Crypto & Blockchain Venture Capital – Q3 2023

Note: the data and figures in this report are subject to revision in subsequent reports due to late and revised reporting from venture firms and startups.

Key Takeaways

Crypto VC still hasn’t bottomed. In terms of both deals done and total capital invested, Q3 was the lowest quarter since Q4 2020.

Companies building in the broad Web3 category dominated deal count, while companies in the Trading category raised the most total capital. The Q3 results continue a trend we’ve seen throughout the year. Interest in AI demanded the creation of a new sector in our dataset, with interest increasing for the overlap between AI and crypto.

The United States continues to dominate the crypto startup landscape, but other jurisdictions are catching up. While US-based crypto startups accounted for more then 35% of all deals completed and raised more than 34% of the capital invested by VC firms, the US is now notably losing share on both deals and capital to countries like the United Arab Emirates, Singapore, and the U.K., all of which have more progressive crypto regulatory frameworks.

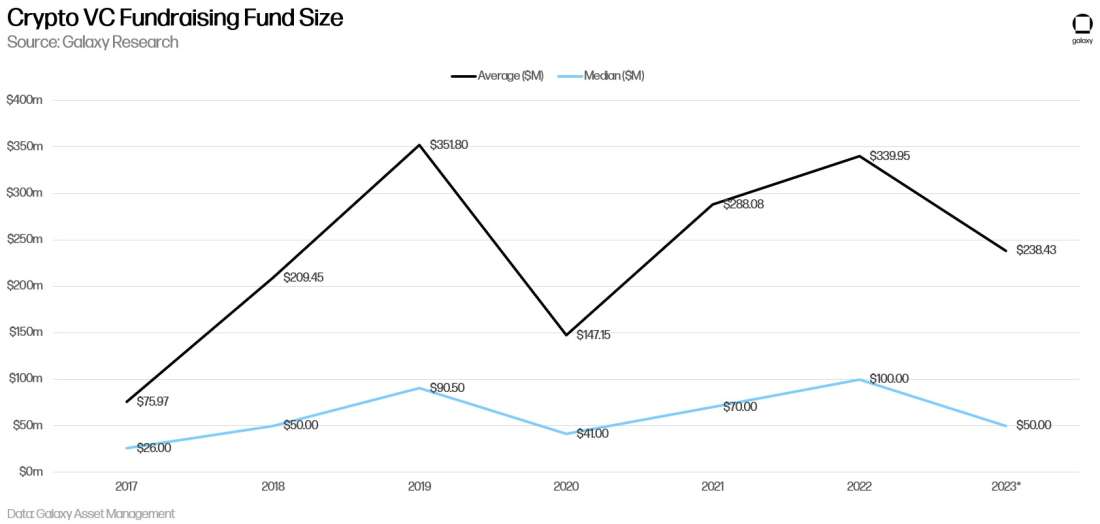

VC fundraising environment remains extremely challenging, but may be improving. More than $1bn was raised by venture funds in Q3 2023, the first uptick since declines began in Q3 2022. New fund launches also ticked up to 15 (from 12 in Q2). Median and average fund sizes are down significantly from their bull run highs.

