The Great Wealth Transfer & its Impact on Crypto

Over the next couple decades, older generations will pass trillions of dollars of money and assets to their children, dramatically changing the face of U.S. wealth. These younger “digital native” generations have very different investment behaviors than their parents and grandparents, including a much higher propensity for Bitcoin and crypto.

Key Takeaways

Millennials are due to inherit the largest wealth transfer in history. Baby Boomers & older generations account for less than 1/3 of the US adult population but collectively hold 2/3 of US household wealth ($96 trillion), more than 11x the wealth owned by Millennials & younger generations. Over the next two decades, Cerulli Associates estimates that $84.4 trillion is set to be transferred from Baby Boomers and older generations to younger generations, with Millennials being the primary beneficiary. Coldwell Banker estimates that Millennials will hold 5x as much wealth by 2030 than at the start of the decade largely due to inheritances.

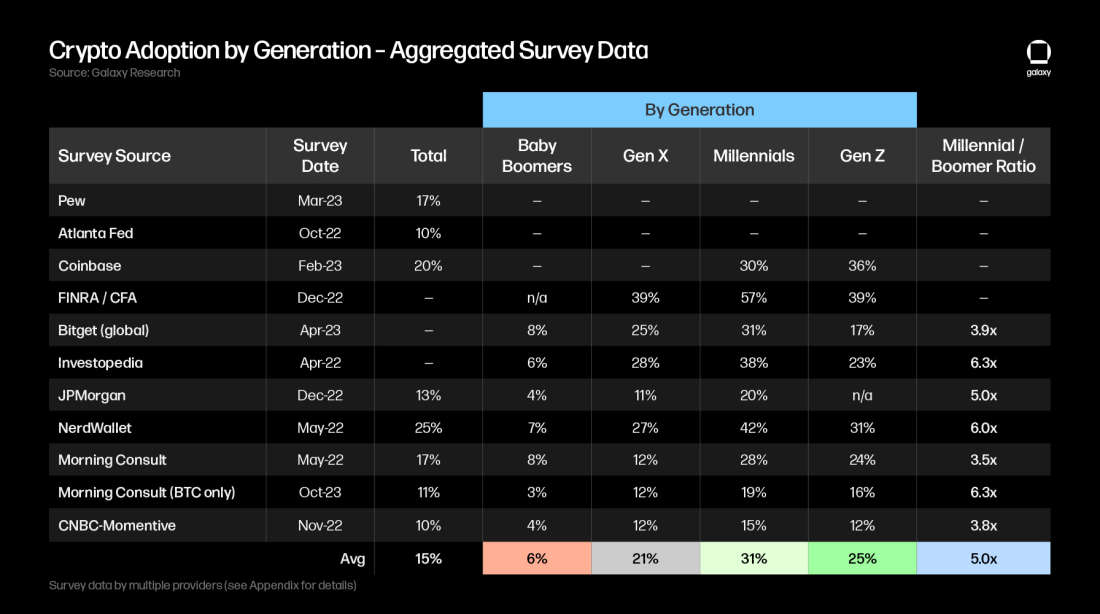

Millennials & Gen Z stand out from older generations & have a higher preference for crypto. Millennials and Gen Z are the first digital natives and are more racially diverse, educated, and socially conscious compared to their parents and grandparents. Hindered by several recessions, steep housing costs, and heavy debt burdens, these younger generations have been more receptive to alternative financial systems and investments, including crypto. Numerous surveys measuring crypto adoption across generations find that these younger generations have at least 3x higher adoption or acceptance rates of crypto compared to Baby Boomers.

