El Salvador Adopts Bitcoin

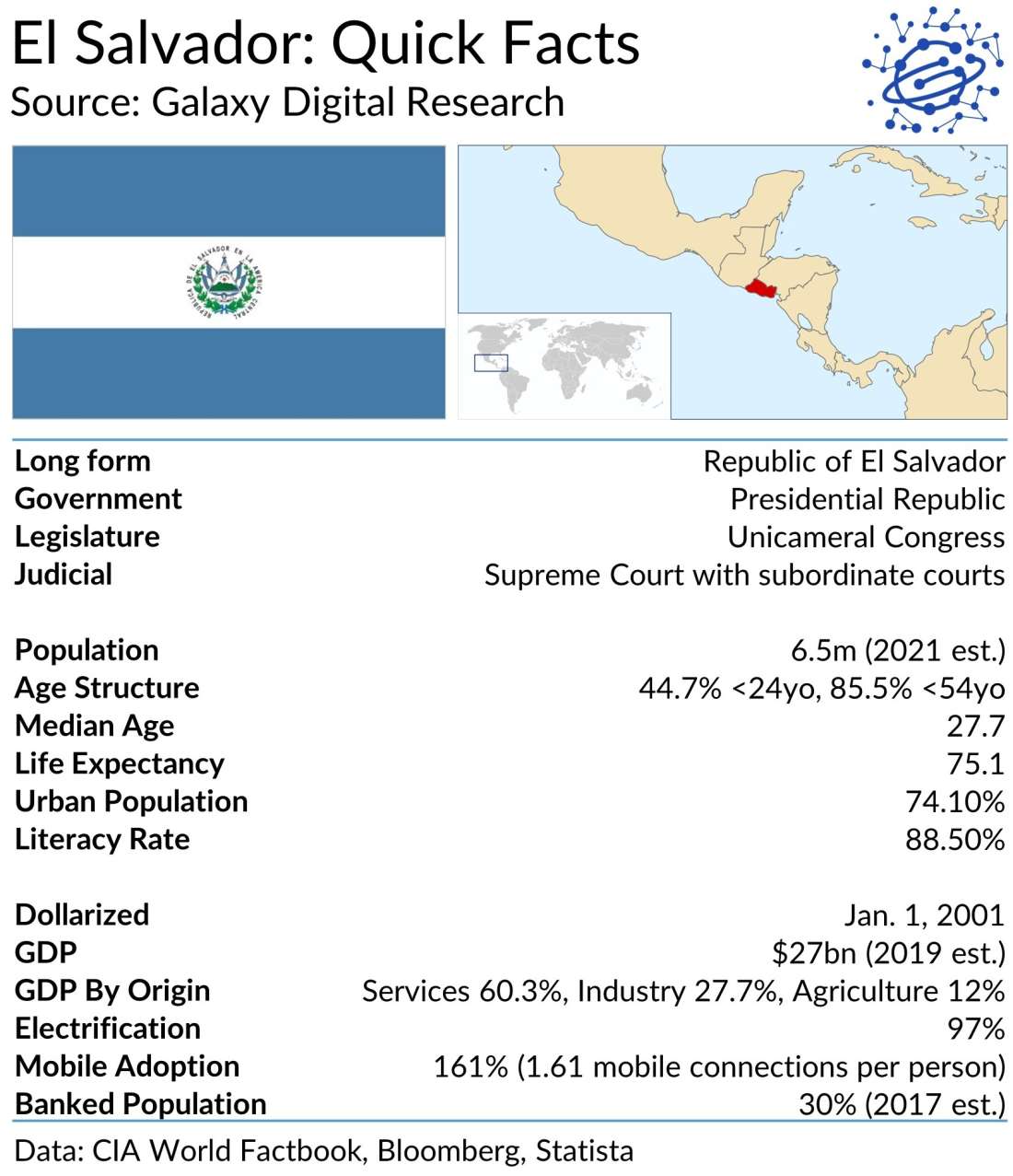

Bitcoin became legal tender in the Central American nation of El Salvador this week, making it officially a sovereign currency. With a population of around 6.5 million and another 2 million living abroad in the United States, Bitcoin will serve to lower remittance costs for a population of mostly unbanked Salvadorans while also giving them a hedge against dollar-denominated Central Bank inflation. While the inauguration is a landmark moment in the coin’s 12-year history, it isn’t going off without a hitch, as some minor technical glitches have impacted the rollout and international forces continue to criticize El Salvador’s government and Bitcoin itself.

