Stablecoins post FTX-Alameda Collapse

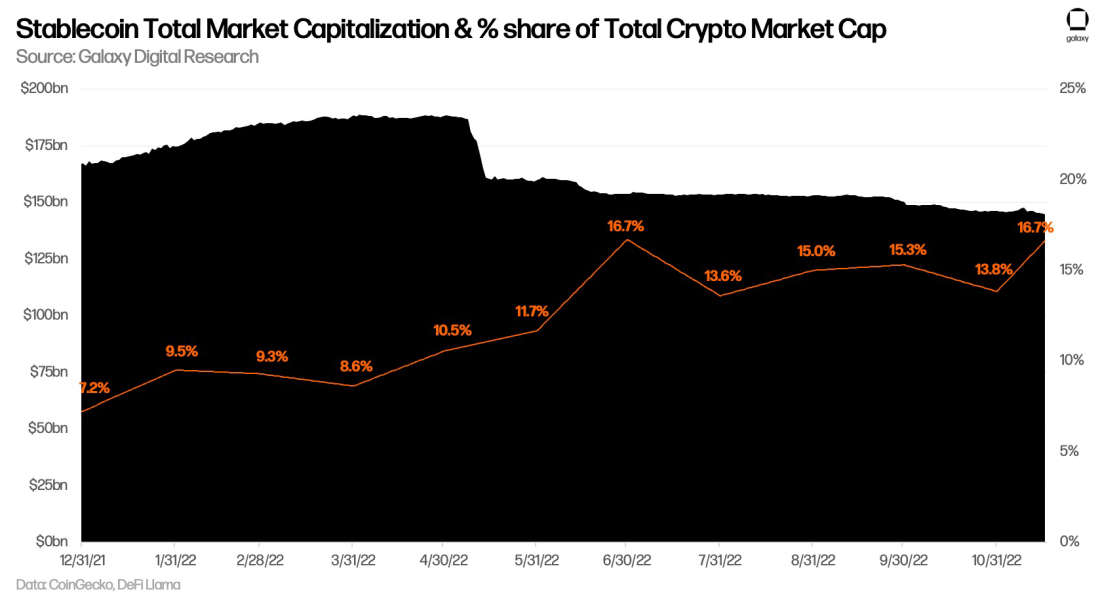

Amid the market turmoil stemming from the collapse of FTX/Alameda, stablecoins have experienced increased interest as seen by trading volumes and on-chain activity. Stablecoins as a crypto asset class fared much better than other crypto assets as their % share of the total market increased by 3% since the start of November to ~17%. Total stablecoin market cap stayed relatively stable as it decreased by just $1.5bn (<1% decline) so far this month.

Stablecoin trading volumes spike with market turmoil

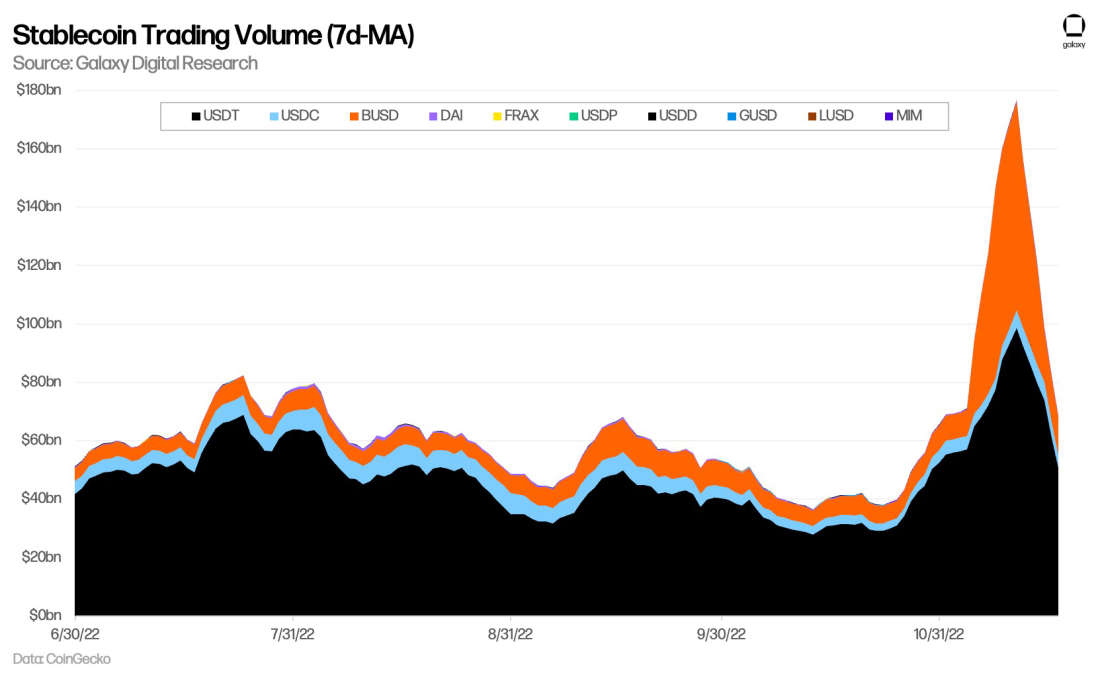

Stablecoin trading volume saw a significant spike since the news first broke of FTX-Alameda’s collapse. According to CoinGecko, over $200bn in daily stablecoin trading volume occurred on November 5 and 8, led by USDT and BUSD volumes. Historically, USDT has been the dominant leader in stablecoin trading volume as it is the underlying currency to quote trading pairs at several large exchanges. Recently, daily BUSD trading volume surpassed USDT on several days. The large increase in BUSD trading volume could be due to Binance’s decision to consolidate its order books and convert user balances in several stablecoins (incl. USDC, USDP, & TUSD) to BUSD as of September 29th.

