Top Stories of the Week - 6/23

In the newsletter, we write about Blackrock’s ETF filing, EigenLayer’s mainnet launch, and a proposal to move Polygon’s POS sidechain to a Validium – a major change for one of the world’s biggest blockchain ecosystems. Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox

World’s Largest Asset Manager Files for Bitcoin ETF

Blackrock filed last Friday for with the SEC to launch a spot-based Bitcoin exchange traded product. While many have sought approval to launch spot-based Bitcoin ETFs in the past – from the Winklevoss Twins in 2013 to the likes of Fidelity, Van Eck, Wisdomtree, Valkyrie, Bitwise, 21 Shares, Skybridge in 2021 – the world’s largest asset manager by AUM ($10tn) had never applied for one, until this week. According to the form S-1, the proposed iShares Bitcoin Trust will store its BTC at Coinbase, following the two companies’ previously announced partnership in which customers of Blackrock’s Aladdin platform gained access to crypto trading via Coinbase. The ETF will utilize the CME CF Bitcoin Reference Rate as its benchmark.

A notable difference between Blackrock’s filing and prior filings is that Blackrock will utilize software sourced from Nasdaq for monitoring spot markets for wash sales, market manipulation, and other market integrity measures. In its prior denials, the SEC has repeatedly noted the lack of sufficient “surveillance sharing agreements” (SSA) to mitigate and prevent market manipulation. Other applications, such as those from Fidelity and Van Eck, contained info about SSAs to monitor derivatives but not spot markets.

The announcement of Blackrock's Bitcoin filing ignited a wave of institutions to re-apply for spot-based Bitcoin ETFs. Since Blackrock’s filing, WisdomTree and several other issuers have re-filed or reactivated their filings. Each of these companies had some kind of prior attempt to launch spot-based Bitcoin ETFs in 2021, but either withdrew their applications or were rejected by the SEC. Before this recent wave of reapplications, the joint filing from 21 Shares and ARK Invest was the sole live application in the queue.

The decision to file for a spot-based Bitcoin ETF comes amidst rising regulatory pressure in the U.S., with the SEC recently engaging in several lawsuits. We covered the SEC's lawsuits against Coinbase and Binance in our prior newsletter. Notably, Blackrock's historical success in ETF approvals (99.86% success rate) indicates that the preeminent asset manager, along with other institutions, identify an opportunistic moment in the market for launching the first spot-based Bitcoin ETF in the U.S.

Our take

Blackrock’s decision to file an application for a spot-based Bitcoin ETF comes at an curious time. The Securities and Exchange Commission (SEC), which must approve any such application, has embarked on an aggressive campaign against cryptocurrency companies in the United States. Concurrently, and this list is not exhaustive, the SEC is embroiled in litigation against: Coinbase, the biggest US-based exchange and the only one that is publicly listed in the US; Grayscale, the largest crypto asset manager; Binance, the world’s largest crypto exchange; and Ripple Labs, issuer of one of the world’s oldest altcoins. And the agency just recently extracted settlements from Kraken and Bittrex. And, of course, more than 20 bitcoin ETF applications have ultimately been unsuccessful.

The big question among observers this week has been, why now? After years of denials and an American crypto industry embroiled in regulatory disputes across the spectrum, why make your first filing now? Actually, with concerns about the integrity of underlying spot BTC markets as the primary concern cited by the SEC in its prior rejections, perhaps Blackrock sees now as a particularly auspicious time to file. The SEC’s actions against Coinbase and Binance can be seen to provide a certain clarity to underlying spot markets, and the announced launch this week of EDX, the disaggregated crypto exchange backed by Citadel, Fidelity Schwab, and Virtu Financial, could be just the type of underlying spot market that the SEC needs in order to approve an ETF. And if you look across the gamut of the SEC’s enforcement actions, one name is conspicuously omitted from scrutiny: Bitcoin. Bitcoin is the only asset that SEC Chair Gary Gensler has explicitly stated is not a security – at least while he has been Chair of the SEC… prior to becoming Chair Mr. Gensler did say that neither Ethereum, Litecoin, nor Bitcoin Cash were not securities. (Incidentally, Bitcoin and these 3 assets are apparently the 4 that will be tradeable day one on EDX).

