its own consensus mechanism, Avalanche consensus, to allow for the leaderless selection of blocks. In this model, validators randomly and periodically sample the chain’s state chain until a majority forms a consensus on the current state. Stakeholders are incentivized to stay live and honest by rewards staying time-locked until a predetermined time expires.

To date, Avalanche's main network, which again hosts an EVM-compatible chain, has hosted the majority of user activity. The network is still actively working to onboard or build other networks into its subnet while also working to diversify developer funding and node manufacturing away from Ava Labs, which is the primary development entity today. Recently, a few AVAX stakeholders voiced their frustration with Ava Labs for pushing through an update without any “discussion, voting period, or snapshot governance,” highlighting that Avalanche is still in a maturation phase.

Out of the PoS networks we accounted for, Avalanche has one of the highest active validator counts (1,096) and Nakamoto Coefficients (25). Additionally, its consensus mechanism enables the validator set to potentially grow unbounded, meaning the network could maintain its top spot in perpetuity, further increasing levels of credible neutrality. Lastly, and perhaps the key to its popularity, the chain offers near-instant finality and low fees.

While the network has outpaced most of the smart contract platforms currently in existence and has been the testing grounds for a novel consensus mechanism, it goes without saying that the network owes much of its early and quick growth to past progress by the Ethereum ecosystem. Going forward, Avalanche’s success may hinge on its ability to siphon mindshare away from Ethereum (and into its EVM chain) and successfully host and validate subnet networks while also disseminating control of the chain’s infrastructure away from just a few parties.

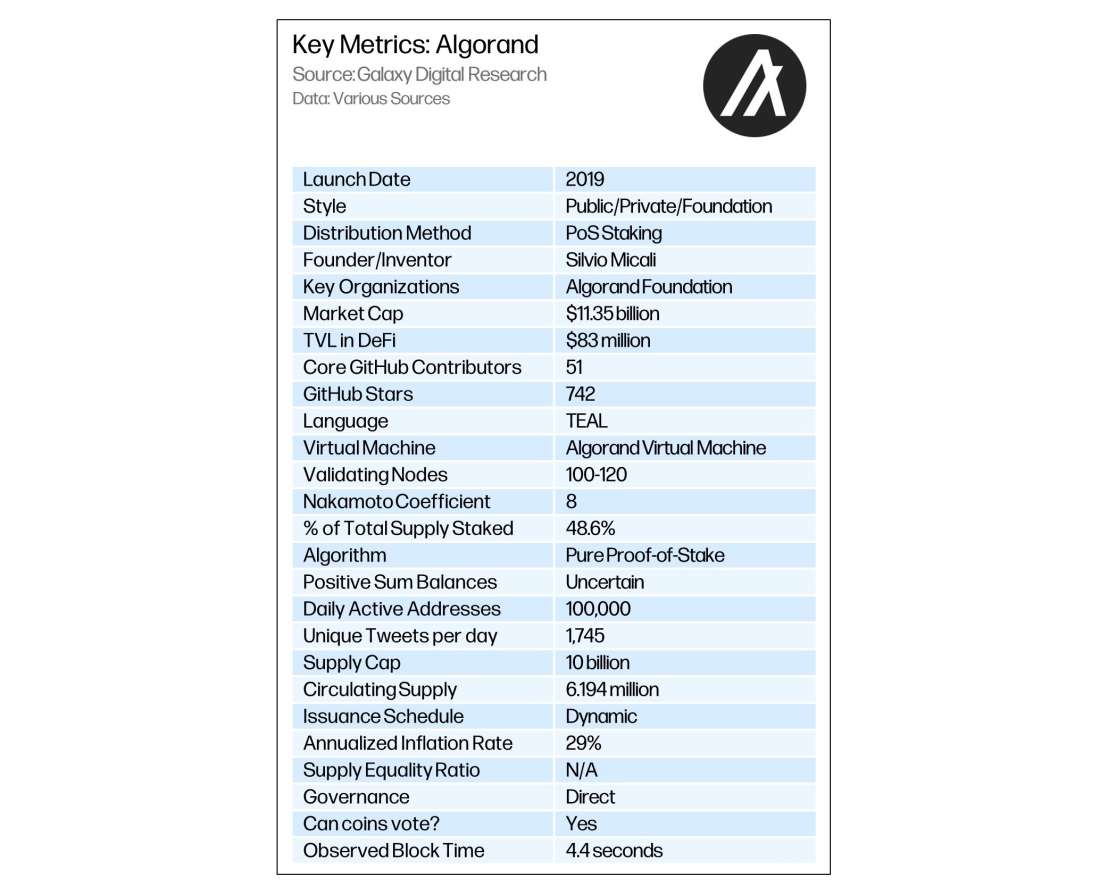

Algorand (ALGO)

Algorand is a general-purpose blockchain network that utilizes a variant of PoS called pure proof of stake (PPoS). In PPoS, participants still deposit tokens, namely ALGO, to acquire a validator spot, but unlike in traditional PoS systems, the number of tokens necessary to stake is much lower and no slashing of validator funds occurs whenever validators act dishonestly. While lower staking costs ensure broader participation, it also ensures the cost of malicious action is much lower than on alternative PoS platforms. Despite supporting several coding languages and being a fast alternative to other layer 1s, the chain has witnessed only low levels of adoption since its mainnet went live in 2019. Algorand was the brainchild of Silvio Micali, a renowned computer science profession at MIT.