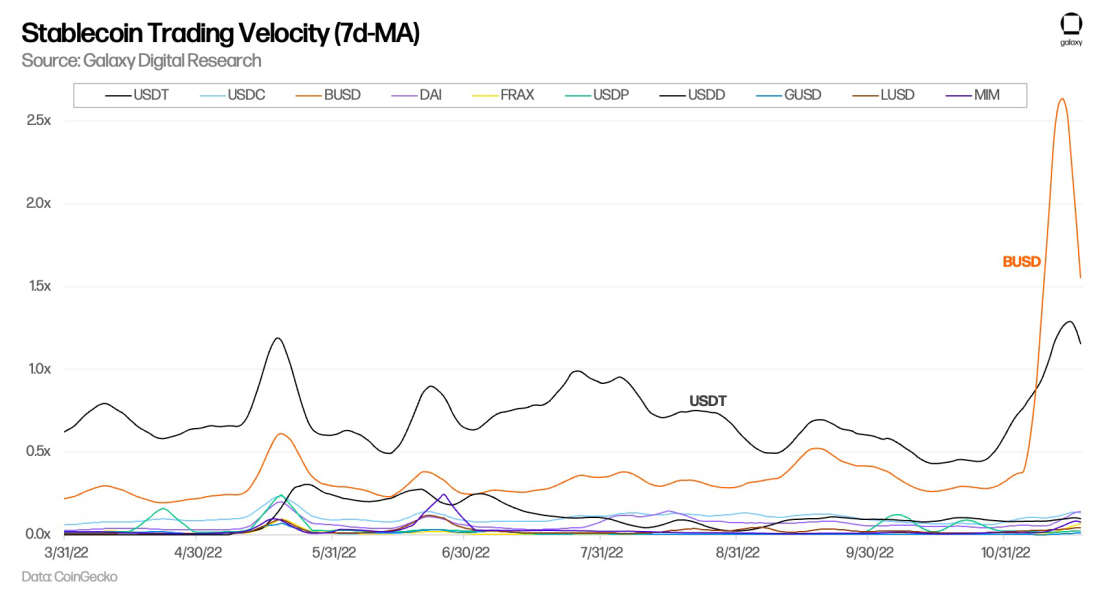

Based on CoinGecko data, the velocity of major stablecoins (defined as trading volume / current supply) also showed a large spike in BUSD, which experienced daily turnover of over 2x its supply. BUSD also overtook USDT’s leading position by a wide margin velocity largely due to its smaller market cap (~$23bn or ~1/3 the size of USDT). USDC velocity is notably lower than that of USDT and BUSD since it isn’t commonly used as a trading pair across most exchanges (as tracked by CoinGecko).