Key Takeaways

On June 9, 2021, El Salvador’s Congress passed a law making Bitcoin legal tender in the country alongside the US dollar, which has been legal tender since 2001.

The law took effect on September 7, 2021; it requires all merchants who are “technologically capable” to accept Bitcoin.

Citizens who download the nation’s Chivo Bitcoin wallet and register with their national ID will receive $30 in free BTC. So far, the nation has purchased 550 bitcoin and it intends to purchase “much more.” The BitGo-powered Chivo is Lightning compatible.

Merchants and citizens are promised the ability to instantly convert between USD and BTC.

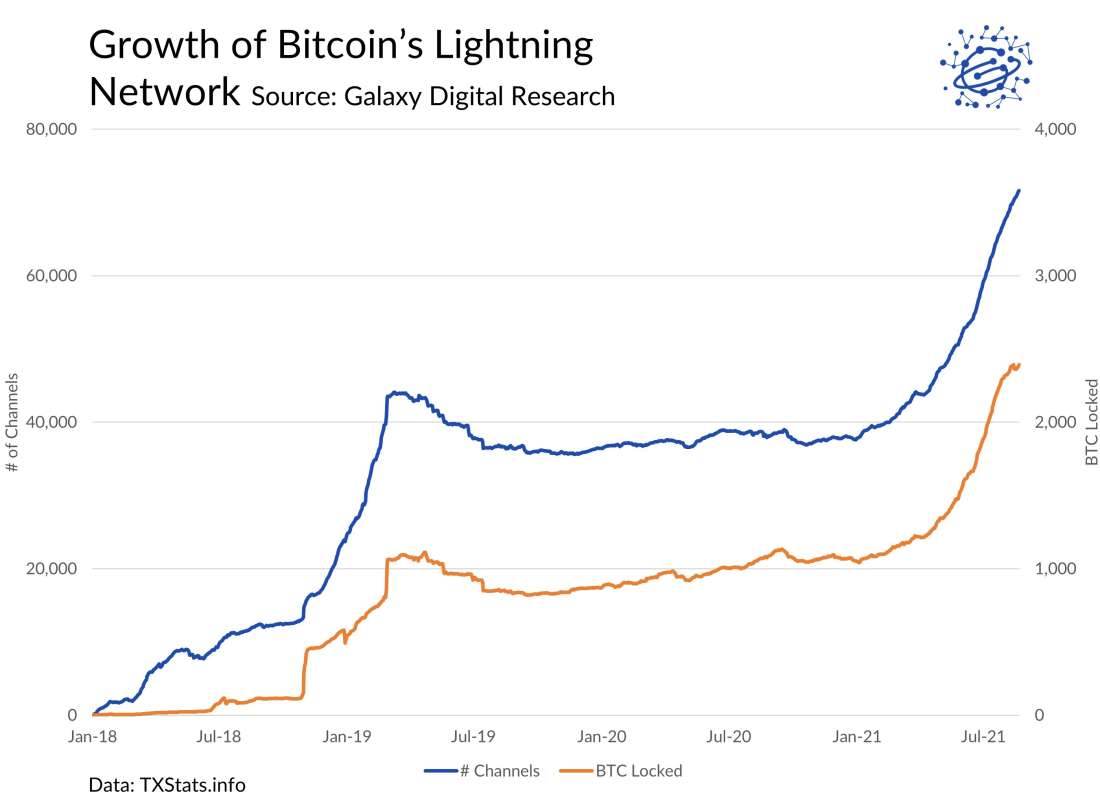

The rollout coincides with significant growth in Bitcoin’s Lightning Network, a layer-2 scaling solution that El Salvador is relying on.

