What to Expect from Ethereum’s Merge Upgrade

The Merge upgrade is Ethereum’s long-awaited transition from a proof-of-work (PoW) consensus protocol to proof-of-stake. As the network’s most complex and radical code change to date, the Merge is expected to strengthen the value proposition of ether (ETH) in three main ways. Narratives around ether as an environmentally sustainable cryptoasset are expected to take off in a way that has never been possible for bitcoin, the world’s first and largest cryptoasset, due to Bitcoin’s reliance on PoW mining. In addition, the Merge’s impact on network issuance is likely to strengthen the narrative around ether as a store of value. Finally, the Merge is also anticipated to bolster the narrative around ether as a productive asset able to generate profits and cash flow through staking yields.

Key Takeaways

Developers anticipate that Ethereum’s electricity consumption as a network will drop by more than 99.9% post-Merge.

The Merge will primarily impact the stakeholders of Ethereum that directly interact with the consensus layer of the network, be it to source data or earn network rewards, but will not change how transactions and decentralized applications are executed on Ethereum from a user-experience standpoint.

Ether supply is projected to become deflationary and contract rather than grow year-over year under PoS.

The Merge is estimated to more than double the rewards earned by validators due to the addition of earnings from priority fees and maximal extractable value.

Despite being Ethereum’s most complex upgrade to date, the Merge will not be the last major upgrade to the network but rather one that will free up the time and focus of core developers to turn attention to other pressing network issues such as scalability and statelessness.

Introduction

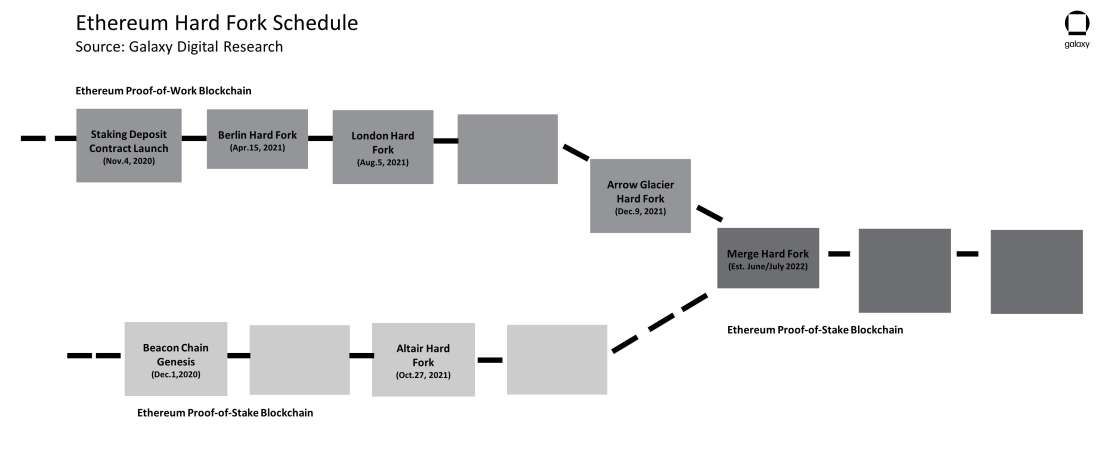

An Ethereum upgrade seven years in the making is nearing its final stages of testing and development. The upgrade has been called by many different names over the course of Ethereum’s history, including Serenity, Casper, Shasper, Ethereum 2.0 and now ‘The Merge.’ The Merge will overhaul the core consensus protocol of Ethereum, which dictates how transactions are validated and blocks get produced. It will replace Ethereum’s existing proof-of-work (PoW) with an alternative type of consensus protocol known as proof-of-stake (PoS).

The main motivation for moving away from PoW as a consensus protocol is to reduce the energy usage of Ethereum. With the planned Merge upgrade, developers anticipate that Ethereum’s electricity consumption as a network will drop by more than 99.9%. The reduction will occur by making mining obsolete on Ethereum. Instead of miners, block production will be handled by validators, which require deposits of 32 ETH (~$3,000 as of writing) as collateral to the network by node operators. Unlike other PoS blockchains, a single node operator may operate multiple Ethereum validators by staking in increments of 32 ETH.

The Merge will primarily impact stakeholders of Ethereum that directly interact with the consensus layer of the network – whether they are sourcing data or earning network rewards. The upgrade will not change how transactions and decentralized applications (dapps) are executed on Ethereum from a user-experience standpoint. On the contrary, user API endpoints, application tooling, and especially network fees are anticipated to remain largely unchanged. In addition, exchanges, custodians, and users holding ETH in accounts directly on the Ethereum blockchain will not be required to move or otherwise change how they access their funds post-Merge.

This report dives into key considerations for investors and market participants as we approach the Merge including the impact on Ethereum’s supply issuance, its staking dynamics, and its future development roadmap. Each of these considerations reinforce the Merge upgrade as a pivotal milestone for the network that further differentiates and strengthens the investment case for Ethereum’s native cryptoasset, ether. Beginning with how the Merge will impact the supply issuance of the network, the following is a discussion of what investors can expect from Ethereum’s most ambitious and complex code change to date.

Supply Issuance

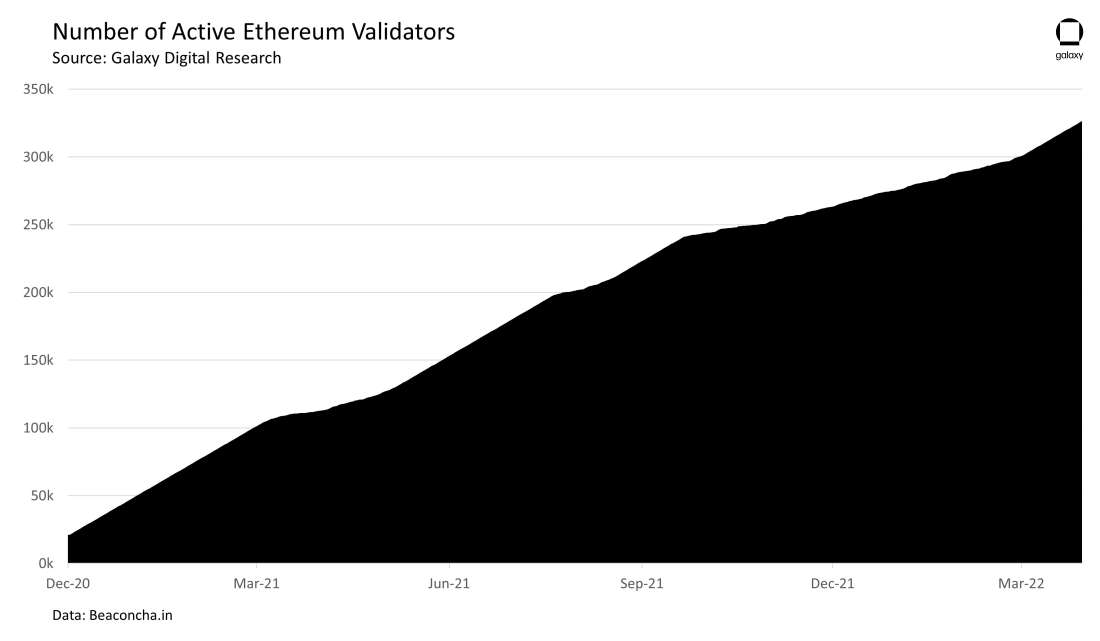

At present, the bulk of new issuance happens on Ethereum’s existing PoW blockchain, also called the execution layer (EL). On the EL, miners earn a fixed amount of 2 ETH/block, which comes out to roughly 13,292 ETH/day. In addition, small amounts of ETH are issued on the Beacon Chain, which is Ethereum’s PoS network, also called the consensus layer (CL). The Beacon Chain has been live and actively issuing ETH since as early as December 1, 2020. The amount of ETH issued on the Beacon Chain varies depending on how many active validators are online and participating in network consensus. The more validators and therefore the more ETH that is staked on Beacon Chain, the more rewards are issued on the CL.