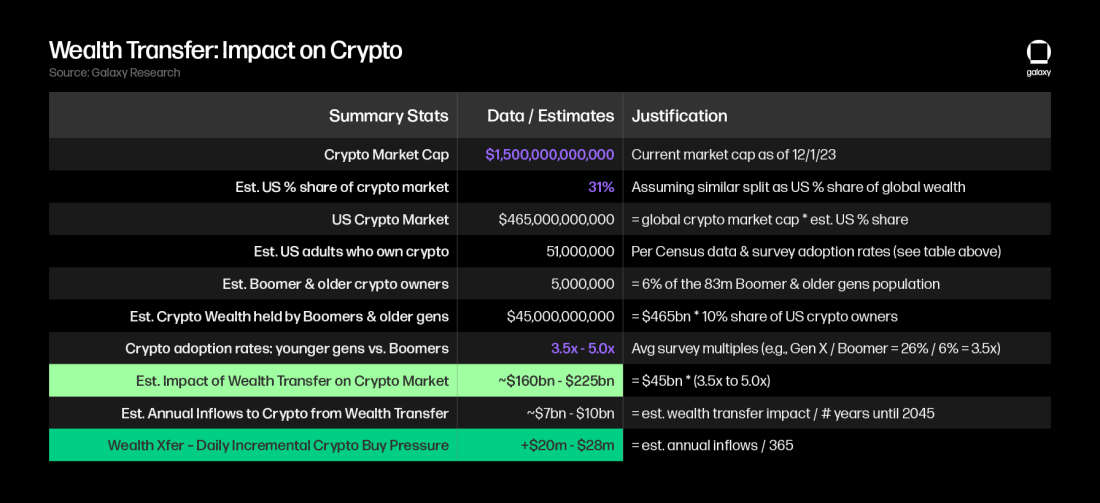

The transfer of wealth into these crypto-friendly hands may result in significantly more demand for Bitcoin and other crypto assets. If the Great Wealth Transfer were to occur today, we estimate an incremental $160bn – $225bn would flow into crypto markets based on the greater acceptance rates of the technology by younger generations relative to Baby Boomers. As most of the wealth held by Boomers & older generations is expected to be passed along to younger generations by 2045, our estimate suggests the impact of the Wealth Transfer may result in $20m – $28m of daily incremental buying pressure across the crypto market over the next 20 years.

The Wealth Transfer may not solve all the financial problems of Millennials and the next gens, though. Only a small portion of the population is expected to see any inheritance. The Wealth Transfer likely won’t flow to the lower income groups which stand to benefit the most from an inheritance. And for those that are expecting an inheritance, the actual amount of wealth transferred will be less than anticipated due to longer life expectancy and higher medical costs, poor financial planning, shifting spending priorities, and fewer entitlements.

Still, the demographic shift of wealth / power to younger generations is inevitable, boding well for crypto. Even if the Great Wealth Transfer does not meaningfully solve the financial burdens of Millennials, the changing of the guard from Baby Boomers to younger generations will have profound social and political consequences – all of which bodes well for further adoption and future development of crypto in the US.

The Great Wealth Transfer

According to the Federal Reserve’s Survey of Consumer Finances, U.S. household wealth totaled $146 trillion as of 2Q23. Of this total, Baby Boomers & older generations (born 1964 & earlier) collectively hold $95.6 trillion, or roughly two-thirds of the total US wealth despite this group representing less than one third of the adult population.

In recent years, Millennials overtook Baby Boomers as America’s largest generation by population. Despite their demographic size, Millennials & younger generations (incl. digital natives like Gen Z) collectively hold $8.3 trillion (~5.7% of total wealth), which amounts to ~11.5x less than the amount held by Baby Boomers & older generations or ~15.5x less per capita.

In the next two decades, Millennials are set to be the primary beneficiaries of what many refer to as ‘the Great Wealth Transfer’, in which older generations pass on trillions in wealth to their children.

Cerulli Associates projects the wealth transferred through 2045 will total $84.4 trillion, of which $73.6 trillion (87% of total) will be transferred to heirs and the remaining $11.9 trillion (13% of total) will be donated to charities. Baby Boomers (aged 59–77) stand to transfer $53 trillion (63% of total transfers), while the Silent Generation (currently aged 78+) is set to transfer ~$16 trillion (19% of total) mostly over the next decade. Coldwell Banker estimates that by 2030 Millennials will hold 5x as much wealth than at the start of the decade largely due to passed down inheritances.

The Generational Divide

Recognizing key differences between these separate groups and identifying generational trends provides valuable insights for individuals, investors, businesses, and policymakers that want to understand user behavior and preferences, capitalize on market opportunities, or assess the impact of policy decisions.

Individuals from each generation have experienced their own set of major influential events and challenges during their formative years that helped shape their life principles and priorities. As young adults, the Silent Generation endured World War 2; Baby Boomers came of age through the post-WW2 global conflicts and the civil rights & counterculture movements; Gen X experienced the fall of the Berlin Wall, significant inflation in the 70s and 80s, and the dot-com bubble; Millennials withstood the Great Financial Crisis and originated the Occupy Wall Street movement; and Gen Z has started to enter the workforce after facing the COVID-era. These major formative events have impacted the way we interact with the world including attitudes towards work and investing preferences.