Crypto VC Investing

Deal Count & Capital Invested

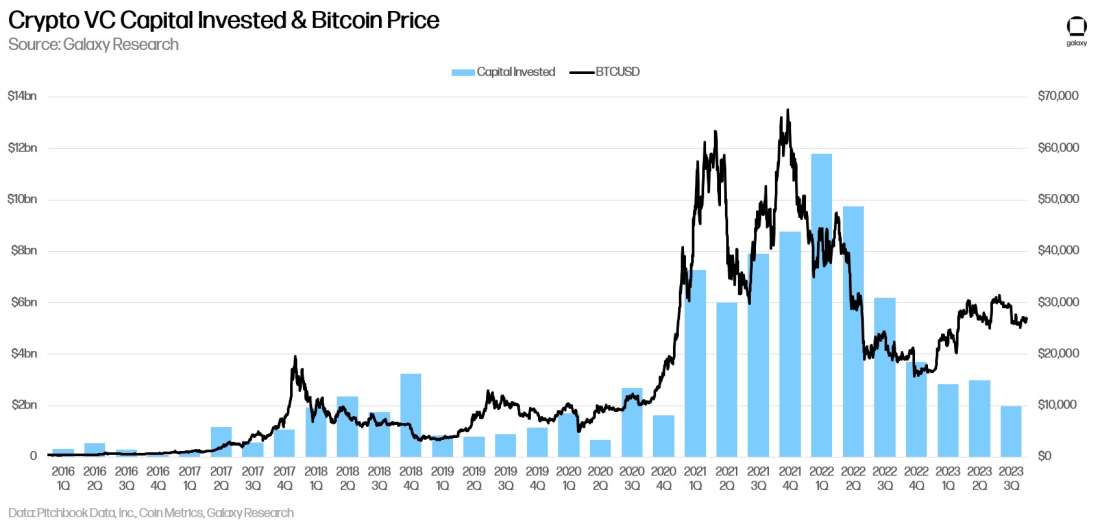

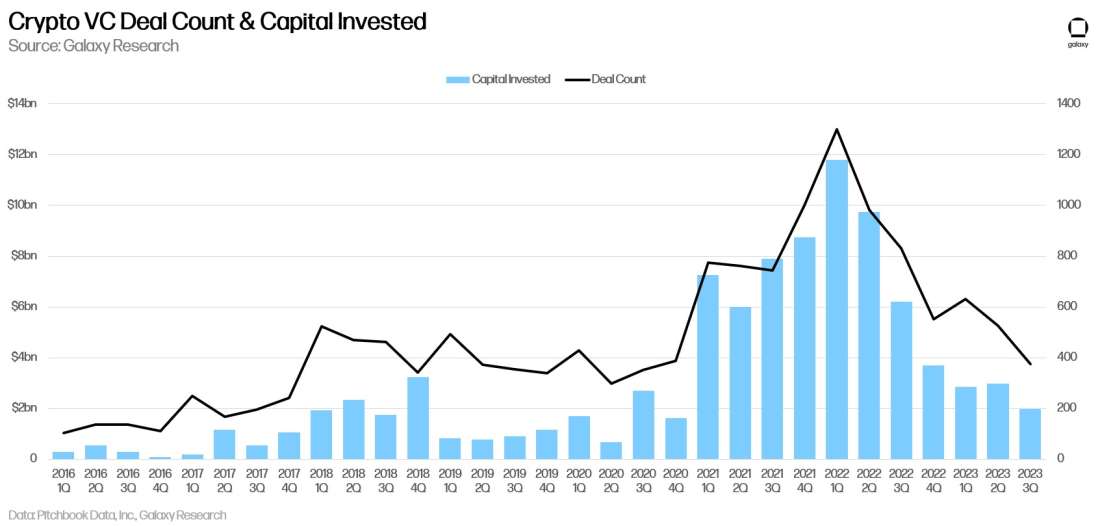

The crypto and blockchain sector saw $1.975bn invested in Q3 2023, marking a new cycle low and the lowest since Q4 2020, continuing a downtrend that began after a peak of $12bn in Q1 2022. Crypto and blockchain startups raised less money across the last 4 quarters combined than they did in just Q1 2022. Deal count too made a new bottom during this cycle at only 376 deals.

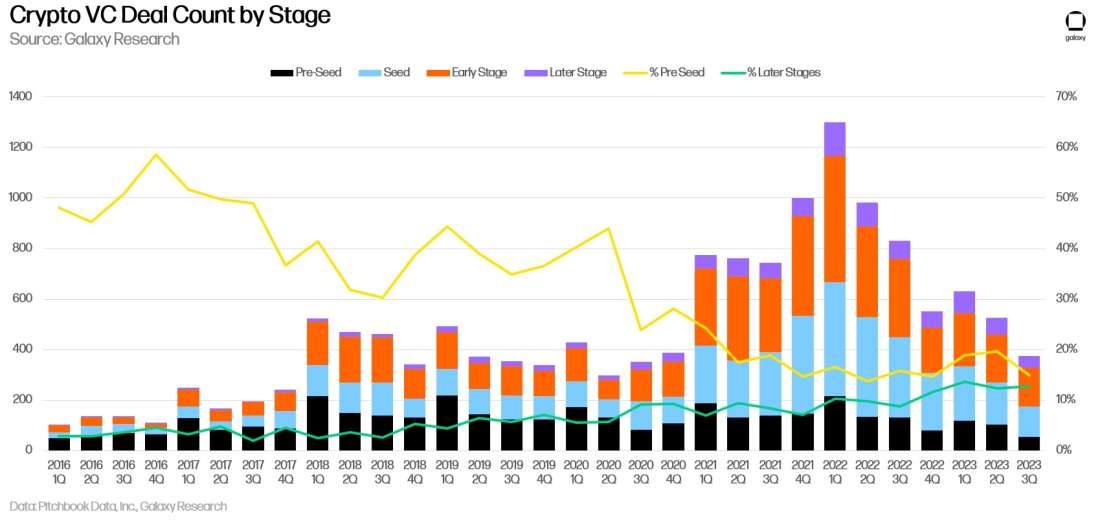

Most deals completed in Q3 2020 involved startups at the Series A stage, with pre-seed deal count receding slightly QoQ.