If successful, the initiative could have a ripple effect, causing other states to progress towards a similar adoption plan.

First for the World

In a late-night Congressional session on June 9, El Salvadorian lawmakers overwhelmingly approved a law to make Bitcoin legal tender in the country, alongside the United States dollar, making it the first nation to accept the world’s oldest and most valuable cryptocurrency. President Bukele hailed the bill’s passage, arguing that the use of Bitcoin and its Lightning Network will expand access to financial services and “help people who send remittances.”

But the initiative is older than 2021, as Bitcoin adoption in El Salvador truly began in the coastal communities of Punta Mango and El Zonte in 2017. Collectively known as Bitcoin Beach, Bitcoin activists led by surfer Michael Peterson have spent four years building a closed “circular Bitcoin economy.” With help from a large anonymous donation from a bitcoin whale determined to see a bitcoin-based economy emerge, Peterson began doling out the currency and helping onboard users and merchants. The population was largely unbanked, but a high percentage had mobile phones, creating fertile ground for mobile bitcoin adoption. Today, most exchanges in the Bitcoin Beach community are facilitated via Bitcoin, and it remains the preferred currency over even the US dollar.

In 2021 the Bitcoinization effort gained momentum, as a parade of bitcoiners flocked to the region. Jack Mallers, founder of the Lightning Network-focused Bitcoin app Strike, made El Salvador his company’s first non-US market in March 2021. After spending several months in the region expanding Strike’s footprint and meeting with officials, Mallers and President Bukele announced at the closure of the Bitcoin 2021 conference in June that Bitcoin would officially become legal tender in El Salvador, meaning the effort to expand the Bitcoin Beach across the country was successful. Just a few days after the announcement, El Salvador’s Congress, which is firmly in control of Bukele’s party, approved the bill by a wide margin and announced it would take effect September 7, 2021.

The Law

El Salvador’s Bitcoin law includes the following requirements:

Bitcoin will be “unrestricted legal tender with liberating power, unlimited in any transaction, and to any title that public or private natural or legal persons require carrying out.”

Bitcoin’s price will float on the free market.

Prices can be listed in bitcoin and tax contributions can be paid in bitcoin.

Exchanges in bitcoin are not subject to capital gains tax, just like any legal tender. El Salvador notably has no property taxes.

“Every economic agent must accept bitcoin as payment when offered to him by whoever acquires a good or service.” This provision, from Article 7 of the law, has received significant criticism, which we discuss below.

Bitcoin can be paid to satisfy any outstanding debt, including those incurred prior to the passing of the law.

“The State will promote the necessary training and mechanisms so that the population can access bitcoin transactions.”

“The State will guarantee, through the creation of a trust at the Banco de Desarrollo de El Salvador (BANDESAL), the automatic and instantaneous convertibility of bitcoin to USD.” The trust is initially funded with $150 million and more can be raised if necessary.

Preparing for Implementation

In the months since the law’s passed, the El Salvadorian government has undertaken several major initiatives to prepare for its enactment. These include:

The installation of hundreds of Bitcoin ATMs. The government has installed at least 200 ATMs around the country to facilitate conversion between Bitcoin and USD. Conversions between UDS and BTC will be “commission-free” and 50 in-person branches across the country will also facilitate deposits and withdrawals. Other providers are installing their ATMs, including Athena Bitcoin, which said it is installing an additional 1,500 ATMs in the country.

Rolled out the Chivo mobile wallet. The government has released an official Bitcoin wallet, also called Chivo (slang for “cool”), to help form the basis for everyday use of the cryptocurrency, which is available both on Android and iOS. However, consumers and merchants are free to use whichever bitcoin wallets they please.

Acquire BTC to support a $30 giveaway to all citizens who sign up. The government has promised to give every citizen who signs up for the Chivo wallet using their national ID $30 in free bitcoin and appears to have begun purchasing the coins on Tuesday, September 6, with the announcement of a 200 BTC purchase (~$10m). This purchase was followed up with another 200 BTC purchase, and then another 150 BTC purchase, bringing the total spent on the 550 bitcoin to roughly $25.3 million.

