What to Expect from Ethereum 2.0’s First Hard Fork

The Ethereum Beacon Chain has activated its first-ever hard fork, dubbed Altair, which is aimed at creating harsher penalties, fairer activity tracking, and new responsibilities for network stakeholders, a.k.a. validators.

Key Takeaways

The “Beacon Chain” is the new consensus chain for the forthcoming Ethereum 2.0 upgrade. As the name implies, the Beacon Chain is like the pilot light for the new network.

Altair is a backwards-incompatible, system-wide upgrade for Ethereum’s proof-of-stake network, the Beacon Chain. It activated today, October 27, 2021.

Altair is largely considered a warm-up for increasingly more complicated upgrades down the road, such as The Merge scheduled for early 2022.

Altair will help lower the barrier to entry for users to run their own hardware and connect directly to the Ethereum blockchain. As such, Altair is anticipated to improve network decentralization and help boost adoption of the Ethereum protocol over the long run.

Introduction

Ethereum’s new consensus engine, dubbed the “Beacon Chain,” successfully completed its first hard fork this month. A hard fork is a backwards-incompatible, system-wide upgrade, meaning that all nodes are required to upgrade to remain on the network. Named after the twelfth brightest star in the night sky, “Altair” is the penultimate upgrade leading up to Ethereum’s highly anticipated switch from a proof-of-work (PoW) to proof-of-stake (PoS).

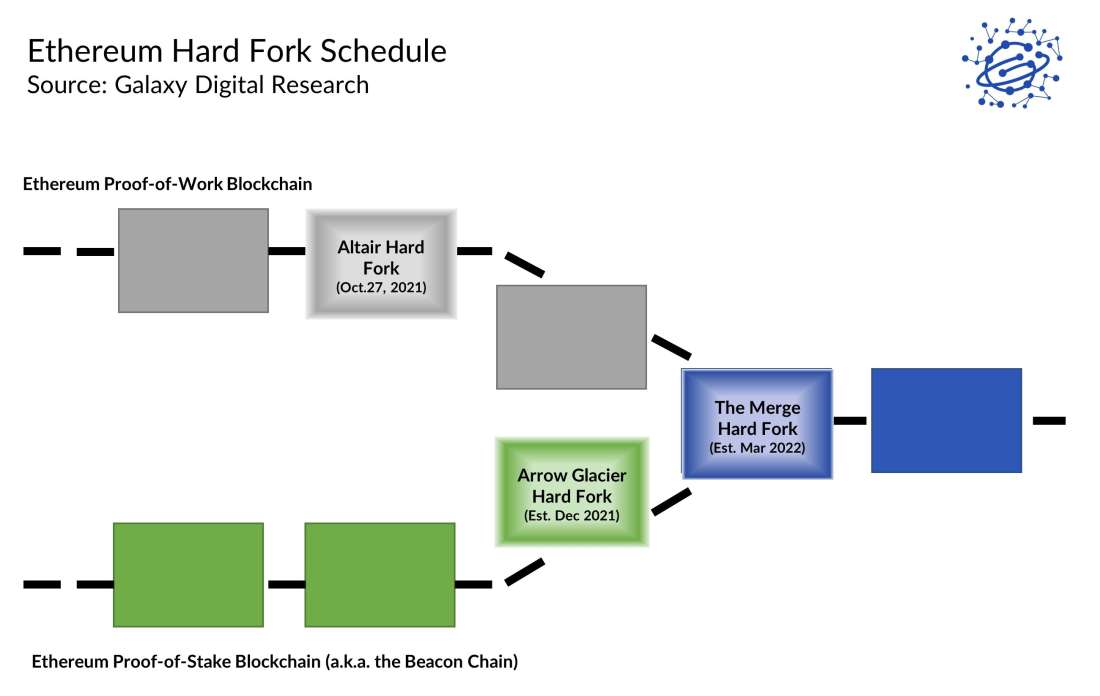

The following graphic illustrates the order of events that will lead up to the Merge. First, the Beacon Chain will undergo its first hard fork, Altair. Shortly thereafter, in December 2021, the Ethereum PoW chain will also be upgraded in preparation for early next year when the two parallel chains finally come together.