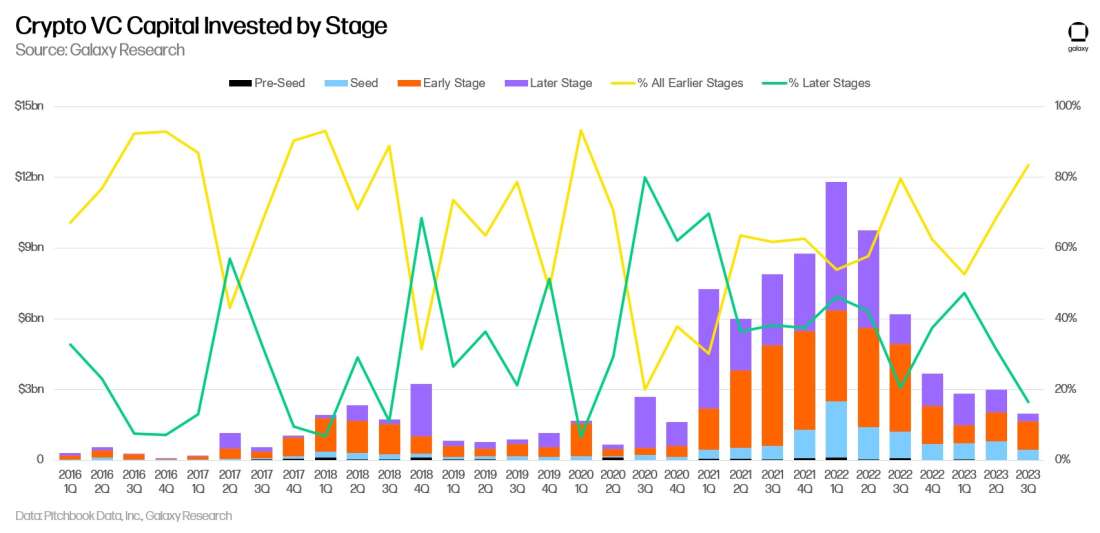

In terms of capital invested, earlier stage deals (Pre-Seed, Seed, and Series A) accounted for the vast majority of investment (83.5%) vs. later stage deals (16.5%). This continues a trend from last quarter.