Coordinated with several external wallet providers. Bitcoin providers are flocking to El Salvador, with providers of Lightning Network services finding fertile ground for experimentation and development. As Bitcoin’s layer-2 scaling solution, the Lightning Network enables instant, global, non-custodial Bitcoin payments at a fraction of the cost of transacting on-chain and with strong, albeit slightly weaker than layer-1, cryptographic assurances. Whether fully a result of the El Salvador rollout, or other forces bumping its adoption, the Lightning Network has seen parabolic growth year-to-date.

Criticisms

The law has received criticism both inside and outside El Salvador. This criticism has come from:

Salvadoran activists: in 2001 El Salvador dollarized, meaning it made the US dollar legal tender. While dollarization has typically benefited lower-income countries like El Salvador, its residents still experienced growing pains while adjusting to the foreign currency. Lower-income Salvadoran’s often couldn’t read, write, or do currency conversions, resulting in them paying more for goods than they had under the old money system, which used a currency called the colones. Businesses even closed due to the switch. Like the dollarization initiative, the turnaround between when the bitcoin legislation passed and when it went into effect was short, meaning businesses and individuals alike were given little time to adjust to the law or learn about their new currency.

International organizations: world organizations,includingThe International Monetary Fund, have disparaged the initiative, saying in a June 10 statement that it foresees several “macroeconomic, financial and legal issues” with the legal tender law and that it is “following developments closely.” The World Bank also pushed back, refusing a request from El Salvador for assistance implementing the law due to “the environmental and transparency shortcomings.” One major concern for regulators is the use of Bitcoin for international money laundering. Markets have noted the concern, as investors are now charging a premium to hold dollar-denominated Salvadoran debt. Raising more debt could become a bigger issue in the country, as its debt to GDP ratio is already over 90%. As a direct consequence of the Bitcoin Law going into effect, ratings agency Moody’s has lowered Salvadoran debt to Caa1 from B3, meaning raising debt will be even more costly.

The US government: pieces of the recent infrastructure bill, coupled with the Treasury Department’s comments and attempts to corral bitcoin, make it clear that much of Washington is not a fan of Bitcoin. But the US’s hold over El Salvador is limited, as the US government has no direct jurisdiction in the country. However, as the highest voting power on the IMF and the sole issuer of dollars, the US does have some financial leverage over El Salvador. Members of Congress have asked the Biden administration to make international funding to El Salvador “contingent on respect for democracy, judicial independence, and the rule of law” while Vice-President Kamala Harris has expressed “deep concerns” over the consolidation of power in El Salvador (more on that below). While it’s worthwhile to keep an eye on the actions of the US, ultimately the IMF and other international organizations are more important for El Salvador’s Bitcoin experiment. Notably, El Salvador’s move means the banning of bitcoin in the US would be equivalent to banning another sovereign's currency, something that the US has never done.

Bitcoiners: while celebratory over the El Salvadoran government adopting bitcoin, bitcoiners have been critical of some of the government’s implementations while they have also condemned that the adoption is being coerced.

Friends of democracy: Since taking office a little over two years ago, Bukele and his party, which controls El Salvador’s Congress, have consolidated power. Criticism over his and the party’s actions has been near-universal, with bitcoiners, media publications, and the governments like the US condemning his actions. In the past, he’s used soldiers to force legislation through Congress and released photos of imprisoned and nearly naked gang members. More recently, he restructured the nation’s Supreme Court by replacing five judges with ones loyal to his party. After that, the same court ruled that he could re-run for president in the next election cycle, (re-election typically requires a 10-year gap). The court also extended the length of presidential terms from five to six years, drawing the criticism of the United Nations Secretary General. While Bukele is cleaning up the streets and lowering corruption, his consolidation of power is alarming and puts the country at a greater risk for foreign intervention in his country’s affairs.