Altair is widely considered by protocol developers as a “warm-up upgrade” for network stakeholders and node operators who will have to upgrade their machines again in early 2022 for the comparatively more complex and risky switch to PoS, also called “the Merge.” At some point in the future (currently estimated for March 2022), the Beacon Chain will merge with the Ethereum proof-of-work (PoW) chain. This upgrade will end mining on Ethereum indefinitely and replace PoW mining with the consensus mechanism of the Beacon Chain called proof-of-stake (PoS).

Among other changes, Altair will introduce stricter penalties to validators, which are the equivalent to miners on a PoS network, and create the stepping stones for “light” software clients able to run at a fraction of the cost currently required to operate a validator on the Beacon Chain.

Unlike the node operators of Ethereum’s PoW chain, individuals and businesses who run Beacon Chain software will need to upgrade their machines for all three hard forks, even the one happening in December. This is because connecting to the Beacon Chain already requires users to operate an Ethereum PoW node, as well as a Beacon Chain node.

Benefits of Moving to Proof-of-Stake

One of the major benefits that Ethereum developers see for moving to Proof-of-Stake (PoS) is that it will make mining operations obsolete and therefore reduce the Ethereum network’s energy usage by over 99%. As a result, the Merge is also anticipated to further differentiate Ethereum from Bitcoin as a comparatively more environmentally-friendly cryptocurrency, given that the network will no longer require large amounts of electricity or hash power to operate.

Since Ethereum’s launch, protocol developers have been planning for and looking ahead to a full transition to PoS. However, the unexpected and exponential surge in user activity on Ethereum since launch has significantly delayed progress on the transition as the number of stakeholders participating in the protocol’s decentralized governance similarly expanded from just a handful of individuals to a sprawling collective.

Given the size of Ethereum’s decentralized application (“Dapp”) ecosystem and the diversity of its participants, collective decision-making about the future of Ethereum has become an increasingly arduous task, fueled by competing interests from users, developers, miners, exchanges, wallet services and more. But rather than getting bogged down with the politics of decentralized governance and leaving the protocol largely unchanged, the Ethereum community — in stark contrast to the Bitcoin community — continues to forge ahead, innovating at the cutting edge of blockchain technology.

Ethereum protocol developers now anticipate the Merge to be ready for activation by the end of March 2022. In the interim, Altair — scheduled for activation at epoch 74240 or Oct 27, 2021, 10:56 UTC — will make several minor improvements to operations on the Beacon Chain and prepare stakeholders earning rewards on the network, also called validators, for the larger “Merge” upgrade down the road.

Making Ethereum More Decentralized

The main benefit of Altair, other than bringing Ethereum one step closer to becoming a greener cryptocurrency through PoS, is that it will establish the building blocks for lightweight versions of Beacon Chain code that can run on virtually any device from a smartphone to a laptop. By enabling mobile-friendly client software, smaller ETH holders who would normally rely on centralized services such as an exchange or staking-as-a-service provider for earning rewards can more easily choose to use their own hardware to connect to the network and thereby regain control of their funds. The more that staked value on Ethereum is decentralized among several participants, as opposed to a handful of big players, the greater the security and reliability of the overall protocol.

While Ethereum currently enjoys greater network decentralization than its layer 1 challengers, such as Solana, Polkadot and Near, the move to PoS may result in greater centralization by placing more control of the network into the hands of the network’s capital (supply). To counteract this potential issue, Ethereum developers are adopting protocols to allow for smaller holders to participate in this PoS consensus.

Ultimately, changes that decentralize Ethereum and make it easier for average users to participate, whether due to Altair or the Merge more broadly, will boost adoption for the cryptocurrency worldwide and increase trust in Ethereum’s Dapp ecosystem.

Main Features of Altair

Ethereum’s Altair has three main features: penalty parameter updates, inactivity score reforms, and sync committee modifications.

Penalty parameters updates

The penalties for inactivity and malicious behavior on the Beacon Chain will be significantly greater because of Altair.

The time it takes for offline validators to be penalized by the network when block finalization is stalled will be reduced by ~13%.

The minimum amount of ETH penalized will increase from 0.25 ETH to 0.5 ETH.

The additional penalty for misbehavior on the network that increases in proportion to the total number of validators penalized at the same time will increase from a factor of one to two.

The rationale for upping the ante on penalties is to bring the consequences of gaming or attacking the network closer to what was originally intended for the Beacon Chain. The values encoded since the launch of the protocol on December 1, 2020 were deliberately made more lenient to encourage users to stake their Ether (ETH) during the Beacon Chain’s most nascent and experimental phase of deployment.