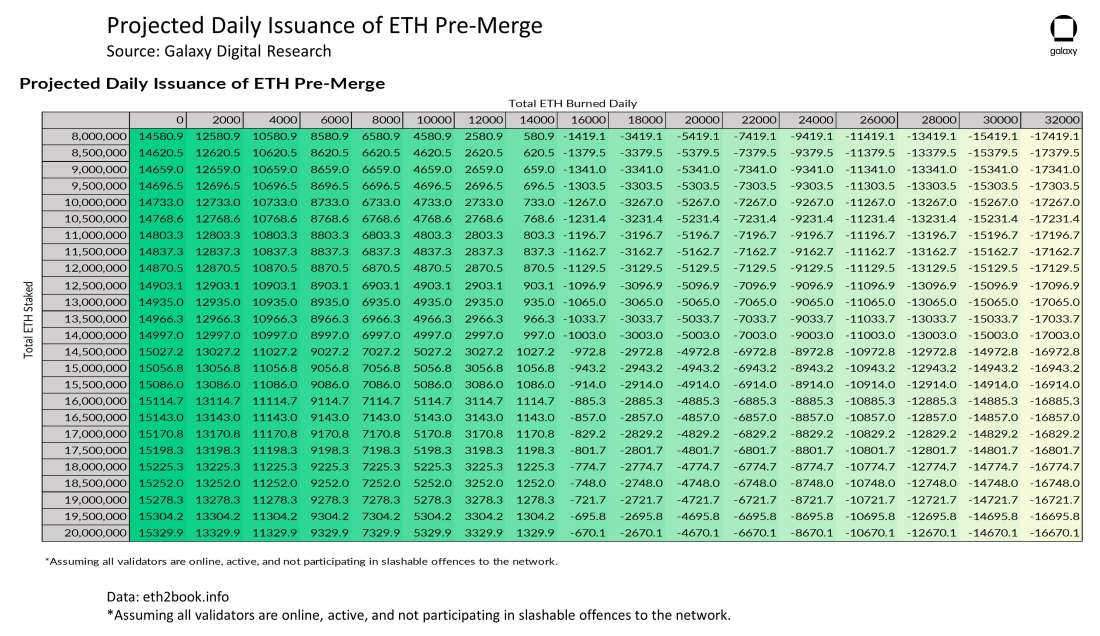

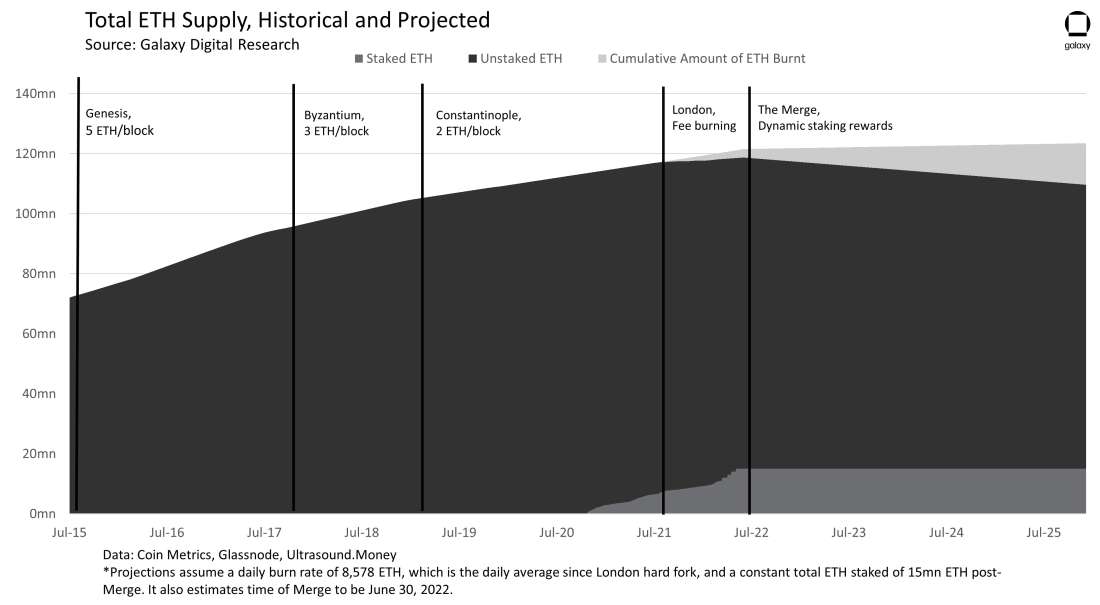

The other variable factor impacting supply growth on Ethereum today are coin burns. As part of the code change known as Ethereum Improvement Proposal (EIP) 1559, which was implemented in August 2021, minimum payments of ETH for transactions on the network are permanently removed from circulating supply. (For background, read our report on EIP 1559 here.) At nearly 11mn ETH staked on the CL, and a continued daily burn rate of 4,000 ETH, the daily new issuance of ETH is projected to be 10,803 ETH. Under these same assumptions, the expected annualized supply growth of Ethereum is roughly 3.32%.

The following chart is a heat map illustrating how changes to the burn rate and total ETH staked on the CL impact daily new ETH issuance at present.

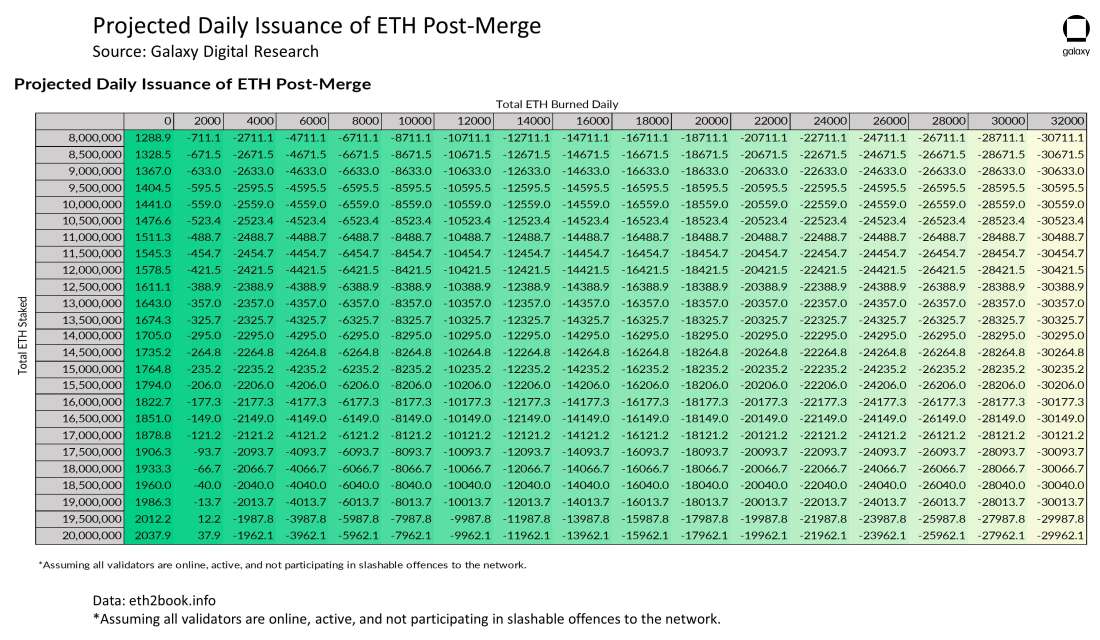

Post-merge, issuance on Ethereum will cease to include a fixed amount of ETH awarded to miners per block - instead, ETH will be awarded to validators based on a dynamic issuance schedule that adjusts per epoch. (An epoch is a period lasting 6.4 minutes where a subset of randomly selected validators propose and vote on batches of up to 32 blocks.) Assuming 11mn ETH staked on the CL, which results in an issuance rate of ~1,511 ETH/day, equating to an annualized supply growth of 0.46%. Factoring in coin burns and assuming the daily burn rate remains constant at 4,000 ETH/day, the projected daily issuance of ETH is anticipated to become deflationary to negative 2,489 ETH/day, which equates to an annualized supply contraction of -0.77%.