Article 7: Article 7, which requires all “economic agents” to accept bitcoin payment, has been disparaged by bitcoiners. In response to the criticism, the country’s finance minister said the use of Bitcoin will be “totally optional” two weeks ago. His comments contradict Article 7, described above, and despite assurances, the finance minister refused to explain the contradiction of why Article 7 shouldn’t then be eliminated in its entirety. They also contradict more recent comments from presidential legal adviser Javier Argueta, who confirmed businesses must have an electronic wallet to receive payment, even if the payment is made in dollars, not bitcoin.

Considerations for El Salvador

El Salvador faces several implementation challenges, due in part to its status as the first nation ever to attempt a Bitcoin integration and some specific internal realities of the country. These include:

Educating the population on bitcoin’s technology and uses. The education of the populace on both the use and trade-offs of Bitcoin is of the utmost importance. El Salvadoran’s are less likely to use Bitcoin if they don’t understand its nascent features (scarcity, immutability, resiliency, decentralization, etc., etc.) and they won’t adopt it if they don’t know how to download a wallet, buy bitcoin, and send and receive payment. Unfortunately, the data indicates Salvadoran’s remain uneducated about Bitcoin, as one survey found 50% of the country “knew nothing” about bitcoin and roughly 75% were skeptical of it.

Ensuring the convertibility between BTC and USD. As mentioned above, El Salvador’s debt situation is worsening. Regrettably, adopting bitcoin could make it worse. Since the country on net imports more than it exports, it is largely dependent on remittances for its dollars. By accepting bitcoin and exchanging it for dollars the state risks lowering its reserves, which are already low by international standards. A crash in bitcoin’s price could cause the state to default (which it did in 2017) and it would potentially be unable to raise more dollar debt on account of its high debt costs. A debt or reserve default could weaken the state convertibility between the US dollar and BTC. Luckily, since Bitcoin is an open monetary network and since stablecoins exist, locals should be able to convert their BTC as needed.

Maintaining technological availability and security. Migrating and running financial infrastructure for an entire country was never going to be easy but on day one that became very clear when the app for El Salvador’s Bitcoin Wallet, Chivo, became temporarily unavailable on Tuesday, as the government struggled with a surge in demand. Luckily, the thing the Salvadoran infrastructure is being built on, Bitcoin, has been the most reliant blockchain network, with a near 100% uptime for nodes since inception. But the network’s resiliency doesn’t mean the country’s rollout will be without its share of hiccups. Thankfully, El Salvador is getting the attention and aid of robust Bitcoin-focused firms, meaning availability should only be a problem in the short term.

The volatility of bitcoin’s price. Bitcoin has been and perhaps always will be famous for its remarkable bull-runs and quick pullbacks. It cannot be overstated how much the success the of El Salvador experiment hinges on Bitcoin’s price. With the majority of its 6 million residents largely uneducated on Bitcoin, any quick drops in the price or sustained sideways trading action like the bear market between 2017 and 2020 will surely make Bitcoin unpopular with the locals, at least until the price recovers. To be successful in the near term and likely the medium and long term, El Salvador likely needs bitcoin to perform well.

Geopolitical pressures and implications. The biggest hurdle for Bitcoin in El Salvador in the long term is likely external geopolitical pressure. The power global financial institutions like the IMF and the World Bank wield over small, underdeveloped nations like El Salvador is immense. The IMF is currently reviewing a proposed $1 billion financing agreement to El Salvador right now. The program will reportedly give El Salvador money to “patch budget gaps.” While Bitcoin in El Salvador may just be a small part of the IMF’s considerations, it could move things, especially when President Bukele has been openly aggressive to the IMF and other international money institutions. To put the importance of the IMF program in perspective, consider: the country has a GDP of $27 billion and the average annual income of a Salvadoran is $4,000. The money from the IMF program is about 4% of the annual income per Salvadoran.