After nearly a year without major issue on the network, protocol developers will use the Altair upgrade to begin taking the “training wheels” off of the Beacon Chain. With the goal of making the penalties for validator misbehavior even more punitive, the Altair upgrade will eventually increase the minimum amount of ETH penalized from a validator to 1 ETH, instead of 0.5 ETH.

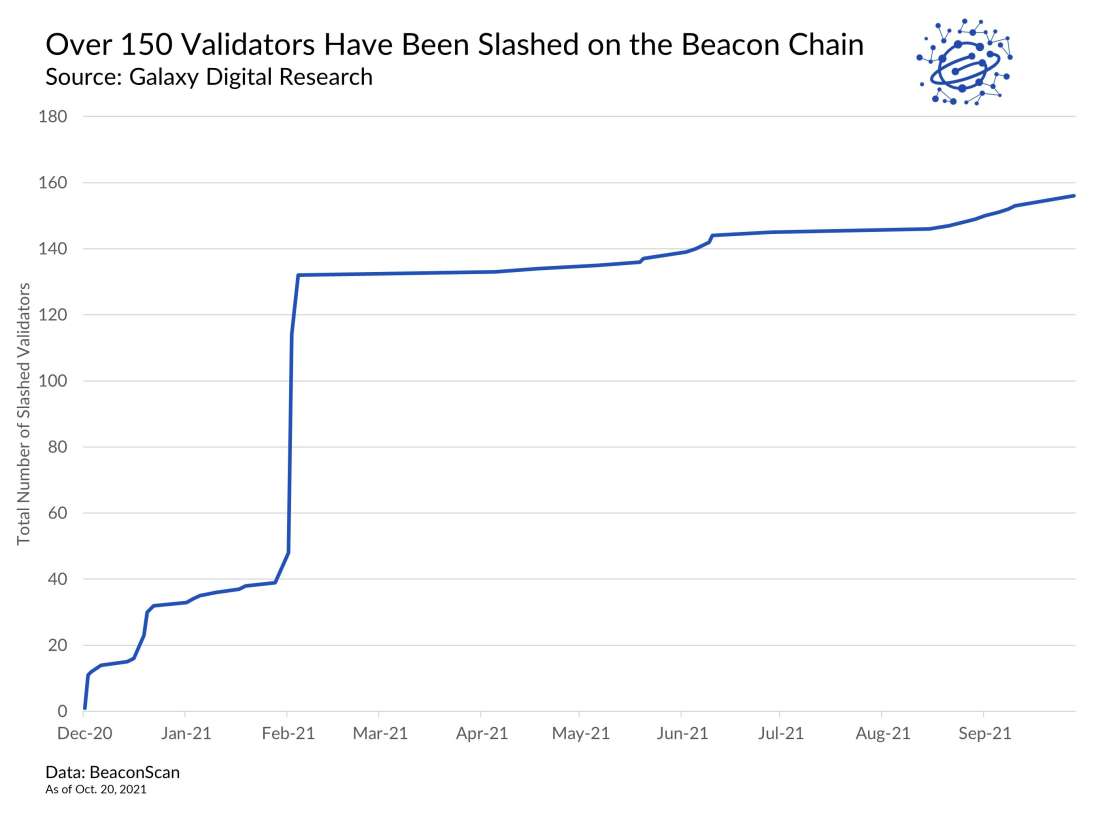

Since launch, less than 1% of validators on the Beacon Chain have been slashed. As evidenced in the chart below, most of these incidents have not occurred with individual node operators but rather with staking-as-a-service providers who are operating dozens if not hundreds of validators at a time. Increasing the cost of making mistakes is expected to further dissuade large staking services from over-engineering their processes unfairly to gain an advantage over smaller stakers.

The Beacon Chain is secured by close to 250,000 validators as of October 2021. Each of these validators represent a deposit of 32 ETH locked as collateral into the network. In exchange for the deposit and for running validator client software, validator node operators receive newly minted ETH issuance, which amounts to receiving an annual percentage yield on their staked ETH as a reward. Engineering the validator client software to collude with other validators or to propose fake blocks can result in a slashing event. Slashing events are when the Beacon Chain forcefully ejects and penalizes validators for having failed to comply with the rules of the protocol.