Algorand’s protocol relies on one validator set and one chain, similar to how BSC, Ethereum, and Solana operate. In other words, all transactions on the Algorand network are secured by one security framework attached to one blockchain. The Algorand protocol is split into 2 layers in order to achieve its high transaction throughput. The first layer is responsible for running basic smart contracts which encompass everyday transactions (such as sending ALGO from one wallet address to another). The second layer can run the long tail of more sophisticated transactions (such as calling the ZK-STARKs library for privacy purposes). Because the execution of layer 2 transactions occurs off-chain, the throughput of the base, layer 1 chain is preserved. Layer 2 transactions only post to the base chain when they have finished executing. Layer 2 transactions are thus non-blocking to the Algorand network. This stands in contrast to protocols like Ethereum which process all contract calls sequentially, regardless of how complex a particular smart contract function call is. Networks like Ethereum see a tremendous amount of congestion when Ethereum-based NFT activity is high. The contract calls associated with NFTs can take long time to process and demand a large amount of the network’s computational resources.

The Algorand network contains two types of nodes: relay nodes and participation nodes. Only participation nodes can propose and vote on blocks, and participation nodes can be run on a basic computer. Relay nodes are network hubs that propagate information across the network rapidly by handling a high throughput of data and connecting to many participation nodes. They require robust compute resources coupled with extremely performant internet. This hybrid approach helps improve the scalability of the network at the cost of decentralization. While anybody with an ALGO balance can run a participation node to maintain the network’s consensus, only 100 validators have so far been approved to run relay nodes. These 100 participants, while geographically distributed across the world, are a mix of Algorand insiders, investors, and affiliated academic institutions.

The pure proof of stake consensus mechanism for Algorand involves 2 stages: proposing and voting. During the proposal phase, a verifiable random function (VRF) is used by the network to randomly select a block leader who will propose the network’s current block. The probability of one participation node being chosen as the block leader is weighted by the size of that node’s stake relative to the network, and only the block leader knows that it has been chosen. During the voting phase, the network randomly chooses a committee of voters to vote on a block proposed by the block leader. Once the committee reaches consensus, the block gets certified and added to the ledger. Both the committee and the block leader get rotated for each block. The cost to participate in consensus as a participation node is neither high computationally nor in terms of a minimum staking requirement. However, most current relay nodes were early investors and stakeholders in Algorand who were grandfathered into a special arrangement granting them outsized Algorand rewards in return for scaling the throughput of the network from the onset.