Our Take: All eyes on Bitcoin

While the passing and initial rollout of the Bitcoin Law in El Salvador has not been without its share of snags, the official making of Bitcoin into a sovereign nation’s legal tender is, without a doubt, a watershed moment for the world’s oldest and most valuable cryptocurrency. Whether or not the Bitcoin experiment is successful in El Salvador will determine how eager and how quickly other nations and other peoples adopt it. It will also be a valuable test of the biggest question left for Bitcoin: Can the tech scale? All eyes are on this Bitcoin experiment.

Less than 90 days passed from June 9th, when the Salvadoran Congress passed the Bitcoin Law, and September 7th, when it was enacted. While this transition period was brief, the consequences of the Bitcoin Law will be long-lasting and, in most ways, they remain unclear. Fortunately, even if the experiment in El Salvador is short-lived or a failure, the traction gained, and the lessons learned from live testing Bitcoin as a nation’s money will likely be invaluable. Early videos on Twitter showed that international corporations McDonalds and Starbucks had implemented Bitcoin payments already, and even if the experiment in El Salvador fails nationally, the adoption by these corporations may ripple out across the world. Moreover, Bitcoin is resilient and tends to bounce back -- a failure in one country doesn’t necessitate other countries won’t try implementing Bitcoin or won’t be successful with their own “Bitcoin Law.” Above all else, Bitcoin’s future in El Salvador remains uncertain. However, there are a few benefits we feel are almost guaranteed. These include:

Lower remittance costs boost El Salvador’s GDP: Bitcoin and the Lightning Network will substantially lower both the time and cost of remittance payments from the US and other nations to El Salvador. With roughly $6 billion or about 23% of GDP sent home to El Salvador every year via middlemen that can charge upwards of 20%, Bitcoin transfers should save the populace hundreds of millions of dollars.

Banking the unbanked: According to President Bukele, around 70% of Salvadorans don’t have a bank account. But the vast majority of the populace have mobile devices, meaning Bitcoin can effectively become their bank account. This should increase financial inclusion and strengthen the overall economy. More financial inclusion means more exchange and as any Freshmen economics student worth their salt can tell you, more exchange means more production e.g., more wealth.

Provide a moat against central bank inflation: As highlighted by Bukele on numerous occasions, Federal Reserve inflation, while somewhat beneficial to American asset holders or US citizens who got stimulus checks during the COVID-19 pandemic, was harmful to dollarized countries like El Salvador. Bitcoin’s capped supply of 21 million coins gives Salvadorans a way to protect their wealth from expansions in the broader USD money supply while also enabling them to continue to use the cash in parallel with Bitcoin.

Importing talent from abroad: Businesses typically disfavor regulation. El Salvador, which has no property tax and will not impose any capital gains tax on BTC conversions, is opening the floodgates to Bitcoin-focused firms and individuals interested in making the coin the center of their career. There’s anecdotal evidence already that talent is migrating south and, with beautiful beaches, low costs of living, and the recent crackdown on gang violence, it’s possible that the country will see additional inflows that grow the economy and help make the country a financial hub of Central America.

While these developments are exciting, it is important to keep in mind that the current rollout isn’t perfect. Bitcoin is democratic money, designed to be an open-source currency that holds its value and can be used by anyone, anywhere, yet President Bukele and his party are mandating the use of the currency while also tightening their grip around El Salvador’s democratic institutions. Bitcoin’s first tie to a nation-state is one that appears increasingly authoritarian. That tie will not aid adoption, nor will Bukele’s sometimes hostile interactions with international forces like the IMF help Bitcoin’s chances of getting favorable regulation. While there are other negatives we could discuss, a Salvadorian decline towards authoritarianism is our chief concern for Bitcoin as it is the most damaging to the cryptocurrency’s image and its adoption.

Regardless of some inherent issues to El Salvador’s use of Bitcoin, the country’s adoption is a net win for Bitcoin because it gives the currency global legitimacy, albeit the legitimacy of a small country. This will provide new and fertile ground for testing and development. And perhaps most importantly, it will substantially decrease the odds that a western nation like the US bans Bitcoin.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsement of any of the stablecoins mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.