The amount of ETH burned is directly correlated to the transaction activity of the network. Should user adoption of Ethereum pick up in the months and years following the Merge upgrade, ether supply would contract at an even faster rate, as illustrated by the table above. As such, the impact of the Merge on Ethereum’s issuance dynamics and resulting decline in supply growth (or even contraction) will make ether more disinflationary and perhaps strengthen the value proposition of ether as a store of value.

The rationale for a dynamically adjusting issuance rate

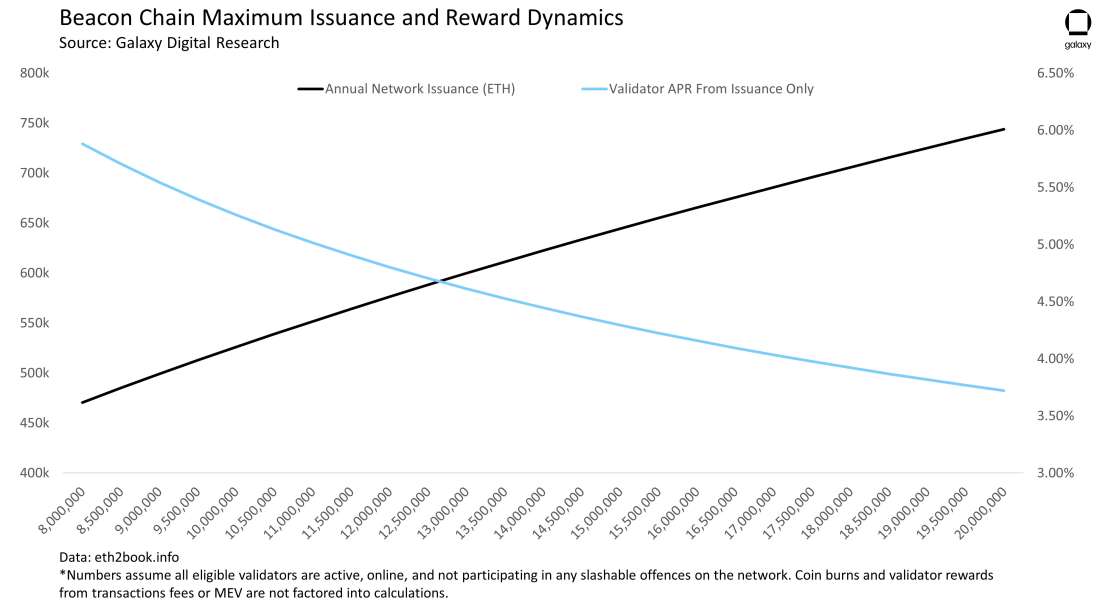

Digging deeper into the rationale for a dynamically adjusting issuance rate, the security budget of Ethereum under PoS requires constant optimization. Instead of miners expending computational energy to secure the network, validators lock collateral into the network in the form of ETH. The more money at stake on Ethereum, the harder it is for a potential attacker or malicious actor to overpower the network and forge transaction history. As such, the CL of Ethereum is programmed to automatically adjust validator rewards based on the amount of ETH staked.

When the total amount of ETH staked grows and there are many more validator entities actively participating in securing network consensus, the returns for running an Ethereum validator declines. The network pays each validator less for their work because there are more of them participating and raising the level of security on Ethereum. However, when the total amount of ETH staked declines and there are fewer validators actively progressing blocks, the returns will increase in efforts to encourage greater levels of participation. Currently, there are over 335,000 active validators staking 9.5% of total ETH supply on Ethereum’s PoS network.

A dynamically changing issuance rate ensures that no matter how much ETH is at stake on the network, Ethereum validators are always sufficiently incentivized for their work. But the dynamic issuance rate does present challenges when it comes to the predictability of Ethereum’s monetary policies over the long-term. The total amount of ETH staked and the amount of coin burns are two variable factors that impact the growth of ETH supply post-Merge. As such, any predictions about coin supply will rely on a set of assumptions about these variables, in addition to a few other more minor metrics including percentage of validators online and number of validators slashed.

The above chart shows a projected decline of ETH supply assuming the daily burn rate of ETH is 8,578 ETH, which is the daily average since EIP 1559 activation, and an increase of total ETH staked to 15mn leading up to the Merge. Even the most conservative estimates of supply growth for ETH after the Merge suggest a reduced issuance rate below 0.5% per year at minimum.

Staking Dynamics

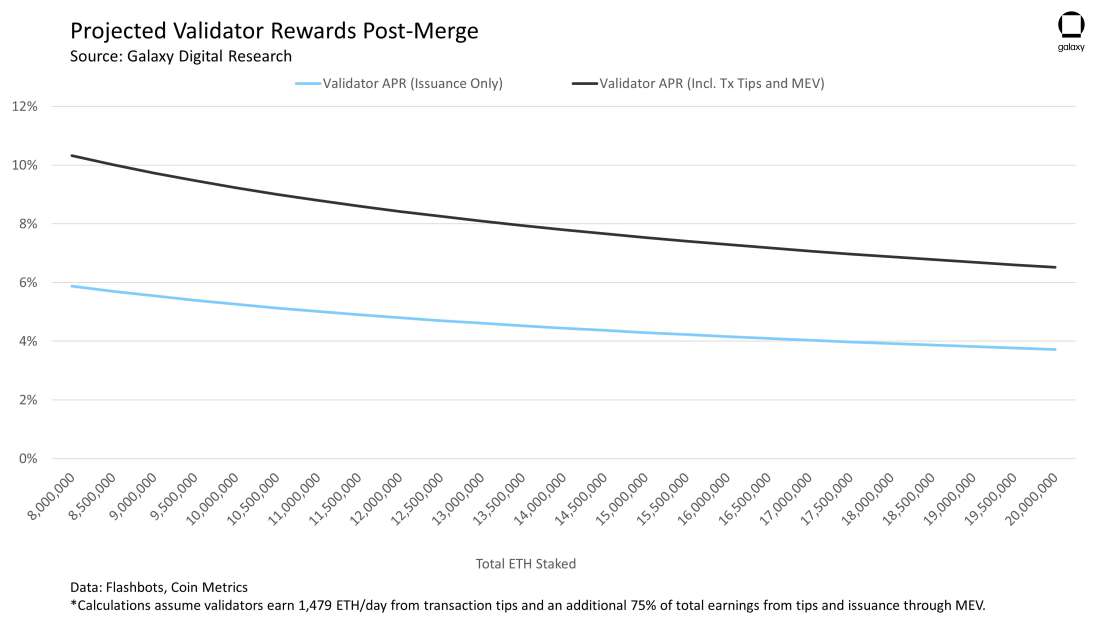

Aside from changes to network issuance, the Merge is estimated to more than double the rewards earned by validators due to the combined impact of redirected priority fees and MEV:

Transaction tips, or priority fees, currently earned by Ethereum miners are redirected to award active validators post-Merge. According to data from Coin Metrics, miners earn on average 1,479 ETH/day from transaction tips. Assuming these earnings stay constant, the tips alone would boost overall daily validator rewards from 1,486 ETH/day (which is also the estimated network issuance rate) to 2,965 ETH/day (+99%).

In addition to transaction tips, validator node operators will begin earning maximal or miner extractable value (MEV). Given that validators take over the responsibilities of block production from miners after the Merge upgrade, they will gain the ability to reorder transactions within blocks, especially the transactions executing token swaps through decentralized exchanges (DEXs), for the purposes of creating additional profits, also called MEV. (To understand more about the nature of MEV extraction on Ethereum, read this Galaxy Digital research report). Factoring in earnings from MEV, Alex Obadia of the Flashbots research organization has estimated that the earnings from MEV could increase validator rewards by an additional 75% on top of current levels.

