Top Stories of the Week - 9/29

This week in the newsletter, we discuss updated timelines for a spot BTC ETF, progress towards launching Celestia, and Pudgy Penguins pushing physical plushies. Christine Kim also has notes on the latest Ethereum developer call.

Subscribe here and receive Galaxy's Weekly Top Stories, and more, directly to your inbox.

Spot Bitcoin ETF Applications Delayed...Again

The SEC delayed decisions on the Global X, Valkyrie, BlackRock, Invesco, and ARK 21Share spot Bitcoin ETF applications. This marks the third extension for Ark 21 Shares, the second for Valkyrie, and the first for Global X. Decisions are now due on January 10, January 15, and November 21 respectively. Seven other Bitcoin ETF applications are awaiting decisions between mid-October to late-November.

The delays for Global X and ARK came just hours after SEC Chair Gensler received a letter from four congress members urging him to approve a spot BTC ETF and a day before an appearance in front of the House Financial Services Committee. In the letter, the representatives argued the recent Grayscale ruling means the, “SEC’s current posture is untenable moving forward,” and “there is no reason to continue to deny such applications under inconsistent and discriminatory standards.” During his appearance in front of Congress, Gensler noted that the SEC is bracing for a 90%+ reduction in staff if there is a government shutdown and repeated his criticism of the way crypto businesses commingle assets while reaffirming the SEC’s view that Bitcoin is not a security.

At the time of writing, the SEC has announced delays for all the pending BTC spot ETF applications except Fidelity, VanEck, and Wisdomtree. But we expect that these remaining applications will be delayed today by the SEC ahead of a government shutdown expected to begin Monday.

OUR TAKE:

The shutdown is almost certainly the reason for the SEC’s decision to delay spot ETF approvals for Bitcoin and Ethereum so far in advance. Historically, the SEC has usually waited until right before a deadline before releasing a decision. The previous decision to delay Ark’s spot BTC ETF application, for example, did not come until two days before it was due.

A major outstanding question is what happens with the Grayscale BTC Trust case. The SEC has until October 13 to appeal the Grayscale ruling at the DC Circuit Court of Appeals. They can do so even in the case of a government shutdown as Federal courts are considered essential services that should remain open for a minimum of two weeks. Whether or not the SEC decides to appeal is a question that market observers are watching closely.

Despite delays to spot applications, Bloomberg analysts now expect the shutdown to accelerate timelines for approving ETH futures ETF applications. Valkyrie’s application was already approved later Thursday, setting the stage for a spot ETH approval down the road. - Lucas Tcheyan

Pudgy Penguin NFTs take Walmart

Pudgy Penguins, the 8th largest NFT collection by market cap, collaborated with Walmart to sell affordable toys in 2000 retail locations across the U.S. The toys are modeled after the images of the Pudgy Penguins PFP project. Walmart will sell 26 different Pudgy toys with price points ranging from $2.99 - $11.99 for six weeks. If the toys generate significant sales, Walmart will extend the shelf life for the NFT inspired toys.

These toys will serve as an onramp into Pudgy World, a multiplayer Web3 social platform where users interact with other collectors. Anyone who purchases a Pudgy toy from Walmart will have the ability to register their collectable through a QR code and begin experiencing Pudgy Penguin's digital ecosystem. The QR code, also called the birth certificate, automatically generates a crypto wallet and allows users to claim unique traits for their digital character inside Pudgy World. Pudgy World is built on zkSync Era, a zero-knowledge based rollup serving as a layer 2 for Ethereum.

Since the announcement which received over 500m impressions on twitter/x, the Pudgy Penguins collection floor price increased 8.7%.

OUR TAKE:

In a pioneering move, Pudgy Penguins is redefining the business model for the intellectual property (IP) of NFT collections. The collection has distinguished itself as the first to distribute physical goods in prominent retail stores such as Walmart and has achieved over $500k in initial sales on Amazon. Presumably, other NFT projects struggling to generate revenue from their IP will attempt to branch out of Web3 centric growth strategies and use traditional brand building initiatives such as mass production of physical goods.

