USDC's Fall Below $1 Sent Ripples Across DeFi

In this report, we examine the impact of USDC’s largest depegging event in its history on DeFi markets.

Circle, the issuer of USDC, holds a portion of its cash reserves with US regulated banking partners including Bank of New York Mellon, Citizens Trust Bank, Customers Bank, New York Community Bank, Signature Bank, Silicon Valley Bank and Silvergate Bank. Per its most recent monthly attestation report as of January, most of the total $43.5bn in reserves backing USDC were in the form of short-term US Treasuries (~77%) while the remaining ~$9.9bn (~23%) were in the form of cash held with US regulated financial institutions.

Circle relied on these banking partners not just for banking the cash reserves that back USDC but also for 24/7 real-time payment services to move its capital to quickly meet demand for client USDC issuance/redemptions requests (e.g., Silvergate Exchange Network (“SEN”) and Signature Bank’s Signet platform). Over the past two weeks, several of the banking partners that Circle relied upon had experienced financial/operational issues. Silvergate announced its voluntary liquidation plan on Wednesday March 8, Silicon Valley experienced liquidity/solvency issues and was eventually taken over by the FDIC March 10, and New York State regulators shut down Signature Bank on Sunday March 12 citing systemic risk.

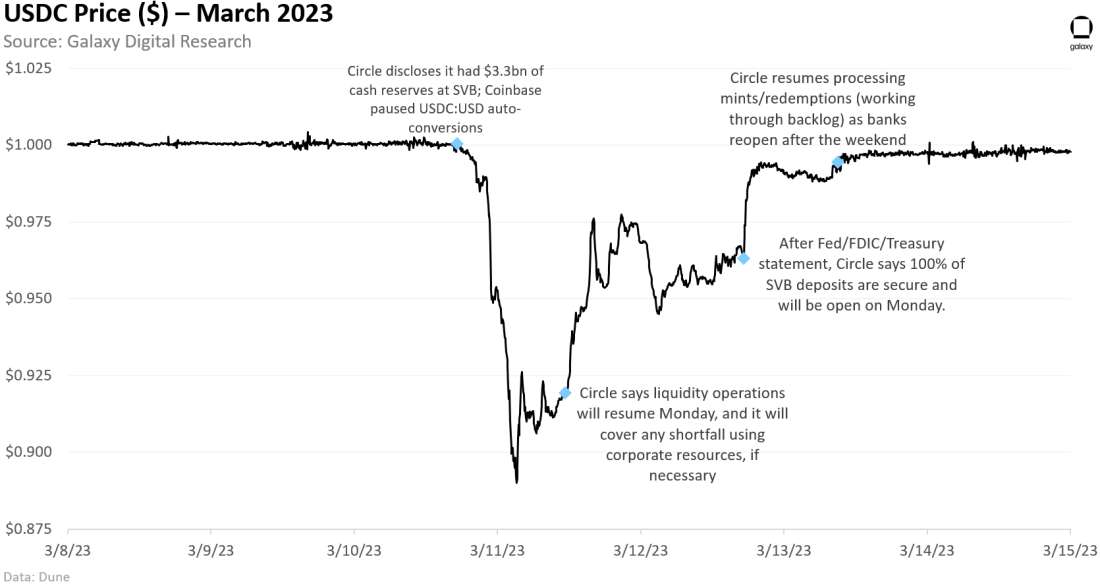

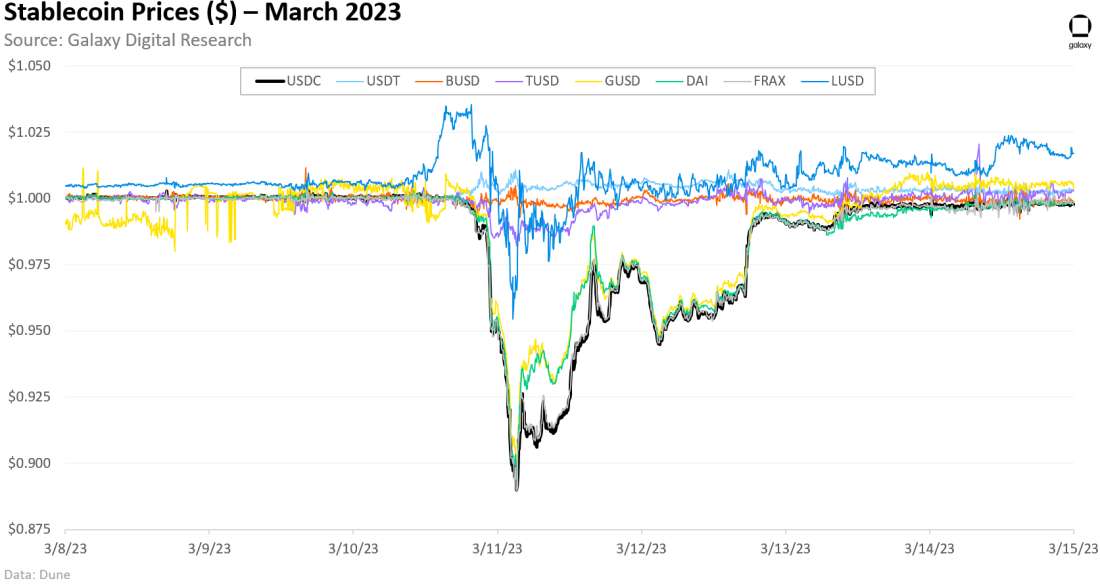

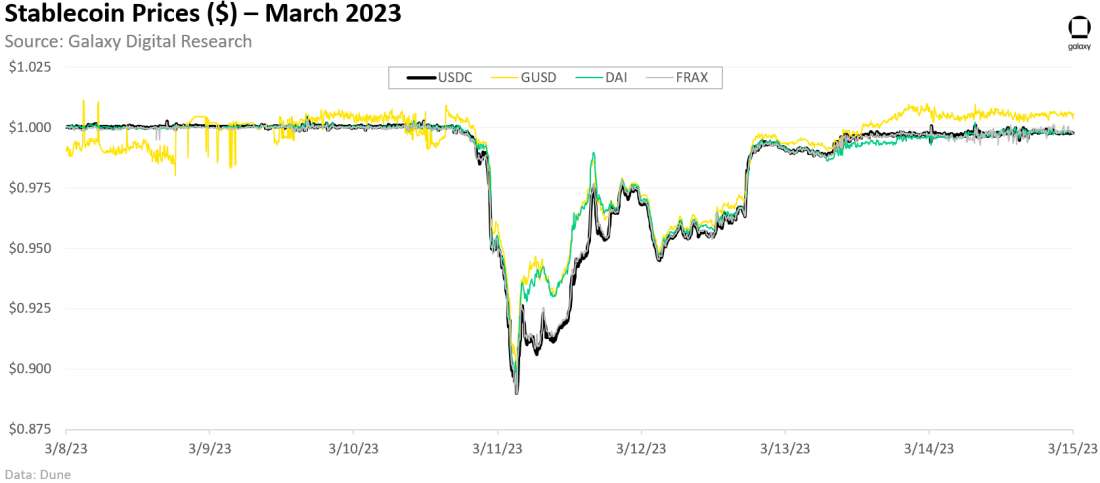

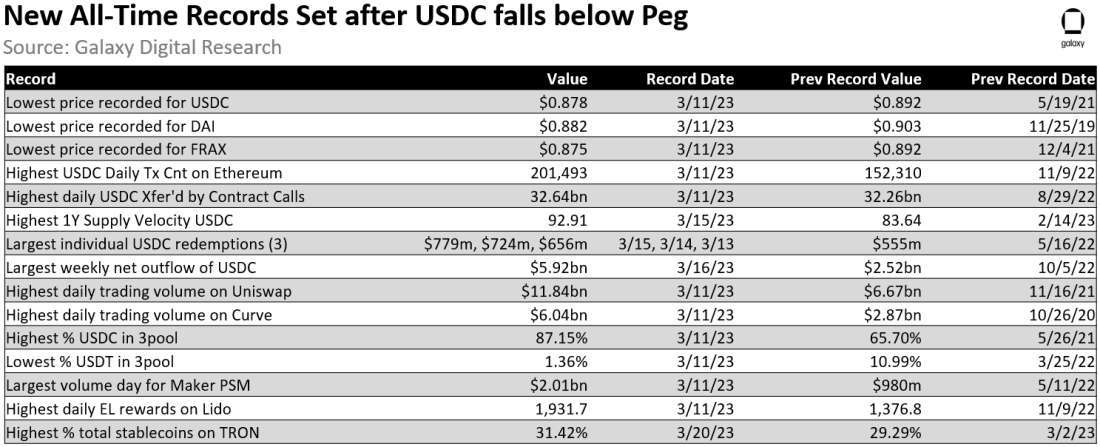

Since a portion of USDC’s cash reserves were tied up at these financial institutions, these sudden banking failures led to concerns over the redeemability of USDC for dollars. On the evening of Friday March 10, Circle disclosed it had $3.3bn of cash reserves at SVB. As USDC’s primary stability mechanism via complete collateralization and Circle’s full redemption guarantees at $1 became temporarily unavailable, USDC’s price became more susceptible to fluctuations on external markets such as on Curve and Uniswap. The price of USDC fell as low as $0.88 over that weekend, which drove significant volatility across the rest of the crypto markets and record-setting trading activity on-chain.