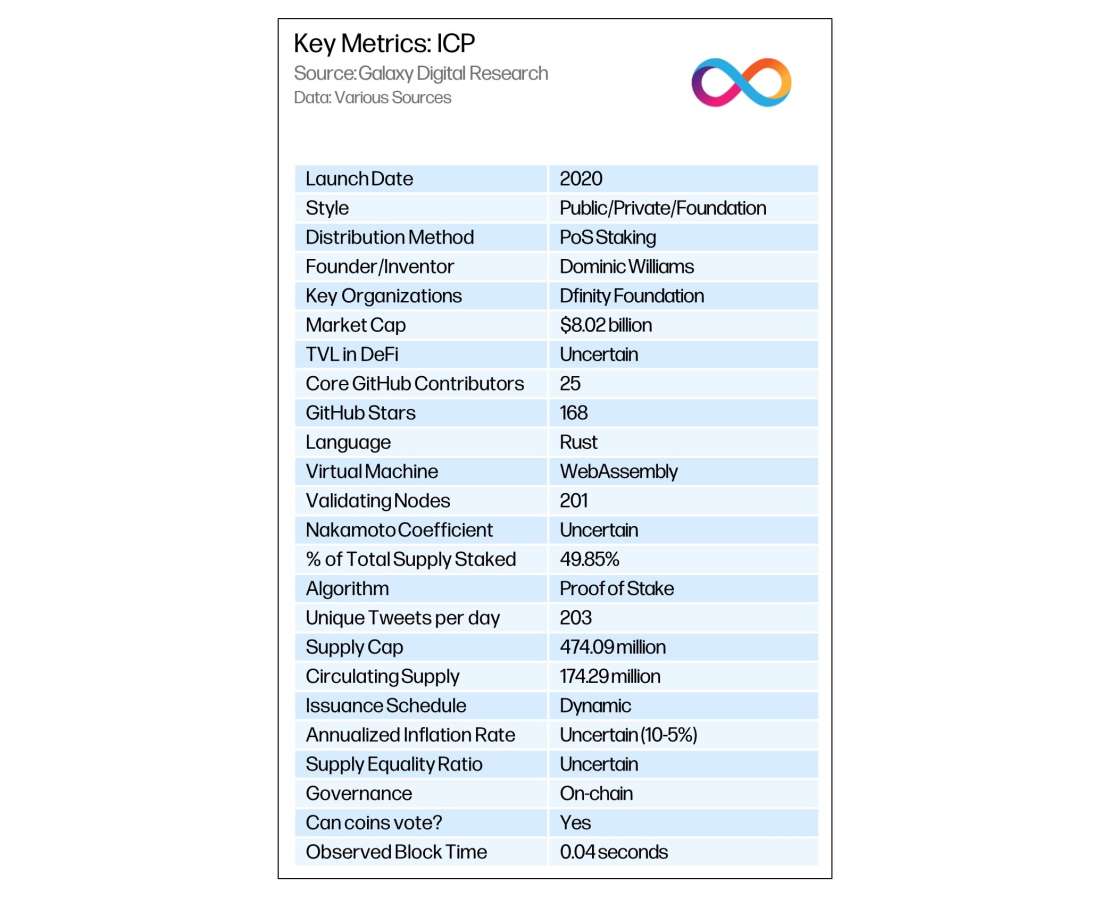

Internet Computer (ICP)

Developed by Dfinity, the Internet Computer aims to take on the modern internet tech stack in the same way Ethereum and other general-purpose blockchains are pitting DeFi against traditional finance. In particular, the Internet Computer seeks to obviate the role of cloud computing platforms. Dfinity raised venture money to build the Internet Computer in 2016 from investors including Andreessen Horowitz and Polychain Capital. Its alpha mainnet went live in 2020, and the public debut of its native token ICP took place in 2021.

ICP is the primary token in the Internet Computer Ecosystem. A second token, cycles, can be created by burning ICP and can be used to pay for computational resources on the network. Cycles are similar to gas in Ethereum, in that their price fluctuates relative to the demand for computational resources. Unlike gas, though, cycles are represented as an independent, secondary token. This allows users to transfer cycles, or create them ahead of time in anticipation of increased demand as a way to speculate or hedge.

ICP operates as a PoS network, where the validator set is a group of data centers. Users and developers interact with the network through canisters, which are computational allocations similar to Amazon EC2 instances. Canisters can also be thought of as comparable to Ethereum smart contracts, in that they self-execute code defined by their developer on-chain. Each canister has a storage capacity of 4 gigabytes, and computations involving canisters are paid for in cycles. Through canisters, the main ICP chain can be used as a hub for secondary chains similar to sidechains.

ICP can be staked to participate in the network’s governance process. The network’s governance process chooses which data centers are allowed to participate and the extent to which they operate on the network. It also votes on upgrades to the protocol and canister smart contracts. Stakers are required to lock up funds for a period of time to ensure that holders are ideologically invested.

As of November 4, 2021, ICP has risen to a market capitalization of nearly $8 billion. Over 1.5 million internet identity anchors have been created on ICP, which are the accounts that users create to interact with dapps on the protocol. Initially to promote dapp development on the network, Dfinity launched a fund of nearly a quarter of billion dollars to support the creation of new smart contracts and social networks on ICP. Looking ahead, protocol developers are planning to roll-out a number of new network features and functionalities, including integration of ICP with the Bitcoin network and Ethereum.

Given the recent surge of popularity for gaming dapps like Axie Infinity on Ethereum, the Dfinity Foundation has partnered with a leading esports media and marketing organization called United Esports to attract game developers of their own to build on ICP and in the words of founder Dominic Williams build some of “the best games ever built on blockchain.” Called Achievement Unblocked, this new joint initiative will award $10 million to the top ICP game developers, as well as other grants, mentorship, technical support and seminars.

Distribution of the ICP token has also diversified since the network’s launch in 2020. Along with cryptocurrency exchanges such as Coinbase, digital asset banks such as Sygnum offer users custody and trading of ICP. Sygnum also provides computing power to the ICP network by operating nodes in data centres across Switzerland. The regulated bank is also a key member of the Internet Computer Association (ICA), which is an organization that helps coordinate ecosystem participants around ICP governance proposals. “We believe that the decentralised and open nature of the Internet Computer will spark a wave of innovation across internet services, software platforms, and user experiences”, said Manuel Krieger, member of Sygnum’s Board of Directors in a blog post from May 2021.