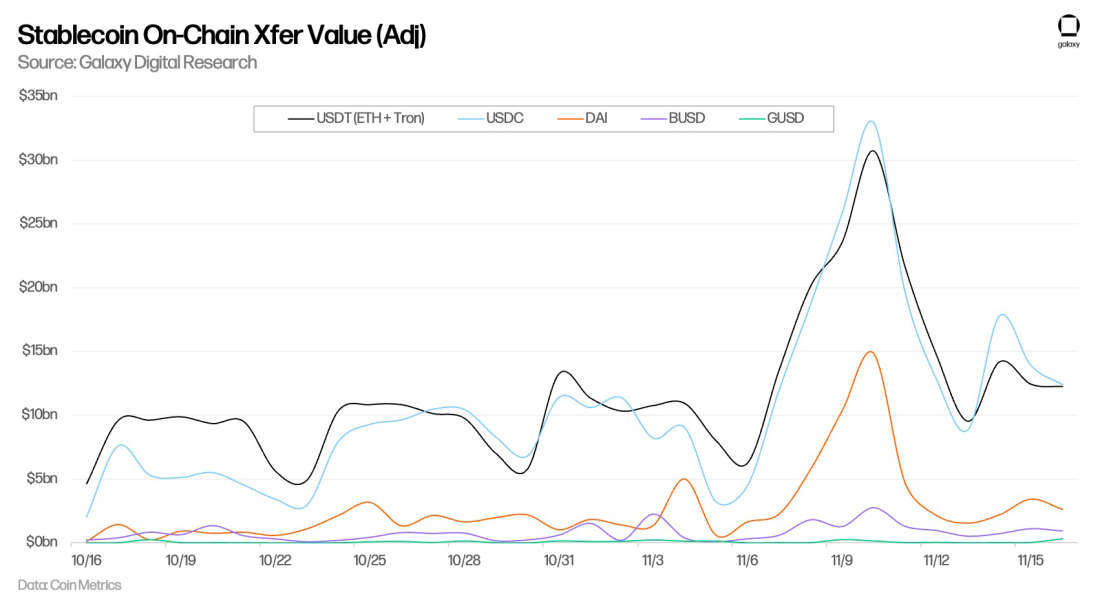

While USDC may not be the preferred quote currency across trading pairs (across crypto trading exchanges tracked by Coin Gecko), it is the most popular stablecoin on Ethereum ranked by on-chain transfer value. DAI also has relatively higher transfer volume on-chain than it does across the trading exchanges tracked in the charts above by CoinGecko.

Exchanges experience large outflows of stablecoins

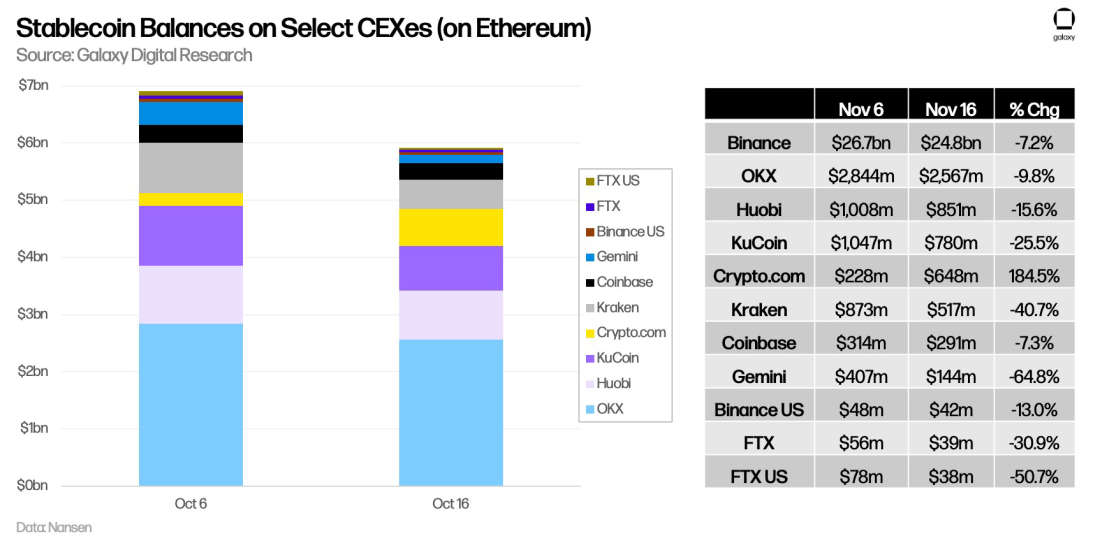

Centralized exchanges have experienced significant outflows in recent weeks. According to Nansen data, FTX and FTX US collectively hold $78m in stablecoins on Ethereum, down ~40% since November 6. Binance is the largest holder of stablecoins on Ethereum with ~$25bn, about 10x the balance of its closest CEX competitor (OKX) and over 80x the balance of Coinbase. Crypto.com was reported to have “accidentally” sent $400m in stablecoins to another exchange at the end of October, which was later returned just prior to the exchange publishing its proof of reserves dashboard. Several exchanges have temporarily suspended deposits or withdrawals of USDC and USDT on Solana including Crypto.com, OKX, and Binance (Binance later reopened deposits for USDT).

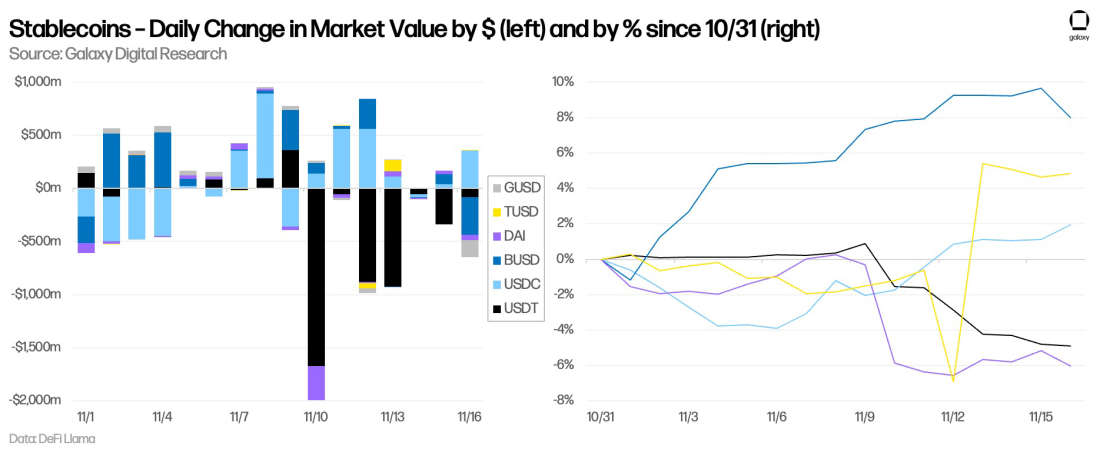

By Asset: Risk-off sentiment drives supply outflows in USDT, DAI

As of November 16, GUSD led the major stablecoins in supply change month-to-date, up 31% (+$151m), primarily due to growth initiatives (discussed below). BUSD and USDC also grew in value, adding 1.7bn BUSD (+9%) and ~800m USDC (+3%), respectively. On the other hand, USDT and DAI experienced declines in supply, both down 5% so far in November.