Even though the price of USDC largely recovered back towards $1 following Sunday evening’s joint announcement from the Treasury/Fed/FDIC that all depositors of SVB and Signature would have access to their deposits (including non-FDIC insured amounts) and Circle’s resuming processing redemptions on Monday, the effects of the past week’s abrupt events impacting the leading onshore stablecoin continue to be felt.

Withdrawals & Redemption Requests Pour in for USDC

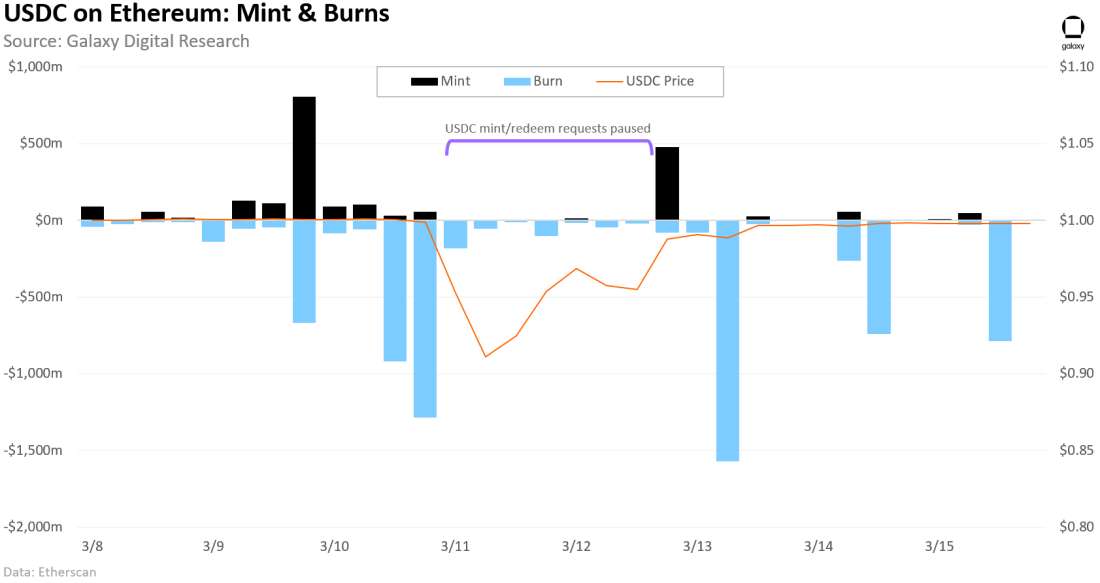

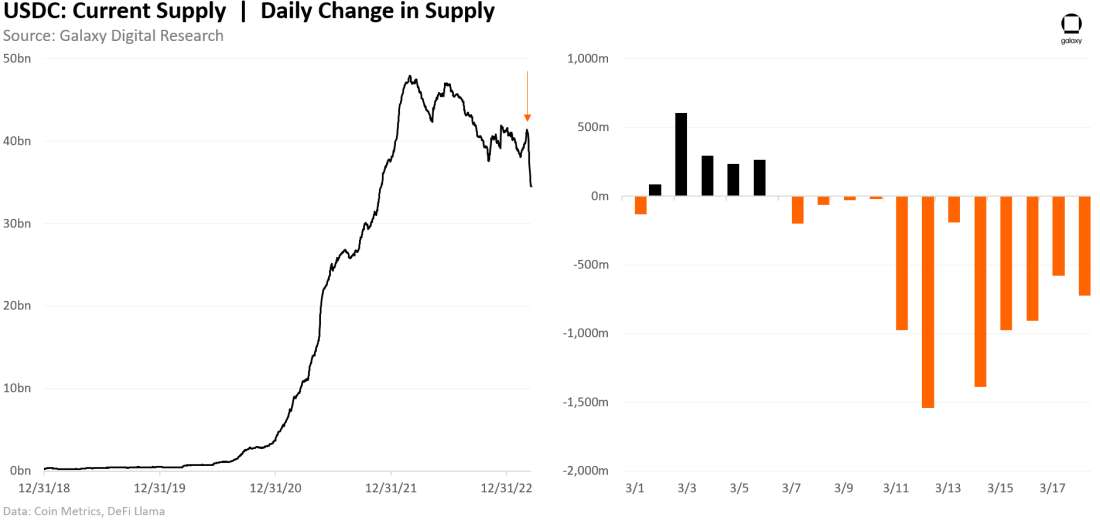

Circle experienced massive redemption requests starting on Friday March 10, totaling over 2.3bn for the day, as panic from banking failures spread to Circle, which had failed to alleviate concerns around the solvency of its stablecoin.