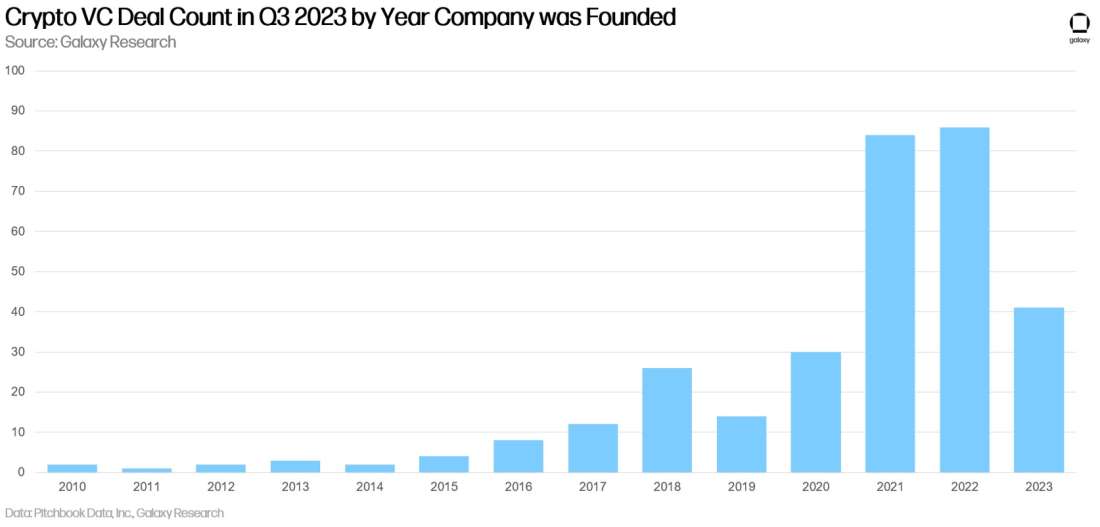

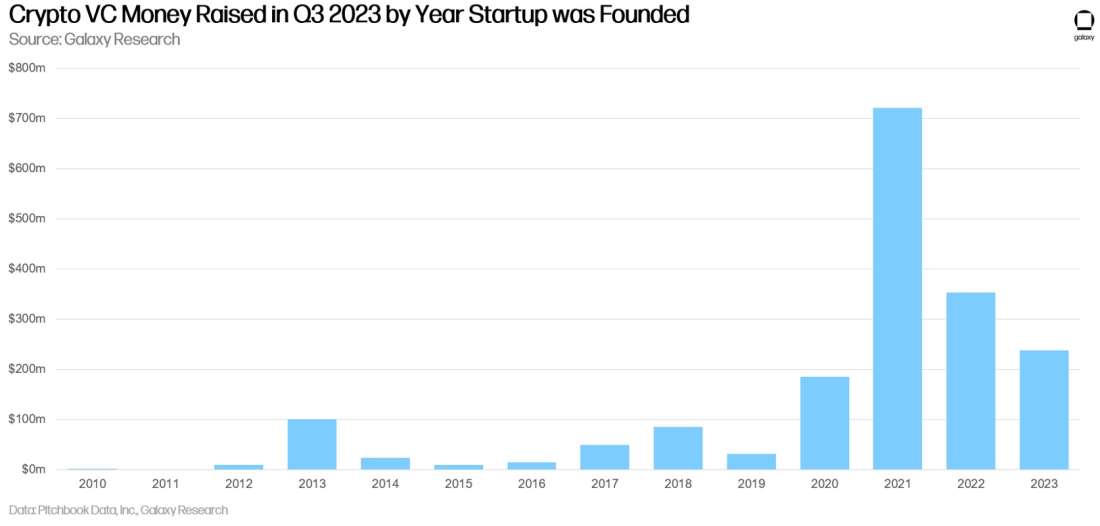

VC Investing by Company Vintage

Companies founded in 2021 and 2022 completed the most venture deals in Q3 2023.

Companies founded in 2021 raised the most capital of any annual cohort, and notably 2022 vintage firms raised significantly less, a change from last quarter.