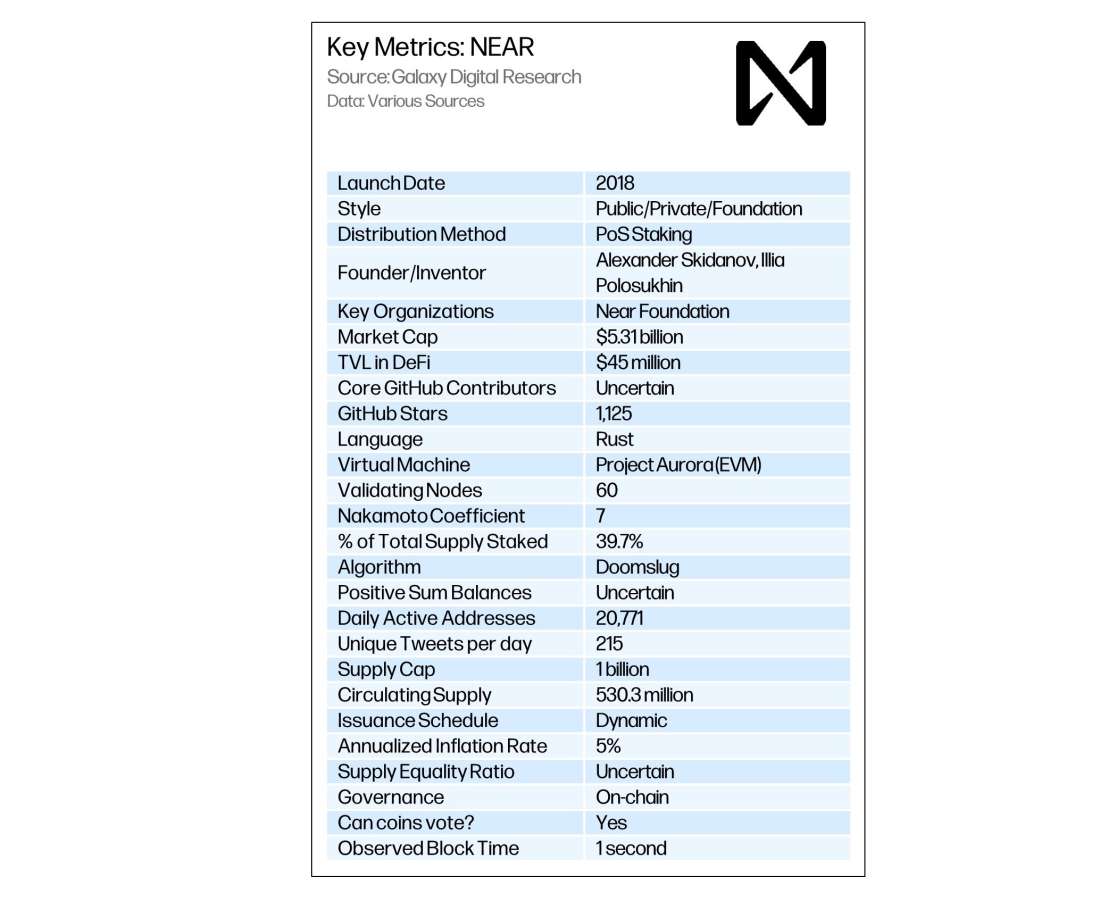

Near Protocol (NEAR)

Founded by Illia Polosukhin and Alexander Skidanov in 2017, NEAR is a smart contract blockchain platform designed for scalability and speed. The main protocol launched on April 22, 2020 with 1 billion NEAR coins created at genesis. Roughly 40% of these initial tokens were allocated to investors, meaning VCs and early protocol developers. Compared to other public blockchain launches, such as that of Ethereum, Cardano and Cosmos, a smaller share of NEAR’s initial token supply was allocated through a pre-launch coin sale open to public participation. Nearly $50 million was raised for the NEAR protocol through private token sales. Initially raising funds through venture capital and a private sale and then selling to the general public through a platform able to manage know-your-customer information and compliance has become an increasingly popular way of blockchain fundraising.

In order to achieve network speeds of 100,000 transactions per second, NEAR combines a proof-of-stake (PoS) consensus protocol with sharding architecture. Sharding as applied to blockchains is a method of splitting and storing transaction data across multiple smaller blockchains called “shards.” Due to the complexities of a fully partitioned blockchain, NEAR has not yet fully sharded the network and, like Ethereum, will release upgrades in phases to eventually reach scalability.

To produce blocks and validate transactions, the NEAR protocol operates under a novel PoS protocol called Doomslug. Network stakeholders called validators are responsible for proposing blocks and voting on which ones should be added to the canonical version of the chain. While there is no minimum amount of stake needed to be a validator, they are required to run specialized software that can stay connected to the network at all times. This requires a computer with at least 16 GB of RAM, 250 GB of stage, and an 8-Core or 16-Thread CPU.

In exchange for running hardware supporting the network’s consensus protocol, validators earn roughly 11% in annual yield generated by new supply issuance. Collectively, their rewards amount to 90% of the network’s annual inflation, which grows the coin supply by 5% each year. The other 10% of supply growth goes to the Protocol Treasury, which is a dedicated fund for NEAR ecosystem development. Earnings are doled out every 12 hours and dependant on the number of blocks a validator has either proposed or signed off on. Delegation of a user’s funds to another user is not supported natively within the NEAR protocol. However, there are smart contracts that do facilitate delegation of stake to other validators. These contracts are usually created and operated by staking-as-a-service providers such as Staked, Bison Trails, Figment, and Everstake. As of October 29, 2021, 61 validators have staked over 421 million NEAR, which represents 40% of the total coin supply. In addition, the network has grown to process over 1.5 million on-chain transactions from over 50,000 active accounts. The majority of this activity however, now comes from decentralized application activity. StateoftheDapps reports a total of only 20 active dapps on the platform, many of which have little to no 24-hour user activity or transaction volume.