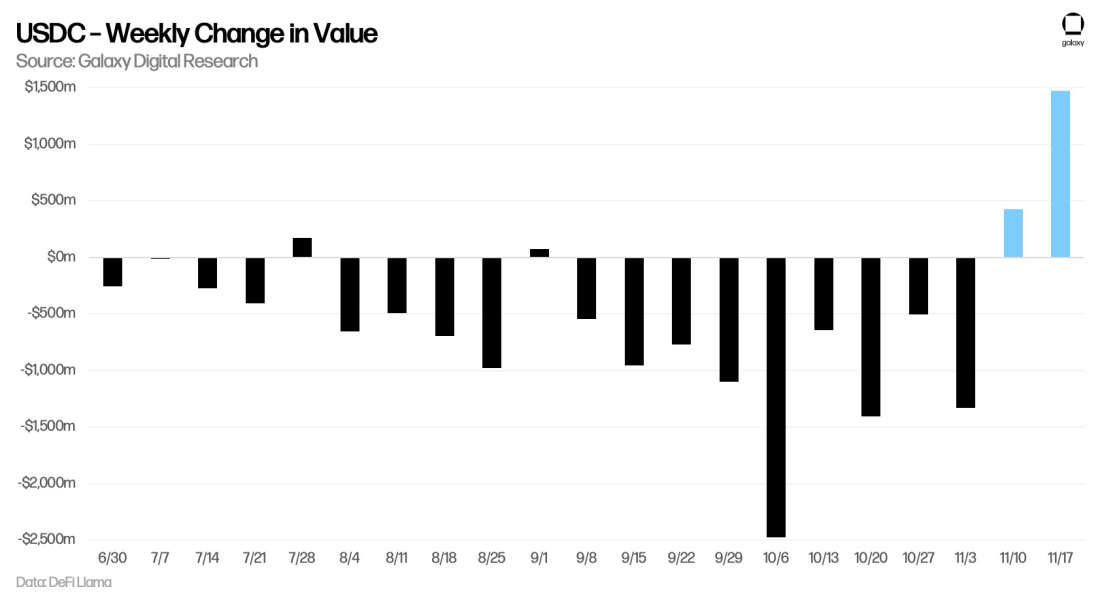

Although USDC’s supply increase was relatively small in percentage terms, the increases from the past two weeks have broken a persistent downtrend in weekly declines which started since mid-year. Since November 3rd, supply of USDC has grown by ~1.9bn.

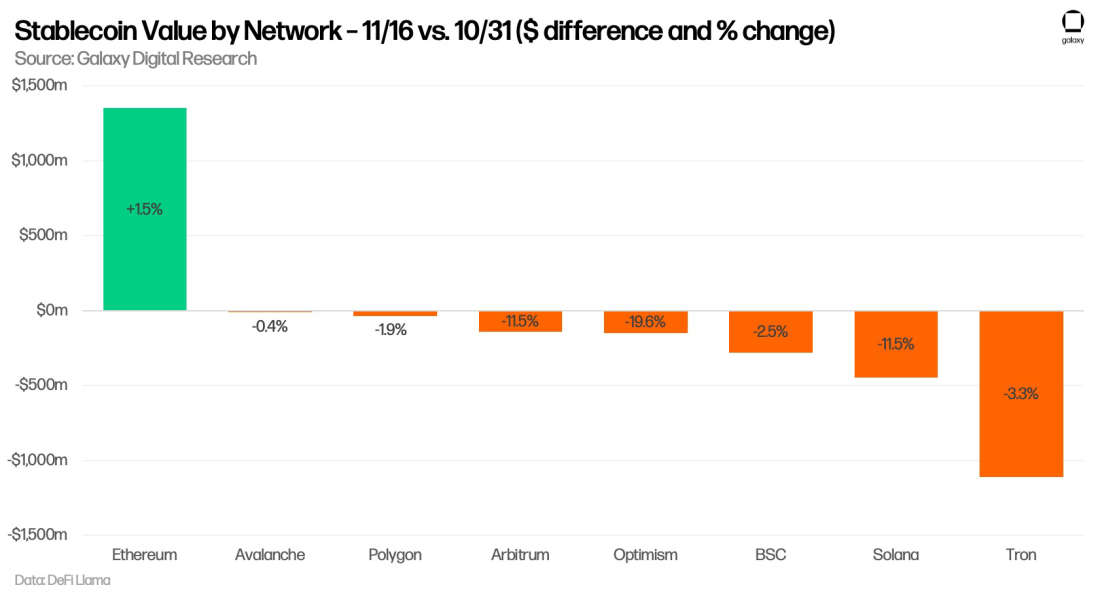

By Network: Tron & Solana lead networks in stablecoin declines, while Ethereum is sole beneficiary

From October 31 to November 16, Ethereum was the only major network to see positive growth in the value of stablecoins (+$1.35bn, +1.5%). By value, Tron led other networks in declines in stablecoin values with $1.11bn lost primarily driven by Tether redemptions and the slight de-pegging of USDD. Value of stablecoins on Solana decreased by ~$450m (-11.5%). On a relative basis, Optimism saw the largest decrease in stablecoin value, down nearly 20%.