In our table above, we list several key developments during the formative years of each generation plus certain characteristics and values of each cohort. Most of these generational characterizations and traits are tied to the global political and socio-economic conditions (e.g., war, capital markets, job market, housing, etc.) that each generation grew up in while others can be the result of technological advances or other trends outside the control of central banks and policymakers (e.g., increased access to information, availability of technology & media, globalization).

Millennials and Gen Z stand out as the first ‘digital natives’ as they were the first to grow up alongside the internet. Compared to older generations, they are more racially diverse, highly educated, and socially conscious. There is also an intergenerational gap between how young people and older people view each other. Today, older generations generally view younger generations as lazy, entitled, materialistic and sensitive. Alternatively, younger generations may perceive older generations as out of touch, stubborn, and narrow-minded.

The merits behind some of these claims from both sides are certainly debatable, but Millennials and younger generations have undeniably had to deal with some unique financial hardships and challenges that their older counterparts did not at similar ages – they not only started their early adulthood with two major recessions, but they also face higher education costs (and student debt), and housing costs, which has impacted their savings and wealth:

Student debt is a much larger issue for Millennials and Gen Z compared to Gen X and Baby Boomers. Not only is there a rising cost of not going to college, but the cost of education has meaningfully increased, outpacing income growth and leading to an expansion in student debt levels for younger generations. From 1982 to 2022, the average cost of attending a four-year college jumped from $11,840 to $30,031 (+153% in 40 years). In the 15 years since 2008, student loan debt has increased 163% in the last 15 years to $1.74T as of 3Q23, the number of federal student loan borrowers has increased 45% to 43.5m Americans, and the average student loan debt at graduation per student is up 33% to $37,650. Compared to Baby Boomers at age 30, Millennials were twice as likely to have some student debt (~40% vs. ~20%) at the same age, and they faced a 4x greater economic burden from debt (debt-to-income ratio of 40% vs. 10%).

Housing costs have similarly become much more expensive on a relative basis for younger generations (mostly to the benefit of Boomers’ wealth as the value of real estate assets increases). Housing has become much less affordable in the past 40 years as median new home prices have outpaced the median household income, which has led to an expansion in outstanding mortgage debt and slowed the homeownership rates for Millennials compared to previous generations (rate hikes in the past two years further impact housing affordability). Millennials are tracking behind older generations’ homeownership rates: at age 30, 43% of Millennials owned their home in 2022 vs. 52% of Boomers at that age.

These economic challenges have negatively impacted the net wealth-to-income of Millennials, causing their ability and propensity to invest or save to fall behind Baby Boomers at similar ages. Higher debt levels can delay the starting age of investing and the amount that is saved and can also have implications on risk behaviors for younger generations. In addition, the traditional retirement income streams have shifted from Social Security and defined benefit pensions to defined contribution plans (i.e., 401(k) plans), which shifts the saving and investment management burden onto employees. Millennials will be the first generation in which most will retire without a defined pension plan and for which Social Security may not be a reliable source of retirement income. As a result, tapping into retirement savings before retirement—i.e., taken loan, early withdrawal, hardship withdrawal—has become a more common occurrence for younger generations according to a Transamerica Institute survey. The survey also finds that younger generations are more concerned about their mental health and their ability to save for retirement.

Attitudes towards and adoption of Crypto by Generation

The traditional financial system has served Baby Boomers well – they enjoyed relatively high income, low cost of living, and many prosperous years of economic growth when compared to Millennials and younger generations. It’s no wonder that studies show they are more likely to have more faith in the financial system and opt for the status quo.

On the other hand, many Millennials and younger generation individuals have grown disillusioned with the financial system that has failed to serve their needs to the same degree as it has for their parents and grandparents. Especially after the 2008 financial crisis, which resulted in inflationary concerns and declining trust in institutions, these digitally-native cohorts have unsurprisingly been more receptive to alternative financial systems and investments. They are more likely to use nontraditional digital-only brokerage apps and robo-advisors and have had a higher investment preference towards tech, ESG, social impact, and alternative investments compared to older generations.

So naturally, the idea of having an alternative financial system using digitally native currency outside the control of banks and governments has resonated with this population. Bitcoin and crypto’s appeal aligned with the values of younger generations as a digital-first, accessible, permissionless, privacy-focused, always online independent approach to personal finance.