And perhaps sentiment at the SEC has changed. Castle Island Ventures general partner Matt Walsh mused that perhaps a third commissioner has evolved on the Bitcoin ETF question, suggesting that perhaps Caroline Crenshaw could become a decisive “yes” vote after previously voting against. Indeed, as Figment’s Josh Deems noted to me, Crenshaw ended a late-2021 speech with an optimistic tone, saying “In my research, it sometimes seems like the only constant in the digital asset universe may be change. As a firm believer that innovation can yield great benefits for individuals and economies, I’m thinking about where change is occurring, what that means for the SEC, and how we can respond. For example, just a few years ago, a significant majority of bitcoin transactions occurred on exchanges operating in jurisdictions that are not party to our legal treaties, and where we have very little visibility.[29] As China recently banned digital asset exchanges operating within its borders, I went back to look at how that has impacted where bitcoin transactions now occur. Today six of the top 11 centralized bitcoin exchanges by volume are in the U.S., and two others are in Financial Action Task Force (“FATF”) member countries.[30] These exchanges may be less subject to manipulative trading, and could have more reliable anti-money laundering programs.”

Beyond the “why now” question, some on Twitter have voiced opposition to Blackrock’s entrance, suggesting that regulators were pushing down the existing crypto industry (disruptors) while making a pathway for the traditional financial services industry (incumbents). Our own President & CIO Chris Ferraro addressed this issue during a Yahoo! Finance interview, when he was asked “a lot of crypto purists, some of the social commentary I saw online described this institutional push as the wolf entering the hen house. Do you think that’s fair? Chris described it aptly as a “natural evolution,” saying that “innovation always tends to be messy and fast and then have to reset itself. We’ve seen that through technology cycles over and over again. The market has made huge strides in terms of technological advancement… but in the background all along, traditional financial institutions… have had dedicated teams building and are now at the point where… they are stepping into the market.”

A few misconceptions to clear up from social media. While this filing does create a trust, not an “exchange traded fund,” it is functionally equivalent to an “ETF” because it trades on an exchange and allows for constant creations and redemptions – it is functionally no different than GLD, the wildly successful SPDR Gold Shares (GLD) trust. And a lot of complaints and conspiracies were floated regarding the “fork-choice” language included in Blackrock’s S-1 filing, specifically that “with respect to any fork, airdrop, or similar event, the Sponsor shall, in its sole discretion, determine what action the Trust shall take. In the event of a fork, the Sponsor will, as permitted by the terms of the Trust Agreement, determine which network it believes is generally accepted as the Bitcoin network and should therefore be considered the appropriate network, and the associated asset as bitcoin, for the Trust’s purpose.” Some alleged that this language suggested a nefarious aim on Blackrock’s behalf, specifically that firm would promote a Bitcoin fork that suited Blackrock’s political aims, such as on ESG, an investment narrative that Blackrock is famous for innovating. The reality, though, is this “fork choice” language is pretty boilerplate – standard in almost all custody agreements, for example.

Blackrock’s team has been working diligently on digital assets for a while, but it’s clear that they viewed this moment as ripe to make their first Bitcoin ETF filing, which is interesting. Theoretically, the soonest Blackrock’s ETF could be approved is August 13, 45 days after registration. This all puts a lot on the SEC’s plate, particularly with some of the older lawsuits supposedly approaching conclusions (Ripple & Grayscale). However this summer goes, it’s clear that the institutional Bitcoin game is on.

– Alex Thorn

Polygon 2.0 Roadmap – Step 1: Polygon PoS → Validium

Polygon proposes upgrading the PoS chain to a Validium under Polygon 2.0 roadmap. After introducing the Polygon 2.0 vision to rearchitect the Polygon network last week, the Polygon Labs team shared details on the first major milestone on its technical roadmap: upgrading Polygon PoS to a zkEVM Validium. According to the team, the goal of Polygon 2.0 is to "build the Value Layer of the Internet" and will feature a series of proposed upgrades to unify all Polygon protocols with ZK technology.

As background, Polygon PoS—a sidechain to Ethereum—is Polygon's most widely adopted chain, but it’s just one of many chains in the Polygon network which also includes Polygon Miden and the recently launched Polygon zkEVM rollup (discussed in our prior research report). Validiums are a scaling solution that operate similarly to ZK rollups by moving execution off chain and periodically publishing validity proofs to the L1 to verify the actual L2 state. However, Validiums differ from ZK rollups because rather than recording the offchain transactions on the L1 (as calldata), the transaction data is stored with some external providers that provide some guarantees over the data availability. This enables lower fees and higher throughput on Validiums at the cost of additional trust assumptions compared to ZK rollups (for more info on L2 designs and tradeoffs, read our report In Search of Scaling).