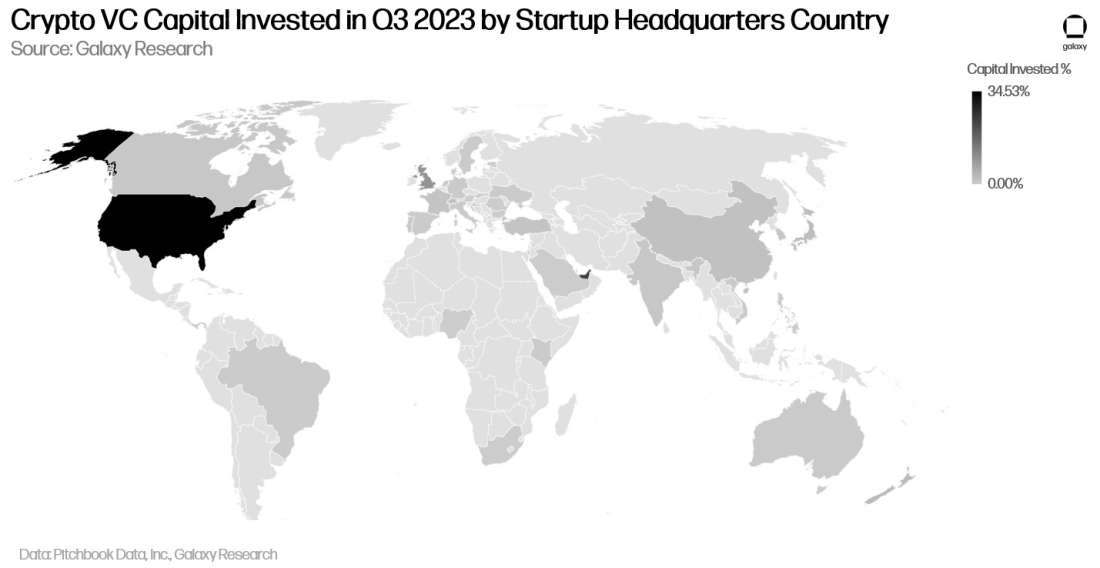

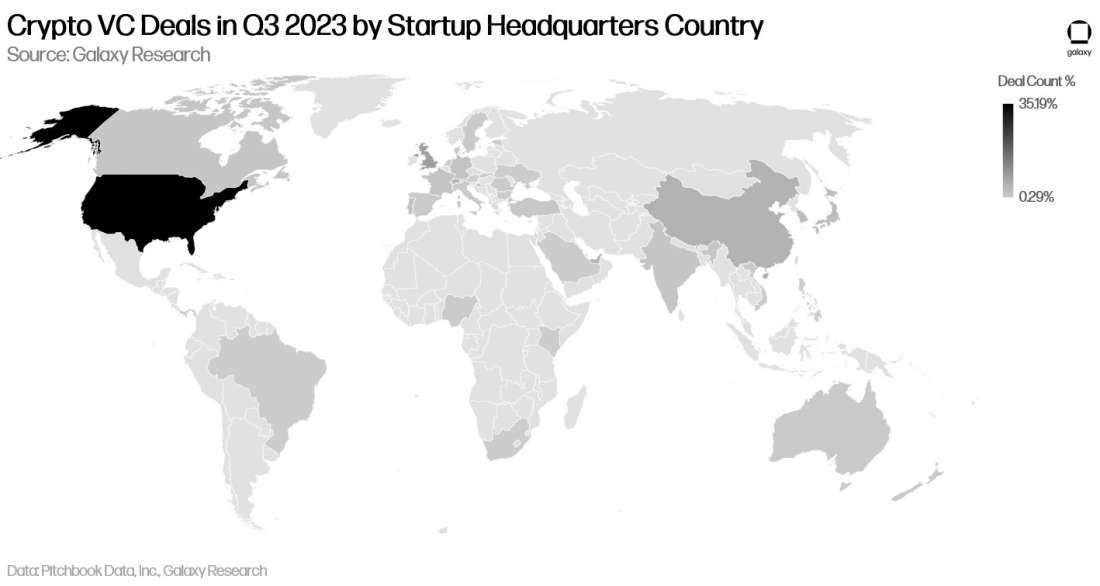

Crypto VC Investing by Company HQ

While the United States continues to lead by deal count and capital invested, Q3 saw significant gains in both categories by companies headquartered in jurisdictions with much more progressive and clear regulatory frameworks for the cryptocurrency industry.

US-based companies raised 34.5% of all crypto VC money in Q3 2023, followed by United Arab Emirates (23.5%), United Kingdom (9.5%), and Singapore (6.2%).

The picture is similar when looking at deals completed. U.S based companies completed 35% of all crypto VC deals in Q3 2023, followed by Singapore (10.6%), United Kingdom (7.9%), and China (4.7%).

Crypto VC Deal Size & Valuation

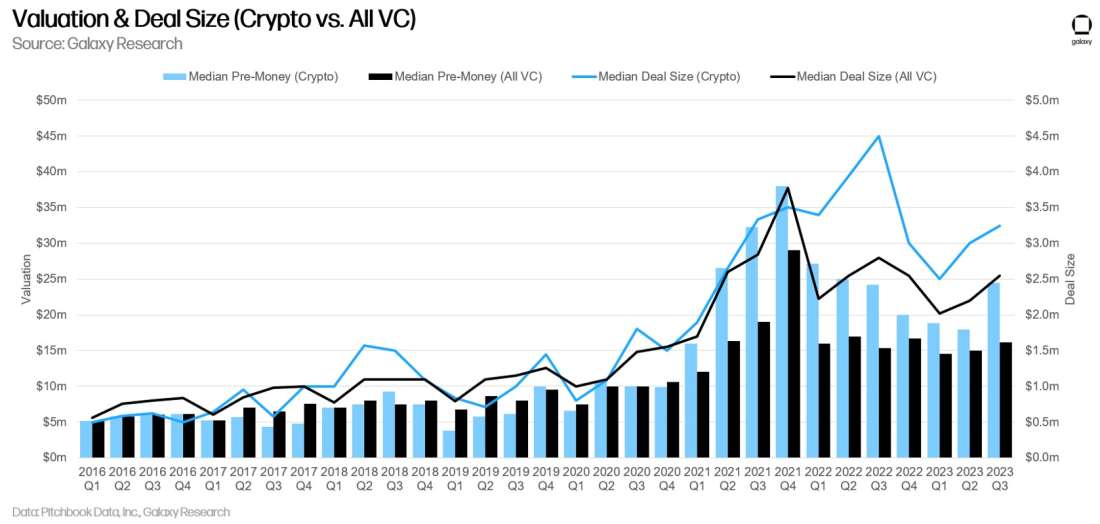

On a median basis, Q3 saw some growth in valuation and deal size across the entire venture complex and including crypto. Some of these gains in both deal size and valuation can be attributed to the increased share of Series A stage deal count vs. declines in Seed and Pre-Seed deals. The broader venture complex, and crypto VC specifically, saw gains in median deal size and valuation in Q3, though both remain well below their 2021 and 2022 highs.