Inactivity score reforms

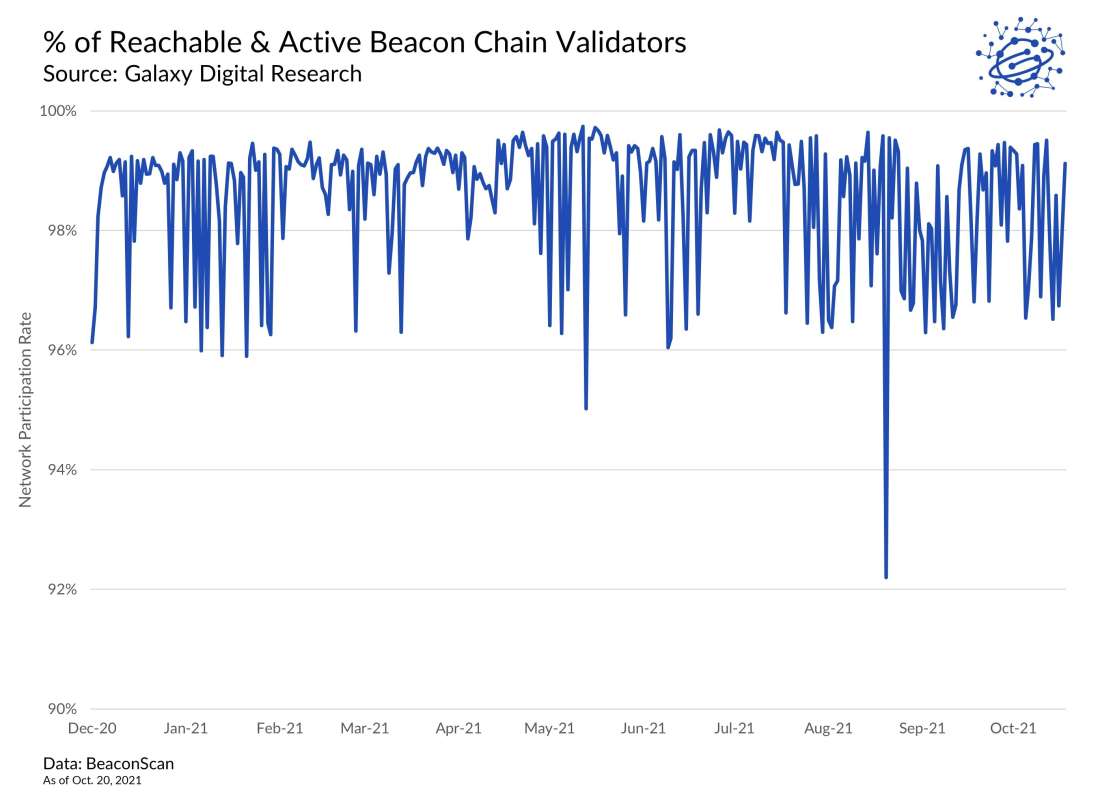

Outside of slashing, validators can also be punished for being offline. When the Beacon Chain is actively producing blocks and progressing through epochs (i.e., bundles of up to 32 blocks finalized over 6.4 minutes), validators who are not connected to the internet and therefore not participating in consensus stand to lose as much as three-quarters of what they could have earned.

When the Beacon Chain is stuck (i.e. not producing blocks and progressing through epochs), the penalties for offline validators become progressively more costly. Altair introduces a way to score offline validators during these scenarios such validators who have historically remained inactive for long stretches of time are penalized more than validators who have a good track record of staying online.

Sync committee modifications

Through Altair, validators will also get rewarded for a new type of network responsibility designed to support lightweight versions of Beacon Chain software that can run on mobile devices. Called “light clients,” this type of software will rely on validators attesting to and broadcasting basic information about the current state of the blockchain.