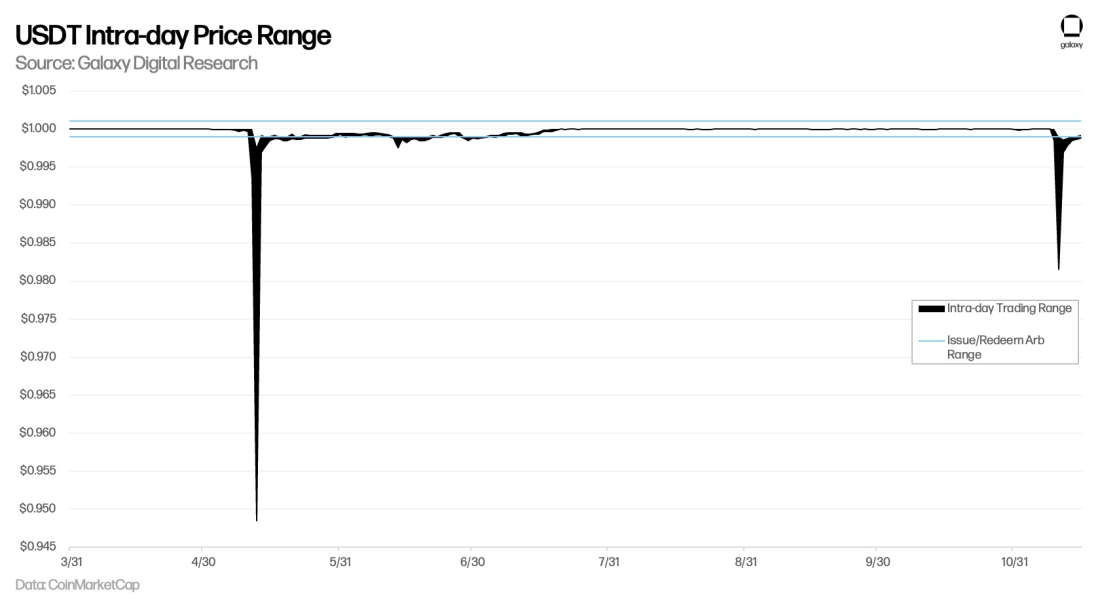

Tether briefly trades off its peg

On November 9th, after a pricing discrepancy on several trading exchanges showed Tether deviating from its peg below $0.985 (explained by Tether CTO Paolo Ardoino), Tether published a blog post, “FTX, Black Swans, and Tether's Continued Stability” which noted “Tether has absolutely no credit towards FTX or Alameda Research. Tether is completely unexposed to Alameda Research or FTX.” The next day, TRON DAO Reserve announced it would purchase 1 billion USDT “to safeguard the overall blockchain industry and crypto market".

Tether customers can issue/redeem USDT directly through Tether for $1 (minimum $100,000; 0.1% for fiat deposits/withdrawals) by sending USDT on-chain to Tether’s Treasury addresses (e.g., on Ethereum, Tron), enabling an arbitrage opportunity window whenever USDT prices deviates outside the range of $0.999 – $1.001.