Crypto VC Investing by Category

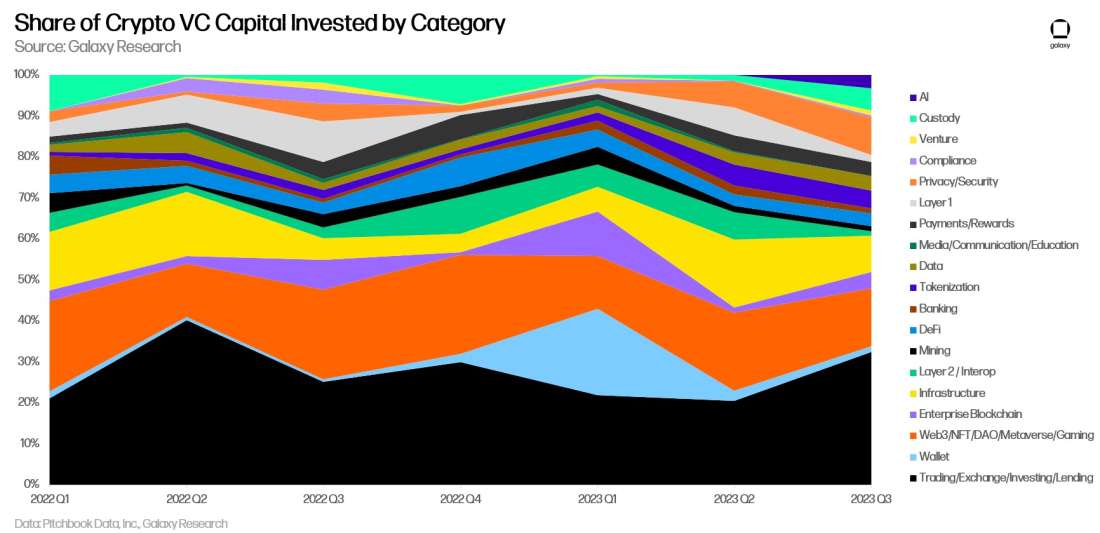

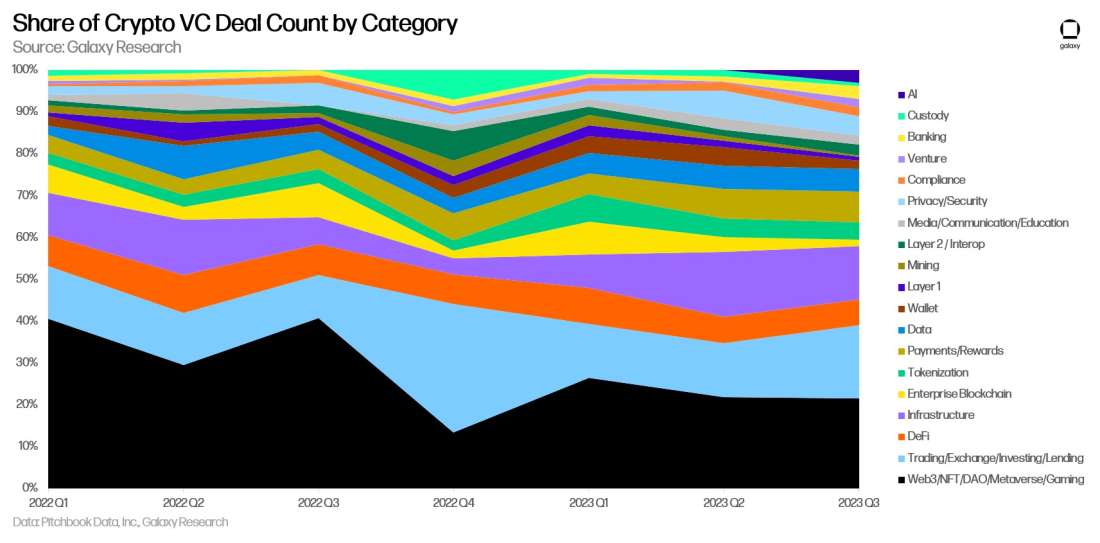

For the third consecutive quarter, Trading, Exchange, Investing, and Lending startups raised the most venture capital money ($611m, 32.5% of all venture capital deployed). For the second quarter in a row, Web3, NFTs, Gaming, DAOs, and Metaverse startups raised the second most capital ($266.5m, 14.2% of all venture capital deployed in the quarter). The Trading, Exchange, Investing, and Lending sector had the largest deal of the quarter, a $400m early-stage raise for Haqqex, a digital asset exchange which markets itself as “Shariah Compliant.” Custody had the second largest deal in Q3 2023, with BitGo raising $100mn in a Series C round. Our new AI category shows that startups building AI-related products raised over $60mn in Q3 2023, representing 3.2% of all venture capital deployed in the quarter.