The primary rationale in the Polygon Labs' proposal to upgrade PoS to zkEVM Validium are to increase security and to future-proof the tech stack. Current challenges with the architecture of the PoS chain noted in the proposal include a suboptimal security model, outdated technology that is reliant on forks of Cosmos SDK and Geth, and UX issues from its probabilistic consensus algorithm that results in frequent deep chain reorgs. Migrating to a zkEVM Validium would open the path to addressing the aforementioned challenges of the PoS chain. Other expected benefits noted in the proposal include faster transaction confirmations with single block finality (2 second block time), improved fee estimation with deterministic consensus, greater levels of decentralization of full nodes and validators (if required), and compatibility with other Polygon chains under the Polygon 2.0 vision.

The proposal is still in the community discussion phase but if consensus is reached, the team notes that implementation and testing could take place from Nov 2023 until Jan 2024, and the activation of the upgrade could happen by Feb – Mar 2024. Next, as part of the Polygon 2.0 roadmap, Polygon Labs will share details around the proposed next phases for the protocol including the Architecture and Stack (expected next week), Tokenomics (expected week of July 10), and lastly Governance (expected week of July 17).

Our take

Does this transition mark the beginning of the end over the debate on whether Polygon is technically an “L2”? Ever since Polygon’s humble beginnings as a plasma chain, even before pivoting to the PoS chain in 2020, critics have argued that Polygon's blockchain should not be classified as an L2. According to L2Beat, an L2 is defined as "a chain that fully or partially derives its security from L1 Ethereum so that users do not have to rely on the honesty of L2 validators for the security of their funds." Even with this recent proposal to upgrade the PoS chain to a Validium, which the Polygon team considers to be an L2 per the marketing communications, there continues to be debate within the Ethereum community over whether Polygon's primary chain would be a "true L2" given the additional security assumptions with storing offline data under a Validium model (note: there appears to be consensus that the recently launched zkEVM chain does fit squarely within the L2 definition).

The PoS sidechain certainly doesn't offer the same security guarantees as the Ethereum base layer (in fact, none of the existing "L2" rollups come without security tradeoffs). But, as we argued in our In Search of Scaling report from 2021,regardless of L2 semantics (relating to the PoS chain at the time), Polygon is (more importantly) politically aligned with Ethereum and has been beneficial to Ethereum's technical progress. Polygon has served as an important defensive alternative for Ethereum against "less aligned," value-extractive EVM chains like Binance Smart Cain (now BNB Chain) and Tron, which both attracted users and builders away from Ethereum during a time when high gas fees were pricing most users out (see chart below). Polygon provided an outlet for those looking for lower fee environments, drove meaningful adoption with numerous web2 partnerships, and pushed Ethereum's tech forward with significant ZK investments (including its strategic ZK-focused $1bn treasury fund announced in 2021).

Now, two years later, the same competitive dynamics described above continue to play out between the Ethereum community and combative fork chains – this past week, the Binance team released opBNB, an L2 built on top of BNB Chain based using Optimism's OP Stack (it is questionable whether BNB Chain needs its own L2 but that can be a discussion for another day). Meanwhile, Polygon's investments finally appear to be paying off as Polygon prepares to fully migrate to a ZK-based network which serves as strong testament to the maturity of its underlying tech. If the proposal is approved and Polygon has both a Validium and a zkEVM solution, the main question going forward will be how each chain will be adopted – Polygon's proposed architecture shares some similarities to Arbitrum, which has the Arbitrum One rollup (mostly used for DeFi) and the Arbitrum Nova chain (for social and gaming applications) which leverages a Data Availability Committee that is more along the lines of a Validium model but with some differences. In any case, the Polygon team will provide more color in coming weeks around how each of its blockchains will come together under the shared ZK-based infrastructure with the transformation to 2.0.