Post-Merge, validators will be able to freely transact with any earnings from transaction fees and MEV, though earnings from new protocol issuance, as well as the underlying minimum deposited balance of 32 ETH, will continue to remain locked and untransferable until the Shanghai hard fork. Shanghai will not be activated until at least six months after the Merge upgrade and will be discussed in greater detail later in this report. The doubling of validator rewards because of transaction tips and MEV, and the liquidity of these new earnings, has caused user interest in staking on Ethereum and total ETH locked on the CL to rise.

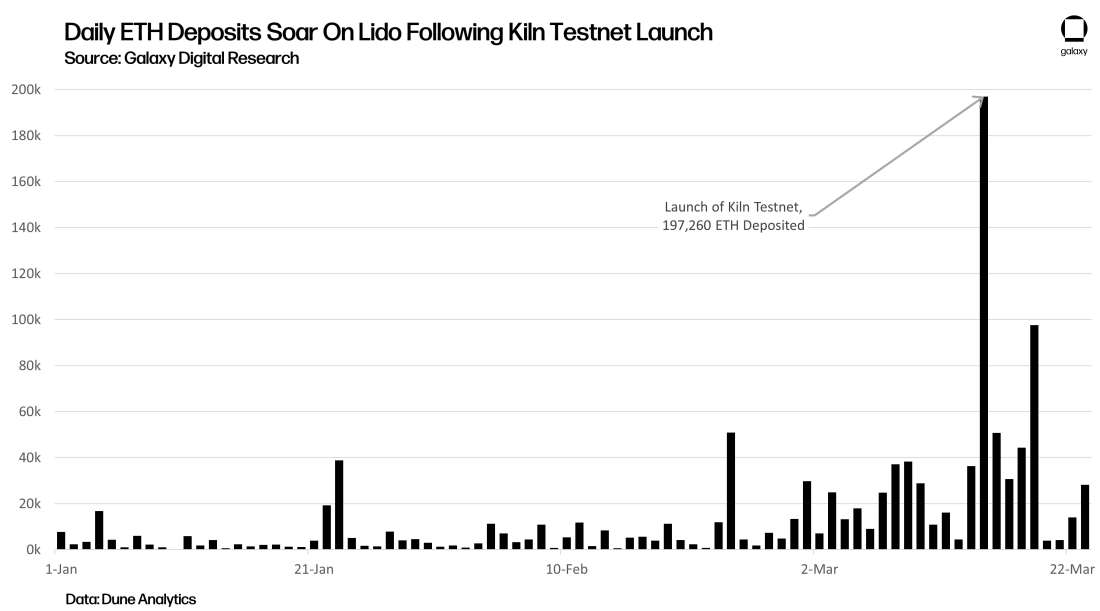

Following the successful launch of Ethereum’s Merge test network Kiln on March 15, 2022, the weekly amount of ETH staked rose by 3.7%. In addition, user deposits into liquid staking provider Lido saw its highest volume of daily deposits on March 15 of over 197,000 ETH.

Centralization concerns with PoS

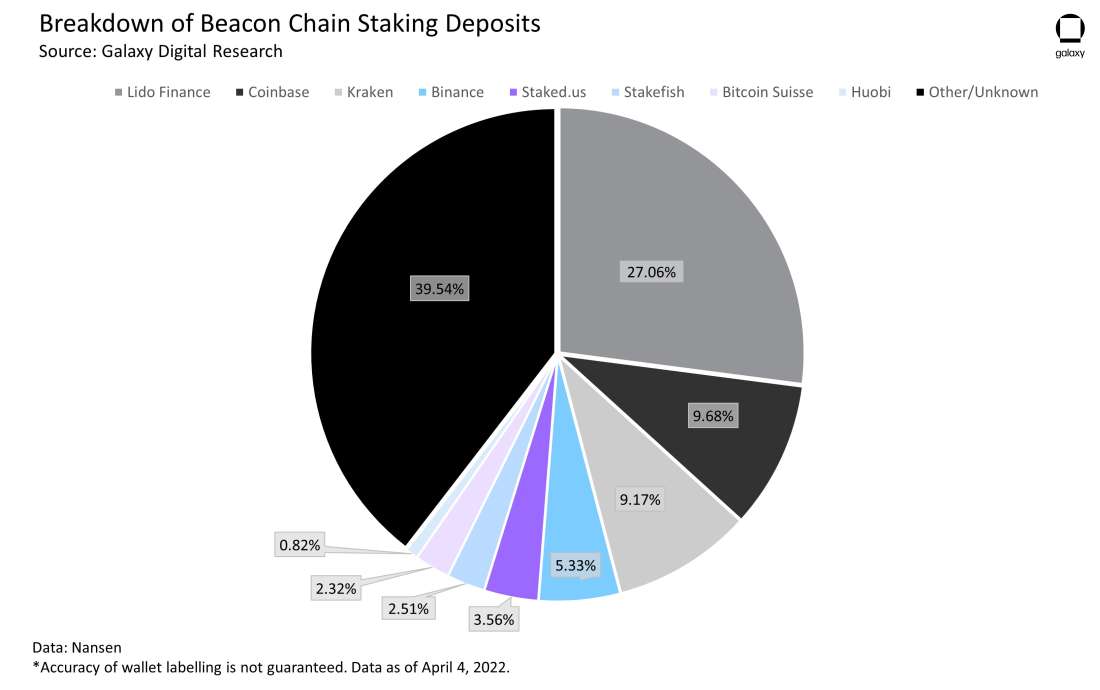

The potential for stake to continue centralizing towards staking-as-a-service (SaaS) providers as opposed to individual/solo stakers is a persisting concern for the long-term health and security of Ethereum’s PoS blockchain. At present, there is just over 10.7 mn ETH staked on the CL, representing ~ 9.5% of circulating supply. The three largest validator node operators by stake under management is liquid staking provider Lido, cryptocurrency exchanges Coinbase, and Kraken. Combined, these entities control 46% of total ETH staked according to data by Nansen.

In theory, the absence of any protocol-level support for the creation of a staking pool is meant to encourage the operation of validators by individuals, as opposed to businesses, on Ethereum. In addition, there are heightened financial penalties for node operators the more validators and therefore stake they control. When a validator breaks the rules of the network, which is defined by Ethereum’s PoS protocol known as Gasper, the amount of stake forfeited increases in proportion to the number of other validators also caught breaking the rules during the same period.

In practice, the disincentives for pooling staked ETH have not prevented SaaS providers from amassing a large controlling interest in the network. This is because delegating stake is easier for users to do from a technical standpoint than running their own validator node software. In addition, many exchanges such as Kraken, Binance, and Coinbase, allow partial deposits of ETH, meaning that users are not required to deposit the minimum amount of 32 ETH needed to run an ETH validator and can earn staking rewards on smaller increments of ETH.

Finally, even in the event of slashing, most staking as a service providers will offer users insurance on their staked deposits that they otherwise would not have if running a validator on their own. Liquid staking providers go one step further in offering users the potential for greater returns by freeing up the capital that otherwise would be locked in a staking contract. In exchange for taking deposits of ETH, liquid staking providers such as Lido offer users a derivative token that tracks the underlying value of staked ETH on the CL that can then be re-deposited into other DeFi protocols for additional yield.