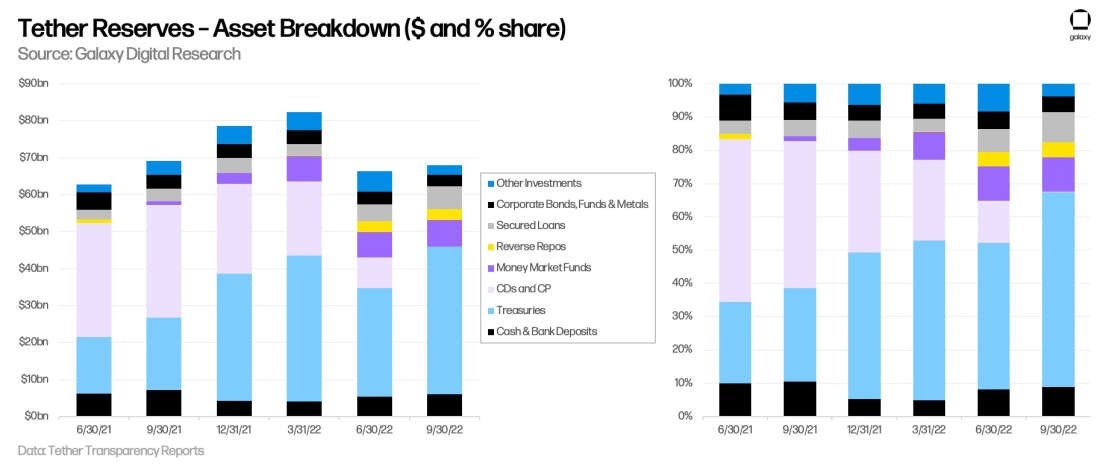

Tether Q3 Attestation Report shows improvement in risk profile

On November 10th, Tether shared its quarterly reserves attestation report for the period ended 9/30/22. The attestation was completed by BDO Italia, the auditor that Tether had recently switched to as of August. The Q3 attestation report showed that Tether was collateralized mostly by US T-Bills (58%) while commercial paper had reduced by $24bn since the start of the year to near $0 (CP mix down from 31%). Recall, Tether had eliminated the remaining CP from its reserves in October.

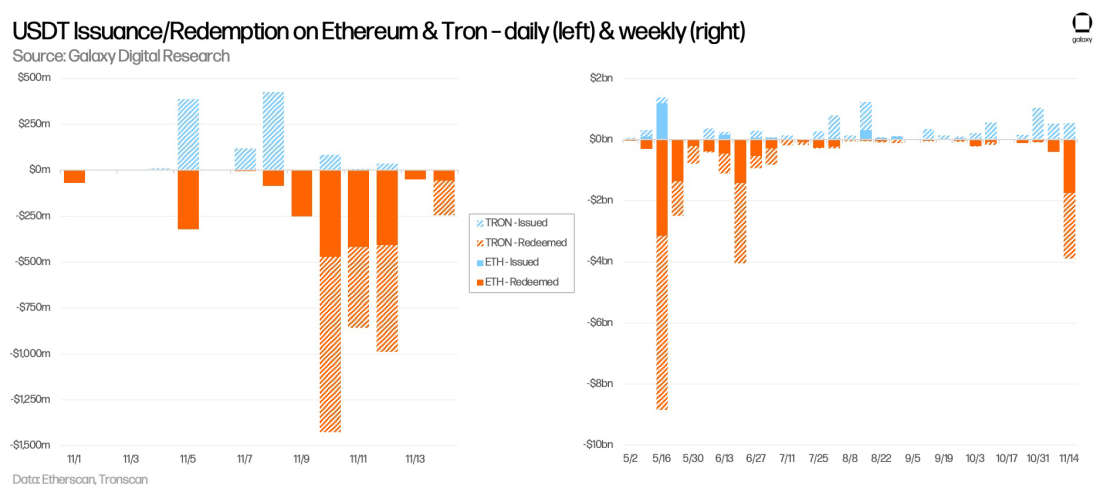

Tether Issuance and Redemptions

From November 8-15, Tether processed nearly $4bn in withdrawal requests across Ethereum and Tron (6% of outstanding supply). By comparison, Tether saw much larger weekly outflows earlier this year related to market selloff from the LUNA crash in May and the subsequent 3AC/CeFi explosion in June, which saw a 30-day period where Tether fulfilled over $20bn in redemptions (25% of reserves) in a timely manner.

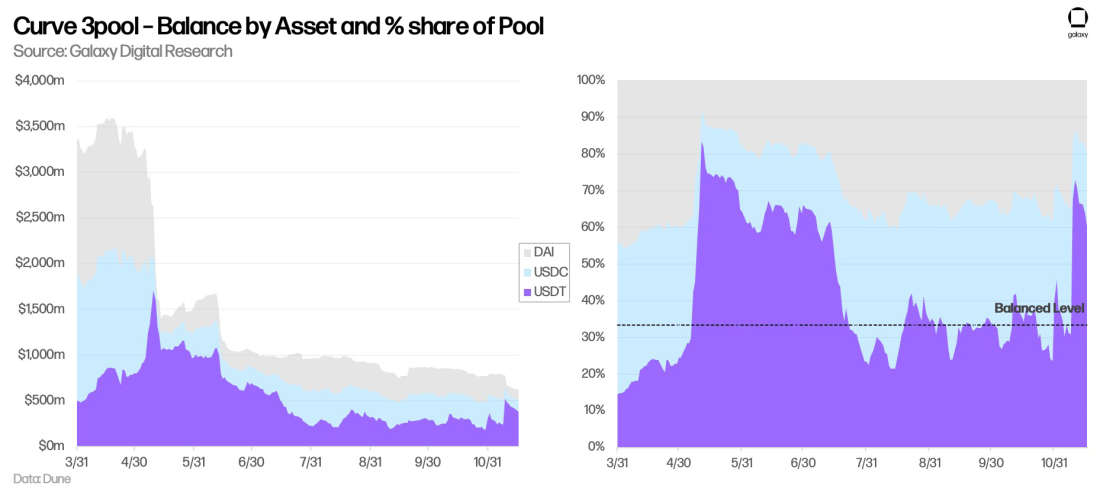

USDT selloff leads to large imbalance in Curve’s 3pool

Outside of direct Tether redemptions, USDT saw heavy selling in other trading venues such as Curve’s 3pool. The 3pool saw over $2bn in trading volumes in USDT from November 8-13, resulting in a severe imbalance of the pool – at one point, USDT’s mix grew to over 80% and 3pool’s combined supply of DAI/USDC dipped to ~$125m.