Adoption rates of Bitcoin / Crypto by Generation

Coinbase estimates that there are 52m Americans that own crypto (roughly 1 in 5 adults) with ownership rates highest among Millennials (45%) and Gen Z (39%). The findings also track somewhat similarly to the results of the Pew study that found 8% of adults aged 50+ have ever invested in, traded, or used crypto, while 25% of those aged 30-49 and 28% of those aged 18-29 have done so, suggesting the adoption levels are 3x higher for younger generations compared to those aged 50+.

Other surveys that track crypto adoption across generations have slightly varying estimates, but each have resulted in similar findings: crypto adoption rate by Millennials is several factors higher than by Baby Boomers, averaging 5.0x across the surveys included in the table below (details and links to each survey are included in Appendix):

Other noteworthy survey findings:

Crypto adopters tend to be individuals with higher levels of education and financial literacy. An empirical study of crypto adoption has found that “individuals with high subjective financial literacy were found to better perceive the gains from using cryptocurrencies and showed higher intention to use.” An Investopedia survey finds that 69% of Millennials reported having intermediate to advanced understanding of digital currency vs. 23% of Boomers.

Younger generations prefer crypto as much as equities and have larger allocations to the asset class. The same Investopedia survey found that Millennials are more likely to have investments in crypto (38%) than in stocks (37%). A FINRA/CFA survey by FINRA found that Gen Z investors were most likely to have started by investing in crypto (44%), then individual stocks (32%) and mutual funds (21%). The FINRA/CFA study also found that Gen Z reported a median of $1,000 invested in crypto, approximate one-fourth of their median total investment holdings of $4,000. A BNY Mellon survey separately found that the ‘Next Gens’ commit 5% of their average portfolio to crypto compared to just an average of 1% for North American family offices.

Stance on crypto could be a key topic influencing voting decision. Millennials and Gen Z adults together make up about 40% of the voting-age population today and will be a majority of voting-age Americans by 2028. A survey by Coinbase finds that 44% of Millennials feel that politicians and policymakers should support crypto/blockchain. Among the 52m that are crypto owners, 55% would be likely to vote for a pro-crypto candidate in 2024 with Millennials leading at 78% over Gen X (71%), Gen Z (69%), and Boomers (51%).

So, across all these generational surveys, no matter how it is framed, Millennials and Gen Z are much more likely than Baby Boomers to be crypto proponents. Thus, shifting wealth from older generations into the hands of this crypto-friendly population is likely to result in greater inflows into bitcoin & the broader crypto asset class.

Impact of the Great Wealth Transfer on Bitcoin / Crypto

The crypto market is worth ~$1.5 trillion as of 11/27/23. Assuming a similar split as the US % of global wealth (31%), we estimate the US crypto market to be worth approximately $465 billion.

If we apply the average crypto adoption rates for each generation from the surveys to the Census population data, we estimate there are a total of 51 million Americans who own crypto (in line with Coinbase’s estimate of 52m), with Baby Boomers & older generations accounting for ~10% of American the US crypto population (vs. 27% for Gen X and 63% for Millennials & younger). Assuming an even distribution of the estimated $465bn in US crypto wealth, we estimate Baby Boomers & older generations currently hold approximately $45bn in crypto wealth.

If the Great Wealth Transfer were to occur today, we estimate an incremental $160bn – $225bn would flow into crypto markets just as wealth moves into the crypto-friendlier hands of the younger generations. This assumes that the 3.5x – 5.0x higher adoption rates for younger generations over Baby Boomers (based on survey data averages using the 3.5x Gen X / Boomer ratio as the lower-bound to our range and the 5.0x Millennial multiple as the upper-bound) equally translates into 3.5x – 5.0x more crypto wealth than what Boomers currently hold.

As most of the wealth held by Boomers & older generations is expected to be passed along to younger generations by 2045, our estimate suggests the impact of the Wealth Transfer may result in $20m - $28m of daily incremental buying pressure for crypto markets over the next 20 years.

Note that this methodology described likely underestimates the impact of the wealth transfer on crypto markets since it uses the rough estimate for crypto wealth held by Boomers as a baseline figure, which essentially implies that crypto adoption increases while the propensity to invest in crypto stays constant. Instead, it is much more likely that there will likely be an additional multiplier effect as Millennials & younger generations typically allocate a greater % of investable wealth towards crypto assets compared to traditional financial assets including stocks and bonds.