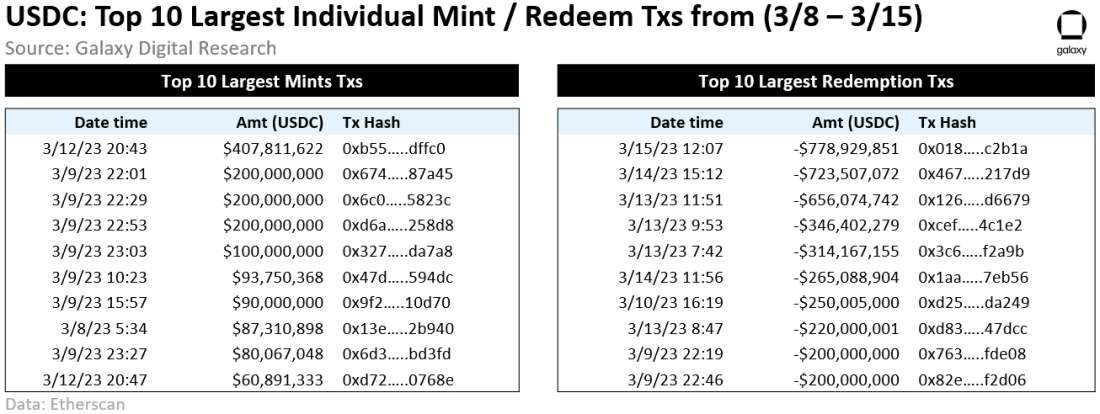

Circle temporarily halted processing of new mints/redeems of USDC overnight on Friday 3/10, which drove USDC’s price to slide. USDC holders with Circle accounts were still submitting redemption requests by sending USDC to the Circle address on-chain (0x55f…844b8), but many of the requests were not processed until after the weekend as a backlog had grown. Minting activity on-chain had resumed in small amounts after a hiatus of 26+ hours, but there were no material mints until Sunday night when there was a large mint of 408m USDC – the largest minting transaction over the previous week.

Despite USDC eventually (mostly) recovering back to its dollar peg after the assurances from the Fed/FDIC/Treasury on Sunday, there were still sizable redemptions in the days that followed. Circle experienced its single largest redemption in its history of 656m USDC (previous record was 555m on 5/16/22), which was quickly surpassed the next day by a redemption of 724m USDC submitted on Tuesday 3/14, only to be eclipsed by an even larger request of 779m the following day - these three redemption transactions are the 3 largest in Circle’s history.

On a net basis, the supply of USDC has decreased by over $7.2bn since 3/7 to ~35.5bn (-18%) as of 3/20. The pace of USDC outflows also accelerated for several days even as the price of USDC recovered from its lows – for the from March 11 to March 19, net outflows of USDC averaged $909m per day.

USDC’s Impact on DeFi

USDC is a foundational asset within DeFi. Compared to Tether, the leading stablecoin by market cap which is used primary as a trading instrument on centralized exchanges, USDC is utilized much more heavily in DeFi as nearly 40% of USDC supply sits within smart contracts. USDC’s de-pegging saw many other stablecoins to fall in line due to various redemption or conversion mechanisms that linked USDC to other stablecoins – or even other stablecoins to other stablecoins by extension through USDC.