– Charles Yu

EigenLayer Completes Phase One of Their Three-Stage Mainnet Launch Plan

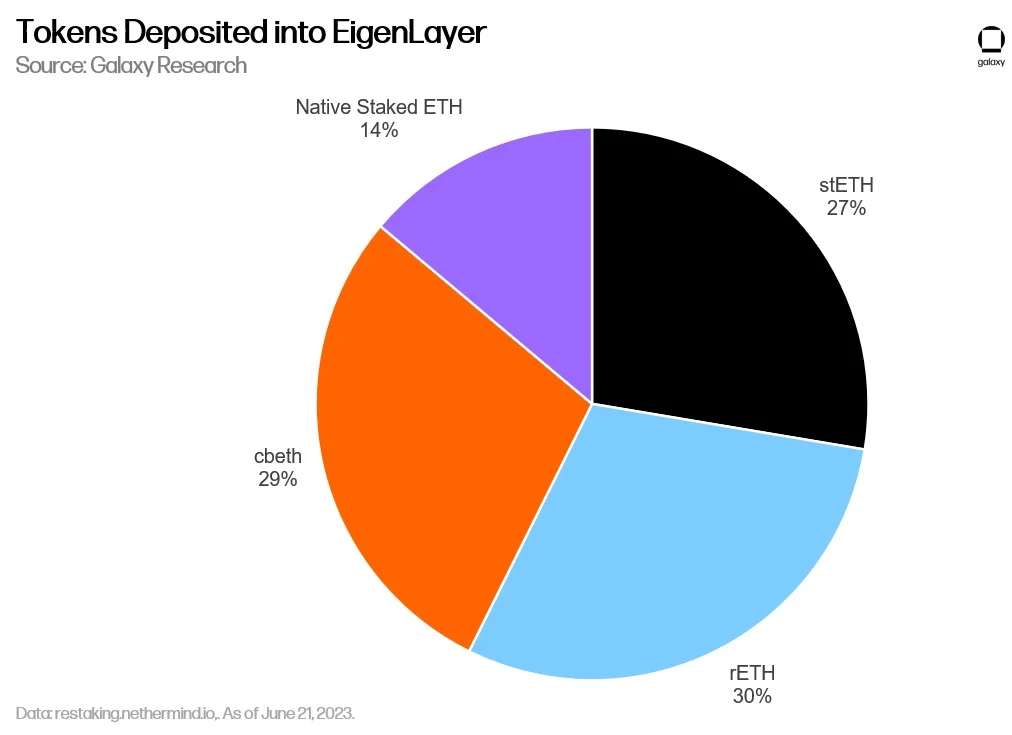

On Wednesday, June 14, the EigenLayer team announced the launch of their restaking protocol on Ethereum mainnet. For the first phase of the EigenLayer launch plan, the protocol will support three liquid staking tokens, stETH, rETH, cbeETH, and native staked ETH. Additionally, there is a cap on the amount of each type of asset that the protocol can accept as deposits from users. Aside from the cap of 9,600 native staked ETH, all other limits for every type of liquid staking token were reached within less than 24 hours of contract deployment. The total value staked on EigenLayer as of Tuesday, June 20 is 11,568.8338 ETH or roughly $20.5mn USD.

As background, the EigenLayer protocol is a restaking application designed to accept deposits of staked ETH or liquid staking tokens and re-deploy the capital to securing and earning rewards on other protocols. Users that deposit assets to EigenLayer must subject their staked assets to additional penalties and slashing conditions required by the alternative protocols, also known as Actively Validated Services (AVSs). EigenLayer stakers can either run the validating software required by the AVS themselves or delegate to an “operator” who will be responsible for performing the necessary validator responsibilities. Through EigenLayer, the total amount of ETH staked in Ethereum can be repurposed to securing several other crypto protocols.

EigenLabs is the Seattle-based development team behind the EigenLayer protocol. The team was founded in 2021 by University of Washington Assistant Professor and Director of the University of Washington’s Blockchain Lab Sreeram Kannan. In March 2023, EigenLabs raised $50mn in a Series A fundraising round. In April 2023, EigenLabs launched the official public test network for Phase 1 of EigenLayer on Goerli.

With Phase 1 now complete on Ethereum mainnet, early users that have successfully deposited assets to EigenLayer will wait until Phases 2 and 3 are complete to begin earning additional staking rewards as the EigenLayer protocol does not yet support functionality for operators or AVSs. The onboarding of operators and AVSs are the goals of Phase 2 and Phase 3, respectively. A few other features of EigenLayer that are expected to become available over time as the protocol matures include:

Removal of staked ETH deposit caps

Addition of more types of eligible liquid staking tokens beyond stETH, rETH, and cbETH

Removal of the 7-day withdrawal delay for staked assets

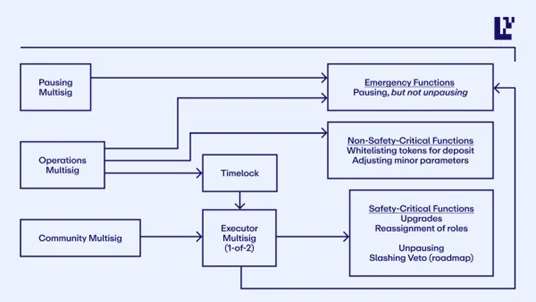

Reducing reliance on multi-sig wallets for executing last-minute upgrades or code patches