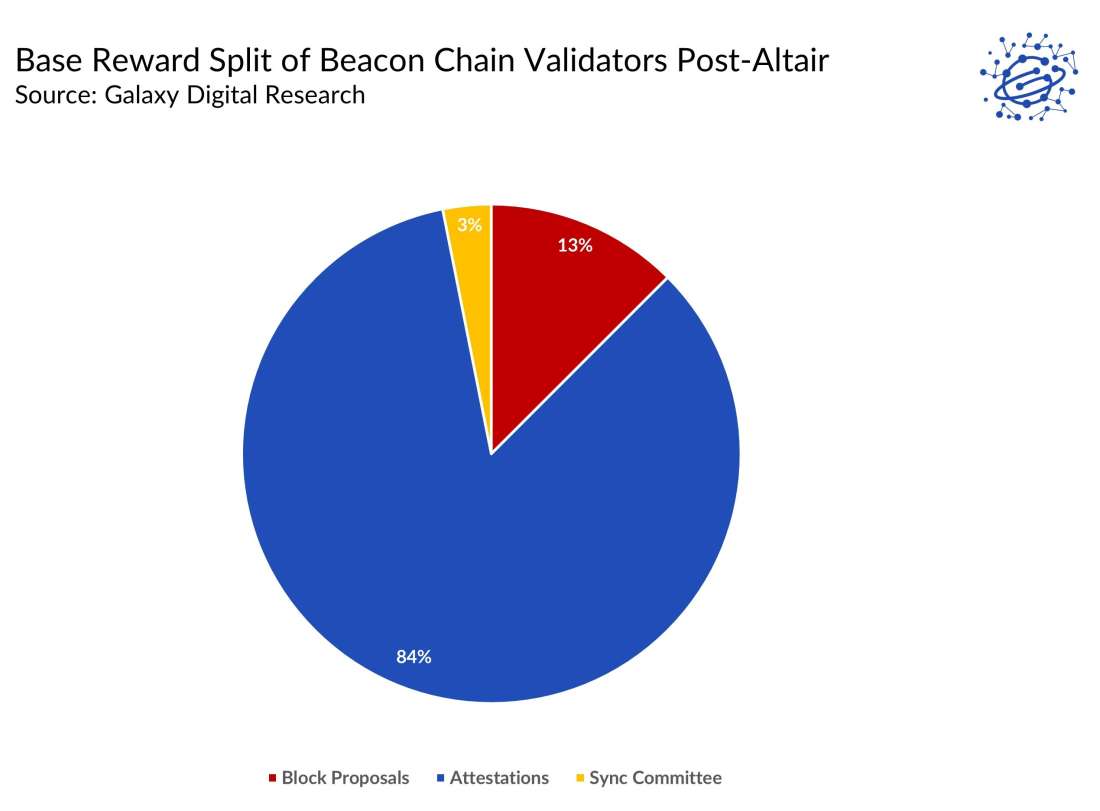

At present, validator responsibilities are mainly split between block proposals and block attestations. Block proposals are when validators are assigned to propose a block containing data about the updated state of the Beacon Chain. They make up a small percentage of total validator rewards because of how infrequently validators are assigned this responsibility. Every 12 seconds, one validator out of the roughly 250,000 total is assigned to propose a block.

All the validators who weren’t selected to propose a block are assigned to an attestation committee. These committees are made up of a minimum of 128 validators and each participating member much “attest” to a proposed block by casting a vote and confirming that the data in the block is valid. These are block attestations.

Post-Altair, validators will also get assignments to participate in “sync committees” that relay useful information for light clients such as the most recent epoch.

After the Altair upgrade, 3% of validator rewards will be earned from responsibilities related to the sync committee. Nearly 85% of rewards, however, will still come from block attestations, which are meant to affirm the progression of a single blockchain and, in the event of a chain split, evaluate which chain is the canonical one.

Conclusion

Altair is the first significant change to the code specifications of a network that has accumulated close to $30 billion in staked ETH. It will introduce greater penalties to validators who violate the rules of the Beacon Chain protocol and establish new parameters for making the reward dynamics for validators more equitable. Finally, Altair is also aimed at setting up the building blocks for light client support that decentralized applications, wallets, and other blockchain services can leverage to create mobile-friendly versions of their products.

All validator node operators must upgrade to the latest software to continue earning rewards. However, miners and other service providers operating nodes strictly on Ethereum’s parallel PoW blockchain are not required to participate in this upgrade.

All node operators, whether on the Beacon Chain or Ethereum’s PoW blockchain, will need to upgrade their machines for minor code changes impacting the mining difficulty schedule this December. The December “Arrow Glacier” upgrade and Altair upgrade are the last two tweaks to the Ethereum protocol that will be executed before all attention is turned to the Merge. The latest estimates from protocol developers suggest the Merge upgrade will be ready for deployment by the end of March 2022.

As a preliminary checkpoint for the Merge, Altair is expected to be a barometer for measuring the readiness and flexibility of the Beacon Chain to successfully activate changes to its protocol. In addition, Altair is anticipated to help combat centralization forces on Ethereum after it switches to proof-of-stake by setting up the building blocks for light client software.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email contact@galaxydigital.io. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.