Curve

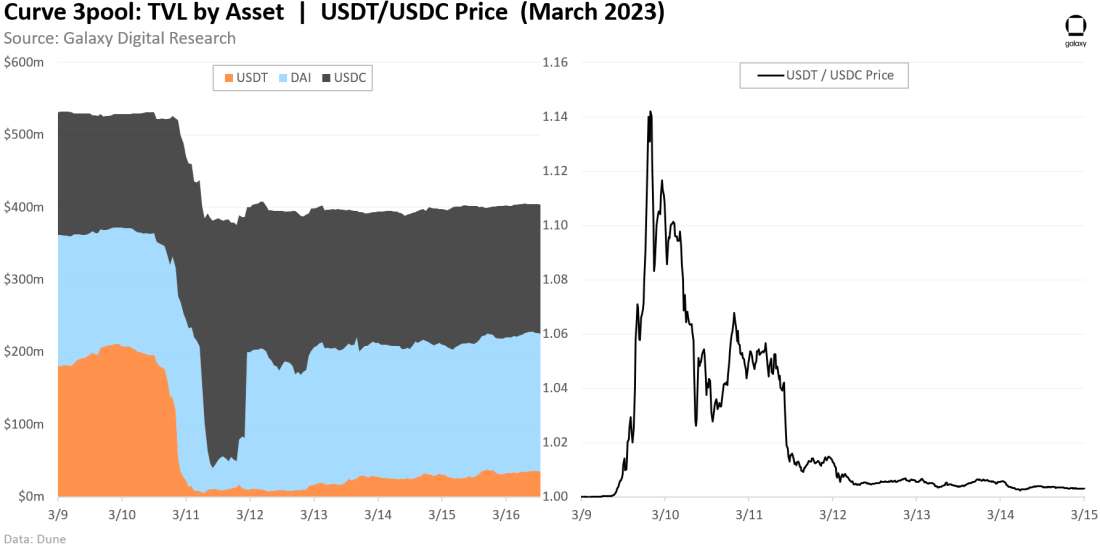

As concerns over USDC’s collateralization first started to pick up, traders turned to Curve for “exit liquidity” – namely the 3pool composed of USDC, USDT & DAI. Traders swapped USDC and DAI for USDT, leading to large supply inbalances that dried up the liquidity of USDT and causing significant price deviations, which in turn, led to further panic selling and creating a negative feedback loop.

At the 3pool’s peak inbalance, the total amount of USDT dropped to $5.6m, representing just 1.39% of the 3pool – the lowest amount in its history. During that time, the USDT was priced at nearly 1.15 USDC.

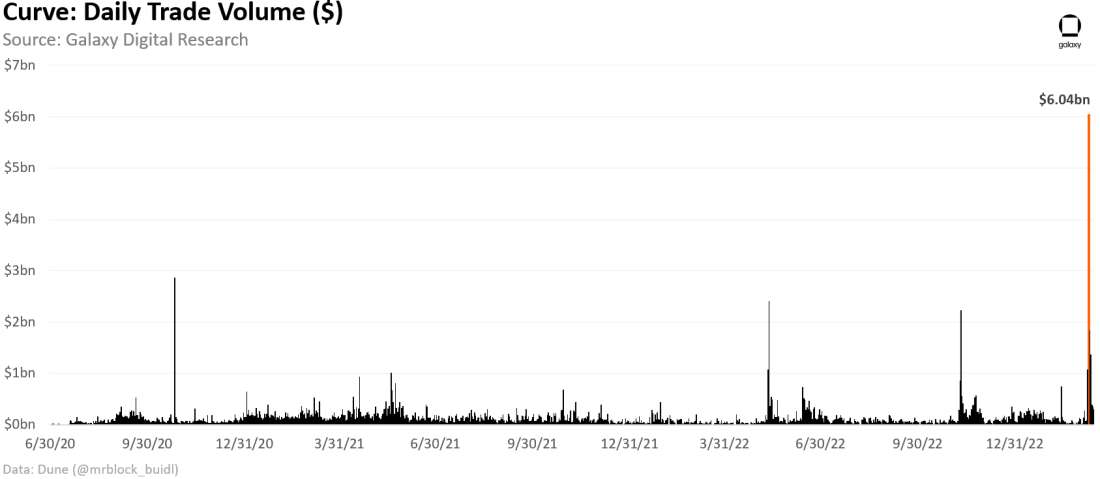

The stablecoin price volatility drove an all-time daily high in volumes on Curve of over $6.04bn on March 11, more than double the previous record of $2.87bn from 10/26/20.

Maker

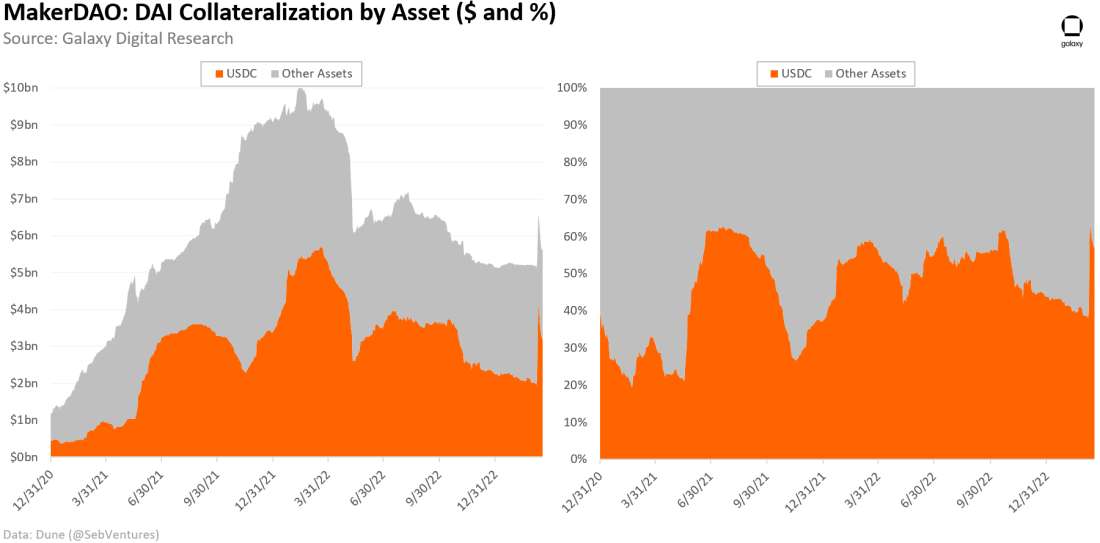

Maker’s DAI relies heavily upon USDC for its collateralization. Prior to the depegging, USDC represented ~40% of DAI’s collateralization and over 63% of DAI has been generated directly using USDC (even more when counting indirect backing through various LPs).