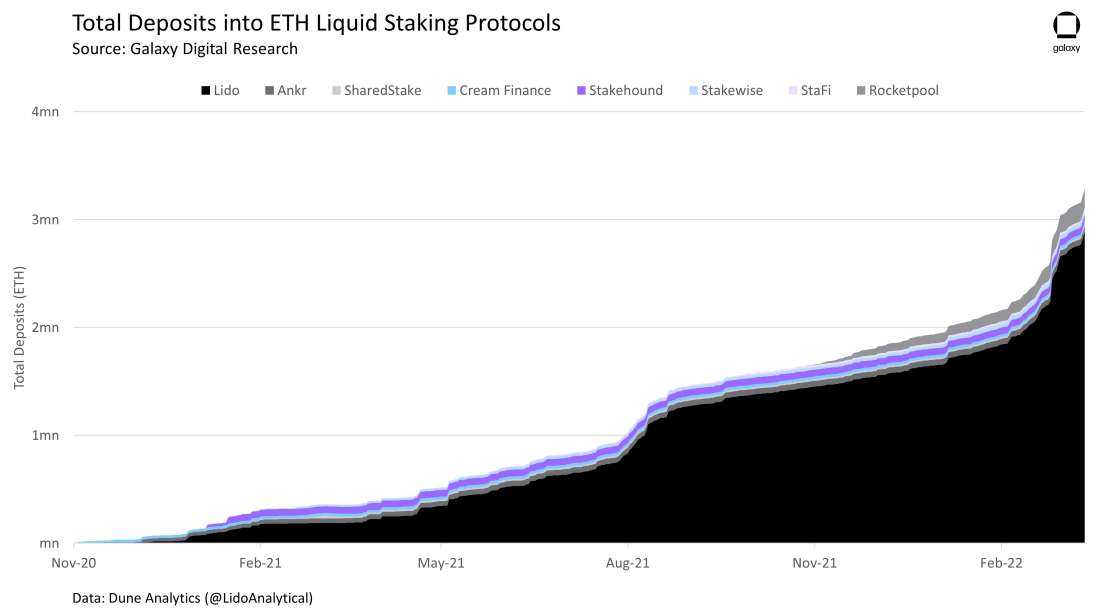

Impact of liquid staking

Due to the increased capital efficiency they bring to users who stake their ETH, liquid staking protocols are likely to continue to accumulate more value over time and proliferate the use of derivative staking tokens in the DeFi ecosystem of Ethereum. Given the superior yield from holding staked ETH derivatives over ETH, tokens like rETH and stETH may one day rival, and even surpass ETH itself in terms of liquidity and use as a base currency for DeFi trades.

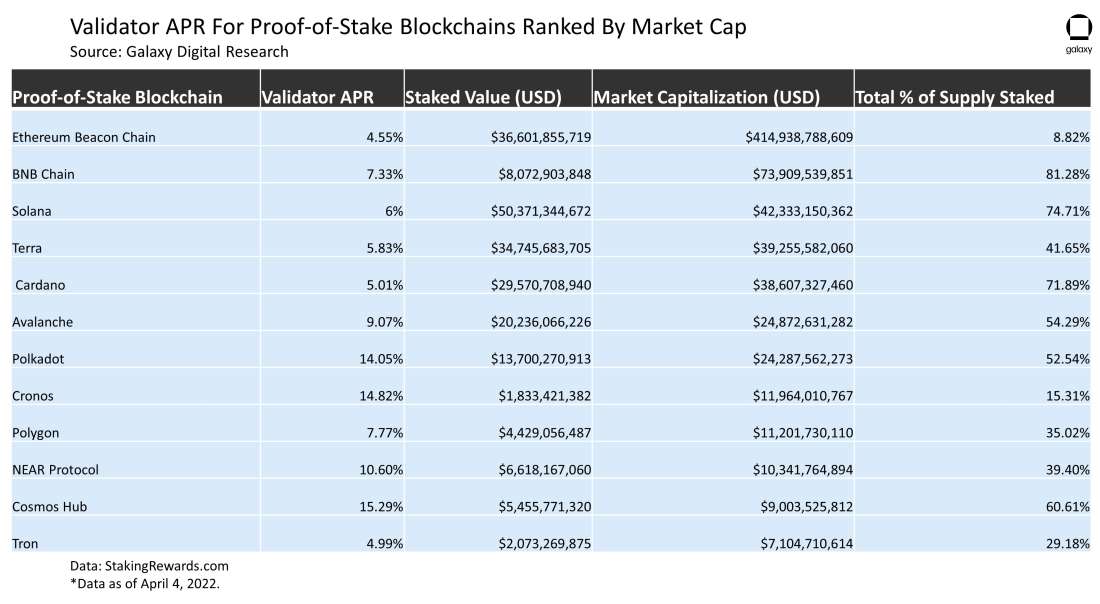

Early analysis on the behavior of ETH as a staked asset also suggest that ETH may begin trading like a perpetual bond and less like a consumable resource for interacting with dapps. Consequently, BitMEX co-founder Arthur Hayes predicts liquid ETH derivatives will trade at a larger and larger premium to ETH. However, for such trends to manifest, the efficacy of staked ETH derivatives in tracking the underlying value of staked ETH efficiently and reliably, especially during times of variable performance by validator node operators, still needs to be proven. Up until now, the returns for staking on Ethereum have been stable and on the lower end of what users could earn by staking on other PoS blockchains.

Post-Merge, returns on staking will become more variable, liquid, and lucrative with the addition of yield from transaction tips and MEV. As the ETH’s use case for fueling dapps competes with its use case as a yield-bearing, bond-like asset, Ethereum’s roadmap for achieving scalability will be especially important to monitor after the Merge. The next section of this report will discuss in more detail how developers plan to expand Ethereum’s transaction throughput using Layer-2 networks and rollup technology, both of which would further abstract dapp activity away from the EL and CL of Ethereum.

In addition to the potential decline in the velocity of ETH, there is likely to be greater adoption and focus on decentralized staking-as-a-service providers in light of their integral role in promoting the long-term health and security of Ethereum as a PoS protocol. Already, there are several campaigns promoting the decentralization of client software in preparation for the Merge that have successfully and materially impacted CL client diversity. In January 2022, it was reported that 68% of Ethereum validators were running on Prysm CL client software. Over the course of four months, this percentage has dropped to 61% in response to active petitioning from Ethereum community members such as Superphiz.

Liquid staking provider Lido has already committed to fully decentralizing its services over time. Unlike exchanges, Lido is primarily a front-end software for connecting users with validator node operators as opposed to a centralized entity that directly controls stake. Rocketpool is an up-and-coming liquid staking provider that boasts a fully decentralized platform, though in comparison to Lido it is a newer service with a higher degree of complexity and technical risk. The performance of Rocketpool and other decentralized SaaS providers as an alternative to centralized staking providers in another important dynamic to watch post-Merge for its impact on the long-term resilience of Ethereum’s PoS network.