Our take

In Phase 1 of the EigenLayer mainnet launch, users are depositing their liquid staking tokens or native staked ETH to the protocol and doing so before they are able to earn rewards, or know how much in rewards they stand to make, which protocols and what additional slashing conditions will be associated with the AVS of their choice, and the number or quality of operators that will be available for taking care of validating responsibilities. This is not unlike the launch of the Ethereum Beacon Chain in December 2020 when early Ethereum enthusiasts were staking their ETH to a new consensus protocol before knowing key details about the protocol such as when they would be able to unstake their assets and how the Beacon Chain would eventually replace or merge with the existing Ethereum network. Participation in the first phase of EigenLayer’s deployment like the initial launch of the Beacon Chain is not for the faint of heart. It is for the users that already have a strong conviction and faith in the EigenLabs team and the EigenLayer protocol, as well as a high-risk appetite.

At least 50 unique Ethereum addresses are identified by the Nethermind Ethereum client team to have deposited assets to the EigenLayer smart contracts. Over the next several months, the owners of these addresses will be the exclusive few to have firsthand access to the operators and the AVSs that are onboarded in Phase 2 and 3, and following Phase 3, be the first to earn restaking rewards. It is unclear how quickly EigenLabs plans on deploying Phase 2 and 3 or the timeline for when the EigenLayer protocol will remove deposit restrictions to allow for more users. The phased launch of EigenLayer and the initial restrictions in terms of functionality are intended to promote safety and limit the potential negative consequences of an unexpected failure in or hack of the protocol. Similarly, EigenLayer’s reliance on upgradeable smart contracts and multiple multi-signature wallets to deploy “emergency actions” and “time-critical upgrades” as outlined in an EigenLab blog post both reinforce the long way that this protocol has yet to go to flesh out its vision of becoming a permissionless, resilient, and censorship-resistant re-staking protocol on Ethereum.

The first phase of EigenLayer’s launch is a small steppingstone in what is likely to be a multi-year development roadmap that like Ethereum’s road to proof-of-stake will be revised again and again and again to encompass changing circumstances such as changes in the protocol of Ethereum, the Layer-2 landscape, cryptography, and the global regulatory environment. That said, every promising crypto project needs to start somewhere and should EigenLayer succeed in achieving its vision of becoming a ubiquitous re-staking protocol on Ethereum through which the vast majority of ETH staked is re-hypothecated, the impacts would be massive, so massive that in a recent blog post founder of Ethereum Vitalik Buterin warned that the Ethereum community “should be wary of application-layer projects taking actions that risk increasing the ‘scope’ of blockchain consensus to anything other than verifying the core Ethereum protocol rules.” Buterin added: “Any expansion of the ‘duties’ of Ethereum’s consensus increases the costs, complexities and risks of running a validator.” Buterin’s point is that there are dangers to extending the functionality of Ethereum’s validator set beyond what the core protocol of Ethereum requires because it may result in conflicting interests and goals within the active validator set of Ethereum that ultimately impacts social consensus resulting in the need for centralizing forces of governance to arbitrate disputes or simply a chain split.

For now, the phased launch of EigenLayer intentionally restricts and constrains the protocol from being adopted too widely. The impact of the potential success of this protocol is muted, or rather not yet fully-fledged. How EigenLabs, Ethereum core developers, and the broader Ethereum community will address the risks associated with too big to fail secondary protocols built atop Ethereum and what limiting processes should be put in place to address these risks is an important question that needs addressing before EigenLayer takes off its training wheels.

– Christine Kim

In Other News

Offchain Labs unveils tool to build Layer 3 'Orbit' chains on Arbitrum

MakerDAO purchases $700 million in Treasury bonds, grows holdings to $1.2 billion

GBTC trading volume spikes 400% after BlackRock files for bitcoin ETF

Proposal to increase Ethereum max validator balance ignites debate

BNB Chain launches EVM-compatible Layer 2 network opBNB on testnet

NFT creation platform Zora launches creator-focused Layer 2

New crypto exchange “EDX” backed by Fidelity, Schwab, Citadel, & Virtu goes live

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email contact@galaxydigital.io. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.