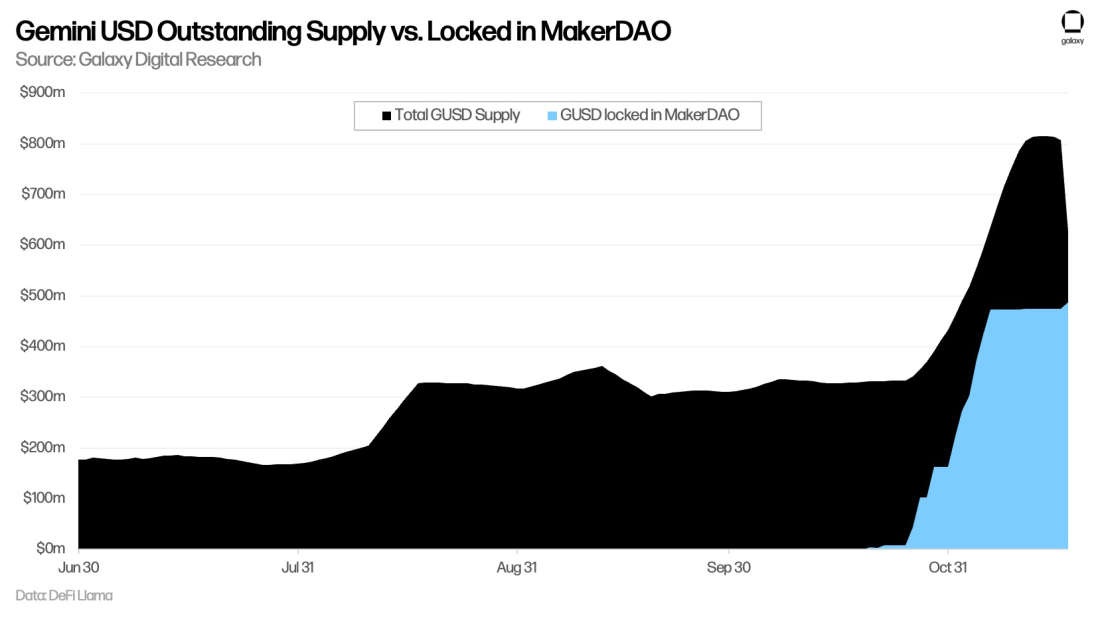

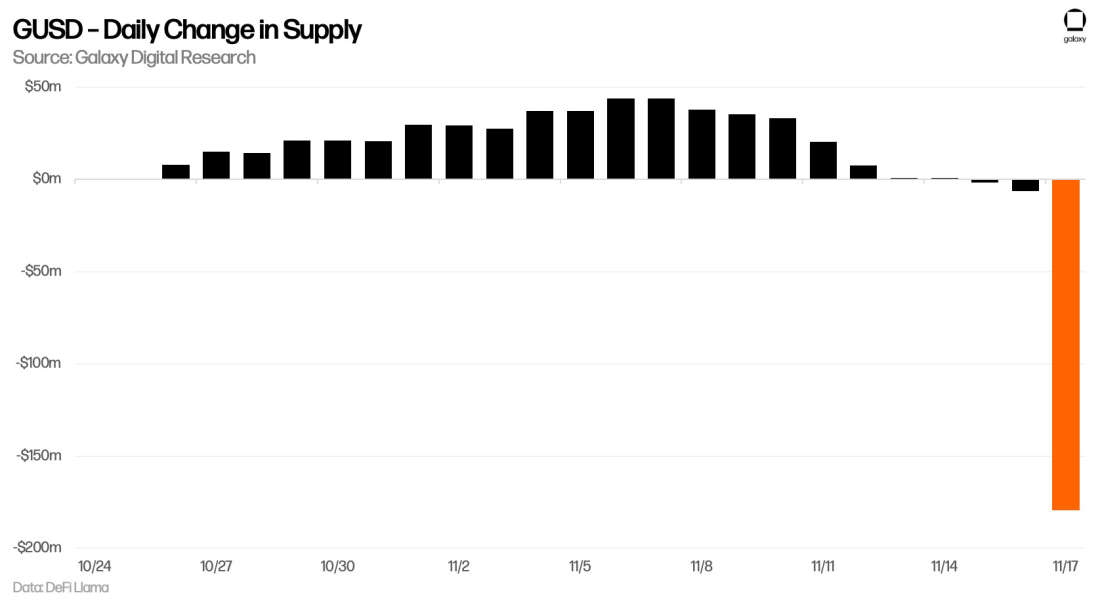

Gemini USD scales up quickly via MakerDAO initiative, then erases some gains on Gemini Earn fears

In September, as a marketing initiative for its stablecoin GUSD, Gemini submitted a MakerDAO governance proposal to implement a Gemini USD Price Stability Module (GUSD PSM) to help diversify DAI’s collateral composition from USDC (60%+); in exchange, Gemini would pay MakerDAO a fixed 1.25% for any GUSD held in its PSM. The proposal was approved and MakerDAO implemented the GUSD PSM with a 500M DAI Debt Ceiling on October 21. Since then, the supply of GUSD more than doubled to $800m+ (+$500m, +137%), of which $475m (60%+) is sitting in Maker’s GUSD PSM.