Future Development Roadmap

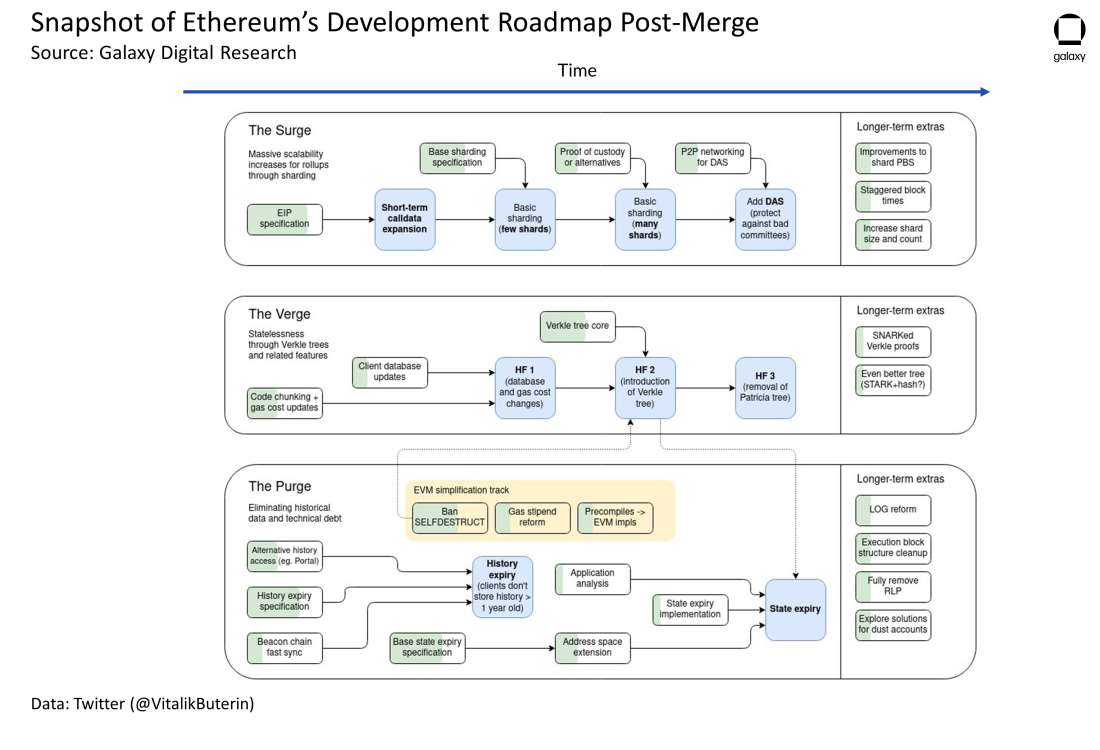

After the Merge is complete, the next major upgrade on Ethereum’s horizon is Shanghai, which will focus on improvements to network scalability, enabling validator withdrawals of stake, and optimizations to the Ethereum Virtual Machine (EVM).

Scalability improvements after the Merge

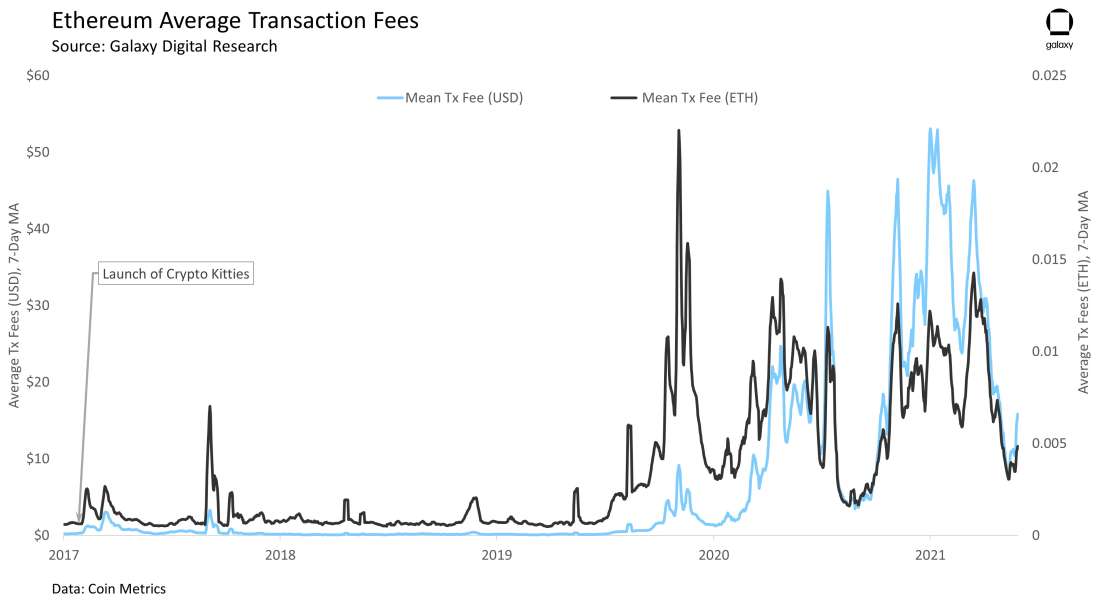

Scalability improvements to Ethereum have been on the development roadmap since almost as long as the transition to PoS. In 2017, the Ethereum blockchain experienced its first bout of transaction congestion due to an influx of new users for a popular cat collectibles game known as CryptoKitties. Since then, high transaction fees caused by an influx of new user activity has only grown more persistent over time.

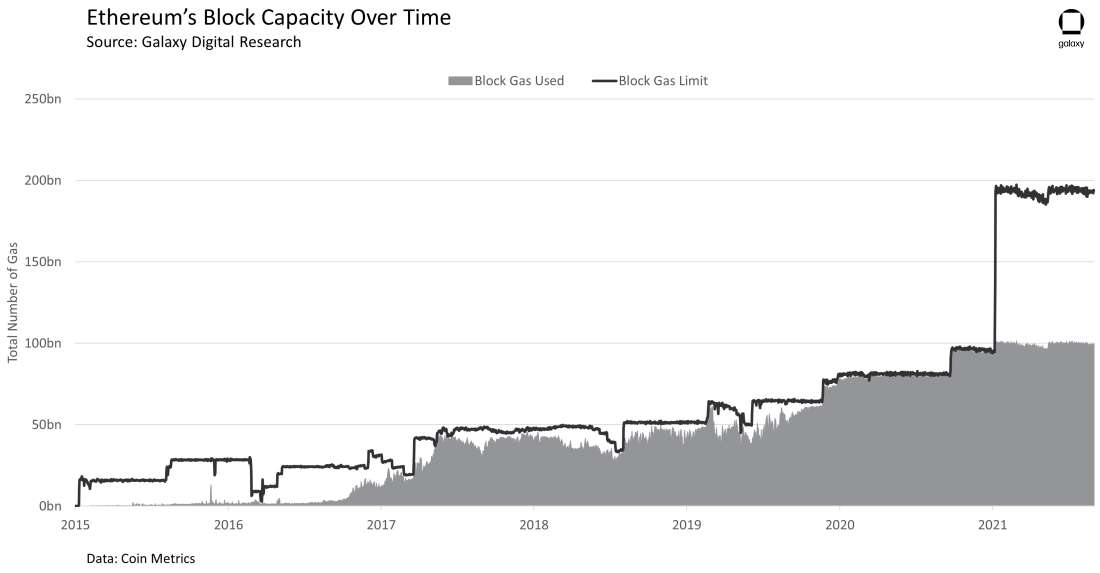

Like the transition to PoS, Ethereum’s roadmap to achieving scalability has faced many delays and changes. Up until the London hard fork which doubled the block capacity of Ethereum in August 2021, Ethereum miners could vote to incrementally increase the network’s block gas limit, which dictates the maximum number of transactions that can be included in a block, as a temporary measure to relieve transaction congestion. As evidenced by the chart below, blocks have almost consistently been filled to their maximum capacity since 2017.

Following the Merge, Ethereum developers are considering an Ethereum Improvement Proposal (EIP) to set-up the building blocks for danksharding. Danksharding is a simplified version of Ethereum’s rollup-centric design to achieve scalability. Rather than increasing the transaction throughput of the CL, danksharding focusses on increasing the network’s data availability for rollups. As background rollups enable secure transaction execution outside of the main Ethereum network and has been an integral part of Ethereum’s scalability roadmap since as early as 2020. Danksharding was first proposed by Ethereum Foundation Researcher Dankrad Feist in February 2022.

EIP 4844 focuses on creating an early template for danksharding that can be leveraged for further scalability improvements down the road but also providers some immediate payoff for existing Layer 2 networks on Ethereum that use rollup technology such as Optimism and Arbitrum. The code change essentially creates a new transaction format on Ethereum for “blob-carrying transactions,” which are transactions containing a large amount of data that do not need to be processed by Ethereum’s computing engine, also called the Virtual Machine. Due to the complexities of implementing EIP 4844, core developer may ultimately push back this code change to a subsequent hard fork after Shanghai.

There is another EIP known as EIP 4488 focused on progressing the use of rollups on Ethereum that is comparatively easier to implement than EIP 4844. EIP 4488 was originally discussed by developers as a code change to be activated before the Merge upgrade. It simply reduces the fixed cost of posting batched transactions from Layer-2 networks to the Ethereum blockchain by 5x. It is not clear currently whether EIP 4488 or EIP 4844 will be included in the Shanghai upgrade, though at least one of the two is likely to be activated.