Under the leadership of new founder Luca Netz, who acquired the project for $2.5m in April 2022, the brand has expanded through licensing deals and social media campaigns. Despite a six-month decline in NFT trading volumes, Pudgy Penguins stands out, having raised $9m on May 9, 2023, to bolster brand awareness and value for collectors.

This innovation comes in the wake of OpenSea’s decision to remove mandatory royalties back in August 2023, pushing NFT collections to explore alternative revenue streams. While some popular NFT collections attempt to generate revenue by releasing additional collections and diluting overall supply, Pudgy Penguins is focusing on brand awareness through using utilizing Web3 frameworks to onboard non crypto natives. The collection has reduced the barrier to entry cost from $7,700 to $2.99, offering an affordable gateway into the Web3 realm and addressing the challenge of onboarding non-crypto native users to Web3 products.

IP within the NFT ecosystem remains a convoluted topic. Our report on NFT IP reveals that NFT purchasers acquire only a license to the IP, while the founders retain the copyright to the IP. However, Pudgy Penguins has allowed holders to sublicense their NFTs for the toy campaign, providing selected Pudgy holders with undisclosed royalties from sales. This innovative approach of sublicensing incentivizes real-world IP utilization, but also necessitates caution regarding SEC regulations. As the SEC intensifies scrutiny on NFT projects deriving value from external activities, exemplified by the unregistered securities offering charge on Impact Theory’s NFT collection, Pudgy Penguins’ toy campaign treads carefully. The regulatory landscape underscores the complexities and potential risks in balancing innovation with compliance in the evolving NFT market. - Gabe Parker

Introducing $TIA, the Native Cryptocurrency of Celestia

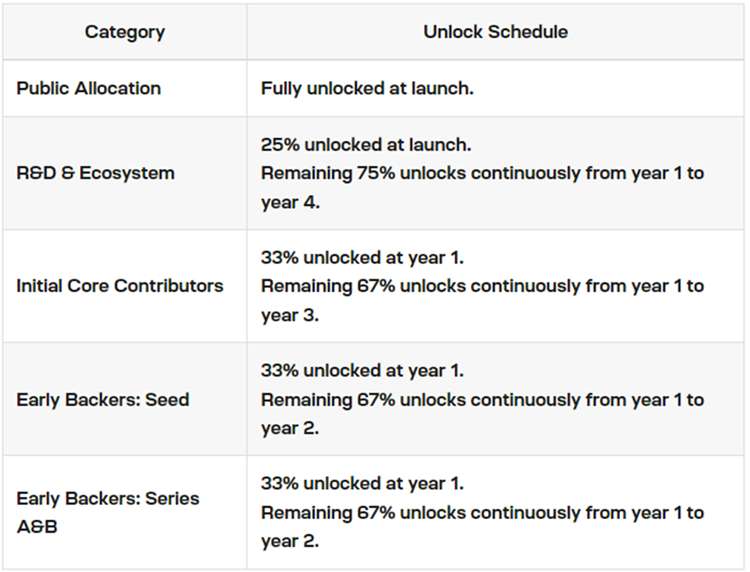

On Tuesday, September 26, the Celestia Foundation announced detailed plans for the issuance and distribution of the Celestia blockchain’s native cryptocurrency, TIA. At genesis, 1bn TIA tokens will be created. 6% of the genesis supply will be airdropped to users across various ecosystems including Ethereum, Cosmos, Optimism, Arbitrum, Starknet, zkSync, and more. More than 75% of genesis supply will be pre-allocated to the Celestia Foundation, Celestia Labs (the development team behind Celestia), and early investors in Celestia that participated in the project’s seed, Series A, and Series B funding rounds. These tokens will be unlocked according to different schedules, which are detailed below:

Aside from information about the distribution of TIA, details about the utility of Celestia's native token was also shared in Tuesday’s blog post. The following is a summary of the use cases for TIA on Celestia:

Staking: Celestia is a proof-of-stake blockchain. Users can help secure the network by delegating their TIA to a Celestia validator for a portion of the validator’s staking rewards.

Network parameters: TIA holders have the power to vote on a set of network parameters, including Celestia’s block size, max square size, and more.