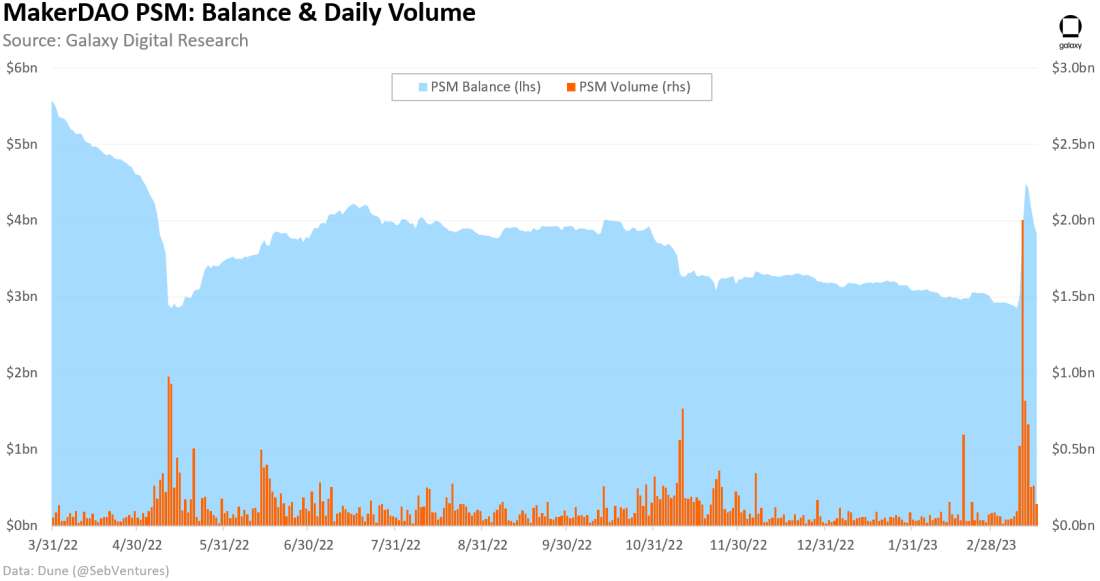

The slide in USDC’s price below $0.90 dragged down the prices of DAI (and GUSD to a lesser degree) thanks to Maker’s Price Stability Module (PSM), which enabled 1:1 conversions with DAI and other stablecoins. The PSM was originally intended for DAI to leverage the price stability of USDC, but in this case, the tool had worked to DAI’s detriment, at least in terms of price (similar to Maker, the FRAX stablecoin is also significantly reliant on USDC for its collateralization, leading prices to fall in line). That said, Maker’s reliance on USDC contributed to a significant expansion in DAI supply by 1.44bn (+29%) from 4.91bn to 6.35bn over 3 days from March 10 to March 13 as USDC holders tapped the PSM while DAI traded higher than USDC.

The daily mint limit for the USDC PSM (950m DAI) and GUSD PSM (50m DAI) were quickly reached, leading Maker governance to submit an emergency proposal to implement circuit breaker to disable PSMs and other measures in an effort to reinforce DAI’s peg. However, DAI’s collateralization by USDC quickly surged back up from 38% to over 60%, erasing 5-months of MakerDAO’s progress to diversify its collateralization to other assets.

On Saturday 3/11, the emergency Executive Vote approved to proposal to implement changes including adding a 1% swap fee for the USDC PSM to go from USDC→DAI, reducing the daily mint limit using the USDC PSM, restricting new issuance of DAI by LPs with USDC, while simultaneously tuning the parameters to make new DAI issuance backed by USDP more favorable. Specifically, the list of changes is the following:

Increase the USDC PSM USDC→DAI swap fee (tin) from 0% to 1%.

Reduce the USDP PSM USDP→DAI swap fee (tin) from 0.2% to 0%.

Increase the USDP PSM DAI→USDP swap fee (tout) from 0% to 1%.

Reduce the USDC PSM daily mint limit (gap) from 950 million DAI to 250 million DAI.

Reduce the GUSD PSM daily mint limit (gap) from 50 million DAI to 10 million DAI.

Increase the USDP PSM daily mint limit (gap) from 50 million DAI to 250 million DAI.