In efforts to boost dapp activity and development on-chain, NEAR developers have created a bridge to Ethereum called the “Rainbow Bridge” that enables tokens and other assets to move freely between the chains. This means that stablecoins, wrapped assets, decentralized exchange tokens, lending tokens and more can seamlessly migrate between NEAR and Ethereum. At the time of writing, $20m was locked in the Rainbow Bridge contract on Ethereum. Additionally, the NEAR Foundation announced in October 2021 the launch of massive $800 million fund dedicated to providing grants to builders of decentralized finance applications, non-fungible tokens, and decentralized autonomous organizations on the platform. Already, $45 million of these funds have been allocated to various projects building the NEAR ecosystem.

There are also Layer-2 protocols on Ethereum that are starting to use NEAR and its consensus mechanism as the backend to facilitate fast, low-cost transactions. Aurora, which is a Layer-2 Ethereum protocol built on the NEAR blockchain, completed an equity fundraising round of $12 million led by Pantera Capital and Electric Capital in October 2021.

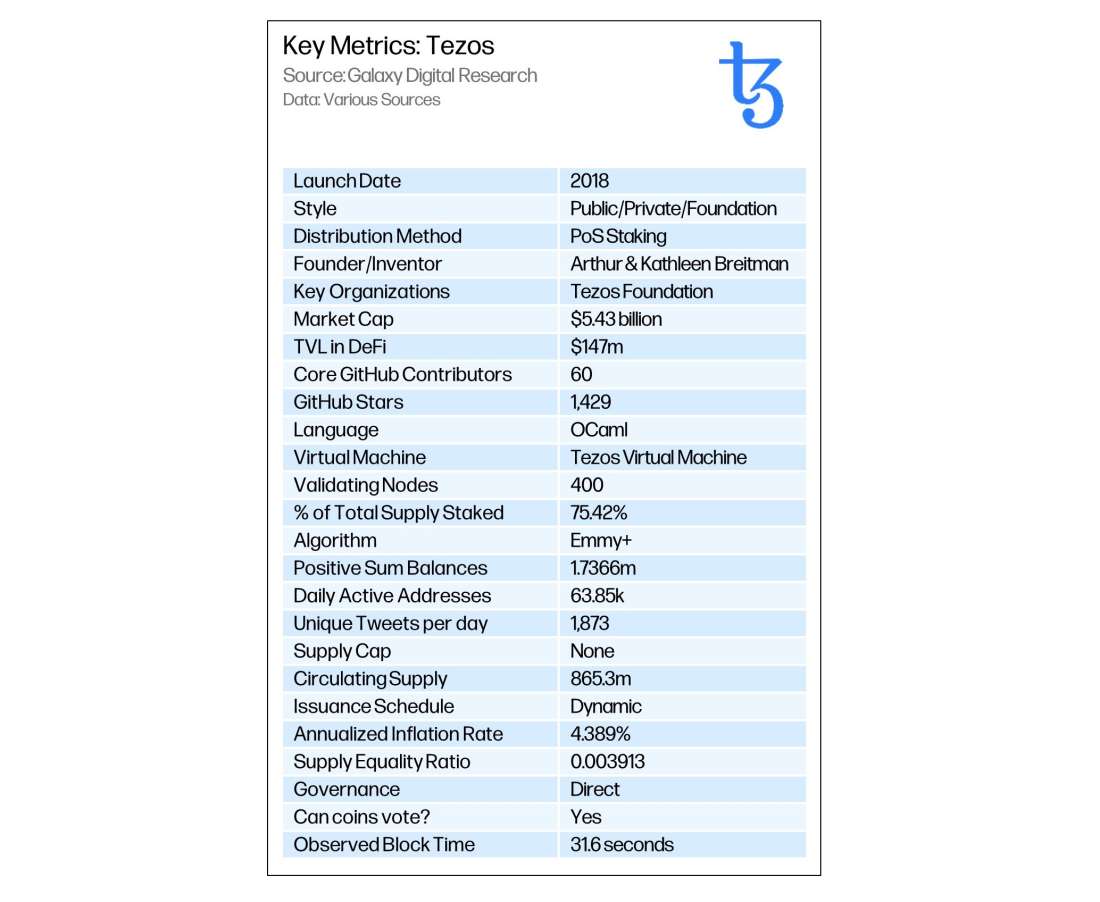

Tezos (XTZ)

Tezos is one of the oldest alternative L1 platforms, having launched on mainnet in June 2018 by Arthur & Kathleen Breitman as a relatively early proof of stake project. Unlike many of today’s L1 projects, Tezos launched with its own smart contract language that sought to address security issues with Solidity and the EVM. Tezos has been comparatively slow to achieve adoption, in part due to its EVM-incompatibility. That said, Tezos achieved some popularity before Ethereum 2.0’s launch as a pilot for staking; NFT creations on the blockchain have also gained some attention due to high-profile partnerships with the likes of McLaren Racing and Doja Cat.