Community pool: 2% of all Celestia block rewards will go to the “Celestia community pool”. TIA holders will be able to vote on how the assets in the community pool are spent.

OUR TAKE:

One of the most notable aspects of the Celestia genesis airdrop design is the broad criteria for eligibility. Users that are eligible for TIA tokens include not only contributors to the Celestia ecosystem, but also the users of the top 10 Ethereum-based rollups by total value locked (TVL), public GitHub contributors to the Ethereum, Bitcoin, and Cosmos codebases, stakers on Cosmos, among other categories of users spread across various Layer-1 and Layer-2 protocols. The Celestia Foundation is clearly targeting the incentivization of users and developers who are already familiar with interactions on a modular blockchain tech stack like Ethereum or Cosmos to bootstrap the launch of Celestia. In some ways, this strategy is akin to a decentralized finance (DeFi) “vampire attack,” where developers create a clone or fork of a popular DeFi application and imbue it with improved incentives and rewards designed to drain users away from competitors.

Though the Celestia genesis airdrop does incentivize users from alternative general purpose blockchains to engage with the Celestia ecosystem, the Celestia protocol is by no means a clone or fork of Ethereum or Cosmos or any other Layer-1 blockchain for that matter. Celestia is a Layer-1 blockchain highly optimized to support Layer-2 rollups that does not natively support general purpose blockchain computation. Celestia offloads the responsibility of smart contract execution to other Layer-2 networks. In doing so, Celestia developers believe the Celestia protocol can become the backbone for a highly scalable and interoperable network of rollups and, most importantly, achieve this modular vision without sacrificing decentralization or security. At its core, the blockchain modularity theory proposes that the core functions of modern blockchains—consensus, computations, and data availability—should themselves be disaggregated and broken into different layers or networks, allowing for tweaks and maximizations that increase the efficiency of each while sacrificing the fidelity of none.

The launch of Celestia is a highly anticipated event in the crypto industry because Celestia from its genesis will be highly optimized as a data availability (DA) layer for Layer-2 rollups and thereby be one of the purest applications of the blockchain modularity thesis. Celestia will be a novel testing ground for the scalability of pure DA layers and offer rollups a new tech stack on which to build that already contains many of the features that Ethereum and Cosmos developers are in the process of introducing. This week’s announcement of the Celestia genesis airdrop confirms that a genesis launch of the network is near and likely to happen before the end of the year. - Christine Kim

Charts of the Week

The DAI Savings Rate (DSR) has retreated to 5% as utilization nears 3-year highs around 30.3%. Utilization is the portion of total DAI supply deposited into the DSR, or DSR Supply / Total DAI Supply. As of August 28, there is 1.66 billion DAI deposited in the DSR and 5.45 billion total DAI in existence.

The Enhanced DAI Savings Rate (EDSR) was introduced as a tool to offer competitive yield on DAI and shore up demand for the stablecoin. The EDSR is a parameterized apparatus that adds a multiple to the DSR and floats with its utilization. A proposal that succeeded in late July called for the reduction of the maximum EDSR to 5% and updated its parameters with the intention of bringing longevity and sustainability to the mechanism.

While the DSR can be used as a device to attract users to DAI, it comes at a cost. The annualized yield paid to DSR depositors topped 115 million DAI in mid-August, and currently sits around 83 million DAI. This cost has direct implications on MakerDAO and its economic health as revenue earned by the DAO funds the DSR. The sharp increase in DSR-related costs prompted the proposal above and brought the economic well-being of MakerDAO into question.

As it currently stands, MakerDAO is estimated to be earning 195 million DAI in annualized revenue and 65 million DAI in annualized profit.

Other News

Coinbase rolling out perpetual futures trading for retail users outside US

Bitcoin Ordinals creator Casey Rodarmor pitches BRC-20 alternative ‘Runes’

Chainlink's CCIP goes live on Coinbase's Ethereum Layer 2 network Base

Curve founder Michael Egorov settles entire debt position on Aave

Binance's market share among non-USD exchanges slips to 50%

Circle launches EURC stablecoin on Stellar network

Chase UK blocks crypto-linked payments due to increasing fraud and scams

Crypto exchange Kraken plans move into US stock trading

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.