Increase the USDP PSM debt ceiling (line) from 450 million DAI to 1 billion DAI.

Reduce the UNIV2USDCETH-A debt ceiling (line) from 50 million DAI to 0 DAI.

Reduce the UNIV2DAIUSDC-A debt ceiling (line) from 100 million DAI to 0 DAI.

Reduce the GUNIV3DAIUSDC1-A debt ceiling (line) from 100 million DAI to 0 DAI.

Reduce the GUNIV3DAIUSDC2-A debt ceiling (line) from 100 million DAI to 0 DAI.

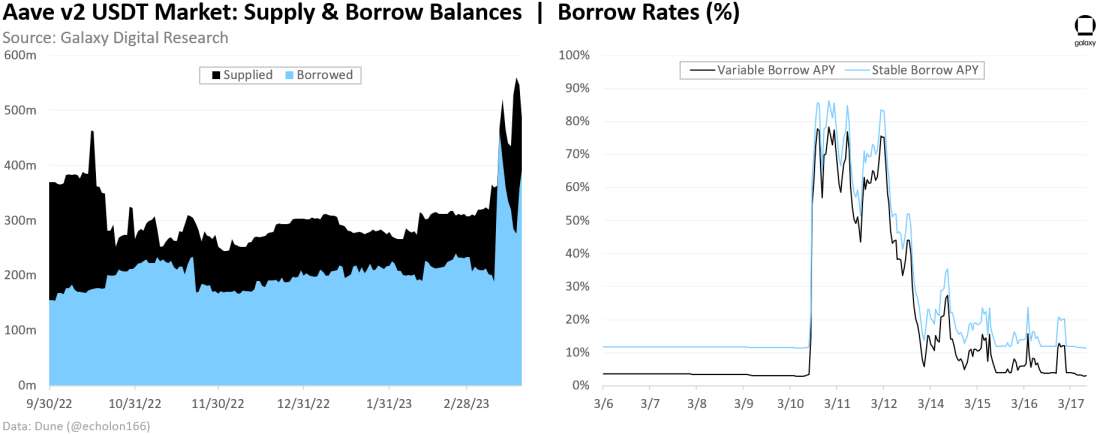

Aave

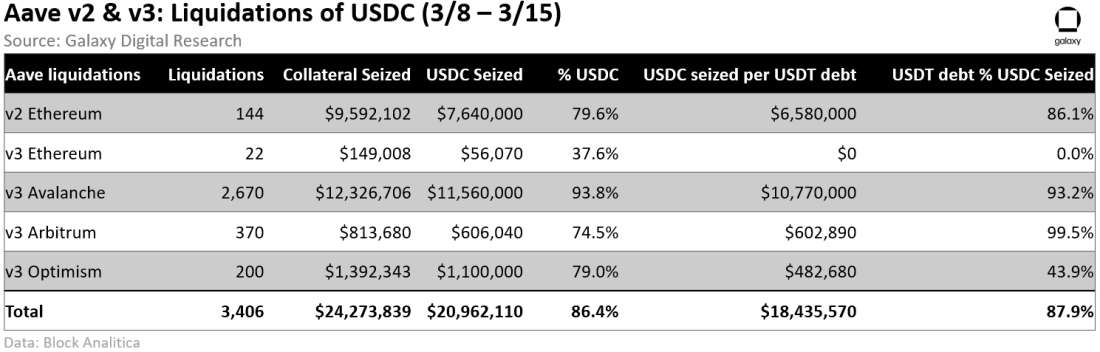

Across Aave v2 and v3 markets, the volatility in stablecoin prices drove over 3.4k liquidations from March 8 to March 15 with ~$24m of collateral sized – 86% of which was in the form of USDC. Over 91% of the USDC that had been liquidated had been against debt positions in USDT or other stablecoins as many borrowers were caught off guard by the two-way impact of their collateral value falling simultaneously as their debt value increased. Since it has historically been a reliable stable asset, Aave set a relatively high max LTV against USDC deposits on Aave v2. Even higher max LTVs were permitted up to 97% against USDC through Aave’s Efficiency mode (E-mode), which drove many of the liquidations.

On Saturday March 11, the Aave DAO passed an emergency proposal by Gauntlet to freeze stablecoin markets on Avalanche to prevent new debt positions and adding risk to the protocol. Note: Avalanche, which led all Aave markets in liquidations, was the first market to implement these new risk parameters given the cross-chain infrastructure doesn’t cover Avalanche so the Aave Guardian can act immediately.

Meanwhile, for traders looking to take advantage of the price volatility of the various stablecoins, demand to borrow USDT drove borrowing rates above the optimal utilization target limits across many of Aave’s markets.