By deal count, companies building products in the Web3 Gaming, NFT, DAO, and Metaverse realm sustained their top spot, followed by Trading, Exchange, Investing, and Lending companies. These trends are unchanged from Q1 and Q2 2023.

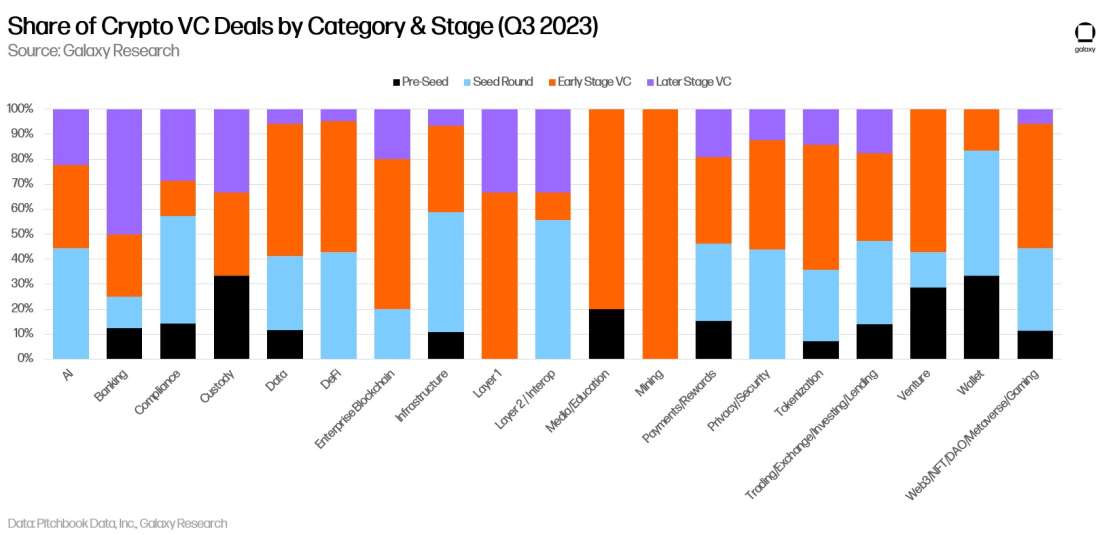

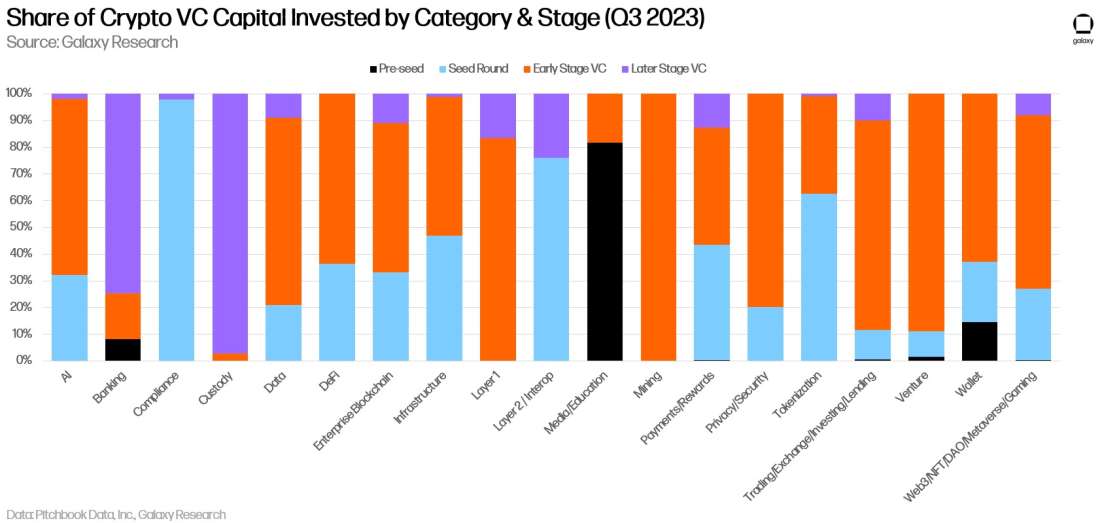

In Q3, the sectors with the largest share of deals at later stages were Banking, Layer 1 and Layer 2, while the sectors with the largest share of deals at the pre-seed stage were Custody, Wallets, and Ventures.

In terms of capital invested in Q3, later stage investment dominated the Custody sector while Media/Education capital invested was dominated by Pre-Seed capital.