Tezos’ consensus algorithm is a delegated proof-of-stake (DPoS) system where users can participate in the creation of new blocks and earn rewards on the network by staking XTZ. The annual yield on stake is roughly 6% and does not require a minimum amount of stake for a user to get started. Normally, users are required to run specialized software called nodes to connect to the Tezos blockchain. However, in exchange for reduced earnings, users can delegate their stake to another user who will run a Tezos node on their behalf.

Tezos nodes require a reliable internet connection, 8GB RAM, and at least 100 GB of storage. In comparison to the specialized mining machines of most proof-of-work consensus protocols such as Bitcoin and Ethereum, Tezos’ requirements for running a node are much more accessible to the average user. As of October 28, 2021, there are 380 active node operators, also called active “bakers,” earning rewards on the Tezos network.

Aside from using XTZ to earn rewards, holders of the cryptocurrency can also use the coin to vote in governance proposals about the development of the Tezos blockchain. Unlike Bitcoin and Ethereum, all code changes to the network are decided on by direct or representative votes of XTZ holders, which means that the protocol has never undergone a chain split because of a contentious upgrade. This governance mechanism allows Tezos to “self-amend” by automatically initiating a four-step process that runs through code change testing and deliberation.

Another notable aspect of Tezos’ governance history is the way in which funding for the protocol was first raised. The creators of Tezos, Arthur and Kathleen Breitman, raised $232 million in an initial coin offering, which at the time was a record high for funds raised through an ICO. The funds were allocated to a Swiss-based entity known as the Tezos Foundation, set up to help finance development and continued maintenance of the Tezos protocol.

However, the Breitman’s had a falling out with the board members of the Tezos Foundation headed by Johann Gevers. The disagreements between the board and the Breitman’s were publicly exposed after internal conversations were leaked to the news publication Reuters, who wrote a scathing article about the conflict on October 18, 2017. The uncertainty over Tezos’ future then significantly impacted the market price of XTZ, which fell by over 50% in the weeks following the release of the Reuters’ article.

Around the same time, the U.S. Securities and Exchange Commission (SEC) charged the Tezos Foundation, which managed the funds, and the project’s founder, the Breitman’s, for selling unregistered securities. On September 1, 2020, it was reported that the Breitman’s and the Tezos Foundation settled with the SEC by paying a fine of $25 million.

Adoption Metrics

We evaluated various network-level metrics to assess the level of adoption of these chains.

Initial Token Distribution

Initial token distribution is an important metric for understanding the governance of blockchains, particularly for PoS networks.