Other impacted DeFi protocols with collateralized stablecoins

Compound: Compound had hardcoded USDC’s price to $1 with an 85% collateral factor, enabling borrowers to take on more leverage and leaving the protocol at risk of bad debt (which would have occurred if USDC had dropped below $0.85). Compound temporarily disabled USDC supply transactions in Compound v2 (users could still borrow, repay and withdraw USDC). Compound v3 functioned without any issues.

FRAX: Frax, which had been nearly entirely reliant on USDC for its backing, had made efforts reduce its exposure to assets with excessive off-chain risk, but still suffered as it hardcoded prices at $1 for several collateral stablecoins including USDC, DAI, USDP, LUSD, and sUSD.

Vesta Finance: Vesta Finance, a CDP on Arbitrum that issues its own stablecoin VST, had also been negatively impacted as it is primarily paired with FRAX.

Reserve Protocol: Reserve is accelerating its timeline for converting its RSV stablecoin (which has been collateralized by BUSD and USDC before Paxos’ ordered wind-down of BUSD) to eUSD, a more resilient stablecoin collateralized by a basket of stablecoins lent out on Compound and Aave.

Overall Impact

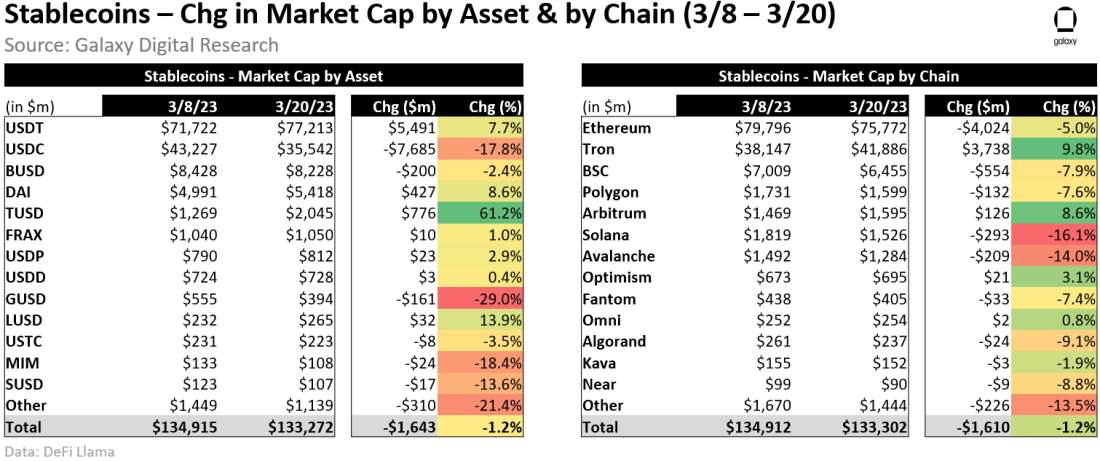

The stablecoin market underwent meaningful changes among the leading tokens. As USDC supply contracted meaningfully since 3/8, other stablecoins experienced supply growth including USDT, DAI, TUSD, and LUSD. TUSD has been the largest benefiary in relative terms, expanding supply by 61% as Binance launched several TUSD spot trading pairs with zero maker and taker fees. Across chains, Tron and Arbitrum were some of the few networks with supply growth of stablecoins while Solana and Avalanche experienced double-digit declines in stablecoin supply.

New all-time records

Outlook

Overall, USDC’s de-pegging event illustrates USDC’s influence over crypto markets and weaknesses in the structure of DeFi markets with its outsized reliance on a centralized stablecoin.

Even though Circle has taken extraordinary measures to increase the transparency of USDC (e.g., monthly attestation reports, detailed breakouts of Treasury holdings, more frequent updates on balances), there needs to be more progress made. Even with monthly attestations, as of March 20, the latest report filed was for the period ended January 31, 2023, which contained stale information that was not useful in assessing USDC’s risk profile. Adopting practices such as disclosing the CUSIPs of US Treasuries is helpful for transparency but, in this case, a lack of visibility existed for the cash portion of USDC reserves (25%), including the amounts held with various banking partners. Crypto-backed stablecoins like DAI and LUSD hold an advantage in transparency over their reserves as anyone can view all the information with real-time updates via on-chain data, although they certainly come with their specific own set of risks.

Across DeFi markets, quick actions taken through governance by teams like Aave, Compound, and Maker were instrumental in mitigating some of these risks. Ideally, these events will hopefully serve as a wakeup call for DeFi protocols to not place their complete trust in a single asset like USDC (e.g., limits on PSMs, greater diversification of collateral assets, no longer hardcoding USDC at $1). As with any failure in crypto, we expect improvements in risk management to follow along better security practices. Hard times build hard money, and the stablecoins that endure the toughest challenges are likely to gain share and thrive.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.