Validator reward withdrawals

Due to the rise of alternative Layer 1 blockchains in direct competition with Ethereum, scalability improvements are viewed by protocol developers and users alike as high-priority issues that will take precedence over others post-Merge. Another high-priority matter that will be addressed through Shanghai is validator reward withdrawals. There are two ways to enable withdrawals on Ethereum. The first creates a new transaction type that would be treated and processed like a regular transfer of ETH or smart contract command. The withdrawal request would be included in a block just like any other transaction and processed by validators.

The other way creates a new system-level operation, akin to operations such as the issuance of new coins to validators for their work. These transactions once initiated would not be counted towards block space dedicated for regular user transactions. Instead, they would be executed by the network before any other transactions are executed like the way payouts for validators are automatically issued every epoch. A new system-level operation is seen as the more advantageous way to enable transfers of validator rewards because it cleanly differentiates this type of transfer from regular user transactions. As such, core developers have decided to enable validator rewards through a new system-level operation in the upcoming Shanghai hard fork after the Merge.

Statelessness and other improvements

Beyond validator withdrawals, several changes improving Ethereum’s virtual machine, which is the engine that executes application code on the network, are also highly likely for inclusion in Shanghai. After Shanghai, there are a number of other major priorities in the development roadmap of Ethereum including statelessness and history expiry. Both initiatives will focus on addressing the massive size of Ethereum’s state, which is over 100 GB and continuing to grow. Ethereum’s state contains data about all user accounts and smart contract balances, as well as transaction history. It is information that must be accessed and updated regularly by an Ethereum node. If left unchecked, an ever-growing Ethereum state can centralize node operators to only users with advanced hardware.

Despite being Ethereum’s most complex upgrade to date, the Merge will not be the last major upgrade to the network but rather one that will allow core developers to begin focusing their attention on other pressing issues such as scalability and statelessness.

Other Considerations

Beyond matters of issuance, staking, and Ethereum’s scalability roadmap, other impacts of the Merge to keep in mind include:

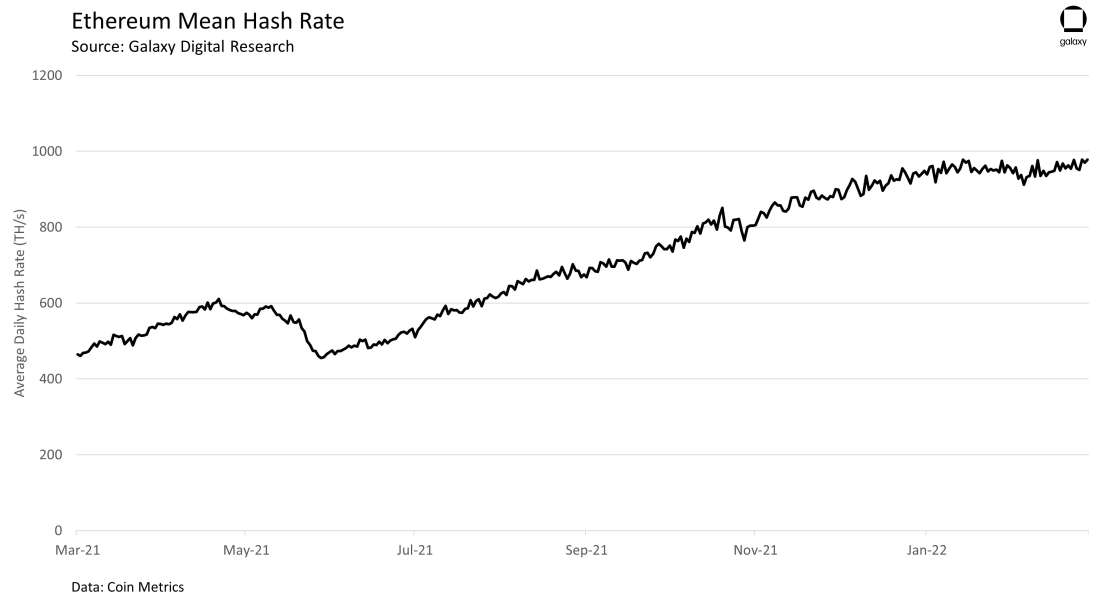

An exodus of Ethereum GPU miners. There are several theories as to where mining power from Ethereum will go after the Merge upgrade. Hashrate, which is a measuring of the collective computing power from miners on a PoW blockchain, has grown significantly on Ethereum due to the bullish price activity of ether in 2022.

So far, Ethereum miners have captured close to $3.7bn in revenue compared to miners on Bitcoin, who have recorded $3bn in revenue over the same period. Ethereum miners will likely take advantage of bullish price activity leading up to the Merge activation and continue squeezing out rewards until the network is fully transitioned over to PoS. The easiest transition for miners is another EVM-compatible, proof-of-work blockchain such as Ethereum Classic or Ravencoin. However, the rewards on these networks are not profitable enough for Ethereum miners to redirect the entirety of their hashpower to these networks. As such, it is more likely that many of them will sell their GPU mining devices as they can be repurposed for gaming or video-intensive graphic design. The large amount of GPU supply that will likely hit secondary markets after the Merge could impact GPU markets broadly, impacting both buyers and manufacturers.

Intensified criticism of PoW as a consensus protocol for securing public blockchains. Following Ethereum’s transition to PoS, Bitcoin will become one of the only major cryptoassets that remain secured by a PoW consensus protocol. This will likely intensify criticism of Bitcoin for the network’s large electricity consumption. While the brunt of electricity usage from blockchains is already expended by Bitcoin, rather than other cryptoassets, the usage of a PoS consensus protocol by the world’s second largest cryptoasset could fuel further disapproval of Bitcoin by critics. It may also boost the investment narrative around PoS coins more broadly simply for sharing the same type of consensus as Ethereum.

An increase in the complexity of Ethereum making it difficult for protocol developers to understand the full ramifications of changes to the network.

The Merge upgrade is the most complex code change of Ethereum’s history. It will effectively fuse together two distinct networks and create redundancies in data that will need to be cleaned up in future hard fork down the road. By expanding the technical complexity of Ethereum’s consensus protocol, mapping out the consequences of any future code change will become more difficult for core developers. This is an overlooked issue that has been raised most notably by Ethereum core developer Péter Szilágyi. Already, the expertise of core developers is becoming specialized to either the EL or CL, which bears the risk of perpetuating a lack of specialization in the full, holistic operations of Ethereum.

The Timing of the Merge

Testing for the Merge is in full swing as of the time of writing this report. Ethereum developers successfully spun-up their last dedicated Merge testnet on March 15, 2022 called Kiln. This revealed bugs in client software that have since been rectified. Developers are now looking ahead to upgrading existing Ethereum testnets such as Goerli and Ropsten. The point of testing and re-testing code specifications is to ensure that all aspects of the Merge code is fully battle tested before mainnet activation, and also so dapp developers and users have time to become accustomed to the new consensus protocol of the network.