Update: On November 16, Gemini announced Gemini Earn program has paused withdrawals and is unable to meet customer redemptions due to exposure to Genesis. This raised solvency concerns with the exchange and its stablecoin, leading to large outflows of GUSD with supply falling by 180m (-21%) in a single day to a new total of 628m. We note that Gemini is regulated by the NYDFS, which imposes relatively stringent requirements on stablecoin issuers. Paxos (issuer behind USDP & BUSD) is the only other significant stablecoin issuer regulated by the NYDFS. MakerDAO later confirmed that the GUSD reserves are segregated and separated from Gemini Earn. Over 75% of GUSD supply is now locked in Maker’s PSM.

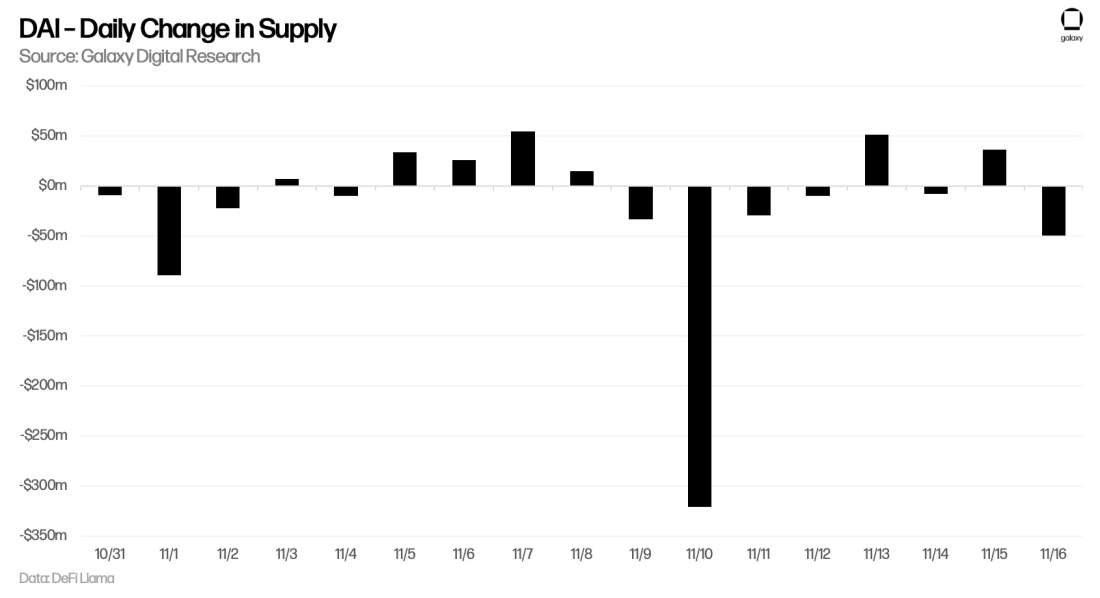

Users reduce leverage exposure to Maker through DAI repayments and withdrawals

November 10th - DAI supply was reduced by over $300m (single day supply reduction of 6%) as users repaid $150m of DAI to reduce/close their leveraged positions. According to Defi Explore Maker dashboard, only 26 vaults were liquidated last week which held 1.2m DAI. There were more than 500 requests to withdraw collateral from Maker, which outpaced the count of users adding more collateral.

Other Recent Stablecoin News

UST: An audit on the Luna Foundation Guard (LFG)’s efforts to defend the peg of TerraUSD (UST) in May was published by a third-party auditor. The report concluded “LFG spent $2.8B (80,081 $BTC and 49.8M in stablecoins) to defend $UST’s peg” and added “TFL spent $613M of its own capital to defend the $UST peg.”

DAI Savings Rate: After initiating agreements with Coinbase and Gemini to earn some extra yield on its USDC and GUSD balances in its PSM, MakerDAO is also considering reenabling the DAI Savings Rate – Maker’s version of a yield-bearing savings account to distribute yield to DAI holders (discussion is still ongoing).

Circle adds support for Apple Pay: Businesses with Circle Accounts can accept Apple Pay payments via Circle, meaning merchants can accept USDC through Circle’s on-ramp API. Last month, Circle announced other merchant services to enable merchants to accept other crypto payments including in BTC and ETH.

Outlook

Stablecoins are important bridges connecting the digital and physical worlds that serve important functions in the crypto economy. Stablecoins combine the benefits of the open crypto economy with the price stability of widely accepted fiat currencies and have the potential to transform the way that people and businesses use money. The events from this year have demonstrated the problems with centralized, trusted set-ups and we, as a community, must continue to push for radical transparency in operations and communications. At least one positive takeaway from this recent turmoil is that stablecoin systems have proven to be functional as issuers continue to process redemptions in an orderly fashion and any de-peggings have been slight and temporary. Hard times build hard money and stablecoins will continue to be one of crypto’s most important offerings.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.