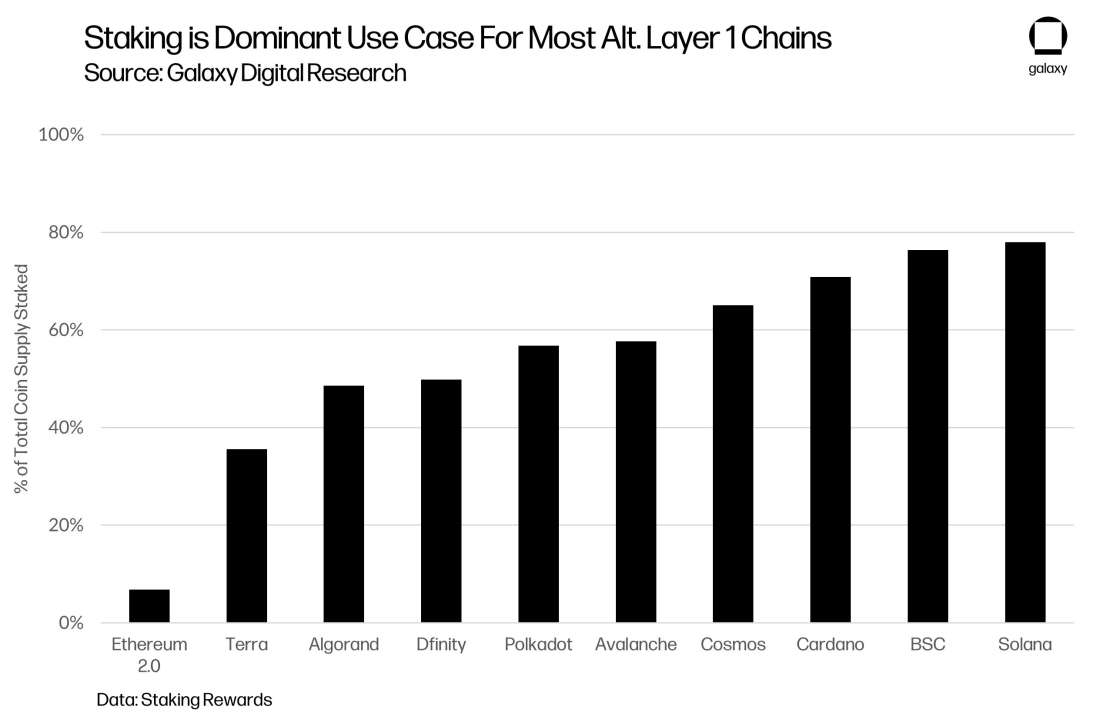

Total Supply Staked

Over 50% of coin supply is locked as collateral on most of these networks for the purposes of validating transactions and finalizing blocks. As a result, these assets can therefore be viewed as interest-bearing instruments, rather than solely as a native currency.

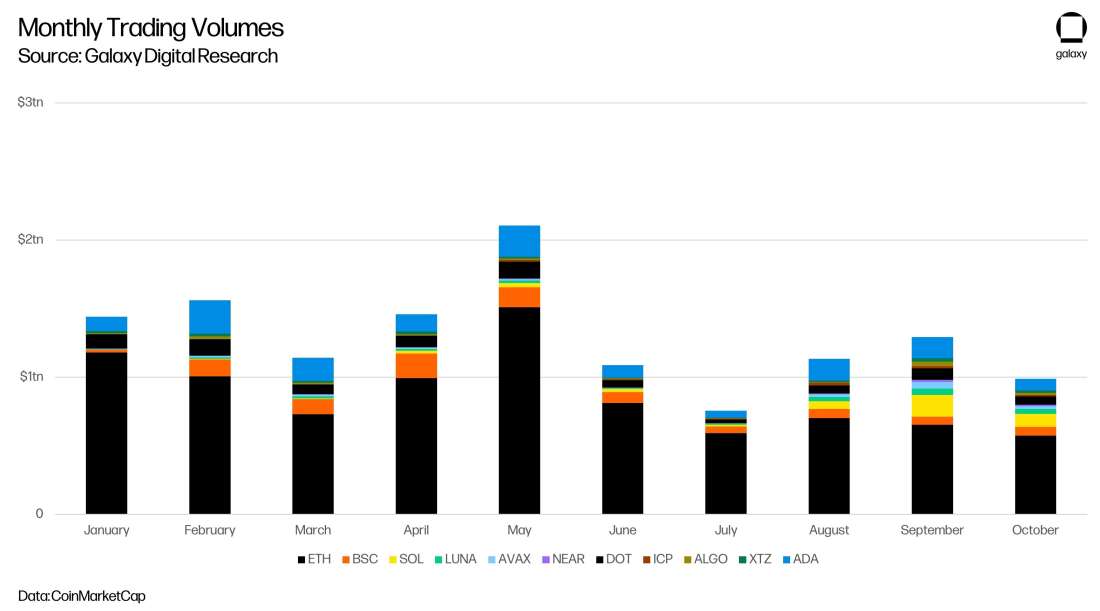

Trading Volume

Looking across exchanges, Ethereum still dominates trading volumes among these smart contracting platforms, though trading in alternate layer 1 coins is growing.