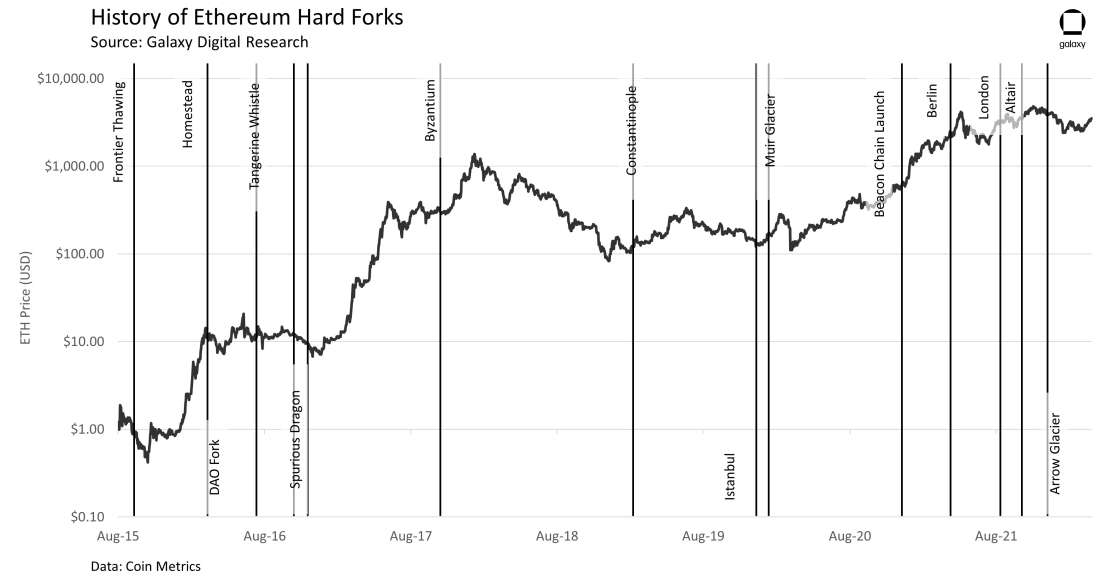

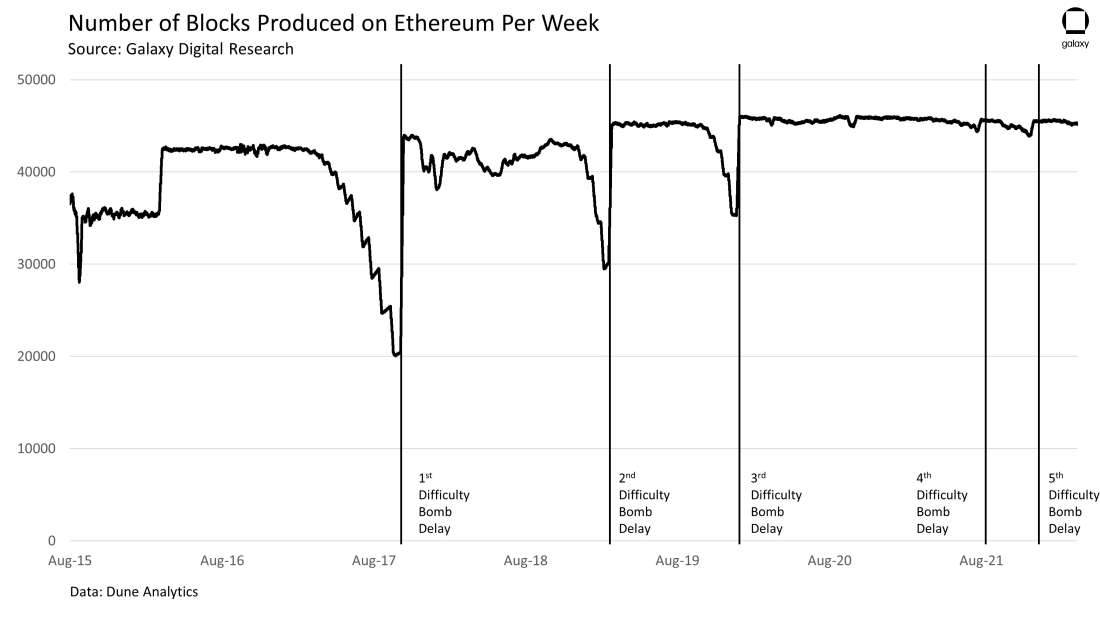

While no date has been formally announced, developers are tentatively working towards an activation of the Merge in Q3 2022 shortly following the activation of the difficulty bomb. The difficulty bomb is a mechanism on Ethereum that gradually increases the difficulty of mining such that once activated, mining new blocks becomes virtually impossible. The mechanism was first activated through a hard fork in 2015 after the genesis of Ethereum, to guarantee a transition to PoS 16 months from launch. Ethereum developers have pushed back the schedule for the bomb five times since 2015. The most recent delay activated in December 2021 pushed back the bomb to late June 2022.

Once testing for the Merge is complete, the upgrade will be scheduled on Ethereum using a difficulty threshold as opposed to a block height. Normally, hard forks on Ethereum specify a block number on which the upgrade activates. However, for the Merge, there is a possibility that malicious miners may use a minority of computational power to build a malicious chain that would trigger the Merge upgrade at a block height faster than anticipated. This is why instead developers will use an accumulated mining difficulty threshold called the Total Terminal Difficulty (TTD). Any changes to TTD would require a majority of hashpower, making this threshold harder to influence by any malicious actors on the Ethereum network.

Exchanges will likely pause services around the expected time of the Merge as they normally do in the event of a hard fork on Ethereum in case of any unexpected network splits or vulnerabilities. Blockchain explorers such as Etherscan and Beaconcha.in are both likely to closely track the activity of the EL and CL respectively so that stakeholders can watch in real time the release of the Merge upgrade. As mentioned, once successfully activated, the Merge upgrade is not anticipated to drastically change how dapp developers, infrastructure providers, and end users interact with Ethereum. Accessing ETH held in smart contracts and externally owned user accounts will also remain the same post-Merge.

The only event in which there may be a disruption to users’ ETH holdings is if a version of Ethereum pre-Merge, that is as a PoW blockchain, continues to be developed and mined after the hard fork. In this event, users would still be able to access their ETH on Ethereum as before, but in addition to this, they would also be able to access tokens on the alternative PoW version of Ethereum in a similar way to how holders of ETH on Ethereum were able to access an equal balance of ETC through the Ethereum Classic blockchain following the DAO fork in 2016. A persisting network split because of the Merge is viewed as highly unlikely given the lack of developer and user support for a PoW version of Ethereum.

Conclusion

The three biggest impacts of the Merge on Ethereum for investors to know are the forthcoming changes to network issuance, staking dynamics, and future development roadmap. Beyond these, Ethereum’s transition to PoS may also impact other dynamics about the network and the crypto industry like the public discourse around blockchains and energy consumption. Protocol developers have yet to determine a specific TTD for the Merge, tentatively estimated for activation sometime this summer or early fall. Developers may press further delays to both the Merge and the difficulty bomb of Ethereum if further testing of the upgrade reveals unexpected bugs in code. Far from being the last major upgrade on the network, the successful activation of the Merge will be followed up with hard forks like Shanghai that will introduce other improvements to Ethereum including greater scalability and EVM optimizations.

No blockchain of Ethereum’s scale has ever completely overhauled its core consensus protocol. The novelty of such a drastic change to the infrastructure of Ethereum bears technical risks. In addition, PoS networks in general are vulnerable to centralization risks from large token holders such as exchanges and staking pools. Finally, the complexity of the Ethereum protocol, though it has always been growing since the network’s first hard fork in 2015, is set to continue compounding due to the dual-network structure of the Merge. As such, the impact of the Merge is a double-edged sword that will prove to strengthen the investment narrative of ether as an environmentally sustainable cryptoasset, a store of value and a productive asset, but carries with it significant complexity and technical risk.

Legal Disclosure:

This document, and the information contained herein, has been provided to you by Galaxy Digital Holdings LP and its affiliates (“Galaxy Digital”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice or is an endorsementof any of the digital assets or companies mentioned herein. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and, Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets and protocols discussed in this document. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. This document provides links to other Websites that we think might be of interest to you. Please note that when you click on one of these links, you may be moving to a provider’s website that is not associated with Galaxy Digital. These linked sites and their providers are not controlled by us, and we are not responsible for the contents or the proper operation of any linked site. The inclusion of any link does not imply our endorsement or our adoption of the statements therein. We encourage you to read the terms of use and privacy statements of these linked sites as their policies may differ from ours. The foregoing does not constitute a “research report” as defined by FINRA Rule 2241 or a “debt research report” as defined by FINRA Rule 2242 and was not prepared by Galaxy Digital Partners LLC. For all inquiries, please email [email protected]. ©Copyright Galaxy Digital Holdings LP 2022. All rights reserved.