Crypto VC Fundraising

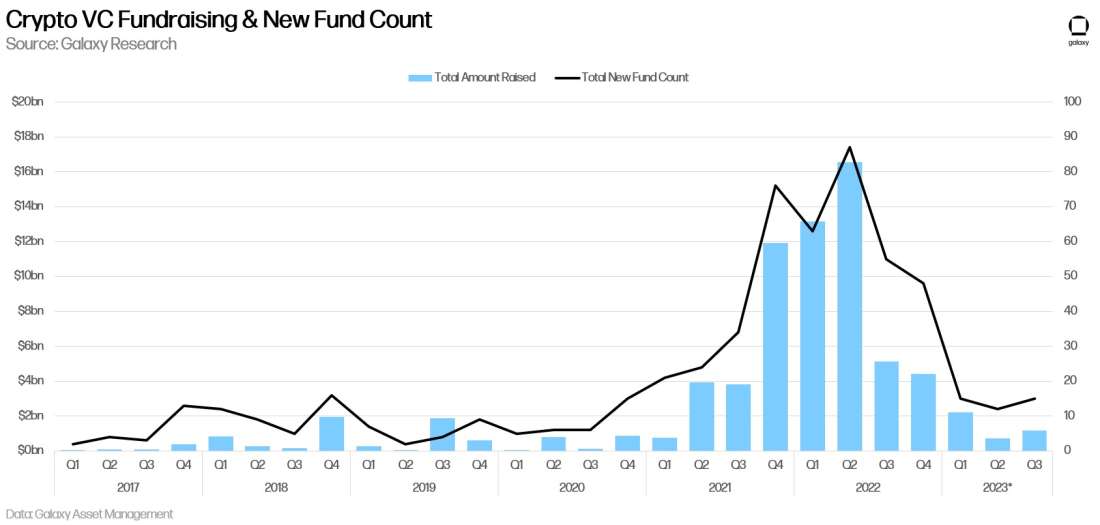

We worked with Galaxy Asset Management to compile information on venture capital fundraises in Q3 2023- that is, money raised by VCs for new funds or new fund vintages. After bottoming in Q2, allocation ticked up slightly in Q3 with $1.17bn allocated across 15 funds.

Incorporating the first three quarters of 2023, average new fund size is now $238.43m while the median is $50m, both down substantially from last year.

Analysis & Conclusions

The bear market in crypto VC continues. In terms of both deal counts and capital invested, it’s not clear yet if the market has reached a bottom. The declines are not unique to crypto, though they may be compounded by the secular events of the crypto ecosystem. High interest rates continue to pressure the venture capital industry broadly. Other important takeaways from Q3 2023’s crypto VC data include:

Crypto VC activity remains robust relative to the prior bear market. Deal count and capital invested is still about double what it was during most of the 2017-2020 bear market, suggesting net growth of the startup ecosystem over longer time frames. That being said, both metrics continue to print new quarterly lows, so it’s impossible to say that the market has actually bottomed.

Venture investors continue to face a tough fundraising environment. In the face of macroeconomic headwinds, allocator appetites to bet on long-tail risk assets like venture funds, particularly those focused on crypto, remain lower than they were during the prior decade of near-zero interest rate policy. When combined with the bear market in cryptoasset prices and the fact that some allocators may feel burned after the spectacular blowups of several venture-backed companies in 2022, venture investors will continue to find it difficult to raise new funds in the near term. There may be green shoots, though, as new fund count and allocated capital increased slightly in Q3. Previously, Q2 2023 saw the lowest amount of capital allocated to the fewest funds since Q3 2020, the height of the COVID-19 pandemic and asset crash.

A lack of significant new venture dollars will continue to pressure founders. Venture-backed startups have had more difficulty raising new rounds this year and will continue to face a tough fundraising environment for the foreseeable future. Many of the more speculative and ambitious blockchain use cases funded during the bull market are struggling to find product-market fit and thus investment dollars now that bull market users and hype have receded. Founders must focus on revenues and sustainable business models and be prepared to raise smaller rounds and give up more equity.

The United States is still leading, but other jurisdictions are catching up. Historically, the United States has been a hotbed of innovation, including in crypto. Historically speaking, crypto companies headquartered in the U.S. have dominated by both share of deals done and capital invested. In Q3, however, that lead shrunk substantially, with share taken by more crypto-friendly jurisdictions like Singapore, U.K. and the United Arab Emirates. American policymakers seeking to retain top talent, promote technological and financial modernization and dominance, and extend American leadership into the economy of the future would be wise to develop progressive policies that foster growth and innovation.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2023. All rights reserved.