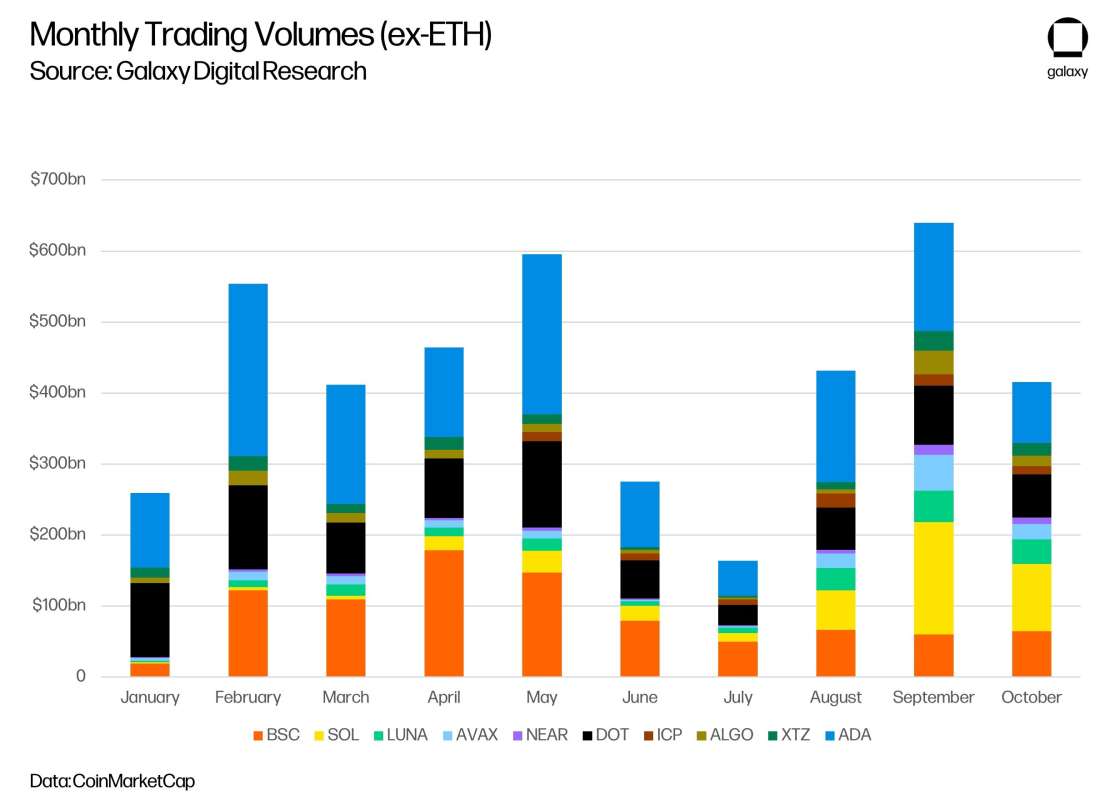

Excluding ETH gives us a better view of the alternate L1 volume picture.

Total Value Locked

Looking at the total value locked in these networks, while a somewhat flawed metric due to the rehypothecation of tokens across various DeFi applications, gives a solid picture of the growth of alternative Layer 1 platforms. Because we consider Ethereum’s Layer 2 ecosystem an important part of Ethereum’s overall scaling plan and an important factor when considering the demand for alternative Layer 1s, we’ve included optimistic rollup L2s Arbitrum and Optimism within the Ethereum dataset. Note, we were unable to locate time-series DeFi TVL data for Polkadot, ICP, or Cardano.

Despite the sheer size of Ethereum’s DeFi TVL, we can see its market share declining over the last 6 months, providing clear cut proof that the multichain world not only exists, but is expanding.

Other Metrics

Some of the best metrics for the current blockchain include transaction volume, number of deployed smart contracts, number of smart contract calls, and users count like active addresses. Unfortunately, due to how nascent many of these networks are or the high cost of running a validating node, data on many of the metrics we wanted to compare was unavailable. Moreover, most of the data providers we contacted were unable to collect data on many of these networks. While data for certain networks, such as Bitcoin and Ethereum, is widespread and easily available, providing data for just a few networks could paint a skewed picture, especially when many of these networks are so new and therefore accelerating much faster than ETH.

Going forward, the ability of these networks to provide better data and audibility is important for both tracking ecosystem growth, comparing networks, and for ensuring these networks continue to stay decentralized and credibly neutral.

Conclusion

As we take hold of the ever-expanding crypto landscape, it’s clear it will be populated multiple interoperable blockchain networks. Many of the protocols that were nascent just 6 months ago have matured to a point where significant usage is now occurring. This expanding set of protocols—with different goals, designs, and tradeoffs—creates robust technology options for developers and differentiated investment options for investors. The pursuit of expanded feature sets by smart contract platforms has further clarified the design choices made by Bitcoin’s community, allowing the world’s largest decentralized monetary network to distinguish itself from the pack as a wholly different good. At the same time, Ethereum’s growing dominance among smart contract platforms has given rise to entire new industries like decentralized finance and non-fungible tokens. And a growing ecosystem of alternative Layer 1 blockchains that build on Ethereum’s success while enacting different design choices leaves something for everyone, developers and investors alike.

But that doesn’t mean success is guaranteed. These networks, while becoming more inter-composable, are still fundamentally competing for users, developers, and funds. So, while the crypto market has still only gained fractional adoption with most of the world’s populace and thus will only increase in a positive-sum fashion, going forward networks and their ecosystems need to prioritize sustainable growth, primarily by onboarding users and building communities, securing funding for developers and carving out a specific niche in which their chains or applications uniquely excel. While to date the chains assessed in this report have attracted mindshare and generated large and sometimes fanatical userbases, most, if not all, have failed to corner any one area of the crypto market. Nevertheless, a few trends have still emerged in the burgeoning Layer 1 world.

First, it’s quite apparent how dependent many of these networks are and continue to be on Ethereum. Outside of Luna, Solana, and a few others, the vast majority of Layer 1 networks are either compatible with Ethereum via sidechains or platforms, or just replicas of Ethereum. That’s not necessarily a bad thing for these chains' own development, but it does mean they will mostly struggle to attract talent and capital from ETH, as its near-ubiquitous Solidity programming language and Virtual Machine have entrenched developers, users, and DeFi applications alike.

Second, the attractiveness of less secure and less proven networks in light of high transaction costs on ETH indicates that most retail users value low-cost operations over security assurances. If ETH ultimately fails to scale or does not scale quickly enough, these chains should continue to attract capital and perform well, especially if they began to offer better assurances of their neutrality. In turn, legitimate proof of more neutrally enforced blockchain mechanisms should allow networks to scale and attract more capital, users, and developers.