The methodology also implies conservatism as it takes a static view of crypto preferences and wealth potential as it stands today – it does not factor in the higher income potential of today’s younger generations, nor does it include the compounding growth effects of investment returns over time. Crypto acceptance and adoption rates should continue to grow with continued development of the infrastructure and application layers and as the potential benefits of the technology become more proven over time.

Moderating expectations around the financial impact of the Great Wealth Transfer

While some economists estimate the Wealth Transfer will result in a 5-10x increase in the overall wealth of Millennials, which could dramatically improve the financial positions of the economically challenged younger generations and lead to an economic (crypto) boom, there are several reasons to believe the Wealth Transfer may be far less impactful:

Most of the wealth expected to be transferred is held by a few wealthy households. If the total wealth held by Boomers & older generations were passed on to the remaining ~250m Americans, it would amount to ~$380k per capita, which could easily lift the younger generations out of all their existing debt. However, the wealth transfer will not be evenly distributed – Cerulli estimates that $35.8T (42%) of the overall total volume of transfers is expected to come from high-net-worth and ultra-HNW households, which collectively make up just 1.5% of all households. A UPenn study of historical inheritances finds that households in the top 5% of income distribution receive inheritances that are 4x to 12x larger than households in the bottom 80%. In addition, the likelihood of receiving an inheritance in any given five-year period is just 7.4% and the probability increases among higher income groups.

For those expecting an inheritance, the amount of wealth passed down is likely less than they expect. A Fed study found a disconnect between how much wealth is passed down compared to how much recipients are expected to inherit: people that received inheritances in the past three years estimated they would receive $72,200 on average (vs.just $46,200 received on average). There is an even greater discrepancy for people in the bottom 50% of wealth as they estimated that they would receive $29,400 on average (vs. $9,700 received on average). With respect to the Great Wealth Transfer, an Alliant Credit Union survey found that 52% of Millennials who are expecting to receive inheritances said they expect to receive at least $350,000 while 55% of Boomers who plan to leave an inheritance said they will pass on less than $250,000.

With longer life expectancy and falling pensions / entitlements, Baby Boomers are spending more on themselves. A Fidelity study finds that retiring couples aged 65 can expect to pay $300k in health care and medical expenses through retirement (+88% since 2002). A Coventry study finds that 85% retirees are prioritizing their own financial security and wellness over leaving inheritances as more than 75% of retirees surveyed are not planning to leave any inheritance.

Previous generational wealth transfer events resulted in greater wealth inequalities. A BLS research report on the previous generational wealth transfer event (tracking inheritances from 1989 to 2007) found little evidence of an inheritance boom – wealth transfers as a proportion of net worth averaged 19%, continuing a downward trend that suggests inheritances and gifts account for a lesser amount of household wealth accumulation over time.

So, any Millennials expecting the wealth transfer to result in an immediate economic boom to pay down all their debt should probably moderate their expectations and have other preparations in place. Most of the wealth to be transferred from older generations will not flow to the lower income groups which would stand to benefit the most from an inheritance. That said, any inheritance amount can still improve the financial standing of any individual and provide greater ability to invest, and Bitcoin and other crypto assets could be major beneficiaries.

Outlook

Baby Boomers have had prosperous years of economic growth post-WW2 and have reshaped American society at large. However, they face a stark generational divide with Millennials and younger generations, who have faced greater financial pressures than their older counterparts. Aside from the massive wealth disparity, the societal values of the digital native generations are also vastly different, especially with respect to technological acceptance, social consciousness, and trust in institutions. It makes sense that these groups would be more receptive to alternative financial systems like Bitcoin and crypto.

With the last of Baby Boomer generation approaching retirement, Millennials are set to become the primary beneficiary of the Great Wealth Transfer, which will see older generations pass on wealth of nearly $100 trillion through inheritances. The Great Wealth Transfer may not solve all the inflating debt problems facing the younger generations, but it represents a substantial demographic shift that will empower the digitally-native populations who have a greater propensity for crypto adoption. So as time passes and as people age, crypto will likely see greater inflows and find a more supportive path towards mainstream adoption.

Appendix: Survey Data

→ Download the PDF of this Report

→ Subscribe to receive report notifications to your inbox

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email contact@galaxydigital.io. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.